Financial Update: Musk's X After The Recent Debt Sale

Table of Contents

The Debt Sale: Details and Implications

Size and Terms of the Debt

The exact terms of X's recent debt sale remain partially undisclosed, with some information filtered through financial news outlets and market speculation. However, reports suggest a substantial amount was raised, potentially billions of dollars. The interest rate is crucial for understanding the financial burden; a higher rate will significantly increase X's interest expense. The maturity date, the point at which the debt must be repaid, will also determine the company's long-term financial planning. The lenders involved likely include a mix of banks and investment firms, although specific names may not be publicly available due to confidentiality agreements.

- Specific figures regarding the debt sale: While precise figures are not yet public, estimates from reliable financial sources point towards a multi-billion dollar debt issuance.

- Type of debt: The debt likely consists of a mix of high-yield bonds and potentially bank loans, given the nature of the transaction and X's financial situation.

- Credit rating impact: The debt sale is expected to negatively impact X's credit rating, increasing its borrowing costs in the future. Rating agencies will closely scrutinize X's financial performance following this sale.

- Comparison to previous funding rounds: This debt sale differs significantly from previous funding rounds, showcasing X's increased reliance on debt financing compared to equity investments.

Immediate Financial Impact on Musk's X

The immediate impact of this significant debt load is a marked increase in X's leverage. This means X now carries a higher ratio of debt to equity, increasing financial risk. Increased interest expense will directly impact profitability, potentially pushing X further into the red in the short term. Furthermore, the substantial interest payments will strain X's cash flow, limiting its flexibility for other investments or operational needs.

- Changes in debt-to-equity ratio: A substantial increase in the debt-to-equity ratio is anticipated, indicating higher financial risk.

- Impact on profitability: The increased interest expense will negatively affect profitability, potentially leading to further losses in the short term.

- Potential strain on cash flow: Substantial interest payments will put pressure on X's already strained cash flow, potentially hindering operational flexibility.

Long-Term Financial Strategy for Musk's X

Debt Repayment Plan

X's debt repayment plan remains largely unannounced, but several strategies are plausible. The company must generate significant revenue to service and ultimately repay this substantial debt. This could involve aggressive pursuit of increased subscription revenue, optimization of its advertising platform, and potentially cost-cutting measures.

- Potential revenue generation strategies: X will likely focus on expanding its paid subscription model (X Premium), maximizing advertising revenue through improved targeting and increased engagement, and exploring new revenue streams.

- Cost-cutting measures: To manage the debt burden, X may implement various cost-cutting initiatives, potentially affecting staffing levels or operational expenses.

- Asset sales: While not confirmed, the sale of non-core assets is a possibility to raise capital for debt repayment.

Impact on Future Investments and Growth

The substantial debt burden will undoubtedly limit X's capacity for future investments and expansion. This could hinder new product development, technological advancements, and potential acquisitions. It may also affect X's ability to attract and retain top talent, impacting its overall competitiveness.

- Potential limitations on expansion plans: The debt will restrict X's capacity for ambitious growth initiatives and market expansion plans.

- Effect on research and development spending: Reduced funding for research and development could stifle innovation and negatively impact the long-term product roadmap.

- Impact on employee recruitment and retention: Limited financial resources could hinder X's ability to compete for top talent, affecting employee morale and productivity.

Market Reaction and Investor Sentiment

Stock Price (if applicable)

While X is currently a privately held company, if it were publicly traded, the debt sale would likely cause significant stock price volatility. The market reaction would depend on investors' assessment of X's ability to manage the increased debt and generate sufficient revenue to cover interest payments and eventual repayment.

- Stock price fluctuations: (Hypothetical for a publicly traded X) We'd anticipate substantial price fluctuations leading up to, during, and following the announcement of the debt sale.

- Analyst ratings and predictions: Financial analysts would likely downgrade X's rating, reflecting the increased financial risk and uncertainty.

- Investor confidence levels: Investor confidence would likely decline initially, but could rebound depending on X's demonstrable progress in revenue generation and debt management.

Credit Rating Agencies' Assessment

Credit rating agencies will critically evaluate X's financial health following the debt sale. A downgrade is highly probable, leading to increased borrowing costs for future funding rounds. The agency's outlook will signal investor sentiment and future risk assessments.

- Credit rating changes: Expect a downgrade in X's credit rating by major credit rating agencies, reflecting the heightened financial risk.

- Outlooks provided by agencies: The outlook accompanying the credit rating change will reveal the agencies’ assessment of X's ability to manage its debt burden.

- Implications for future borrowing costs: A lower credit rating will translate to higher interest rates on any future borrowings, compounding the financial burden on X.

