Seven Tech Titans: $2.5 Trillion Market Value Wipeout In 2024

Table of Contents

The Seven Tech Titans Leading the Decline

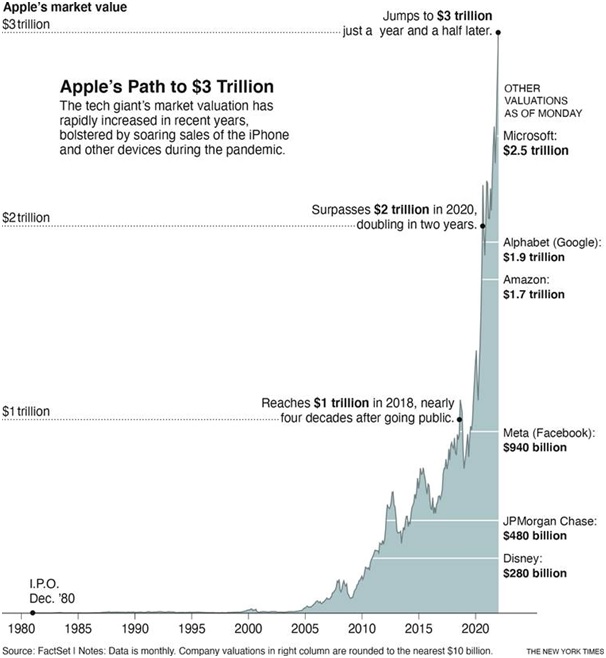

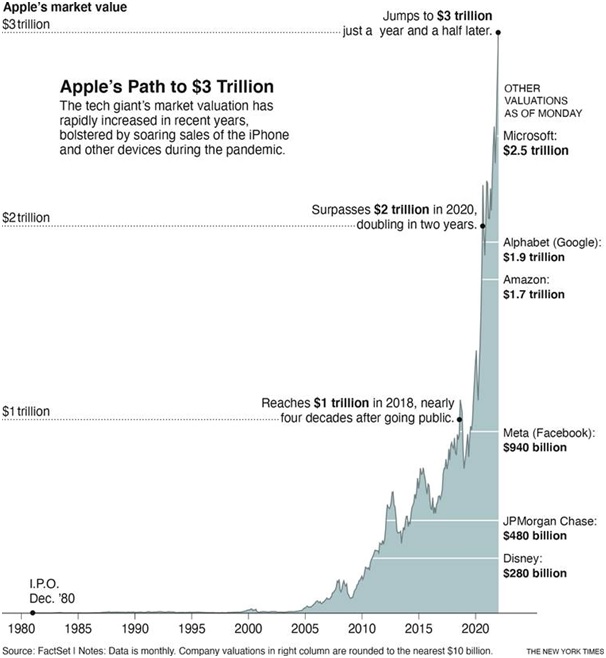

The Tech Titans most affected by this 2024 Tech Crash included some of the world's most recognizable companies. While precise figures fluctuate daily, the approximate losses experienced by these seven companies were substantial, representing a significant portion of the overall $2.5 trillion wipeout.

- Apple: Experienced a market capitalization decrease of approximately [Insert approximate dollar figure and cite source with hyperlink]. [Link to relevant financial news source]

- Microsoft: Suffered a decline in market cap of roughly [Insert approximate dollar figure and cite source with hyperlink]. [Link to relevant financial news source]

- Amazon: Saw its market value reduced by an estimated [Insert approximate dollar figure and cite source with hyperlink]. [Link to relevant financial news source]

- Google (Alphabet): Experienced a market cap decrease of approximately [Insert approximate dollar figure and cite source with hyperlink]. [Link to relevant financial news source]

- Meta (Facebook): Suffered a substantial loss of [Insert approximate dollar figure and cite source with hyperlink] in market capitalization. [Link to relevant financial news source]

- Tesla: Witnessed a market cap reduction of around [Insert approximate dollar figure and cite source with hyperlink]. [Link to relevant financial news source]

- NVIDIA: Experienced a market capitalization decline of approximately [Insert approximate dollar figure and cite source with hyperlink]. [Link to relevant financial news source]

These figures highlight the severity of the Tech Stock Decline and its widespread impact on the global tech landscape.

Rising Interest Rates and Inflationary Pressures

The Federal Reserve's aggressive interest rate hikes throughout 2023 and 2024 played a crucial role in the Tech Titans' market value decline. Higher interest rates increased borrowing costs for tech companies, making expansion and investment more expensive. This directly impacted valuations, as future growth prospects were discounted more heavily.

Simultaneously, persistent inflationary pressures reduced consumer discretionary spending. With prices rising across the board, consumers prioritized essential goods and services, reducing demand for non-essential tech products.

- Increased borrowing costs for tech companies: Higher interest rates made it more expensive to secure loans for research and development, acquisitions, and expansion projects.

- Reduced consumer discretionary spending: Inflation forced consumers to cut back on spending on non-essential items, including smartphones, computers, and other tech gadgets.

- Impact on investment and expansion plans: Many tech companies scaled back their investment and expansion plans in response to rising costs and reduced demand.

The Slowdown in Tech Spending

The decline in tech spending, both from corporations and consumers, further exacerbated the 2024 Tech Crash. Corporate investment in cloud computing, software, and other tech services slowed significantly as businesses tightened their budgets in response to economic uncertainty.

Consumer spending on tech products also decreased. This was due to a combination of factors: inflationary pressures, reduced consumer confidence, and a saturation in certain market segments (e.g., smartphones). Supply chain disruptions further complicated matters, leading to delays and increased production costs.

- Cloud computing slowdown: Growth in the cloud computing market, once a key driver of tech sector growth, slowed considerably.

