Ethereum Price Resilience: Upside Break Imminent?

Table of Contents

Analyzing Ethereum's Recent Price Action and Resilience

Ethereum's price has experienced considerable fluctuations in recent months. However, it has consistently demonstrated resilience, repeatedly bouncing back from significant dips. Analyzing the price charts reveals key support and resistance levels that have played a crucial role in maintaining Ethereum's price stability.

[Insert chart/graph showing Ethereum price action, highlighting support and resistance levels.]

- Ethereum held support at $1500 despite a broader market sell-off in [Month, Year]. This demonstrated underlying strength and demand for ETH even during periods of general market weakness.

- Strong buying pressure was observed near the $1800 support level, indicating that investors see this as a crucial buying opportunity.

- The Relative Strength Index (RSI) shows signs of a bullish reversal, suggesting that the downward momentum may be weakening. This is a positive indicator for potential price appreciation.

The Impact of Ethereum's Upcoming Upgrades on Price

Ethereum's ongoing development and upcoming upgrades are significant catalysts for its long-term price growth and are directly related to Ethereum price resilience. These improvements enhance the network's scalability, security, and overall functionality, boosting investor confidence and driving demand.

- The Shanghai upgrade enabled staked ETH withdrawals, unlocking substantial liquidity previously locked in the staking contract. This increased the supply of available ETH, but the market has largely absorbed this without a significant price drop, further showing resilience.

- Layer-2 scaling solutions like Optimism and Arbitrum are significantly improving transaction speeds and reducing gas fees, making Ethereum more accessible and attractive to a wider range of users and applications. This increased usability is a major factor in long-term price appreciation.

- The increased DeFi activity on the Ethereum network is another key driver for price appreciation. The growth of decentralized finance applications built on Ethereum directly translates to increased demand for ETH, positively impacting price.

Market Sentiment and Investor Confidence in Ethereum

Analyzing market sentiment is crucial for understanding Ethereum's price trajectory. While general market sentiment can be bearish at times, investor confidence in Ethereum remains strong. This is fueled by several positive factors:

- Growing institutional interest in Ethereum as a store of value is driving institutional investment. Large financial institutions are increasingly recognizing Ethereum's potential as a long-term investment asset.

- Positive regulatory developments in certain jurisdictions are creating a more favorable regulatory environment for cryptocurrencies, including Ethereum. Clearer regulations can reduce uncertainty and attract further investment.

- Increased media coverage highlighting Ethereum's potential is boosting public awareness and interest. Positive media portrayals of Ethereum’s technological advancements and use cases can positively influence investor sentiment.

Technical Analysis: Signs of an Impending Upside Break

Technical analysis provides further evidence supporting the potential for an upside break in Ethereum's price. Several indicators point toward a bullish trend:

[Insert chart/graph showing Ethereum price chart with technical indicators.]

- A breakout above the key resistance level of $[Price] could trigger a significant price rally. This would confirm a bullish trend and could lead to substantial price gains.

- A positive crossover of the 50-day and 200-day moving averages signals bullish momentum. This is a classic bullish signal indicating a potential trend reversal.

- The MACD histogram turning positive suggests a shift in momentum from bearish to bullish. This is another technical indicator supporting the potential for an upward price movement.

Conclusion: Ethereum Price Resilience – A Bullish Outlook?

Ethereum's price has demonstrated remarkable resilience despite recent market volatility. The upcoming upgrades, improving market sentiment, and positive technical indicators all point towards a strong potential for an upside break. The increased adoption, network improvements, and growing institutional interest are fundamental factors underpinning Ethereum price resilience. Stay tuned for further updates on the Ethereum price and consider adding ETH to your portfolio as we analyze the potential for further upward momentum in Ethereum price resilience. Don't miss the opportunity to capitalize on this potential surge in Ethereum price resilience.