Conclusion

This Musk's X financial update reveals a complex financial picture following the recent debt sale. The substantial debt significantly increases X's financial risk, potentially straining cash flow and hindering future investments. While X has outlined plans to increase revenue, the success of these plans will determine whether it can successfully navigate its increased financial burden. The market's reaction and the assessment of credit rating agencies will provide crucial indicators of investor confidence and future borrowing costs. The long-term financial health of X hinges on its ability to generate sufficient revenue to service and repay its debt. Keep an eye on future developments as we continue to monitor the financial trajectory of Musk's X following this significant debt sale.

Featured Posts

-

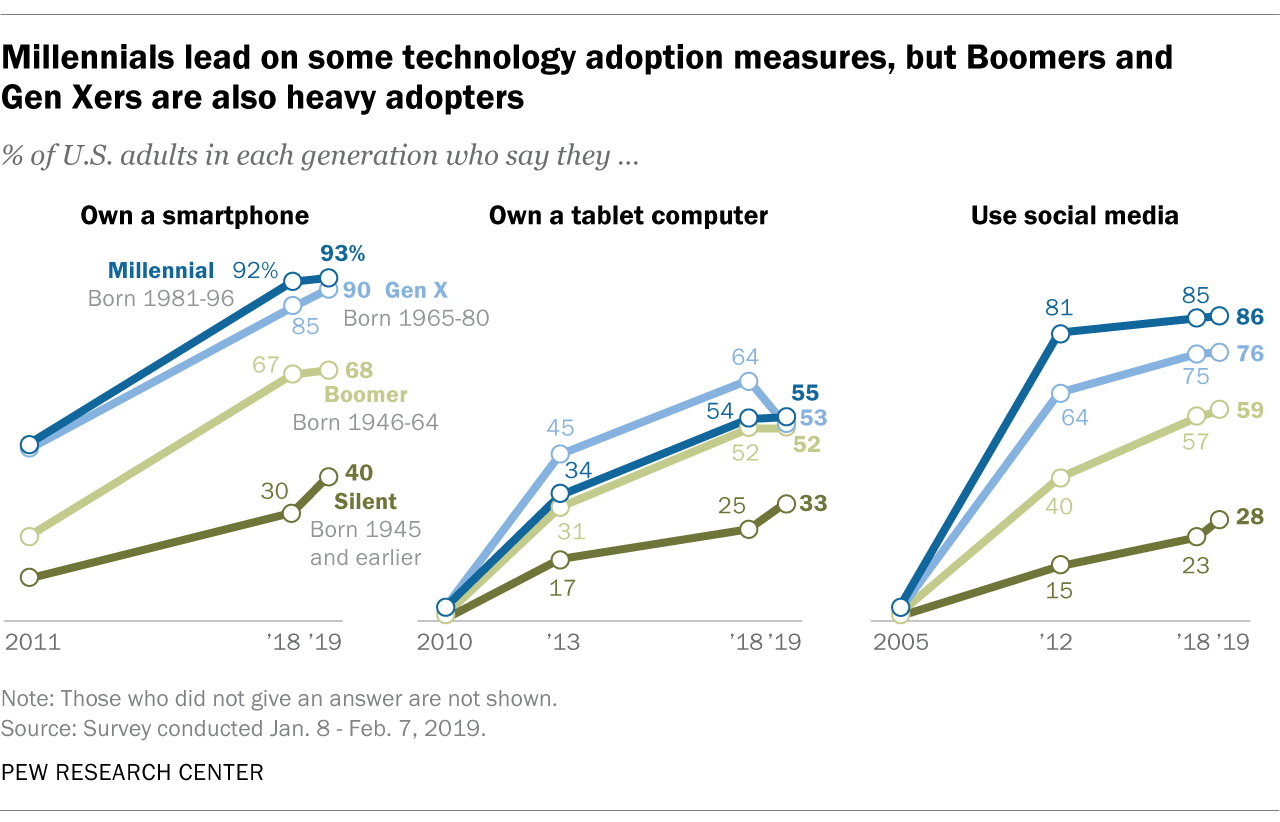

Nprs Findings You Tubes Increasing Popularity Among Older Generations

Apr 29, 2025

Nprs Findings You Tubes Increasing Popularity Among Older Generations

Apr 29, 2025 -

Capital Summertime Ball 2025 Securing Your Place At The Show

Apr 29, 2025

Capital Summertime Ball 2025 Securing Your Place At The Show

Apr 29, 2025 -

How To Purchase Capital Summertime Ball 2025 Tickets

