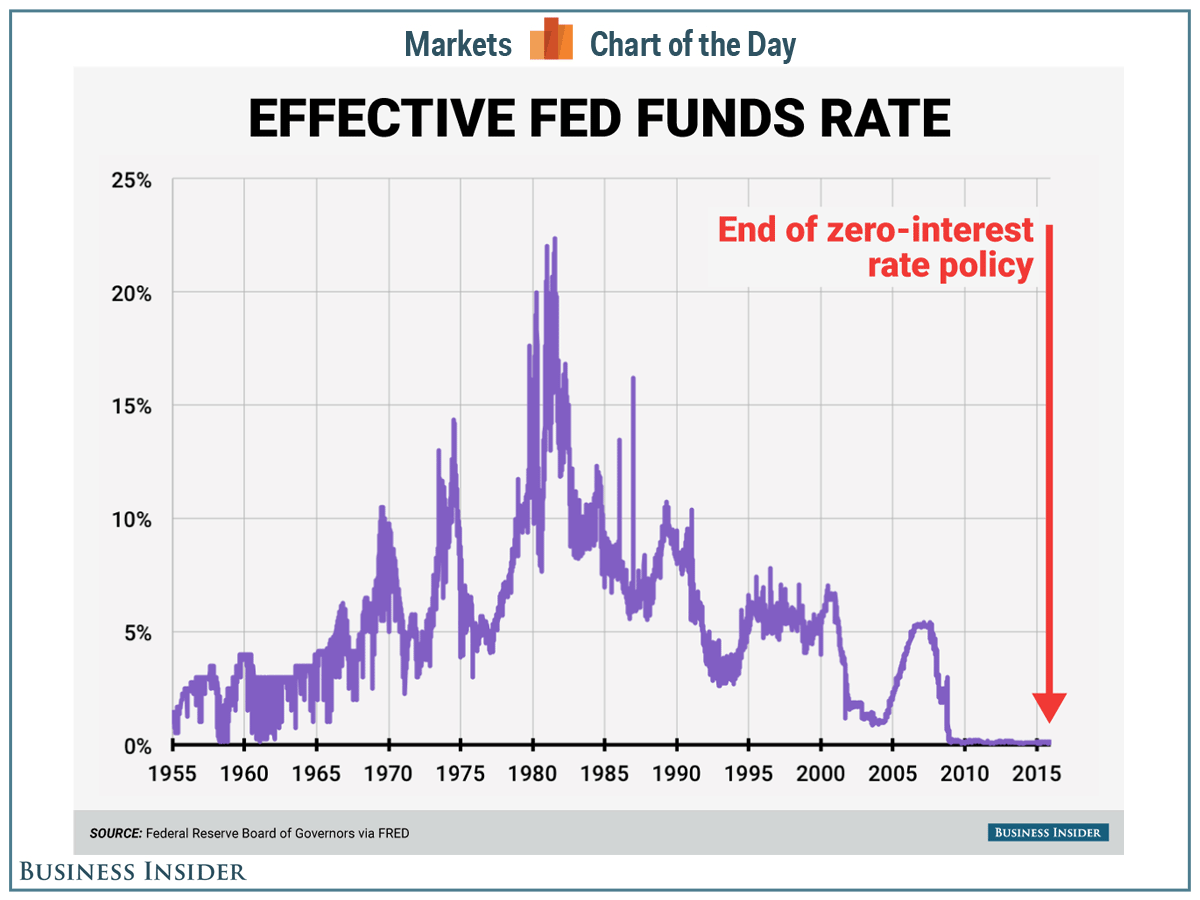

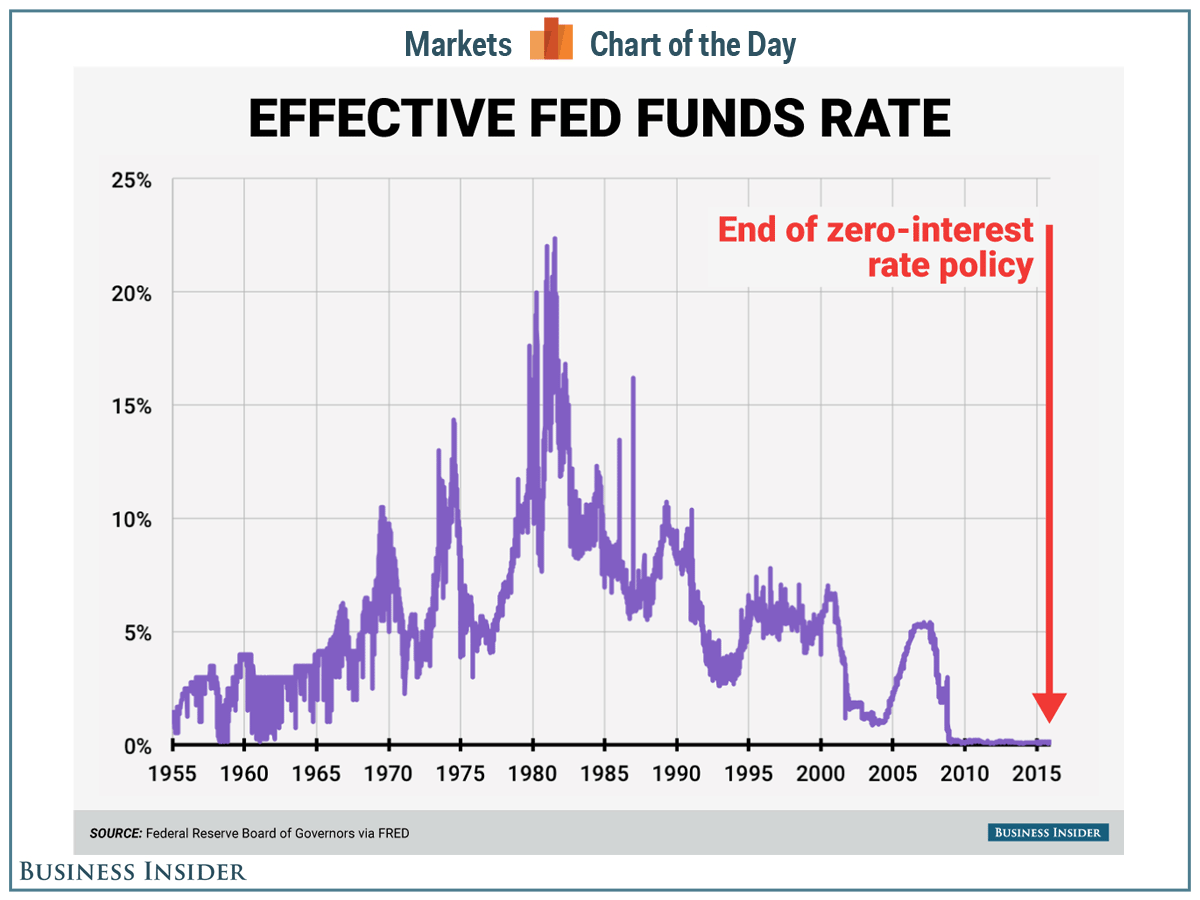

Fed's Hesitation: Why Interest Rate Cuts Aren't Imminent

Table of Contents

Persistent Inflation Remains a Primary Concern

While inflation has cooled significantly from its peak, it remains stubbornly above the Federal Reserve's 2% target, a primary concern hindering any immediate interest rate cuts. This persistent inflation, reflected in metrics like the Consumer Price Index (CPI) and Producer Price Index (PPI), continues to pose a significant challenge. The core inflation rate, which excludes volatile food and energy prices, remains elevated, indicating underlying price pressures that are not easily addressed.

-

Core inflation remains elevated, indicating underlying price pressures. The persistence of core inflation signals that inflationary pressures are deeply embedded within the economy, requiring a more sustained approach to monetary policy.

-

The Fed prioritizes price stability and will likely maintain a hawkish stance until inflation is consistently near its target. The Federal Reserve's mandate emphasizes price stability, and achieving this goal remains paramount before considering easing monetary policy through interest rate cuts.

-

Sticky inflation in services sectors poses a continued challenge. Inflation in services, such as healthcare and rent, has proven to be particularly persistent, further complicating the path back to the Fed's 2% inflation target. This stickiness suggests that simply lowering interest rates may not be sufficient to address all inflationary pressures.

