Ethereum Price Rebound: A Weekly Chart Indicator Signals A Potential Buying Opportunity

Table of Contents

Analyzing the Weekly Chart: Key Indicator Suggests a Reversal

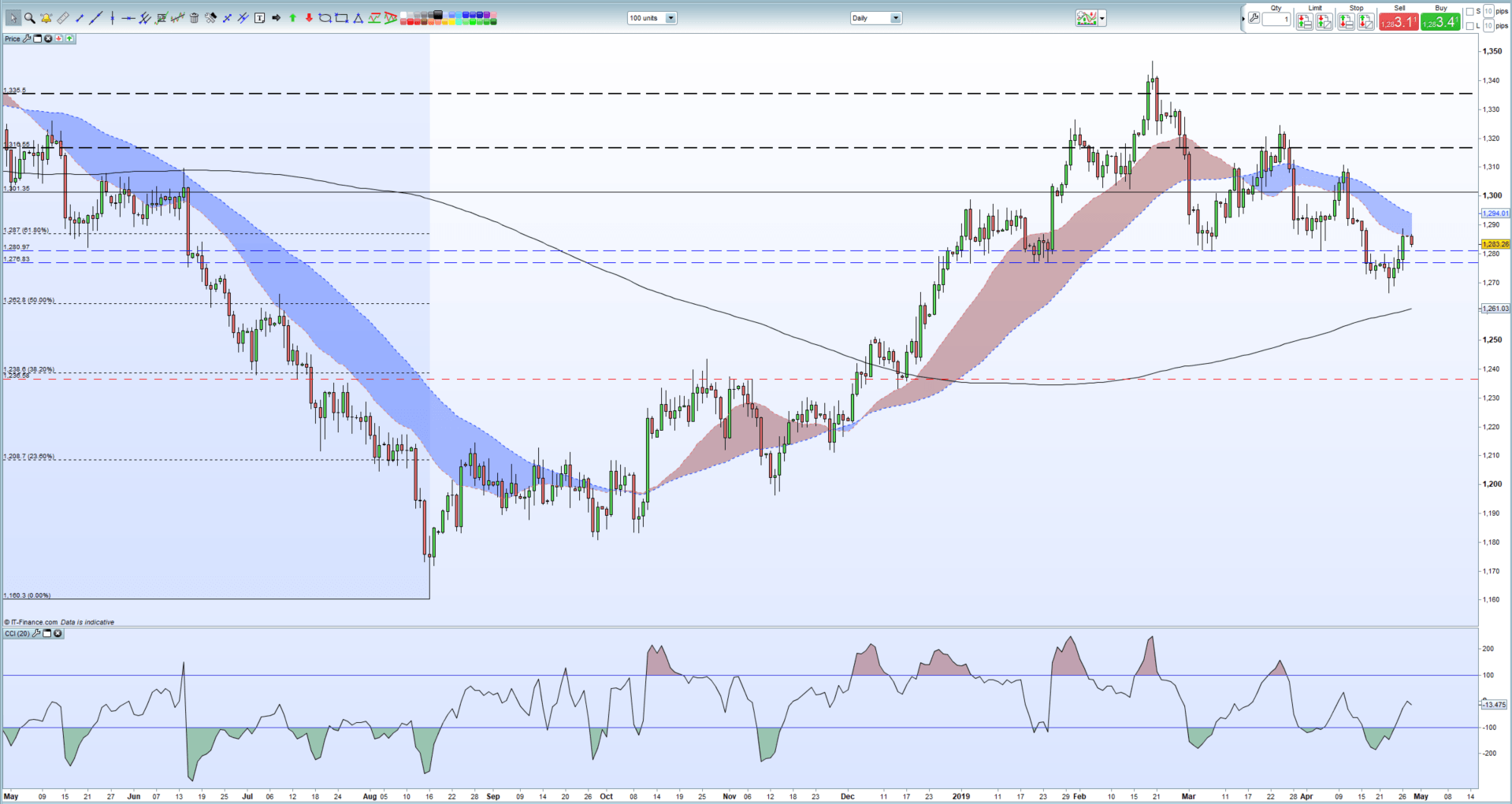

This analysis focuses on the Relative Strength Index (RSI) on the Ethereum weekly chart. The RSI is a momentum oscillator that measures the speed and change of price movements. It ranges from 0 to 100, with readings above 70 generally considered overbought and readings below 30 oversold.

[Insert Chart Image of Ethereum Weekly Chart with RSI here]

-

Specific values of the indicator and their significance: Currently, the RSI on the Ethereum weekly chart is showing a reading of 38. This is a significant move from its recent low, suggesting that the selling pressure is diminishing. Historically, when the RSI has reached similar oversold levels, Ethereum has experienced a subsequent price bounce.

