Reliance Shares Surge: Biggest Gain In A Decade

Table of Contents

Factors Driving the Reliance Shares Surge

Several converging factors have contributed to the remarkable rise in Reliance shares. Understanding these elements is crucial for comprehending the current market dynamics and making informed investment decisions.

Robust Q3 Results and Positive Future Outlook

Reliance's strong Q3 (October-December 2023) financial performance played a pivotal role in this surge. The company reported impressive revenue growth, exceeding market expectations, and showcased robust profit margins across its diverse business segments.

- Increased profitability in key sectors: Significant growth was observed in the petrochemicals, refining, and telecom sectors.

- Positive guidance for future quarters: Reliance's management provided optimistic guidance for the coming quarters, further boosting investor confidence.

- Successful new initiatives: The success of new ventures and strategic expansions contributed significantly to the positive financial outlook. Specific examples should be included here based on actual Q3 results (e.g., growth in Jio's subscriber base, success of new retail initiatives). This section should incorporate relevant financial data for maximum impact (e.g., percentage increase in revenue, net profit margins). Use keywords like Reliance Industries Q3 earnings, financial performance, revenue growth, profit margins, Reliance Jio subscriber growth.

Strategic Investments and Partnerships

Strategic investments and partnerships have been instrumental in enhancing Reliance's market position and attracting investor interest.

- Jio Platforms investments: The strategic investments in Jio Platforms have yielded substantial returns, contributing to Reliance's overall financial strength. Mention specific partnerships and their positive impact on Reliance's bottom line.

- Retail sector expansion: Reliance's aggressive expansion in the retail sector, including acquisitions and new store openings, has broadened its revenue streams and market reach. Again, specific examples are vital here, tying them to the overall share price increase.

- Other key partnerships: Highlight any other significant partnerships or collaborations that have enhanced Reliance's competitive advantage. Use keywords such as Strategic partnerships, Jio Platforms, Reliance Retail, investments, Reliance Jio, Future Group (if applicable).

Positive Market Sentiment and Investor Confidence

The overall positive market sentiment towards Reliance and the broader Indian economy has contributed to increased investor confidence.

- Positive economic indicators: Strong macroeconomic indicators for India have fueled positive investor sentiment.

- Government policies: Government policies supportive of the energy and telecom sectors have created a favorable environment for Reliance's growth.

- Positive analyst ratings: Favorable analyst ratings and upgrades have further solidified investor confidence in Reliance's future prospects. Use keywords such as Investor sentiment, market outlook, Indian stock market, analyst ratings, economic growth.

Impact of the Reliance Shares Surge on the Market

The significant rise in Reliance shares has had a considerable impact on the broader Indian stock market.

Influence on the Sensex/Nifty

The surge in Reliance share prices has significantly influenced key market indices like the Sensex and Nifty.

- Increased index values: The rise in Reliance's share price has contributed to a percentage increase in the Sensex and Nifty indices. Include the actual percentage increase.

- Market capitalization: The surge has also led to a substantial increase in Reliance's market capitalization, solidifying its position as a market leader.

- Ripple effect: The positive momentum has had a ripple effect on other related stocks and sectors, boosting overall market sentiment. Use keywords such as Sensex, Nifty, market capitalization, benchmark indices, Indian stock market.

Implications for Investors

The Reliance share surge has important implications for investors, both current and potential.

- Short-term gains: Investors who held Reliance shares have experienced significant short-term gains.

- Long-term investment strategy: The surge highlights the potential for long-term growth in Reliance shares, but investors should always consider their risk tolerance and diversify their portfolios.

- Potential risks and rewards: While the outlook is positive, investors need to consider potential risks and implement suitable risk management strategies. Use keywords such as investment strategy, stock market investment, risk management, portfolio diversification.

Future Outlook for Reliance Shares

Predicting the future performance of any stock is inherently challenging, but analyzing current trends and expert opinions can help in formulating expectations.

Analyst Predictions and Projections

Financial analysts have offered a range of predictions and projections for Reliance shares.

- Target prices: Mention the target prices set by leading analysts, highlighting the range of expectations.

- Growth expectations: Summarize analysts' expectations for future growth, considering various factors such as market conditions and company performance.

- Potential risks and challenges: Discuss potential risks and challenges that could affect Reliance's future performance (e.g., global economic slowdown, competition). Use keywords such as stock price prediction, future outlook, financial projections, analyst forecast, potential risks.

