Extreme Price Hike: Broadcom's VMware Deal Faces AT&T Backlash

Table of Contents

The Broadcom-VMware Acquisition: A Deeper Dive

Broadcom's $61 billion acquisition of VMware, finalized in late 2022, was a monumental event in the tech industry. Broadcom, a leading provider of semiconductor and infrastructure software solutions, sought to expand its enterprise software portfolio by acquiring VMware, a virtualization and cloud infrastructure giant. The strategic rationale behind this move was to create synergies between Broadcom's existing hardware and software offerings and VMware's dominant position in the virtualization market. This integration aims to provide comprehensive solutions for enterprise clients, streamlining operations and potentially leading to cost savings for Broadcom in the long run.

VMware holds a significant market share in the enterprise software market, offering a comprehensive suite of products and services including:

- vSphere: A leading virtualization platform for data centers.

- vCloud Director: A cloud management platform for service providers.

- VMware Tanzu: A portfolio of tools and services for modern application development and deployment.

- NSX: A network virtualization platform.

This acquisition brings together Broadcom's extensive hardware portfolio with VMware’s leading software solutions, creating a potentially powerful combination. However, the price increase following the acquisition has cast a shadow over this seemingly synergistic merger.

AT&T's Concerns and the Backlash

AT&T, a major telecommunications company and a significant VMware client, has voiced strong concerns over the substantial price increases following Broadcom's acquisition. Reports suggest price hikes of up to 30% for certain VMware products and services. This dramatic increase directly impacts AT&T's operational costs and its bottom line, forcing the company to re-evaluate its IT spending and potentially seek alternative solutions.

The price hike’s impact on AT&T is multifaceted:

- Increased Operational Costs: The significant percentage increase in VMware licensing fees adds millions to AT&T's annual IT budget.

- Potential Budgetary Constraints: This unexpected expense could lead to budget reallocations and potential delays in other IT projects.

- Competitive Disadvantage: Increased costs could put AT&T at a competitive disadvantage compared to rivals who may find more cost-effective solutions.

AT&T's potential responses include negotiating with Broadcom for more favorable pricing, exploring alternative virtualization technologies, and potentially even pursuing legal action or regulatory intervention. Public statements from AT&T express their deep concern about the pricing and its potential impact on their business.

Wider Implications and Market Reactions

The Broadcom-VMware deal and the subsequent price hike have far-reaching implications for the entire technology industry. Many other enterprise clients rely on VMware products and services, and the potential for similar price increases across the board is causing widespread concern. This situation raises questions about the potential for future mergers and acquisitions in the tech sector to lead to similar anti-competitive pricing practices.

The market reaction has been varied:

- Concerns about Consolidation: Industry analysts express worry about the consolidation of power in the hands of fewer tech giants.

- Impact on Future Valuations: The controversy could affect how investors value future tech mergers and acquisitions.

- Search for Alternatives: Companies are now actively exploring alternative virtualization and cloud solutions.

The stock market response to Broadcom’s acquisition and the ensuing price increases will continue to be a key indicator of investor sentiment.

Potential Solutions and Future Outlook

Addressing the price hike concerns requires multifaceted solutions. Negotiations between Broadcom and its clients, particularly those expressing concerns like AT&T, are crucial. Regulatory bodies will also likely play a role in ensuring fair pricing practices and preventing anti-competitive behavior. Transparency in pricing models and clear communication from Broadcom regarding pricing strategies are also needed to maintain trust and confidence with existing clients.

Possible outcomes include:

- Negotiated Price Reductions: Broadcom may offer revised pricing structures to retain key clients.

- Regulatory Scrutiny: Antitrust regulators might investigate the deal's impact on competition.

- Market Adjustments: The emergence of competitive alternatives could temper Broadcom’s pricing power.

The long-term implications of the Broadcom-VMware deal remain uncertain. However, its impact on enterprise pricing and the competitive landscape within the virtualization market will be felt for years to come. Forecasting future prices for VMware products and services is difficult, dependent largely on the outcome of negotiations and regulatory review.

