Evaluating Stretched Stock Market Valuations: A BofA Perspective

Table of Contents

Bank of America (BofA) Global Research, with its extensive experience and resources in financial markets, provides valuable insights into global economic trends and their impact on investment strategies. Their analyses offer a comprehensive view, incorporating macroeconomic forecasts, sector-specific assessments, and sophisticated valuation models. This article aims to distill BofA's key insights into understanding and responding to potentially stretched stock market valuations. We will delve into key valuation metrics, BofA's macroeconomic outlook, sector-specific analysis, and recommended strategies for investors.

Key Metrics for Evaluating Stock Market Valuations

Relying on a single valuation metric to assess the entire market can be misleading. A comprehensive approach requires using multiple indicators to paint a complete picture. BofA likely employs a similar multi-faceted approach. Let's examine some key metrics:

Price-to-Earnings Ratio (P/E):

The P/E ratio measures a company's stock price relative to its earnings per share (EPS). A high P/E ratio suggests investors are paying a premium for each dollar of earnings, potentially indicating overvaluation. However, interpreting P/E ratios requires context. BofA's analysis would consider:

- Historical Context: Comparing current P/E ratios to historical averages for the specific company, sector, and the overall market. Are we significantly above long-term averages?

- Growth Prospects: High-growth companies often justify higher P/E ratios due to future earnings potential. BofA would assess the sustainability of these growth projections.

- Interest Rates: Lower interest rates can support higher P/E multiples as investors seek higher returns in the equity market.

Price-to-Sales Ratio (P/S):

The P/S ratio compares a company's market capitalization to its revenue. This metric is particularly useful for valuing companies with negative earnings, a scenario that may be more prevalent during economic downturns or for rapidly growing tech firms. BofA's analysis of P/S ratios would involve:

- Industry Benchmarks: Comparing P/S ratios across different sectors to identify relative overvaluation or undervaluation.

- Profitability Analysis: Even with a seemingly low P/S ratio, BofA would scrutinize the company's profitability and its path to future profitability.

- Revenue Growth: Sustained revenue growth can justify higher P/S multiples.

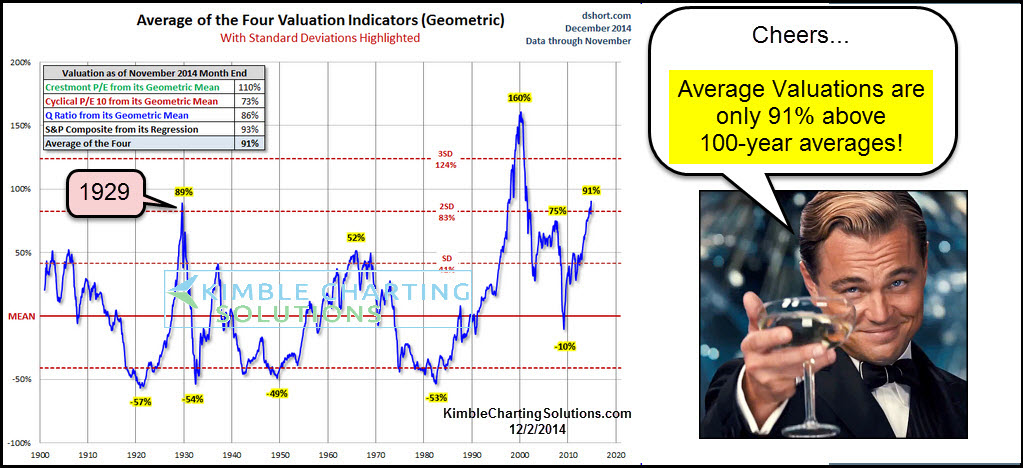

Cyclically Adjusted Price-to-Earnings Ratio (CAPE):

The CAPE ratio, also known as the Shiller P/E ratio, smooths out short-term fluctuations in earnings by using a 10-year average of inflation-adjusted earnings. This helps to provide a longer-term perspective on valuation. BofA’s interpretation of CAPE would consider:

- Long-Term Trends: CAPE provides a better indication of long-term market valuation than the standard P/E ratio.

