Exclusive Access: A Lucrative Side Hustle Trading Stakes In Elon Musk's Private Ventures

Table of Contents

Understanding the Market for Elon Musk's Private Ventures

The Appeal of Investing in Musk's Companies

The allure of investing in companies associated with Elon Musk is undeniable. His track record of success and disruptive innovation in sectors like electric vehicles (Tesla), space exploration (SpaceX), and renewable energy (SolarCity) makes his ventures exceptionally attractive to investors seeking high-growth potential and exposure to disruptive technology. Keywords like "Elon Musk investments," "high-growth potential," and "disruptive technology" are frequently associated with this space, attracting significant investor interest.

- Limited Availability: Direct investment opportunities in these private companies are extremely limited, often reserved for accredited investors or through specialized funds.

- High Returns (with High Risk): Successful private equity investments in companies with similar profiles to Musk's ventures have historically yielded exceptionally high returns. However, it's crucial to remember that the potential for significant losses exists.

- Secondary Markets: The existence of secondary markets for private company shares provides a pathway for accessing these opportunities, albeit with its own set of complexities.

Accessing Investment Opportunities: Strategies and Platforms

Identifying Potential Investment Vehicles

Gaining exposure to Musk's private ventures requires exploring various avenues. This can include:

-

Private Equity Funds: Investing in private equity funds that specialize in high-growth technology companies is one route, though often requires significant capital and sophisticated investment knowledge.

-

Secondary Markets: These markets allow investors to buy and sell shares of privately held companies from other investors. This can be a more accessible entry point compared to direct investments, but requires careful due diligence.

-

Crowdfunding (Limited): While less common for ventures of this scale and prestige, crowdfunding platforms might occasionally offer limited participation opportunities.

-

Due Diligence: Rigorous due diligence is paramount before committing any capital. This involves carefully researching the target company, its financials (where available), its management team, and the overall market conditions.

-

Legal & Regulatory Understanding: Navigating the legal and regulatory landscape is critical. Understanding securities laws and regulations is essential, as is ensuring compliance with all relevant investment guidelines.

-

Accessing Opportunities: Publicly available platforms or networks specifically dedicated to facilitating these types of investments are relatively rare. Often, access is through established networks and relationships within the financial industry.

-

Professional Advice: Seeking advice from qualified financial advisors specializing in alternative investments is strongly recommended.

Risk Mitigation and Due Diligence in High-Risk Investments

Assessing the Risks

Investing in private companies, particularly those associated with a high-profile individual like Elon Musk, carries inherent risks. The potential for significant losses is real, and it’s crucial to acknowledge this reality. Keywords like "high-risk investment," "due diligence," "risk assessment," and "portfolio diversification" emphasize the caution necessary.

- Thorough Research: Conduct thorough research into the company's business model, financial health (if disclosed), competitive landscape, and management team.

- Market Volatility: Be prepared for significant market volatility. The value of these private investments can fluctuate dramatically based on various factors, including market sentiment and unforeseen events.

- Diversification: Diversify your investment portfolio. Don't put all your eggs in one basket, especially in high-risk ventures.

- Professional Financial Advice: Consult with a qualified financial advisor before making any investment decisions. They can help you assess your risk tolerance and develop an appropriate investment strategy.

Legal and Ethical Considerations

Navigating the Regulatory Landscape

Navigating the legal and ethical complexities is essential when considering investments in private companies. Keywords such as "regulatory compliance," "insider trading," "securities laws," and "investment regulations" highlight the potential legal pitfalls.

- Securities Laws: Understanding and complying with all applicable securities laws is crucial. Violating these laws can result in severe legal and financial penalties.

- Transparency and Ethics: Maintain transparency and act ethically throughout the investment process. Avoid any actions that could be construed as insider trading or other unethical practices.

- Regulatory Compliance: Ensure compliance with all relevant regulations, both at the national and international level, depending on the location of the company and the investor.

Conclusion

Trading stakes in Elon Musk's private ventures presents a potentially lucrative side hustle, but it's crucial to understand the inherent risks and complexities. Thorough due diligence, robust risk mitigation strategies, and unwavering adherence to legal and ethical guidelines are paramount. While the potential rewards are substantial, the potential for loss is equally significant.

Call to Action: While this article provides valuable insights, always conduct thorough research and consult with a qualified financial advisor before making any investment decisions regarding Elon Musk's private ventures. Remember, informed decisions are key to success in this exciting but risky market. Start your research today and explore the possibilities of this lucrative side hustle!

