Fintech Giant Revolut Reports 72% Revenue Jump, Targeting Global Markets

Table of Contents

Revolut's Explosive Revenue Growth: A Detailed Look at the 72% Jump

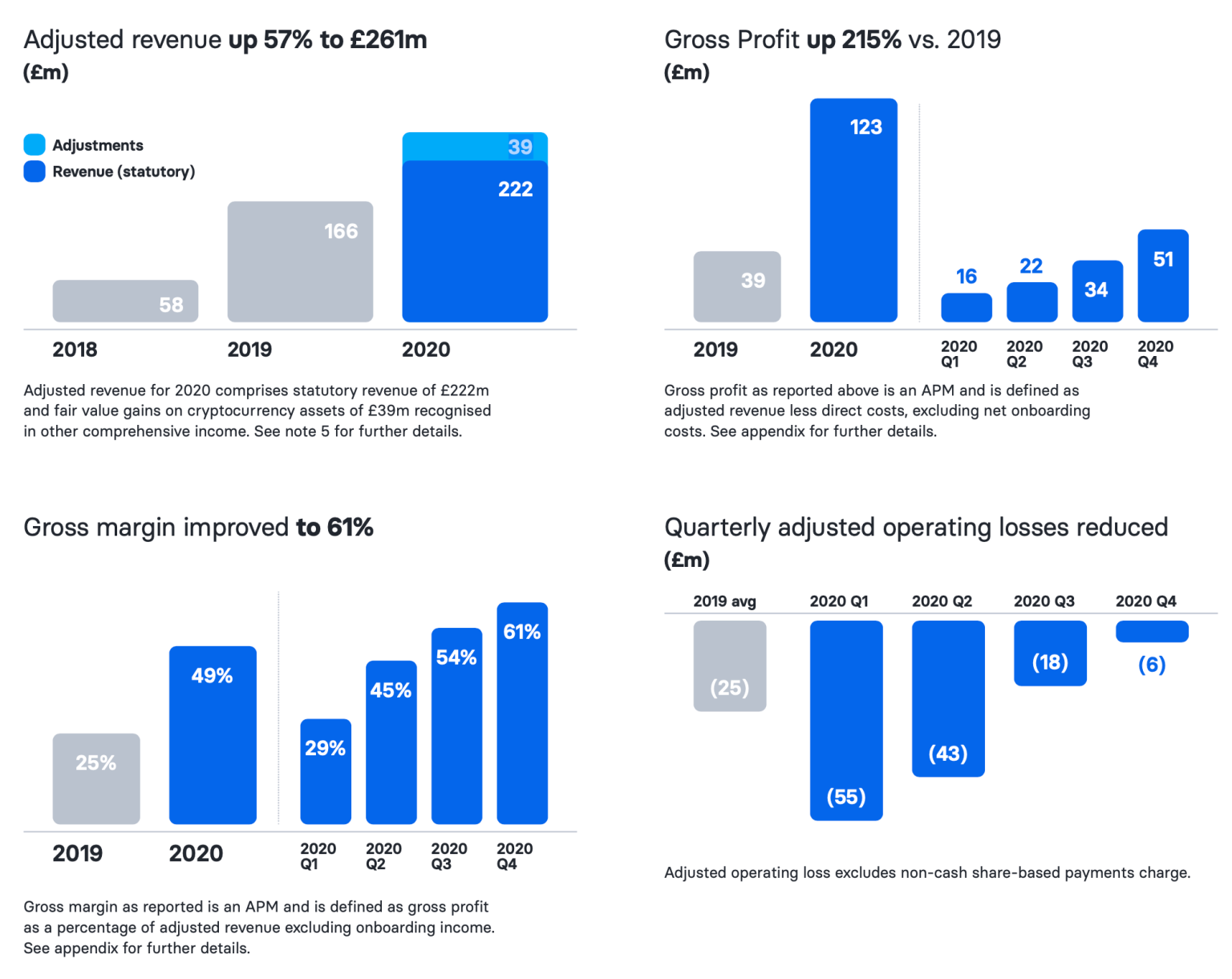

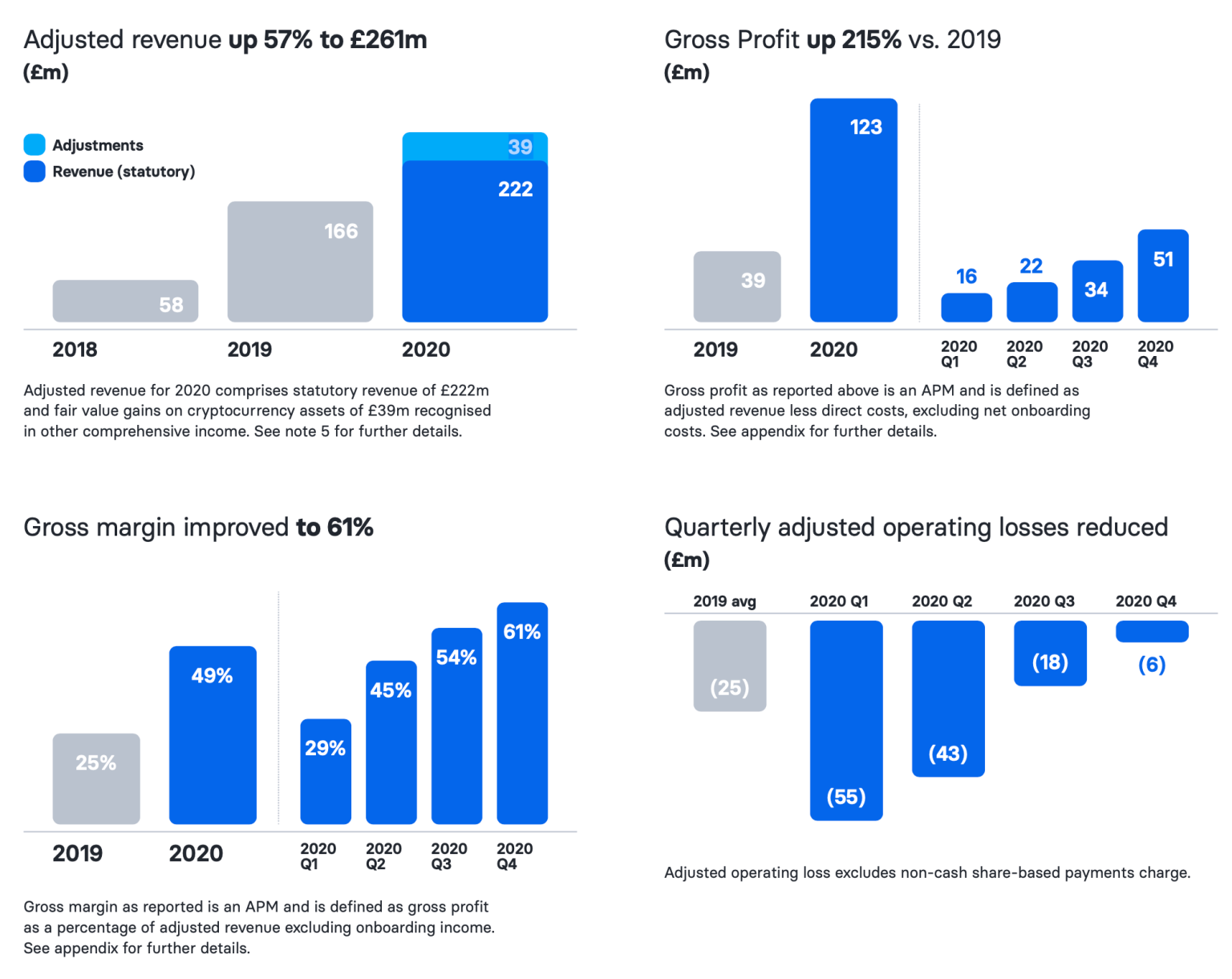

Revolut's reported 72% revenue increase represents a significant milestone for the company. While precise figures from the official report may vary, this substantial growth demonstrates strong financial performance and increasing market penetration. This impressive year-on-year growth can be attributed to several key factors:

- Diversified Revenue Streams: Revolut's revenue isn't solely reliant on transaction fees. A significant portion comes from premium subscriptions (Revolut Premium, Metal) offering enhanced features and benefits, as well as lucrative currency exchange services, capitalizing on the growing demand for seamless international payments.

- Consistent Year-on-Year Growth: This 72% jump builds upon previous years of strong growth, indicating a sustainable and scalable business model. The company's consistent performance showcases its ability to adapt to market demands and maintain a strong competitive edge within the Fintech industry.

- Significant Milestones: The reported period likely included the successful launch of new features, partnerships, or expansions into key markets, all contributing to this remarkable revenue surge. The achievement of key profitability milestones further reinforces the positive trajectory.

- Improved Profitability: While specific profit figures require official confirmation, the substantial revenue growth strongly suggests improved profitability, indicating a financially healthy and sustainable future for the Fintech giant.

Global Expansion Strategy: Revolut's Ambitious International Growth

Revolut's aggressive global expansion is a cornerstone of its success. The company's strategic move into numerous international markets has significantly broadened its customer base and revenue streams. This ambitious international growth strategy involves:

- Key Regions of Expansion: Revolut has seen significant growth in Europe, North America, and Asia, strategically targeting markets with a high demand for convenient and cost-effective international financial services. Further expansion into other promising markets is anticipated.

- Strategic Market Entry: Revolut employs a multifaceted approach to entering new markets, including strategic partnerships with local businesses, careful navigation of regulatory compliance within each region, and a commitment to providing localized services.