-

Historical context – how this indicator has performed in past Ethereum price movements: Reviewing past instances where the weekly RSI for Ethereum fell below 40, we observe that in most cases, a price rebound followed within a few weeks or months. It's crucial to remember that past performance isn't indicative of future results.

-

Mention any divergence between price action and the indicator, and its implications: We're also observing a potential bullish divergence. While the price of Ethereum has made lower lows, the RSI is forming higher lows, indicating weakening bearish momentum. This divergence often precedes a price reversal.

Factors Contributing to a Potential Ethereum Price Rebound

Several factors beyond the technical analysis contribute to the potential for an Ethereum price rebound:

-

Regulatory developments (positive or negative): Positive regulatory clarity in key jurisdictions could significantly boost investor confidence and lead to increased institutional investment in Ethereum. Conversely, negative regulatory news could dampen the rebound.

-

Adoption by institutions and businesses: Growing adoption of Ethereum by enterprises for decentralized applications (dApps) and blockchain solutions strengthens the underlying value proposition and fuels demand. Increased enterprise blockchain usage is a key driver of long-term price appreciation.

-

Developments within the Ethereum ecosystem (e.g., new DeFi projects, improvements to scalability): The continuous development of decentralized finance (DeFi) applications on Ethereum and improvements in scalability through solutions like sharding increase the utility and attractiveness of the network. This ecosystem growth fuels demand for ETH.

-

Overall market sentiment towards cryptocurrencies: A general improvement in overall cryptocurrency market sentiment can positively influence the price of Ethereum, even independently of the RSI signals.

The Role of Staking and Ethereum 2.0

Ethereum 2.0 and staking play a crucial role in influencing the price:

-

Impact of staking rewards on supply and demand: The staking mechanism reduces the circulating supply of ETH, potentially increasing its value due to increased scarcity. Staking rewards incentivize holding ETH, further impacting supply and demand dynamics.

-

Positive long-term outlook due to Ethereum's transition to proof-of-stake: The transition to proof-of-stake enhances Ethereum's security, scalability, and energy efficiency, strengthening its long-term prospects and fostering investor confidence.

Risk Assessment: Understanding Potential Downsides

Investing in cryptocurrencies inherently carries significant risks:

-

Volatility of the crypto market: The cryptocurrency market is notoriously volatile, and Ethereum's price can experience sharp fluctuations.

-

Potential regulatory hurdles: Unfavorable regulatory changes could negatively impact the price of Ethereum.

-

Technological risks associated with blockchain technology: While unlikely, technological vulnerabilities or unforeseen bugs could potentially affect the network's functionality.

-

Importance of diversifying investments: Diversifying your investment portfolio across different asset classes is crucial to mitigate risks associated with cryptocurrency investments.

Conclusion

This analysis of the Ethereum weekly chart, combined with a consideration of contributing factors like regulatory developments, ecosystem growth, and the transition to Ethereum 2.0, suggests a potential buying opportunity. The RSI indicator points towards a potential reversal, and bullish divergence strengthens this signal. However, it is crucial to remember the inherent risks in cryptocurrency investments, including market volatility and regulatory uncertainty.

Call to Action: While this indicator signals a potential Ethereum price rebound, thorough due diligence is essential before making any investment decisions. Conduct your own research and carefully consider your risk tolerance before participating in the Ethereum market. Learn more about mitigating risks in the volatile cryptocurrency market by [link to relevant resource/further reading].

Featured Posts

-

Stock Market Valuation Concerns Bof A Offers A Different Perspective

May 08, 2025

Stock Market Valuation Concerns Bof A Offers A Different Perspective

May 08, 2025 -

Ripples Xrp Rallies A Reaction To The Presidents Trump Related Post

May 08, 2025

Ripples Xrp Rallies A Reaction To The Presidents Trump Related Post

May 08, 2025 -

Py Ays Ayl Trafy Ka Lahwr Myn Dwrh Shayqyn Ka Jwsh W Khrwsh

May 08, 2025

Py Ays Ayl Trafy Ka Lahwr Myn Dwrh Shayqyn Ka Jwsh W Khrwsh

May 08, 2025 -

Hot Toys Japan Exclusive 1 6 Scale Rogue One Galen Erso Figure Unveiled

May 08, 2025

Hot Toys Japan Exclusive 1 6 Scale Rogue One Galen Erso Figure Unveiled

May 08, 2025 -

Bitcoin Price Prediction Analyzing The Potential Of A 100 000 Btc Price After Trumps Speech

May 08, 2025

Bitcoin Price Prediction Analyzing The Potential Of A 100 000 Btc Price After Trumps Speech

May 08, 2025