Exploring The Investment Potential Of Uber's Driverless Technology Through ETFs

Table of Contents

Understanding Uber's Autonomous Vehicle Initiatives

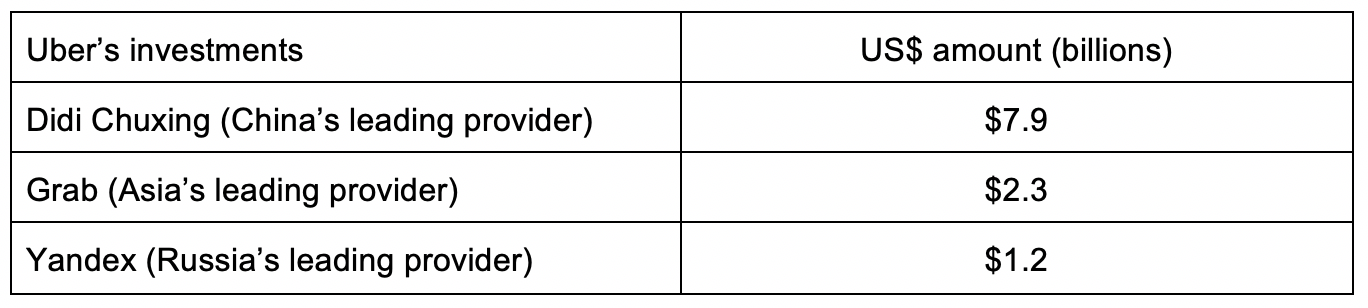

Uber's journey into autonomous vehicles began years ago with significant investments in research and development. Their ambition extends beyond simply improving their ride-sharing platform; they aim to revolutionize transportation and logistics. Key partnerships and acquisitions, such as their collaborations with various tech companies and their acquisition of autonomous driving startups, have significantly bolstered their capabilities.

- Strategic Partnerships: Uber has partnered with numerous technology companies to accelerate the development and deployment of its self-driving technology. These partnerships bring together expertise in areas such as sensor technology, AI, and mapping.

- Acquisitions: Uber's acquisitions of autonomous vehicle companies have provided access to crucial technologies and talent, strengthening its position in the competitive autonomous vehicle landscape.

- Market Impact: The successful implementation of Uber's driverless car technology promises several significant impacts:

- Increased Efficiency: Autonomous vehicles could significantly reduce operational costs by eliminating driver salaries and improving route optimization.

- Market Expansion: Driverless technology can expand Uber's services to areas previously inaccessible due to high labor costs or driver shortages.

- Service Diversification: Beyond ride-sharing, Uber's autonomous technology has potential applications in food delivery, package logistics, and other transportation sectors.

Despite the immense potential, significant technological challenges and risks remain. These include ensuring safety, navigating complex traffic scenarios, and overcoming regulatory hurdles.

Identifying Relevant ETFs for Exposure to Uber's Driverless Technology

Directly investing in Uber's autonomous vehicle division presents challenges due to its structure and limited public access. However, Exchange Traded Funds (ETFs) provide a diversified and accessible route to gain exposure to this exciting sector. ETFs offer several advantages:

- Diversification: ETFs invest in a basket of companies, reducing risk compared to investing in a single company.

- Liquidity: ETFs are easily traded on major stock exchanges.

- Low Costs: Many ETFs have low expense ratios compared to actively managed funds.

Several ETFs offer exposure to companies involved in autonomous vehicle technology, either directly or indirectly benefiting from Uber's success:

- Technology ETFs: Many broad technology ETFs hold shares of companies developing key technologies for autonomous vehicles, like sensor manufacturers, AI developers, and mapping companies. (e.g., QQQ, XLK – remember to research specific holdings before investing)

- Transportation ETFs: ETFs focused on the transportation sector often include companies involved in developing or implementing autonomous driving solutions. (e.g., IYT, VTI – research holdings for specific exposure)

- Robotics ETFs: Companies specializing in robotics and automation are key players in the autonomous vehicle industry. ETFs focused on this sector could provide indirect exposure. (e.g., ROBO – always check current holdings)

Remember to carefully examine each ETF's holdings, expense ratio, and investment strategy before investing. The expense ratio (the annual fee charged by the fund) should be considered alongside the potential returns.

Assessing the Risks and Rewards of Investing in Autonomous Vehicle ETFs

Investing in autonomous vehicle technology, even through ETFs, carries inherent risks:

- Regulatory Uncertainty: The regulatory landscape surrounding autonomous vehicles is constantly evolving, creating uncertainty.

