Financial Planning: CFP Board CEO Announces Retirement For Early 2026

Table of Contents

Impact of the CEO's Retirement on the CFP Board

The upcoming retirement of the CFP Board CEO will undoubtedly leave a significant mark on the organization. [CEO's Name]'s tenure has been characterized by [mention specific accomplishments, e.g., increased CFP certification standards, successful advocacy efforts, navigating regulatory changes]. Their departure presents both opportunities and challenges for the CFP Board.

-

A Legacy of Leadership: [CEO's Name]'s contributions to the CFP Board, such as [mention specific achievements with quantifiable results if possible], have significantly impacted the financial planning profession. Their leadership has helped to elevate the standards and credibility of CFP® professionals.

-

The Search for a Successor: Finding a suitable replacement for such an influential figure will be a crucial undertaking. The CFP Board will need to identify a candidate with a deep understanding of financial planning, regulatory compliance, and the complexities of the financial services industry. The search process will likely involve a rigorous evaluation of candidates' qualifications, experience, and leadership capabilities, emphasizing their commitment to maintaining the high standards of CFP certification.

-

Navigating the Transition: The transition period will require careful management to ensure the continued smooth operation of the CFP Board and its ongoing initiatives. Maintaining consistency in regulatory compliance and upholding the integrity of the CFP certification process will be paramount. Potential delays or disruptions to existing programs should be minimized through a well-defined succession plan.

-

Future Strategic Direction: The new CEO will likely shape the future strategic direction of the CFP Board, impacting initiatives related to financial planning education, technology adoption, and ethical standards. This could mean a renewed focus on specific areas of financial planning, such as retirement planning, wealth management, or financial planning for diverse populations.

Implications for Financial Advisors and CFP Professionals

The change in leadership at the CFP Board will have far-reaching consequences for financial advisors and CFP® professionals. The impact will be felt across various aspects of their careers, from continuing education requirements to the overall perception of the CFP® designation.

-

Continuing Education and Professional Development: The new leadership might introduce adjustments to continuing education requirements for CFP® professionals, potentially focusing on emerging technologies, regulatory updates, or specific areas of financial planning. Financial advisors should proactively anticipate these changes and remain committed to lifelong learning.

-

Ethical Guidelines and Standards: While the core principles of ethical conduct are likely to remain unchanged, the interpretation and application of these guidelines might evolve under new leadership. Financial advisors must stay abreast of any updates to ensure compliance and maintain the highest professional standards.

-

CFP Certification Process: While significant alterations to the CFP certification process are unlikely in the short term, there's potential for refinements in areas such as exam content or practical experience requirements. Financial planning professionals should monitor any announcements from the CFP Board regarding these aspects.

-

Reputation and Public Perception: The reputation and public perception of CFP® professionals are directly linked to the CFP Board's effectiveness. The leadership transition period requires strong communication and transparency to maintain the public's trust and confidence in CFP® certification.

Opportunities and Challenges for the Future of Financial Planning

The retirement of the CFP Board CEO comes at a time of significant transformation within the financial planning industry. Technological advancements, shifting demographics, and evolving regulatory landscapes present both challenges and opportunities for the profession.

-

Adapting to Change: The future of financial planning requires adaptability and innovation. Financial advisors must embrace new technologies and data analytics to better serve clients and improve efficiency. This also includes staying informed about evolving regulations and adapting strategies accordingly.

-

Technological Advancements: The integration of fintech solutions, AI-powered tools, and robo-advisors is reshaping the financial planning landscape. Financial advisors need to develop proficiency in using these technologies to enhance their services and stay competitive.

-

Evolving Demographics: The aging population and increasing financial complexity require financial planners to specialize in areas such as retirement planning, long-term care, and estate planning. Financial planning education should reflect these evolving needs.

-

The CFP Board's Role: The CFP Board plays a crucial role in shaping the future of the profession by setting standards, promoting education, and advocating for its members. The new CEO will have a significant influence on how the CFP Board navigates these trends and challenges.

Conclusion

The retirement of the CFP Board CEO marks a significant moment for the financial planning industry. The transition presents both challenges and opportunities, requiring careful navigation by the CFP Board and adaptation by financial advisors alike. The search for a new leader will be critical in maintaining the high standards of the CFP certification and guiding the profession into a future increasingly shaped by technological advancements and evolving client needs. The industry will be watching closely to see how the next chapter unfolds for financial planning and the CFP Board.

Call to Action: Stay informed about developments within the financial planning profession and the CFP Board's search for a new CEO. Keep your financial planning knowledge current to adapt to the ever-changing landscape. Consider pursuing your CFP® certification to enhance your career prospects in this dynamic field. Learn more about financial planning and CFP certification by visiting [link to relevant resource].