Conclusion: Navigating the Aftermath of Broadcom's VMware Deal

Broadcom's acquisition of VMware, while initially promising synergy, has resulted in a significant price hike sparking considerable backlash, particularly from AT&T. This situation has far-reaching implications for the technology industry, raising concerns about the potential for anti-competitive pricing practices following major mergers and acquisitions. The resulting uncertainty affects not only major corporations like AT&T but also the wider market and the future of enterprise software pricing. Stay tuned for further updates on the Broadcom VMware deal and its implications for enterprise pricing. The impact of this extreme price hike will continue to shape the tech landscape in the coming months.

Featured Posts

-

Tariff Tensions Walmart And Target Executives Consult With Trump

Apr 23, 2025

Tariff Tensions Walmart And Target Executives Consult With Trump

Apr 23, 2025 -

Section 230 And Banned Chemicals On E Bay A Judges Ruling

Apr 23, 2025

Section 230 And Banned Chemicals On E Bay A Judges Ruling

Apr 23, 2025 -

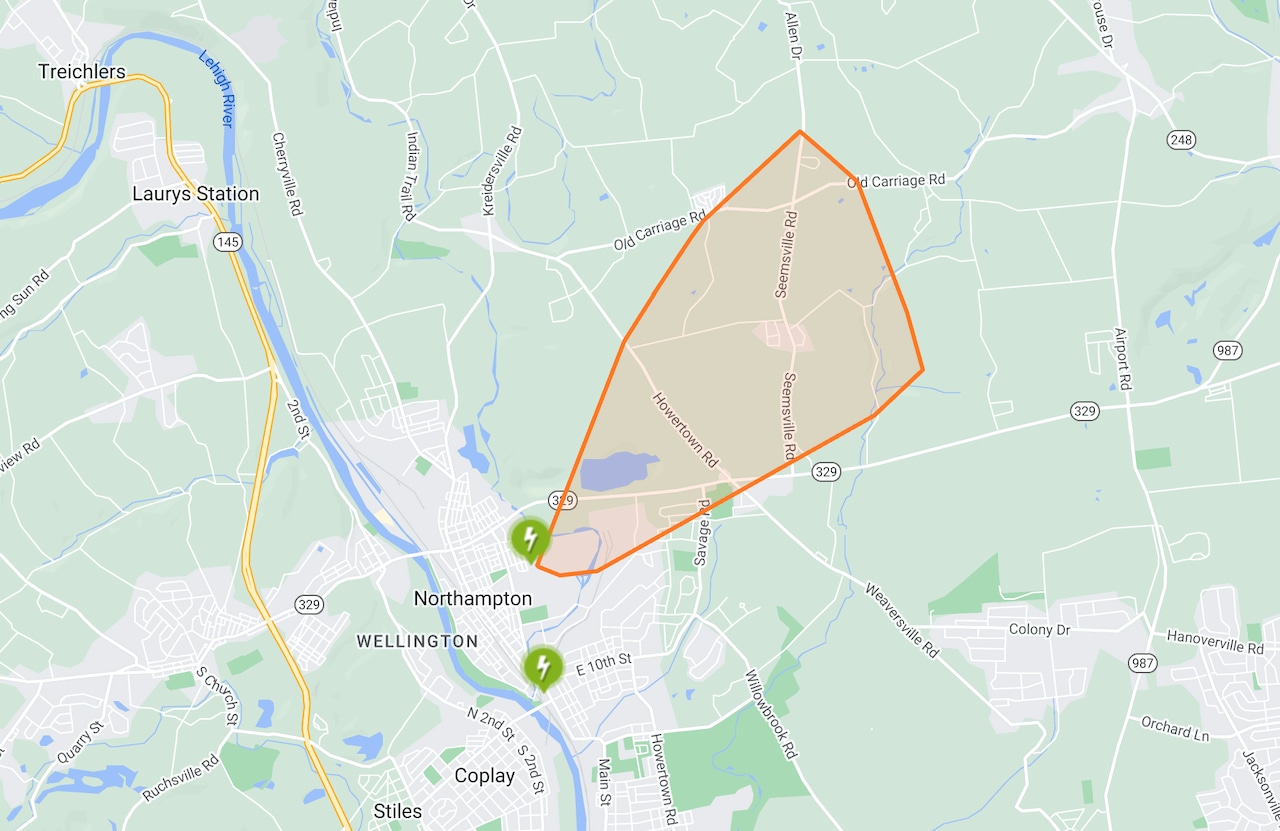

Power Outages Hit Lehigh Valley Amid High Winds Photo Gallery

Apr 23, 2025

Power Outages Hit Lehigh Valley Amid High Winds Photo Gallery

Apr 23, 2025 -

Les Informations Cles De Bfm Bourse 17 02 Xx 15h 16h

Apr 23, 2025

Les Informations Cles De Bfm Bourse 17 02 Xx 15h 16h

Apr 23, 2025 -

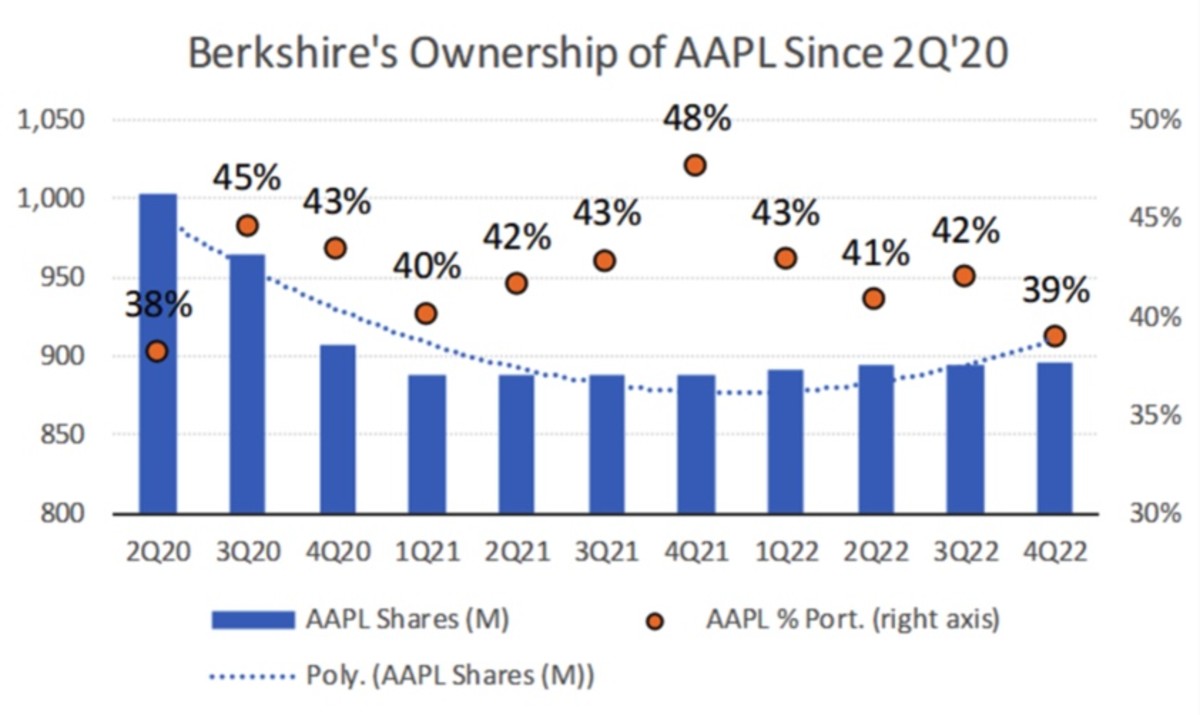

Warren Buffetts Apple Stock Sale A Strategic Move And What It Means For Investors

Apr 23, 2025

Warren Buffetts Apple Stock Sale A Strategic Move And What It Means For Investors

Apr 23, 2025