Featured Posts

-

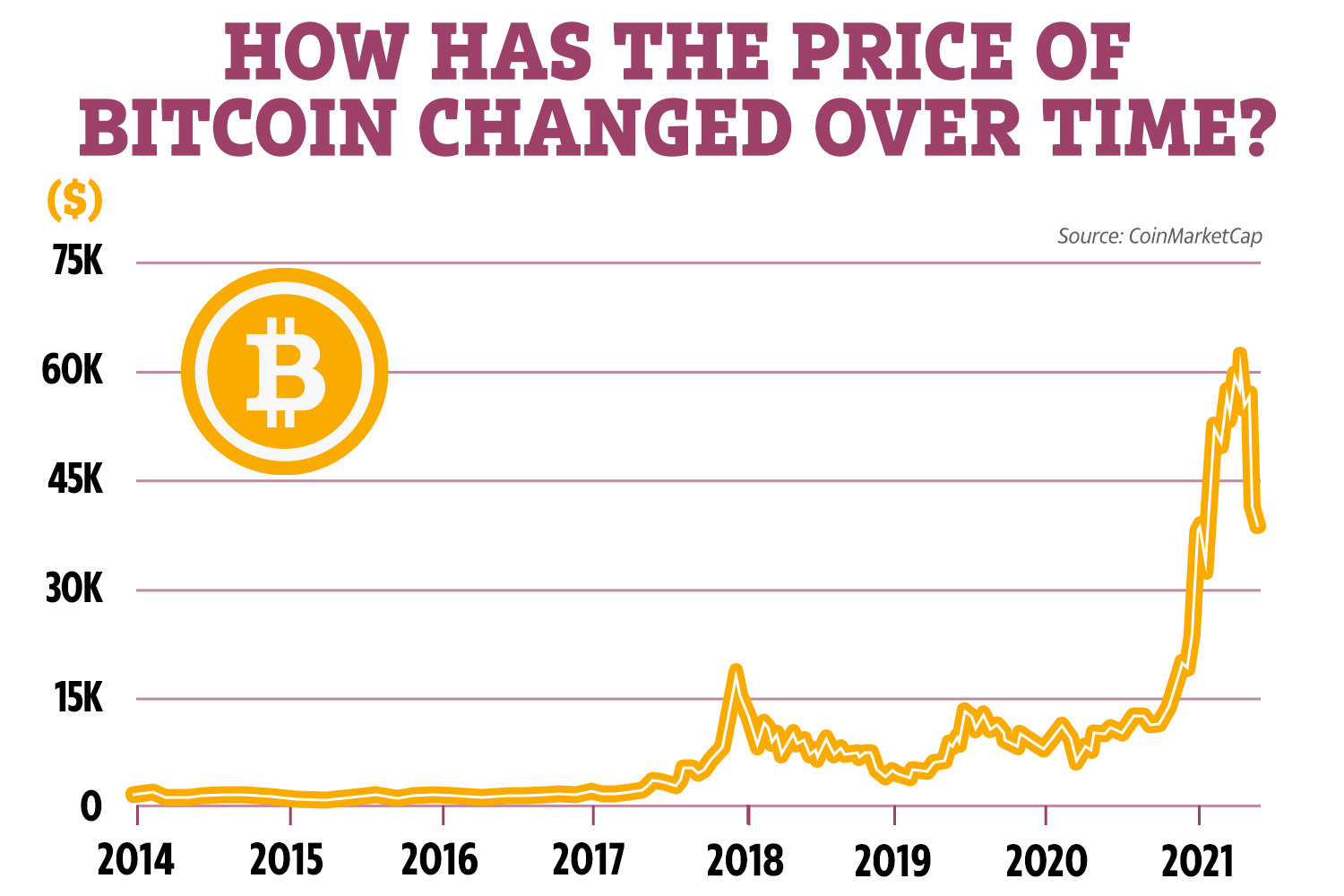

Five Year Bitcoin Forecast Potential For A 1 500 Rise

May 08, 2025

Five Year Bitcoin Forecast Potential For A 1 500 Rise

May 08, 2025 -

Dwp Benefit Checks A Rise In Home Visits And Their Implications

May 08, 2025

Dwp Benefit Checks A Rise In Home Visits And Their Implications

May 08, 2025 -

Official Lotto Lotto Plus 1 And Lotto Plus 2 Draw Results