- Overcoming International Challenges: Operating in diverse markets presents challenges, including regulatory hurdles specific to each jurisdiction, navigating cultural differences and adapting services to suit local preferences, and competing with established financial institutions. Revolut has successfully addressed these challenges through strategic planning and adaptable operational models.

- Localization and Adaptation: Revolut's success in international markets is also attributed to its ability to adapt its services and user interfaces to cater to local needs and preferences. This includes offering support in multiple languages and providing locally relevant features within its mobile banking app.

Revolut's Product Innovation: Driving User Growth and Revenue

Revolut's continued success hinges on its commitment to product innovation. The app's user-friendly design and feature-rich functionality have been instrumental in driving user growth and boosting revenue.

- Core Features and Services: Revolut's platform offers a wide range of features, including multi-currency accounts, international money transfers with competitive exchange rates, budgeting tools, investment options, and even crypto trading, catering to diverse user needs.

- Impact of Recent Product Updates: Regular product updates and new feature releases have played a pivotal role in maintaining user engagement and attracting new customers. This ongoing innovation keeps Revolut ahead of the competition in the ever-evolving FinTech sector.

- User Experience and Design: Revolut prioritizes a seamless and intuitive user experience. The app's clean design, easy navigation, and simple interface enhance user satisfaction and promote increased usage.

- Future Product Roadmap: Revolut’s ongoing investment in R&D indicates plans for further innovation, suggesting a continuous pipeline of new features and improvements, ensuring they stay at the forefront of FinTech advancements.

Competition and Future Outlook for Revolut

The Fintech industry is highly competitive. Revolut faces competition from established players and emerging startups alike. However, Revolut's strategic advantages are substantial:

- Key Competitors: Major competitors include Wise (formerly TransferWise), N26, and Monzo, each with its own strengths and market focus. Understanding these competitive landscapes is crucial to Revolut's long-term strategy.

- Competitive Advantages: Revolut's competitive advantages include its extensive global reach, its innovative product features, and its user-friendly mobile application. Maintaining these advantages is critical to sustaining growth.

- Future Market Trends: Understanding future market trends in global payments, mobile banking, and regulatory changes will be crucial for Revolut's continued success.

- Future Performance Predictions: Based on current trajectory, Revolut is well-positioned for continued growth, though navigating the competitive landscape and adapting to evolving market demands will be essential for maintaining its leading position.

Conclusion

Revolut's remarkable 72% revenue jump is a testament to its successful strategy combining aggressive global expansion, continuous product innovation, and strong financial performance. This growth highlights the immense potential of innovative Fintech solutions in the global financial services sector. The company's focus on user experience, global reach, and ongoing product development positions it for continued success in the competitive Fintech market. Learn more about Revolut and its services today! Download the app and experience the future of finance.

Featured Posts

-

Eurovisions Response To Israel Boycott Demands

Apr 25, 2025

Eurovisions Response To Israel Boycott Demands

Apr 25, 2025 -

Is Ashton Jeantys Potential Move To The Chicago Bears More Likely Than You Think

Apr 25, 2025

Is Ashton Jeantys Potential Move To The Chicago Bears More Likely Than You Think

Apr 25, 2025 -

Unilevers Q Quarter Results Sales Beat Forecasts On Pricing And Demand

Apr 25, 2025

Unilevers Q Quarter Results Sales Beat Forecasts On Pricing And Demand

Apr 25, 2025 -

Gold Market Rally Trumps Softer Tone Impacts Prices

Apr 25, 2025

Gold Market Rally Trumps Softer Tone Impacts Prices

Apr 25, 2025 -

Bayern Munich Stunned By Late Union Berlin Equaliser

Apr 25, 2025

Bayern Munich Stunned By Late Union Berlin Equaliser

Apr 25, 2025

Latest Posts

-

Charlie Kirk Claims Gavin Newsoms Podcast Will Derail His Political Ambitions

Apr 26, 2025

Charlie Kirk Claims Gavin Newsoms Podcast Will Derail His Political Ambitions

Apr 26, 2025 -

Governor Newsom Targets Judgmental Democrats In Latest Remarks

Apr 26, 2025

Governor Newsom Targets Judgmental Democrats In Latest Remarks

Apr 26, 2025 -

California Governor Calls Out Intra Party Toxicity

Apr 26, 2025

California Governor Calls Out Intra Party Toxicity

Apr 26, 2025 -

Newsoms Sharp Rebuke Of Toxic Democrats

Apr 26, 2025

Newsoms Sharp Rebuke Of Toxic Democrats

Apr 26, 2025 -

Gavin Newsom Criticizes Toxic And Judgmental Democrats

Apr 26, 2025

Gavin Newsom Criticizes Toxic And Judgmental Democrats

Apr 26, 2025