Ethereum Price Analysis: Bullish Signals And Potential For Further Growth

Table of Contents

Recent Market Trends and Technical Analysis

Analyzing the current Ethereum price requires a thorough examination of recent market trends and technical indicators. This section will delve into chart patterns, trading volume, and market sentiment to provide a comprehensive picture.

Analyzing ETH/USD Chart Patterns

The ETH/USD chart reveals several interesting patterns suggesting potential upward momentum. Recent price movements show a clear upward trend, bouncing off key support levels multiple times.

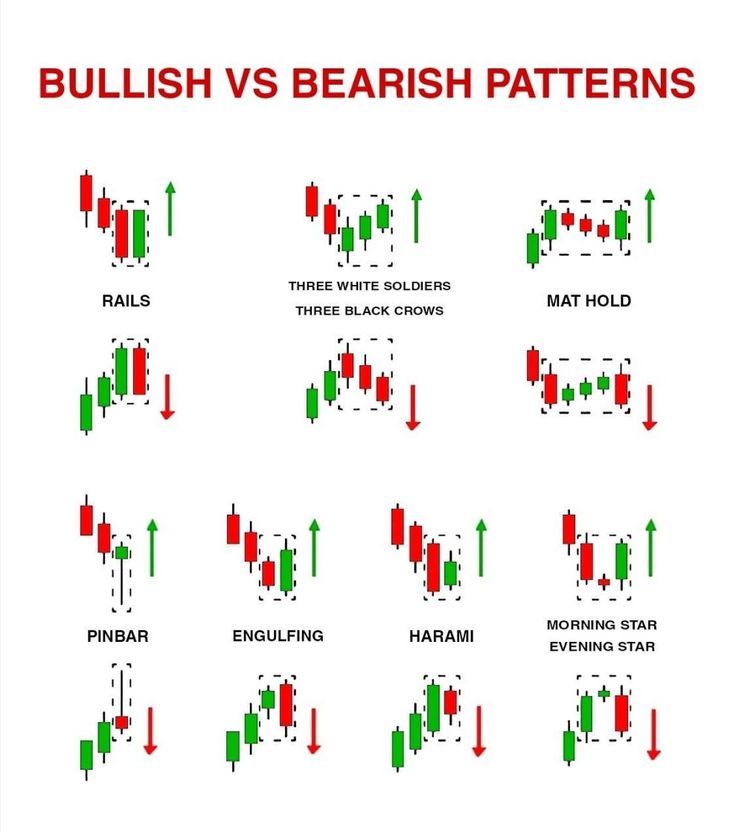

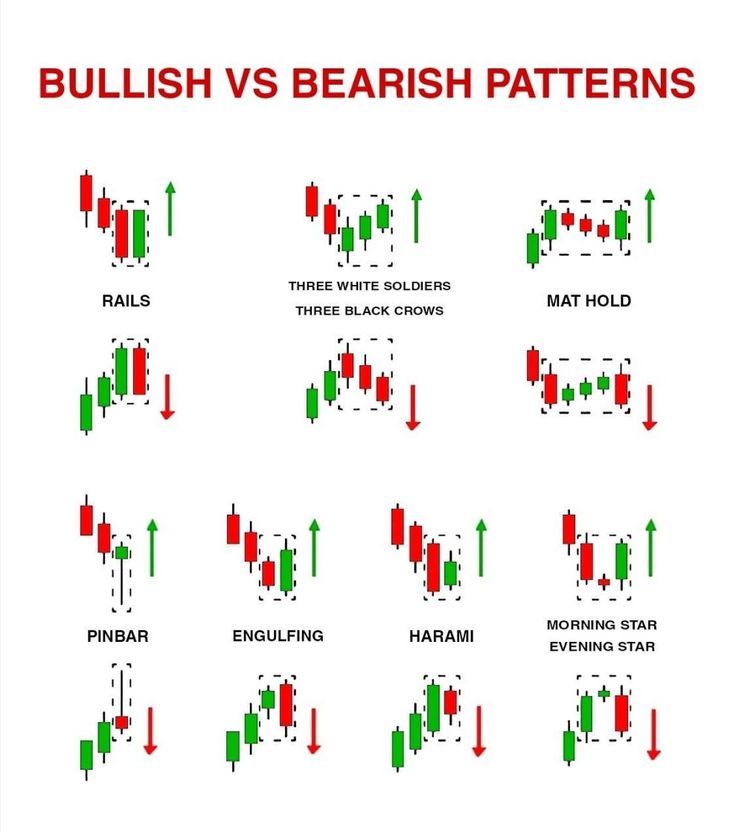

- Bullish Engulfing Patterns: On [Date], a bullish engulfing pattern formed, indicating a potential reversal of the previous downtrend. The price closed significantly higher than the previous day’s high, suggesting a shift in buyer sentiment.

- Hammer Candles: Several hammer candles have appeared on the chart, especially around the $[Price] support level. These candles signal a potential bottom and a subsequent price increase.