Featured Posts

-

Fortnite Chapter 4 Season 4 New Icon Skin Unveiled

May 03, 2025

Fortnite Chapter 4 Season 4 New Icon Skin Unveiled

May 03, 2025 -

Switzerlands Continued Backing Of Ukraine Presidents Firm Stance

May 03, 2025

Switzerlands Continued Backing Of Ukraine Presidents Firm Stance

May 03, 2025 -

Alan Roden A Profile Of The Spectators Author

May 03, 2025

Alan Roden A Profile Of The Spectators Author

May 03, 2025 -

Former Liverpool Captain Attacks Manchester Uniteds Transfers

May 03, 2025

Former Liverpool Captain Attacks Manchester Uniteds Transfers

May 03, 2025 -

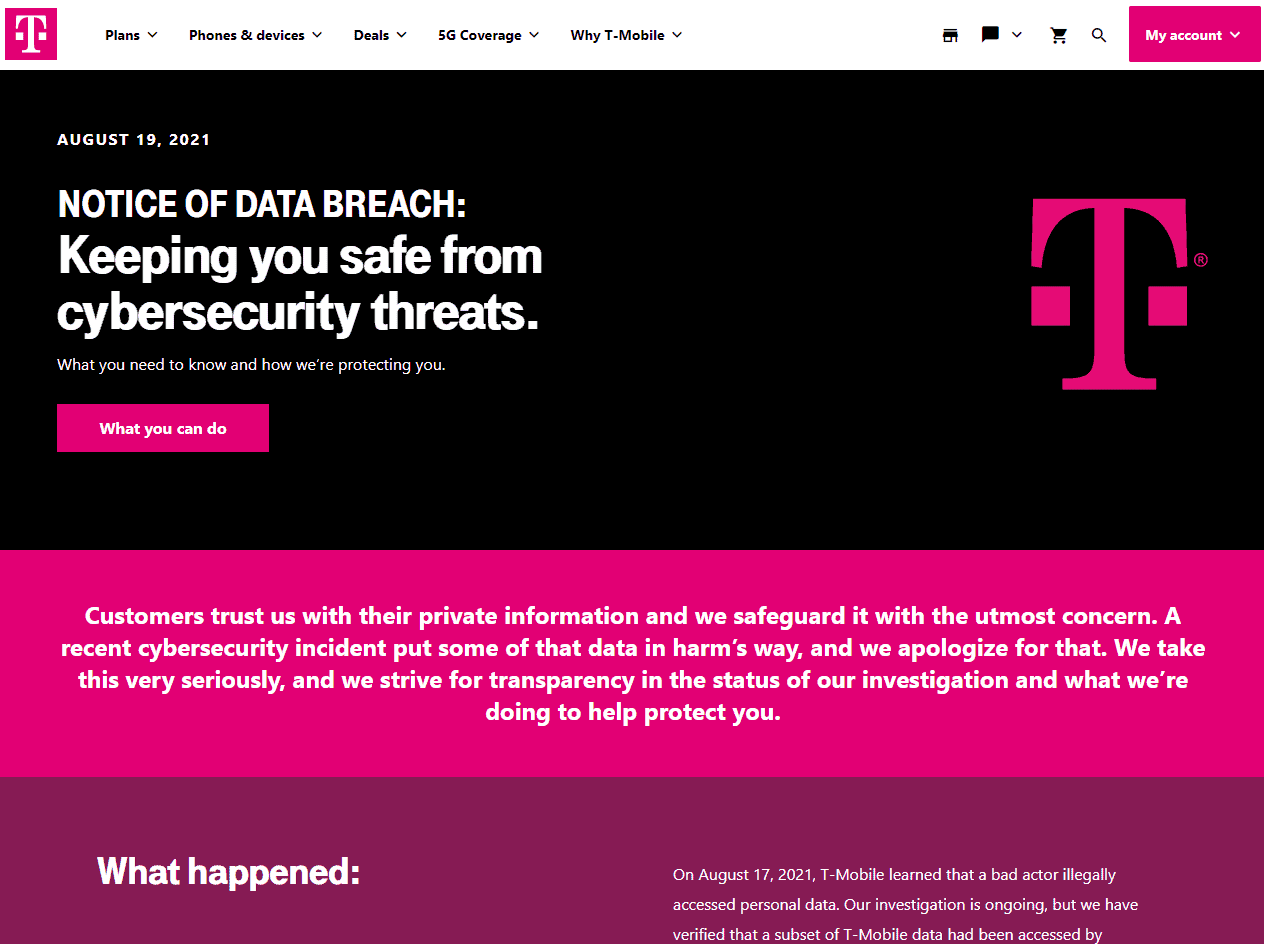

T Mobile Penalized 16 Million For Repeated Data Breaches

May 03, 2025

T Mobile Penalized 16 Million For Repeated Data Breaches

May 03, 2025

Latest Posts

-

Chinas Electric Motor Monopoly Alternatives And Solutions

May 04, 2025

Chinas Electric Motor Monopoly Alternatives And Solutions

May 04, 2025 -

Gta Vi Trailer Breakdown Key Details And Speculation

May 04, 2025

Gta Vi Trailer Breakdown Key Details And Speculation

May 04, 2025 -

53 Year Sentence In Hate Crime Attack Against Palestinian American Mother And Son

May 04, 2025

53 Year Sentence In Hate Crime Attack Against Palestinian American Mother And Son

May 04, 2025 -

Rewatching The Gta Vi Trailer What We Know So Far

May 04, 2025

Rewatching The Gta Vi Trailer What We Know So Far

May 04, 2025 -

The Future Of Electric Motors Diversifying Supply Chains Beyond China

May 04, 2025

The Future Of Electric Motors Diversifying Supply Chains Beyond China

May 04, 2025