Apr 29, 2025

How To Purchase Capital Summertime Ball 2025 Tickets

Apr 29, 2025 -

Russias Military Posture A Growing Threat To European Stability

Apr 29, 2025

Russias Military Posture A Growing Threat To European Stability

Apr 29, 2025 -

Reliance Shares Surge Biggest Gain In A Decade

Apr 29, 2025

Reliance Shares Surge Biggest Gain In A Decade

Apr 29, 2025

Latest Posts

-

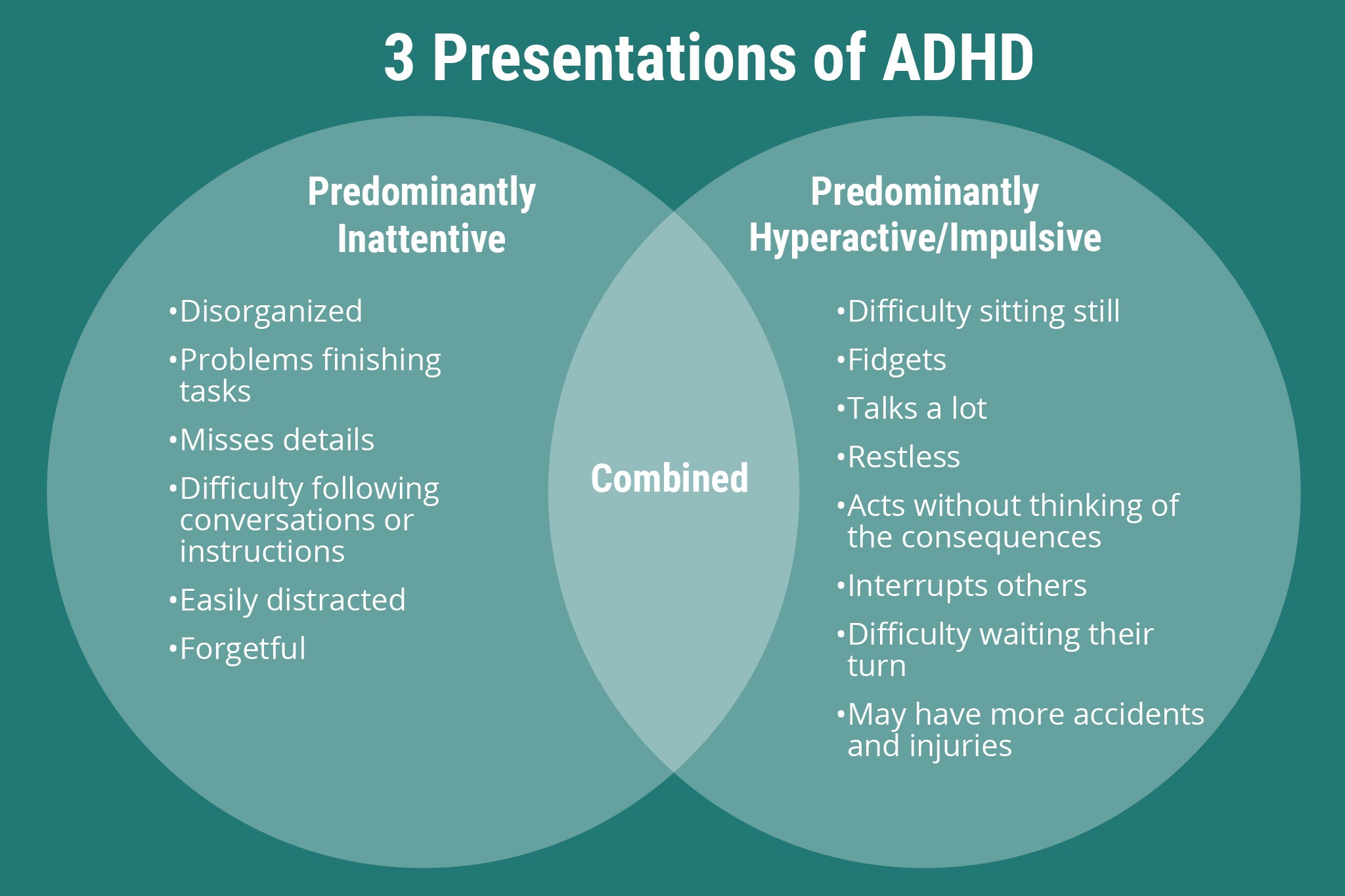

Group Support For Adhd Finding Community And Managing Symptoms

Apr 29, 2025

Group Support For Adhd Finding Community And Managing Symptoms

Apr 29, 2025 -

Adhd And Aging The Role Of Brain Iron In Cognitive Function

Apr 29, 2025

Adhd And Aging The Role Of Brain Iron In Cognitive Function

Apr 29, 2025 -

Get Capital Summertime Ball 2025 Tickets The Ultimate Guide For Fans

Apr 29, 2025

Get Capital Summertime Ball 2025 Tickets The Ultimate Guide For Fans

Apr 29, 2025 -

Get Capital Summertime Ball 2025 Tickets The Ultimate Guide

Apr 29, 2025

Get Capital Summertime Ball 2025 Tickets The Ultimate Guide

Apr 29, 2025 -

Adhd Aging And Brain Iron Understanding Attention And Cognitive Decline

Apr 29, 2025

Adhd Aging And Brain Iron Understanding Attention And Cognitive Decline

Apr 29, 2025