- Technological Hurdles: Unexpected technological challenges and development delays could impact the growth of the sector.

- Competition: The autonomous vehicle market is highly competitive, with several major players vying for market share.

- Market Volatility: Like any emerging technology, the autonomous vehicle sector is subject to market volatility and economic fluctuations.

Despite these risks, the potential rewards are significant:

- High Growth Potential: The autonomous vehicle market is poised for explosive growth, offering substantial investment returns.

- Portfolio Diversification: Adding autonomous vehicle ETFs to a well-diversified portfolio can reduce overall risk.

- Long-Term Investment: This is a long-term investment opportunity; patience is crucial for reaping potential rewards.

Conclusion: Navigating the Future of Transportation: Investing in Uber's Driverless Technology Through ETFs

Investing in Uber's driverless technology through ETFs presents a compelling opportunity to participate in a transformative industry. While risks exist, the potential rewards justify careful consideration. Thorough research into relevant ETFs, understanding their holdings, expense ratios, and investment strategies is crucial. By diversifying your investment across several ETFs focused on technology, transportation, or robotics, you can mitigate individual company risk and gain broader exposure to the autonomous vehicle revolution. Remember to explore various ETF options related to Uber's driverless technology through ETFs and conduct further research before making any investment decisions. The long-term potential of this sector is substantial, promising exciting returns for those who carefully navigate the opportunities and risks involved.

