Ethereum Price Drop: $67M In Liquidations Fuel Sell-off Fears

Table of Contents

The $67 Million Liquidation Event: A Deep Dive

The recent Ethereum liquidation event stands as a stark reminder of the inherent risks within leveraged trading. This significant event, occurring on [Insert Date of Event], involved approximately $67 million in liquidated positions. This wasn't a distributed loss; the impact was concentrated, highlighting the vulnerability of highly leveraged traders.

- Timing: The liquidations occurred during a period of [Describe market conditions at the time – e.g., increased volatility, negative news].

- Size and Affected Assets: The $67 million figure represents a substantial portion of the overall trading volume at the time, indicating a significant market correction. The liquidations primarily affected [Specify types of assets – e.g., ETH-USD perpetual swaps, ETH options].

- Impact: These liquidations exerted considerable downward pressure on the ETH price, contributing to the overall sell-off. The forced selling of assets by liquidated traders exacerbated the price decline.

- Traders Impacted: Leveraged traders, particularly those with high leverage ratios, were disproportionately affected by margin calls, leading to forced liquidations. This underscores the risks associated with highly leveraged positions in volatile markets. Keywords like Ethereum liquidation event, ETH liquidation, leveraged trading, margin calls, and forced selling are key to understanding this aspect.

Underlying Factors Contributing to the Ethereum Price Drop

The sharp Ethereum price drop wasn't an isolated event; several interconnected factors contributed to the downward pressure.

Macroeconomic Factors

The broader macroeconomic environment plays a significant role in influencing cryptocurrency markets. Current concerns such as:

- Inflation: High inflation rates erode the purchasing power of fiat currencies, potentially impacting investor confidence in all asset classes, including cryptocurrencies.

- Interest Rates: Rising interest rates make holding less-liquid assets like cryptocurrencies less attractive, as investors seek higher returns from more traditional investments.

- Recessionary Fears: Concerns about a potential global recession often lead to risk aversion, causing investors to pull back from riskier assets like cryptocurrencies.

These macroeconomic headwinds create a challenging environment for the entire crypto market, including Ethereum.

Regulatory Uncertainty

Regulatory uncertainty continues to be a major factor impacting investor sentiment. Potential changes in regulations, differing approaches across jurisdictions, and overall regulatory clarity (or lack thereof) can significantly influence ETH price volatility.

- Unclear Regulatory Landscape: The evolving regulatory landscape for cryptocurrencies creates uncertainty for investors, potentially leading to cautious behavior and reduced investment.

- Government Crackdowns: News of government crackdowns on cryptocurrency exchanges or activities can trigger immediate sell-offs and negatively impact investor confidence.

Market Sentiment and Whale Activity

Negative news, coupled with the actions of large investors ("whales"), significantly impacts overall market sentiment.

- Negative News: Negative news events, whether related to Ethereum specifically or the broader crypto market, can trigger widespread selling pressure.

- Whale Activity: Large sell-offs by whales can create significant downward pressure on prices, further accelerating existing downward trends. The influence of these key players cannot be understated.

These factors combined create a perfect storm for increased volatility and price drops. Keywords like macroeconomic environment, regulatory risks, investor sentiment, whale activity, and ETH price volatility are all essential in understanding the complexities at play.

Analyzing the Sell-off Fears and Potential Consequences

The Ethereum price drop has sparked fears of a wider sell-off across the cryptocurrency market, a potential crypto market crash, and the onset of a bear market.

- Contagion Risk: The interconnected nature of the cryptocurrency market means that a significant price drop in one asset can trigger selling pressure in others.

- Long-Term Implications for ETH Investors: For long-term investors, this volatility presents both risks and opportunities. A sustained bear market could lead to significant losses, while a subsequent recovery could offer substantial gains.

- Recovery Scenarios: Several factors could influence the future direction of the ETH price. These include improvements in the macroeconomic environment, positive regulatory developments, and a resurgence in investor confidence. Predicting the future is impossible, but analyzing these factors is crucial. Keywords like crypto market crash, bear market, ETH price prediction, long-term investment, and market recovery are important considerations.

Strategies for Navigating the Volatility

Navigating periods of market volatility requires a cautious and informed approach.

- Diversification: Diversifying your investment portfolio across different cryptocurrencies and asset classes is crucial for mitigating risk.

- Risk Management: Implementing effective risk management strategies, such as setting stop-loss orders and avoiding excessive leverage, is vital.

- Long-Term Investing: Focusing on a long-term investment strategy, rather than engaging in short-term trading, can help to weather market fluctuations.

- Stay Informed: Staying informed about market trends through reputable news sources and analytical tools is essential for making informed investment decisions. Keywords here include risk management, crypto investment strategies, diversification, long-term investing, market analysis, and ETH trading.

Conclusion: Ethereum Price Drop: What's Next?

The recent Ethereum price drop, fueled by a $67 million liquidation event and exacerbated by macroeconomic factors, regulatory uncertainty, and market sentiment, highlights the inherent volatility of the cryptocurrency market. While short-term price predictions are speculative, understanding the contributing factors is crucial for navigating this dynamic landscape. The significance of the liquidation event underscores the importance of risk management in cryptocurrency investments. The long-term outlook for Ethereum remains dependent on a multitude of factors, necessitating ongoing vigilance and informed decision-making. To stay abreast of Ethereum price movements and market conditions, consistently monitor reputable sources and engage in thorough cryptocurrency market analysis. This will help you to navigate the complexities of the ETH market and make informed decisions about your Ethereum investments.