- Market Cycles: BofA would likely analyze CAPE in the context of historical market cycles to identify potential inflection points.

- Comparison to Historical Averages: Is the current CAPE significantly above or below its historical average?

Dividend Yield:

Dividend yield, the annual dividend payment per share divided by the share price, is a crucial metric, especially in mature markets. High dividend yields might indicate undervaluation, while low yields might reflect a preference for growth over income. BofA's perspective would factor in:

- Dividend Sustainability: The ability of companies to maintain their dividend payouts.

- Interest Rate Environment: Higher interest rates might make high-dividend stocks more attractive.

- Industry Trends: Dividend policies vary across sectors, making industry comparisons crucial.

Comparing current valuations to historical averages and industry benchmarks is crucial for a complete picture. BofA's analysis likely involves rigorous benchmarking against historical data and peer companies.

BofA's Macroeconomic Outlook and its Impact on Valuations

BofA's macroeconomic forecasts significantly influence their assessment of stock market valuations. Their predictions for key indicators like inflation, interest rates, and GDP growth are pivotal.

- Rising Interest Rates: Higher interest rates generally lead to lower valuations as the cost of borrowing increases, reducing corporate profitability and investor demand for equities.

- High Inflation: Persistent inflation erodes purchasing power and can pressure corporate earnings, leading to lower P/E ratios and potentially lower valuations.

- Strong GDP Growth: Robust GDP growth typically supports higher valuations, as it indicates a healthy economy with increased corporate earnings.

- Geopolitical Uncertainty: Global events and geopolitical risks significantly impact investor sentiment and market valuations. BofA's analysis incorporates these uncertainties.

BofA's macroeconomic outlook provides the backdrop against which they analyze individual stock valuations and sector performance.

Sector-Specific Valuation Analysis (A BofA Perspective)

BofA likely conducts a thorough sector-by-sector valuation analysis, identifying potential overvaluations and undervaluations within specific sectors. Their analysis considers sector-specific growth prospects, regulatory changes, and competitive dynamics.

- Technology: BofA might identify certain segments within the technology sector as overvalued given their high P/E ratios relative to historical averages and growth prospects.

- Energy: The energy sector's valuation may be influenced by factors like oil prices and the transition to renewable energy. BofA would analyze these dynamics.

- Financials: Interest rate changes and economic growth directly impact the financial sector, so BofA would closely monitor these factors.

By analyzing each sector individually, BofA creates a nuanced picture of market valuations, going beyond broad market indices.

Strategies for Navigating Stretched Valuations

Navigating a market with potentially stretched valuations requires a cautious and strategic approach. BofA might recommend the following strategies:

Diversification:

Diversifying across asset classes (stocks, bonds, real estate) and sectors reduces portfolio risk. This is a fundamental principle in investment management.

Value Investing:

Value investing focuses on identifying undervalued companies with strong fundamentals. BofA's research could highlight such opportunities in the current market.

Selective Stock Picking:

Thorough due diligence is critical. BofA would emphasize the importance of analyzing individual companies’ financial health, competitive advantages, and management quality before investing.

Defensive Positioning:

In a market with high valuations, a more defensive portfolio positioning might be warranted. This could include reducing exposure to high-growth, high-valuation stocks and increasing holdings in more stable, defensive sectors.

BofA's recommendations would likely incorporate these strategies, tailored to individual investor risk tolerance and investment goals.

Evaluating Stretched Stock Market Valuations – Key Takeaways and Next Steps

Evaluating stretched stock market valuations requires a multi-faceted approach. BofA's analysis emphasizes the importance of utilizing multiple valuation metrics, incorporating macroeconomic forecasts, and conducting sector-specific analyses. Careful consideration of these factors is crucial for making informed investment decisions. Diversification and a strategic approach are key to navigating the uncertainties of the current market environment.