Featured Posts

-

O Maik Magiers Ensarkonei Ton Ilon Mask Sto Saturday Night Live

May 18, 2025

O Maik Magiers Ensarkonei Ton Ilon Mask Sto Saturday Night Live

May 18, 2025 -

Reddit Takes Action Addressing Upvotes For Violent Content

May 18, 2025

Reddit Takes Action Addressing Upvotes For Violent Content

May 18, 2025 -

Cannes Then And Now Fun Crazy And Ludicrous Photo Comparison

May 18, 2025

Cannes Then And Now Fun Crazy And Ludicrous Photo Comparison

May 18, 2025 -

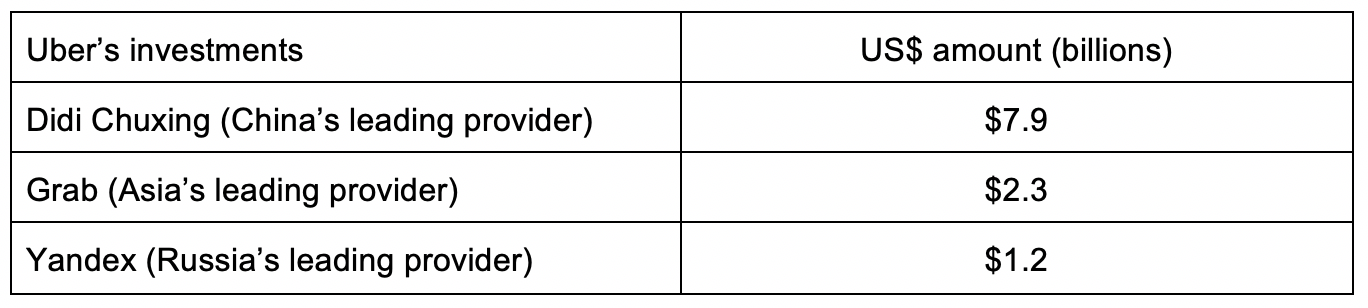

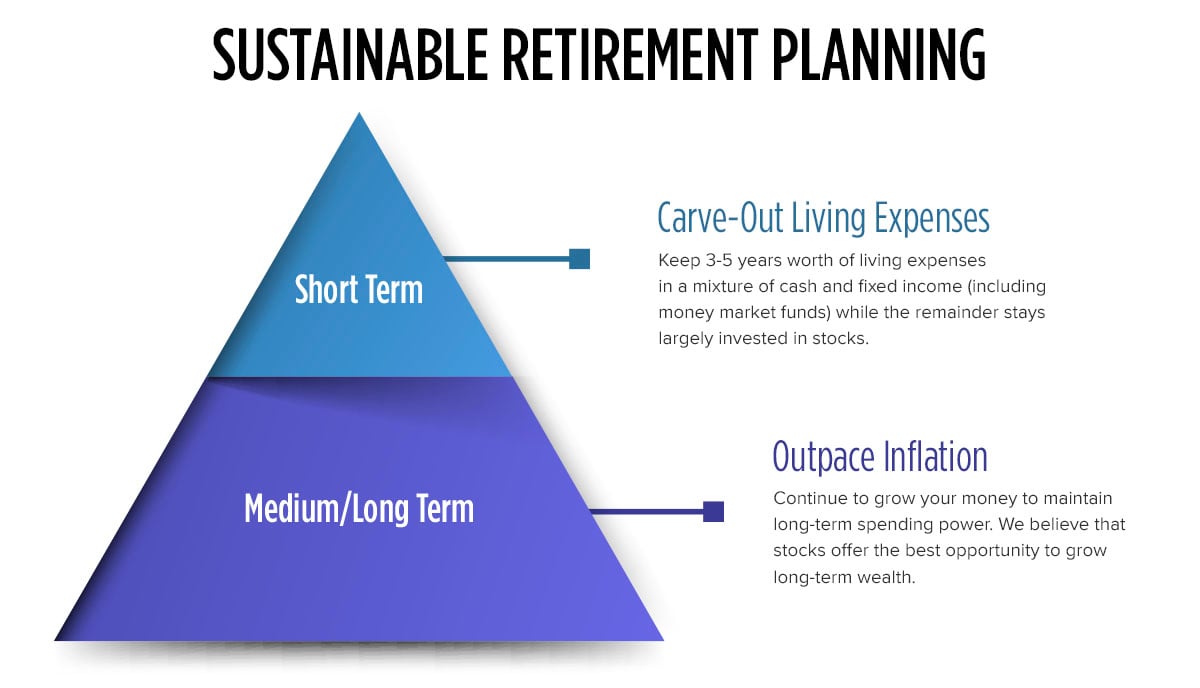

Retirement Investment Strategy Is This New Idea A Good Or Bad Choice

May 18, 2025

Retirement Investment Strategy Is This New Idea A Good Or Bad Choice

May 18, 2025 -

Investigation Into Lingering Toxic Chemicals Following Ohio Train Derailment

May 18, 2025

Investigation Into Lingering Toxic Chemicals Following Ohio Train Derailment

May 18, 2025

Latest Posts

-

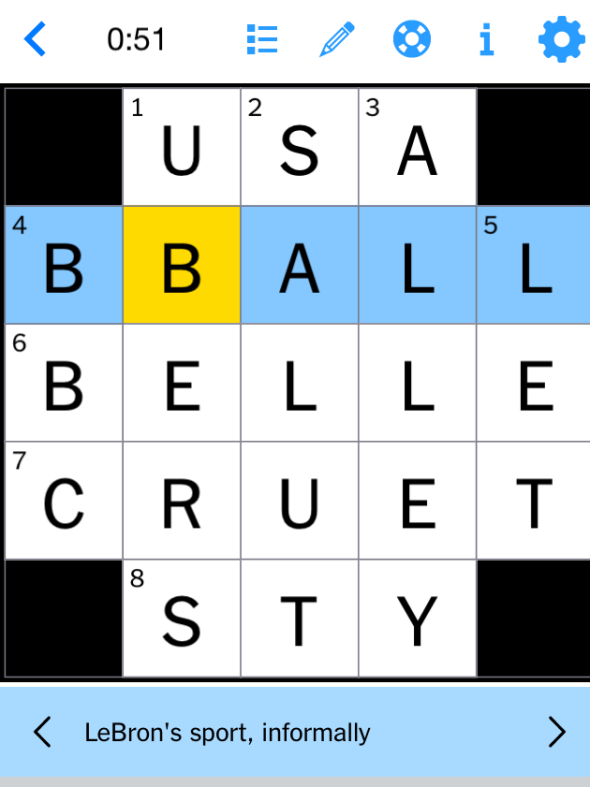

Nyt Mini Crossword Clues And Answers March 26 2025

May 19, 2025

Nyt Mini Crossword Clues And Answers March 26 2025

May 19, 2025 -

Nyt Mini Crossword Solutions For March 16 2025

May 19, 2025

Nyt Mini Crossword Solutions For March 16 2025

May 19, 2025 -

Delhi And Mumbai Get Uber Pet Convenient Pet Travel

May 19, 2025

Delhi And Mumbai Get Uber Pet Convenient Pet Travel

May 19, 2025 -

Nyt Mini Crossword Answers Today March 16 2025 Hints And Clues

May 19, 2025

Nyt Mini Crossword Answers Today March 16 2025 Hints And Clues

May 19, 2025 -

Nyt Mini Crossword Puzzle Solutions March 26 2025

May 19, 2025

Nyt Mini Crossword Puzzle Solutions March 26 2025

May 19, 2025