- Reduced demand for smartphones and PCs: Sales of smartphones and personal computers declined as consumers delayed purchases due to economic uncertainty.

- Impact of supply chain disruptions: Persistent supply chain issues impacted the production and delivery of tech products, leading to delays and higher prices.

Geopolitical Uncertainty and Supply Chain Disruptions

Geopolitical instability, particularly the ongoing war in Ukraine, created significant uncertainty in the global economy, negatively impacting the tech sector. The war disrupted supply chains, particularly for semiconductors, leading to chip shortages that hampered production.

Trade tensions and tariffs also contributed to the challenges faced by tech companies. These factors increased production costs and created uncertainty about future trade relations.

- Impact of the war in Ukraine: The conflict disrupted global supply chains, impacting the availability of crucial components for tech products.

- Ongoing chip shortages: The semiconductor shortage continued to constrain production, leading to delays and higher prices for tech products.

- Trade tensions and tariffs: Trade disputes and tariffs added to the costs of producing and importing tech products.

Overvaluation and Market Correction

The tech sector experienced a period of significant overvaluation in the years leading up to 2024. Speculative bubbles inflated stock prices beyond their fundamental values, creating a vulnerable market susceptible to a sharp correction.

The Market Value Wipeout of 2024 can be seen as a necessary correction, bringing stock prices back in line with their underlying fundamentals. Investor sentiment shifted dramatically, with investors becoming more cautious and risk-averse. Algorithmic trading amplified the volatility, exacerbating the decline.

- Speculative bubbles in the tech market: Years of rapid growth fueled speculative investment, leading to inflated stock valuations.

- Investor sentiment shifts: As economic uncertainty increased, investor confidence waned, leading to a sell-off in tech stocks.

- The role of algorithmic trading: Algorithmic trading amplified market volatility, exacerbating the downward trend.

The Future Outlook for Tech Titans

The outlook for the tech sector remains cautious. While a complete recovery is expected, it's unlikely to be swift. The affected companies will need to implement strategies focused on profitability, efficiency, and innovation to navigate this challenging period.

- Potential for consolidation in the tech industry: We may see mergers and acquisitions as companies seek to gain scale and efficiency.

- Increased focus on profitability and efficiency: Tech companies will likely prioritize profitability over rapid growth.

- Innovation and diversification as key survival factors: Companies that can innovate and diversify their product offerings will be better positioned for future success.

Investing in the Post-Wipeout Tech Market

Investing in the tech sector after the Market Value Wipeout requires a cautious and strategic approach. Diversification, long-term investment strategies, and thorough due diligence are crucial for mitigating risk.

- Diversification of investment portfolios: Don't put all your eggs in one basket. Diversify your investments across different sectors and asset classes.

- Long-term investment strategies: The tech sector has historically shown resilience. A long-term perspective can help weather short-term volatility.

- Due diligence and risk assessment: Thoroughly research any investment before committing your capital.

Conclusion

The $2.5 trillion market value wipeout affecting seven Tech Titans in 2024 serves as a stark reminder of the inherent volatility within the tech sector. A confluence of factors—rising interest rates, decreased spending, geopolitical uncertainty, and market corrections—contributed to this significant downturn. Understanding the dynamics of this Tech Titans market decline is crucial for both investors and tech companies. Stay informed about market trends and adapt your strategies accordingly to navigate the evolving landscape of the tech industry, mitigating risks associated with future Tech Stock Decline and Market Value Wipeout events. Learn more about managing risk in the volatile world of 2024 Tech Crash investing.

Featured Posts

-

Fox News Faces Defamation Lawsuit From Jan 6th Figure Ray Epps

Apr 29, 2025

Fox News Faces Defamation Lawsuit From Jan 6th Figure Ray Epps

Apr 29, 2025 -

Investigation Underway After Wrong Way Crash Kills Texas Woman Near Border

Apr 29, 2025

Investigation Underway After Wrong Way Crash Kills Texas Woman Near Border

Apr 29, 2025 -

Us Pressure Fails Hungarys Unwavering Economic Relationship With China

Apr 29, 2025

Us Pressure Fails Hungarys Unwavering Economic Relationship With China

Apr 29, 2025 -

Raid On Underground Nightclub Cnn Video Documents Over 100 Immigrant Detentions

Apr 29, 2025

Raid On Underground Nightclub Cnn Video Documents Over 100 Immigrant Detentions

Apr 29, 2025 -

Israeli Airstrike Shakes Southern Beirut Evacuation Warning Issued

Apr 29, 2025

Israeli Airstrike Shakes Southern Beirut Evacuation Warning Issued

Apr 29, 2025

Latest Posts

-

The Challenges Of Producing All American Goods

Apr 29, 2025

The Challenges Of Producing All American Goods

Apr 29, 2025 -

Why Making An All American Product Is So Difficult

Apr 29, 2025

Why Making An All American Product Is So Difficult

Apr 29, 2025 -

Ohio Train Derailment Investigation Into Long Term Toxic Chemical Presence In Buildings

Apr 29, 2025

Ohio Train Derailment Investigation Into Long Term Toxic Chemical Presence In Buildings

Apr 29, 2025 -

Detailed One Plus 13 R Review A Budget Friendly Alternative To Pixel 9a

Apr 29, 2025

Detailed One Plus 13 R Review A Budget Friendly Alternative To Pixel 9a

Apr 29, 2025 -

Choosing Between One Plus 13 R And Pixel 9a Performance Camera And Value

Apr 29, 2025

Choosing Between One Plus 13 R And Pixel 9a Performance Camera And Value

Apr 29, 2025