The Labor Market Remains Tight

The strength of the current labor market presents another significant obstacle to imminent Fed interest rate cuts. Low unemployment rates and robust job growth contribute to upward pressure on wages, further fueling inflation. This tight labor market dynamic reflects continued high demand for labor, resulting in increased wage growth.

-

Low unemployment rates indicate continued demand for labor. The low unemployment rate suggests that the economy is still operating at or near full employment, a condition that typically puts upward pressure on wages and prices.

-

Strong wage growth fuels inflation. Increased wages, while positive for workers, contribute to inflationary pressures as businesses pass increased labor costs onto consumers through higher prices.

-

The Fed views a tight labor market as inflationary. The Federal Reserve recognizes the tight labor market as a significant contributor to inflation and is unlikely to ease monetary policy until it sees substantial easing in labor market tightness.

Risks Associated with Premature Rate Cuts

The potential downsides of prematurely cutting interest rates are substantial and contribute to the Fed's cautious approach. A premature easing of monetary policy could reignite inflation, undoing much of the progress made in bringing inflation down and undermining the Federal Reserve's credibility.

-

Premature rate cuts could lead to a resurgence of inflation. Cutting interest rates too soon could inject renewed inflationary pressures into the economy, potentially pushing inflation back towards levels seen earlier in 2022.

-

It would weaken the Fed’s commitment to price stability. Acting prematurely would signal a wavering commitment to the Fed's primary mandate of price stability and could damage its credibility in the eyes of markets and the public.

-

Uncertain economic outlook requires careful consideration of policy actions. The current economic outlook remains clouded by uncertainty, requiring a cautious and data-driven approach to monetary policy. The Fed needs to carefully assess the situation before making any significant shifts in its policy stance.

Quantitative Tightening is Still in Effect

The Federal Reserve's ongoing quantitative tightening (QT) program further complicates the possibility of immediate interest rate cuts. QT involves reducing the Federal Reserve's balance sheet by allowing assets to mature without reinvestment. This process further reduces the money supply and exerts upward pressure on borrowing costs, acting as a restrictive monetary policy that complements higher interest rates.

-

QT further reduces money supply and puts upward pressure on borrowing costs. By reducing the money supply, QT makes borrowing more expensive, thereby curbing economic activity and inflation.

-

The effects of QT are still unfolding and need to be carefully monitored. The full impact of QT on the economy is yet to be fully realized, requiring careful observation before any policy changes are considered.

-

QT’s impact on inflation is likely to continue for several months. The effects of QT are expected to be felt over a period of time, making it even less likely that interest rate cuts will happen in the near term.

Conclusion

The Federal Reserve's reluctance to cut interest rates stems from a confluence of factors: persistent inflation, a tight labor market, and the ongoing impact of quantitative tightening. Premature rate cuts risk reigniting inflation and eroding the Fed's credibility. While the economic outlook remains uncertain, understanding the Fed's rationale behind its current stance on interest rate cuts is crucial for investors and businesses. Stay informed about the latest developments regarding Fed interest rate cuts and adapt your strategies accordingly. Follow our blog for updates on the Fed's monetary policy and its impact on the economy.

Featured Posts

-

Home Office Intensifies Asylum Restrictions Focus On Three Nations

May 10, 2025

Home Office Intensifies Asylum Restrictions Focus On Three Nations

May 10, 2025 -

Cheveux Faire Un Don A Dijon Pour La Recherche

May 10, 2025

Cheveux Faire Un Don A Dijon Pour La Recherche

May 10, 2025 -

Mediatheque Champollion Dijon Intervention Des Pompiers Pour Un Depart De Feu

May 10, 2025

Mediatheque Champollion Dijon Intervention Des Pompiers Pour Un Depart De Feu

May 10, 2025 -

El Salvador Prison Transfers A Debate On Due Process And Jeanine Pirros Stance

May 10, 2025

El Salvador Prison Transfers A Debate On Due Process And Jeanine Pirros Stance

May 10, 2025 -

The Relationship Between Dangote Refinery Nnpc And Petrol Price Fluctuations

May 10, 2025

The Relationship Between Dangote Refinery Nnpc And Petrol Price Fluctuations

May 10, 2025