Financial Models For A 270MWh Battery Energy Storage System (BESS) Project In Belgium

Table of Contents

Assessing the Belgian Energy Market Landscape for BESS Investment

The success of a BESS project hinges on a thorough understanding of the Belgian energy market. This involves analyzing both the regulatory environment and the market's demand for energy storage solutions.

Regulatory Framework and Incentives

Belgium offers a supportive regulatory framework for renewable energy projects, including BESS systems. Several incentives are available to encourage investment in battery storage:

- Government Subsidies: The Belgian government provides various subsidies and grants for renewable energy projects, including those incorporating BESS. Specific programs and their eligibility criteria should be carefully reviewed.

- Tax Benefits: Tax breaks and accelerated depreciation allowances can significantly reduce the overall cost of a BESS project, making it more financially attractive.

- Renewable Energy Targets: Belgium has ambitious renewable energy targets, creating a strong market demand for energy storage solutions to integrate intermittent renewable energy sources like solar and wind power. This demand fuels the need for BESS investment.

- Capacity Mechanisms: The Belgian regulatory authority may implement capacity mechanisms to ensure grid stability, creating revenue streams for BESS projects providing ancillary services.

- Feed-in Tariffs: While potentially less significant for BESS than for generation, understanding feed-in tariff schemes is important for overall project economics and revenue forecasting.

The impact of European Union regulations, such as the Renewable Energy Directive, also significantly influences the Belgian energy market and BESS project financing. Compliance with EU regulations is crucial for securing funding and project approval.

Market Demand and Price Signals

Electricity price volatility in Belgium presents both challenges and opportunities for BESS investors. The fluctuating prices, often correlated with renewable energy generation, create revenue streams through:

- Arbitrage: Buying energy at low prices and selling it at peak prices.

- Frequency Regulation: Providing grid stabilization services by responding to fluctuations in frequency.

- Peak Shaving: Reducing peak demand and lowering overall electricity costs.

- Demand-Side Management: Optimizing energy consumption through intelligent grid management and BESS integration.

[Insert chart/graph illustrating electricity price fluctuations in Belgium]. The chart demonstrates the potential for significant profits from arbitrage and peak shaving, highlighting the financial viability of BESS deployment in Belgium. Detailed analysis, considering seasonality and various market scenarios, is crucial for accurate revenue projections.

Key Financial Models for BESS Projects in Belgium

Securing funding for a 270MWh BESS project requires exploring various financial models. The optimal choice depends on project specifics, investor preferences, and market conditions.

Debt Financing

Traditional financing methods for BESS projects in Belgium include:

- Bank Loans: Commercial banks often provide loans for large-scale infrastructure projects like BESS, subject to rigorous due diligence and creditworthiness assessments.

- Project Finance: This specialized financing structure involves securing loans based on the projected cash flows of the BESS project itself.

- Green Bonds: These bonds attract investors specifically interested in financing environmentally friendly projects, potentially offering more favorable interest rates.

Credit rating agencies play a crucial role in securing favorable loan terms. A strong project development plan with realistic financial projections is essential for attracting lenders.

Equity Financing

Several equity financing options exist for BESS projects:

- Private Equity: Private equity firms may invest in BESS projects seeking high returns.

- Venture Capital: Venture capitalists often invest in early-stage projects with high growth potential.

- Public Offerings (IPOs): While less common for BESS projects at this stage, an IPO could be a viable option for larger, well-established projects.

Attracting strategic investors with expertise in the energy sector can be highly beneficial, providing not only capital but also valuable industry knowledge and networks.

Hybrid Financing Models

Combining debt and equity financing optimizes capital structure and minimizes risk:

- Blended Finance: Combining public and private funding sources can reduce reliance on any single source and diversify risk.

- Crowdfunding: While potentially challenging for projects of this scale, crowdfunding could supplement traditional financing methods.

Successful hybrid models used internationally provide valuable case studies for Belgian BESS project developers.

Essential Financial Considerations for a 270MWh BESS Project

A detailed financial analysis is crucial for the success of any large-scale BESS project.

Capital Expenditure (CAPEX) and Operational Expenditure (OPEX)

The cost breakdown for a 270MWh BESS project is significant and includes:

- Battery Technology: The choice of battery chemistry and its associated costs significantly influence overall CAPEX.

- Installation: Costs associated with site preparation, installation, and commissioning.

- Grid Connection: Securing grid connection and associated infrastructure costs.

- Maintenance: Ongoing maintenance and replacement of battery components throughout the project's lifespan.

- Operations: Costs associated with the ongoing operation and monitoring of the BESS system.

Battery lifetime and degradation rates impact long-term OPEX, influencing the overall financial model. Sensitivity analysis should account for variations in these costs.

Revenue Projections and Risk Assessment

Revenue projections should consider:

- Electricity Price Volatility: The variability of electricity prices impacts the profitability of arbitrage and other revenue streams.

- Regulatory Changes: Changes in government policies and regulations can affect project profitability.

- Technological Advancements: Technological advancements may impact battery performance and costs, necessitating regular updates to the financial model.