May 08, 2025

Official Lotto Lotto Plus 1 And Lotto Plus 2 Draw Results

May 08, 2025 -

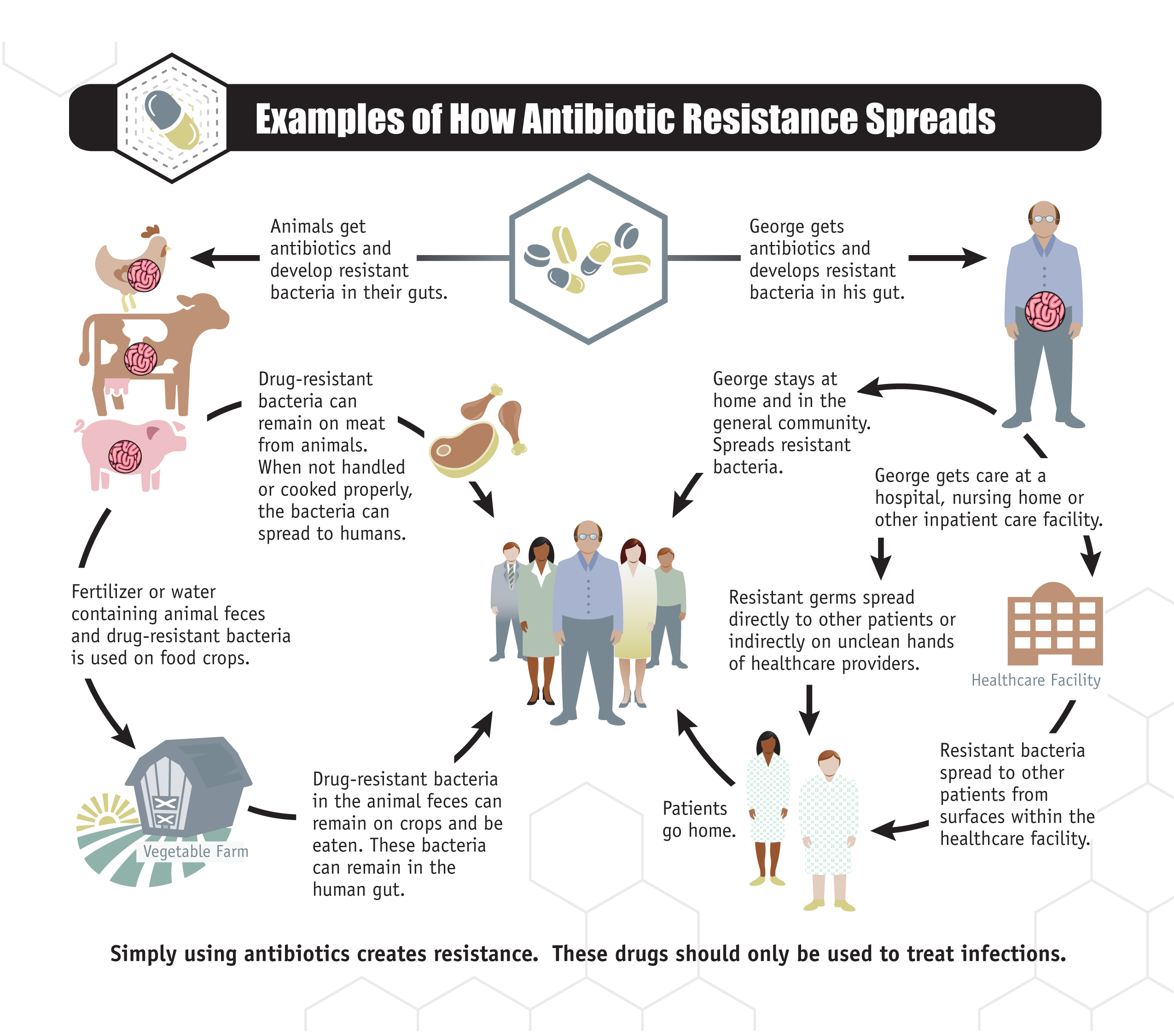

Fungal Infections A Growing Threat Of Antibiotic Resistance

May 08, 2025

Fungal Infections A Growing Threat Of Antibiotic Resistance

May 08, 2025 -

Bitcoin Price Golden Cross What It Means For Investors

May 08, 2025

Bitcoin Price Golden Cross What It Means For Investors

May 08, 2025