To gain a deeper understanding of BofA's perspective on evaluating stretched stock market valuations, we urge you to consult their research reports and investment newsletters. For personalized guidance, contact a BofA financial advisor. Staying informed about market trends and utilizing expert analysis is vital for successful long-term investment strategies.

Featured Posts

-

Romanias Election Latest Updates On The Upcoming Runoff

May 06, 2025

Romanias Election Latest Updates On The Upcoming Runoff

May 06, 2025 -

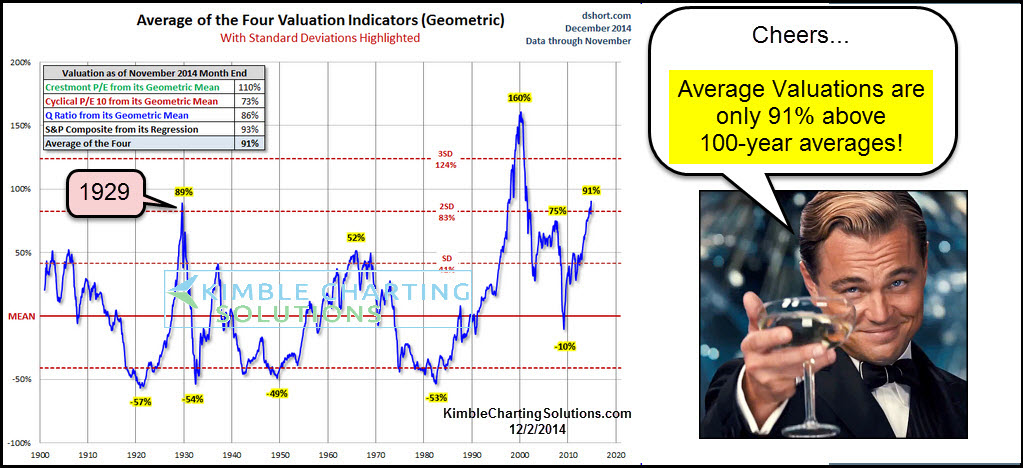

Westpac Wbc Shrinking Margins Lead To Lower Profitability

May 06, 2025

Westpac Wbc Shrinking Margins Lead To Lower Profitability

May 06, 2025 -

Budget Friendly Buys Where To Find Quality Without Compromise

May 06, 2025

Budget Friendly Buys Where To Find Quality Without Compromise

May 06, 2025 -

Duze Zamowienie Na Trotyl Implikacje Dla Polskiego Przemyslu Zbrojeniowego

May 06, 2025

Duze Zamowienie Na Trotyl Implikacje Dla Polskiego Przemyslu Zbrojeniowego

May 06, 2025 -

Wildfire Speculation A Grim Reflection Of Our Times Los Angeles

May 06, 2025

Wildfire Speculation A Grim Reflection Of Our Times Los Angeles

May 06, 2025

Latest Posts

-

Halle Bailey And Ddg Feud Intensifies New Diss Track Surfaces

May 06, 2025

Halle Bailey And Ddg Feud Intensifies New Diss Track Surfaces

May 06, 2025 -

Ddgs Dont Take My Son A Diss Track Targeting Halle Bailey

May 06, 2025

Ddgs Dont Take My Son A Diss Track Targeting Halle Bailey

May 06, 2025 -

The Fly A Case For Jeff Goldblums Overlooked Oscar Deserving Role

May 06, 2025

The Fly A Case For Jeff Goldblums Overlooked Oscar Deserving Role

May 06, 2025 -

Halle Bailey Targeted In Ddgs New Song Dont Take My Son

May 06, 2025

Halle Bailey Targeted In Ddgs New Song Dont Take My Son

May 06, 2025 -

Why Jeff Goldblum Should Have Won An Oscar For The Fly

May 06, 2025

Why Jeff Goldblum Should Have Won An Oscar For The Fly

May 06, 2025