A comprehensive risk register must identify and quantify potential risks, including financial risks (e.g., interest rate fluctuations), operational risks (e.g., equipment failure), and regulatory risks (e.g., policy changes). Insurance and risk transfer mechanisms should be incorporated into the risk mitigation strategy.

Return on Investment (ROI) and Internal Rate of Return (IRR)

Key financial metrics like ROI and IRR are crucial for assessing project viability:

- ROI: Measures the profitability of the investment over its lifetime.

- IRR: The discount rate that makes the net present value (NPV) of the project equal to zero.

- Payback Period: The time it takes for the project to recoup its initial investment.

A detailed discounted cash flow (DCF) analysis, incorporating all revenue streams and expenses, provides a comprehensive assessment of the project’s financial performance over its lifespan.

Conclusion

This article has examined various financial models applicable to a 270MWh BESS project in Belgium, highlighting the importance of understanding the regulatory environment, market dynamics, and various financing options. Successfully securing funding for such projects requires a thorough understanding of the Belgian energy market, a robust financial model that accurately reflects the potential risks and rewards, and a comprehensive plan for mitigating these risks. By carefully considering these factors, developers can unlock the significant financial opportunities presented by investing in BESS projects and contributing to Belgium's energy transition. Further research and exploration into specific financial models tailored to your BESS project in Belgium are crucial for success. Begin your journey by conducting a detailed financial feasibility study and exploring the various funding avenues available to you in the Belgian energy market, focusing on securing optimal financial models for BESS projects in Belgium.

Featured Posts

-

Record Breaking Heat Pump Launched At Utrecht Wastewater Treatment Plant

May 04, 2025

Record Breaking Heat Pump Launched At Utrecht Wastewater Treatment Plant

May 04, 2025 -

The High Price Of Offshore Wind A Shift In Industry Sentiment

May 04, 2025

The High Price Of Offshore Wind A Shift In Industry Sentiment

May 04, 2025 -

Two Days At A Crypto Party A Recounting Of Events

May 04, 2025

Two Days At A Crypto Party A Recounting Of Events

May 04, 2025 -

The 2024 Singapore Election A Referendum On The Paps Rule

May 04, 2025

The 2024 Singapore Election A Referendum On The Paps Rule

May 04, 2025 -

Nigel Farage Faces Defamation Claim From Rupert Lowe Over False Allegations

May 04, 2025

Nigel Farage Faces Defamation Claim From Rupert Lowe Over False Allegations

May 04, 2025

Latest Posts

-

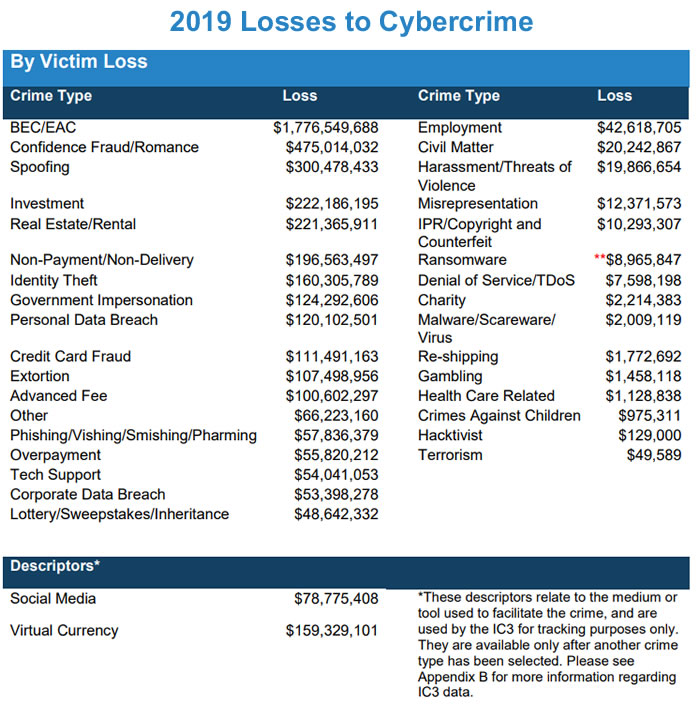

Cybercriminal Nets Millions Through Executive Office365 Account Compromise

May 04, 2025

Cybercriminal Nets Millions Through Executive Office365 Account Compromise

May 04, 2025 -

Federal Investigation Office365 Hack Leads To Multi Million Dollar Loss

May 04, 2025

Federal Investigation Office365 Hack Leads To Multi Million Dollar Loss

May 04, 2025 -

Millions Stolen Insider Reveals Office365 Breach And Executive Targeting

May 04, 2025

Millions Stolen Insider Reveals Office365 Breach And Executive Targeting

May 04, 2025 -

Assessing The Success Of Marvels Thunderbolts

May 04, 2025

Assessing The Success Of Marvels Thunderbolts

May 04, 2025 -

Thunderbolts Will This Team Save The Mcu

May 04, 2025

Thunderbolts Will This Team Save The Mcu

May 04, 2025