- Moving Average Crossover: The 50-day moving average recently crossed above the 200-day moving average, a bullish signal often interpreted as a confirmation of an uptrend. This crossover occurred around [Date] at a price of $[Price].

- RSI and MACD Indicators: The Relative Strength Index (RSI) is currently above [Value], indicating the market is not overbought, leaving room for further price appreciation. The Moving Average Convergence Divergence (MACD) is showing a bullish crossover, further supporting the positive outlook.

Trading Volume and Market Sentiment

Increased trading volume often accompanies significant price movements. We've observed notable volume spikes coinciding with recent price surges.

- Volume Spikes: On [Date], a significant increase in trading volume accompanied a sharp price increase of [Percentage]%, suggesting strong buying pressure.

- Social Media Sentiment: Social media analysis reveals a generally positive sentiment surrounding Ethereum, with many investors expressing bullish expectations. Tools like [mention specific tool] show a strong positive sentiment score.

- News Coverage: Positive news regarding Ethereum 2.0 upgrades and the expansion of the DeFi ecosystem has contributed to improved market sentiment. (Link to relevant news articles).

Fundamental Factors Driving Ethereum Price

Beyond technical analysis, several fundamental factors contribute to Ethereum's price. These factors are crucial for assessing the long-term potential of ETH.

Ethereum 2.0 and Network Upgrades

The transition to Ethereum 2.0 and subsequent network upgrades are major catalysts for price growth.

- Proof-of-Stake (PoS): The shift from Proof-of-Work (PoW) to PoS significantly improves network efficiency and scalability, reducing energy consumption and transaction fees.

- Sharding: The implementation of sharding will further enhance scalability, enabling faster transaction processing and potentially lower fees.

- EIP-1559: This upgrade implemented a fee-burning mechanism, reducing the overall supply of ETH and potentially contributing to price appreciation.

DeFi Growth and Ecosystem Expansion

The thriving DeFi ecosystem built on Ethereum is a key driver of demand for ETH.

- Total Value Locked (TVL): The total value locked in DeFi protocols on Ethereum has reached [Value], showcasing the immense growth of this sector.

- Popular DeFi Applications: Applications like [mention examples, e.g., Uniswap, Aave] continue to attract users, increasing the demand for ETH.

NFT Market and Metaverse Development

The explosive growth of the NFT market and the burgeoning metaverse further fuels ETH demand.

- NFT Marketplaces: Ethereum remains the dominant blockchain for NFTs, with leading marketplaces like OpenSea operating on its network.

- Metaverse Applications: Many metaverse projects utilize Ethereum for transactions and digital asset management, driving further demand. (Link to relevant metaverse projects)

Potential Risks and Challenges

While the outlook for Ethereum is generally bullish, potential risks and challenges must be considered.

Regulatory Uncertainty and Government Intervention

Government regulations pose a significant risk to the cryptocurrency market, including Ethereum.

- Increased Scrutiny: Increased regulatory scrutiny could lead to limitations on cryptocurrency trading or even outright bans in some jurisdictions.

Competition from Other Blockchains

Several competing blockchain platforms are vying for market share.

- Solana and Cardano: These blockchains offer faster transaction speeds and lower fees, potentially attracting users away from Ethereum.

Market Volatility and General Crypto Market Sentiment

The cryptocurrency market is inherently volatile, susceptible to market sentiment shifts.

- Bitcoin Correlation: Ethereum's price often correlates with Bitcoin’s price, meaning a decline in Bitcoin’s value can negatively impact Ethereum.

Conclusion

This Ethereum price analysis reveals a combination of bullish signals and potential challenges. While the ongoing network upgrades, thriving DeFi ecosystem, and burgeoning NFT market suggest a positive outlook for Ethereum’s long-term growth, investors must remain aware of regulatory uncertainty and competition. The potential for further growth is significant, but careful consideration of the risks is crucial for informed investment decisions. Continue to monitor this space for further updates on the Ethereum price and explore Ethereum price predictions from reputable sources to stay ahead of the curve. Conduct thorough research before investing in any cryptocurrency, including Ethereum investment opportunities.

Featured Posts

-

Saving Private Ryan Top 10 Characters

May 08, 2025

Saving Private Ryan Top 10 Characters

May 08, 2025 -

Ethereum Price Breakout Could 2 000 Be Next

May 08, 2025

Ethereum Price Breakout Could 2 000 Be Next

May 08, 2025 -

16 Million Penalty For T Mobile Three Year Data Breach Investigation Concludes

May 08, 2025

16 Million Penalty For T Mobile Three Year Data Breach Investigation Concludes

May 08, 2025 -

Xrp Price Prediction Analyzing The Impact Of Grayscales Etf Bid

May 08, 2025

Xrp Price Prediction Analyzing The Impact Of Grayscales Etf Bid

May 08, 2025 -

Military Historian Ranks These Realistic Wwii Films Above Saving Private Ryan

May 08, 2025

Military Historian Ranks These Realistic Wwii Films Above Saving Private Ryan

May 08, 2025