Featured Posts

-

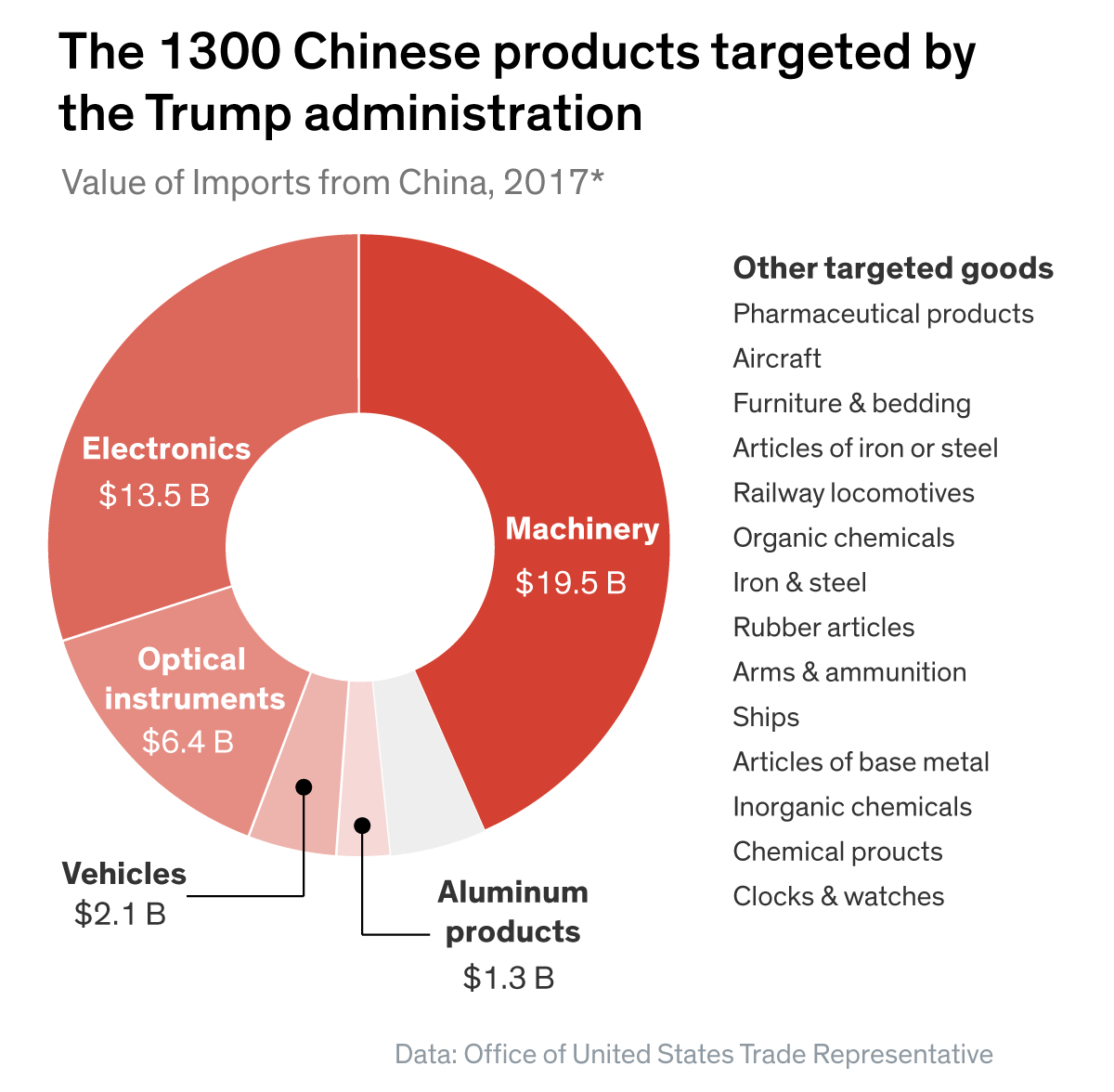

Golds Record High Understanding The Trade War Impact On Bullion

Apr 26, 2025

Golds Record High Understanding The Trade War Impact On Bullion

Apr 26, 2025 -

Love Island Nepo Babies Ranking The Biggest Names

Apr 26, 2025

Love Island Nepo Babies Ranking The Biggest Names

Apr 26, 2025 -

Osimhen To Man United Dream Transfer Budget Reality

Apr 26, 2025

Osimhen To Man United Dream Transfer Budget Reality

Apr 26, 2025 -

Portnoy Slams Newsom A Detailed Look At The Controversy

Apr 26, 2025

Portnoy Slams Newsom A Detailed Look At The Controversy

Apr 26, 2025 -

Randstad Rail Network Amsterdam Facing Major Track Failure Disruptions

Apr 26, 2025

Randstad Rail Network Amsterdam Facing Major Track Failure Disruptions

Apr 26, 2025