Long-Term Growth Potential

Reliance Industries boasts significant long-term growth potential across its diverse business segments.

- Emerging markets: Expansion into emerging markets offers significant opportunities for growth.

- Technological advancements: Reliance's investments in technology and digital platforms position it for future success.

- Diversification strategies: The company's diversified business portfolio reduces its dependence on any single sector and strengthens its resilience. Use keywords such as long-term growth, business diversification, technological innovation, future prospects.

Conclusion: Understanding the Reliance Shares Surge

The remarkable surge in Reliance shares is a result of a confluence of factors, including strong Q3 results, strategic investments, positive market sentiment, and a favorable regulatory environment. This surge has significantly impacted the Indian stock market indices and presents both opportunities and challenges for investors. While the outlook appears positive for the long term, careful consideration of potential risks is crucial for informed investment decisions. To stay updated on the latest developments regarding Reliance share price and broader market trends, subscribe to our newsletter, follow us on social media, or conduct further research using keywords such as "Reliance share price analysis," "Reliance investment strategy," or "Reliance stock forecast."

Featured Posts

-

Vancouver Festival Tragedy Car Rams Crowd Leaving Many Injured

Apr 29, 2025

Vancouver Festival Tragedy Car Rams Crowd Leaving Many Injured

Apr 29, 2025 -

The Impact Of Snow Tornadoes And Historic Flooding On Louisville In 2025

Apr 29, 2025

The Impact Of Snow Tornadoes And Historic Flooding On Louisville In 2025

Apr 29, 2025 -

Why Older Viewers Are Choosing You Tube For Their Entertainment

Apr 29, 2025

Why Older Viewers Are Choosing You Tube For Their Entertainment

Apr 29, 2025 -

Nyt Strands March 3 2025 Complete Answers And Hints

Apr 29, 2025

Nyt Strands March 3 2025 Complete Answers And Hints

Apr 29, 2025 -

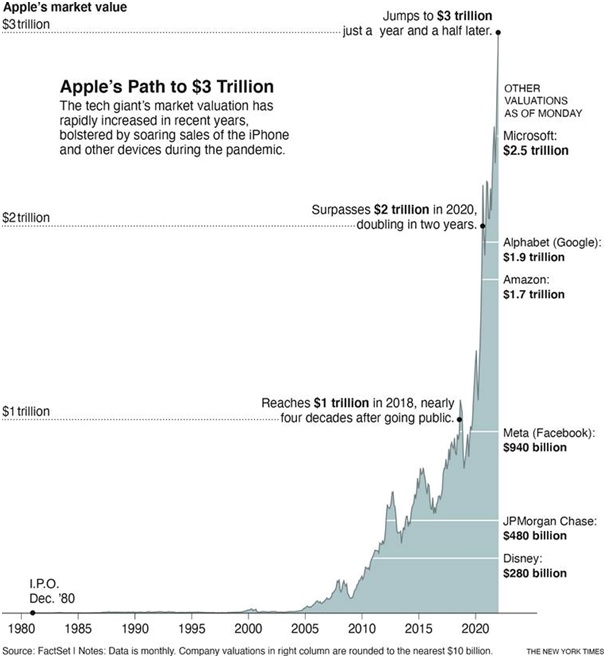

Seven Tech Titans 2 5 Trillion Market Value Wipeout In 2024

Apr 29, 2025

Seven Tech Titans 2 5 Trillion Market Value Wipeout In 2024

Apr 29, 2025

Latest Posts

-

Cardinal Trial Claims Of Prosecutorial Misconduct Gain Traction With New Evidence

Apr 29, 2025

Cardinal Trial Claims Of Prosecutorial Misconduct Gain Traction With New Evidence

Apr 29, 2025 -

How You Tube Became A Go To Platform For Older Viewers

Apr 29, 2025

How You Tube Became A Go To Platform For Older Viewers

Apr 29, 2025 -

British Court Ruling Vatican Wins Case Against London Real Estate Fraud

Apr 29, 2025

British Court Ruling Vatican Wins Case Against London Real Estate Fraud

Apr 29, 2025 -

You Tubes Growing Appeal To Older Viewers Nostalgia And Accessibility

Apr 29, 2025

You Tubes Growing Appeal To Older Viewers Nostalgia And Accessibility

Apr 29, 2025 -

London Property Fraud British Court Upholds Vaticans Claim

Apr 29, 2025

London Property Fraud British Court Upholds Vaticans Claim

Apr 29, 2025