Featured Posts

-

Yann Sommers Thumb Injury A Setback For Inter In Serie A And Champions League

May 08, 2025

Yann Sommers Thumb Injury A Setback For Inter In Serie A And Champions League

May 08, 2025 -

Universal Credit Claiming Back Money After Hardship

May 08, 2025

Universal Credit Claiming Back Money After Hardship

May 08, 2025 -

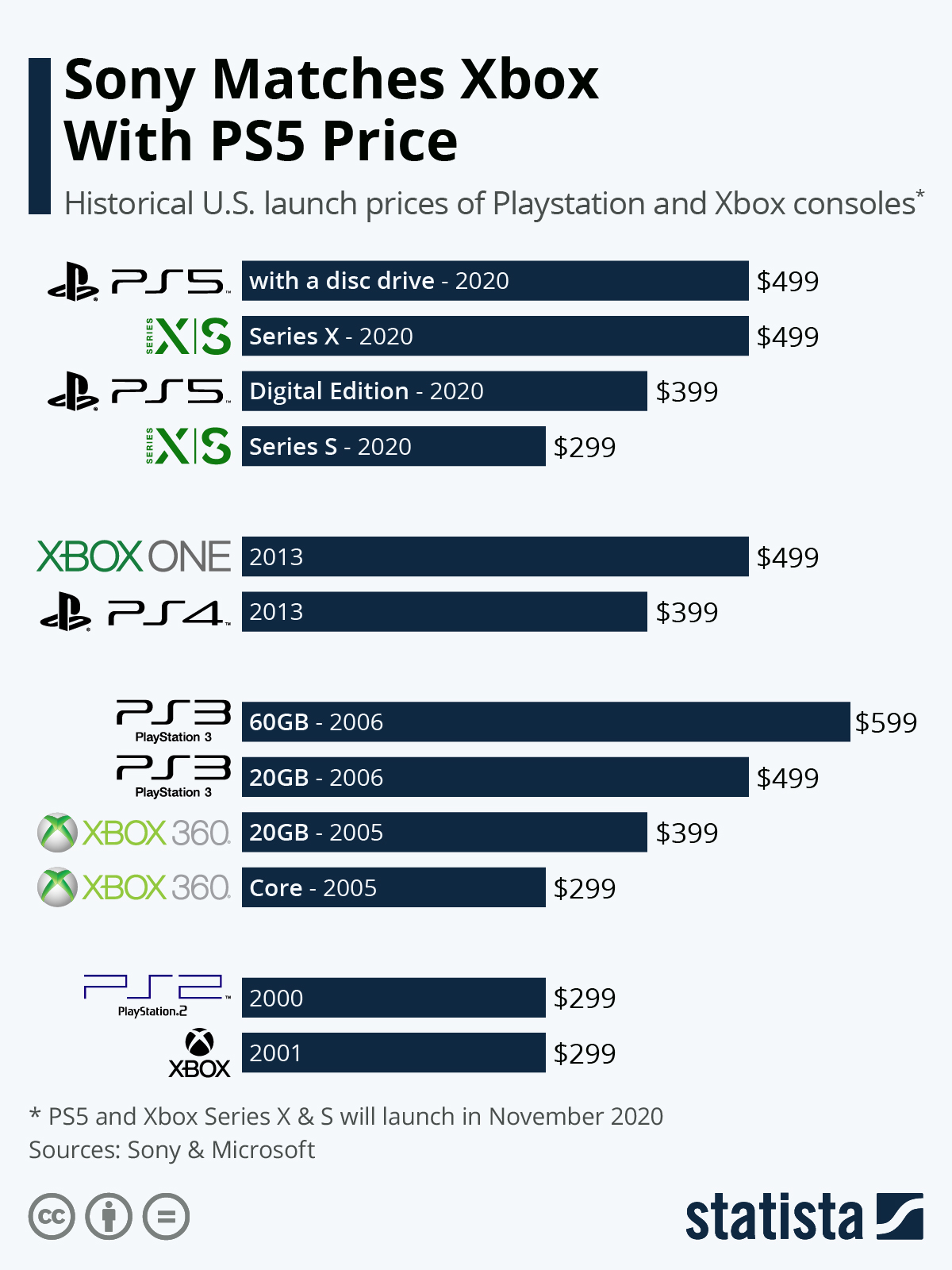

Beat The Ps 5 Price Increase Your Guide To Finding A Console

May 08, 2025

Beat The Ps 5 Price Increase Your Guide To Finding A Console

May 08, 2025 -

Car Dealers Double Down Against Mandatory Electric Vehicle Sales

May 08, 2025

Car Dealers Double Down Against Mandatory Electric Vehicle Sales

May 08, 2025 -

Made In Gujranwala Exhibition A Success Celebrated By Sufian And The Gcci

May 08, 2025

Made In Gujranwala Exhibition A Success Celebrated By Sufian And The Gcci

May 08, 2025