Gold Market Rally: Trump's Softer Tone Impacts Prices

Table of Contents

Understanding the Safe-Haven Appeal of Gold

Gold has long been considered a safe-haven asset, its value rising during times of economic and geopolitical uncertainty. This appeal stems from several key factors.

Geopolitical Uncertainty and Gold Prices

Gold historically acts as a hedge against uncertainty and risk. When geopolitical tensions escalate, investors often flock to gold as a store of value, driving up demand and prices.

- The Cold War: Periods of heightened Cold War tensions saw significant gold price increases.

- 9/11 Attacks: The terrorist attacks of September 11, 2001, triggered a notable surge in gold prices.

- 2014 Crimean Crisis: Russia's annexation of Crimea led to increased investor demand for gold.

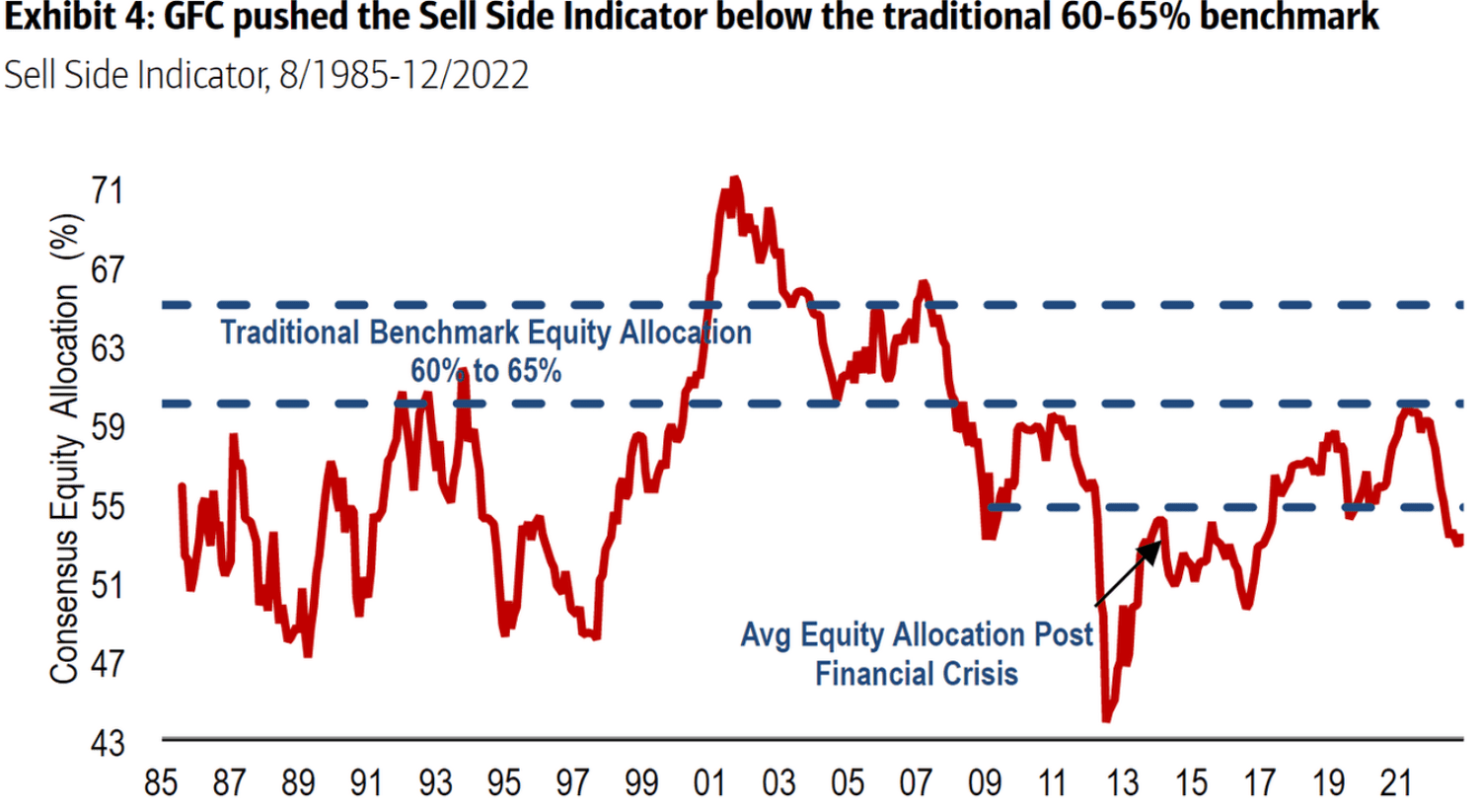

[Insert chart or graph here showing correlation between major geopolitical events and gold price movements]

Economic Instability and Gold's Role

Gold also serves as a hedge against inflation and currency devaluation. Weakening economic conditions often lead investors to seek the stability offered by gold.

- Investors perceive gold as a reliable store of value during periods of high inflation, protecting their purchasing power.

- A weakening dollar or other major currencies can boost demand for gold as investors seek alternative assets.

- Gold's limited supply contributes to its value, making it a desirable asset during times of economic turmoil.

Related keywords: inflation hedge, safe-haven asset, portfolio diversification, currency risk.

Gold's Intrinsic Value

Beyond its role as a safe-haven asset, gold possesses intrinsic value. Its scarcity, durability, and resistance to corrosion have made it a valuable commodity for millennia. This inherent worth provides a base level of stability, independent of market fluctuations.

Trump's Softer Tone and Its Market Impact

Recent shifts in President Trump's rhetoric and policy have been interpreted by many as less aggressive and more conciliatory. This change in tone has had a measurable impact on global markets, including the gold market.

Specific Policy Changes or Statements

Specific examples of this softening include [cite specific examples and reliable sources, e.g., a less confrontational stance on trade with China, de-escalation of rhetoric towards specific countries, etc.]. These actions have reduced the perceived level of political risk in the market.

- Reduced trade tensions: A decrease in aggressive tariff threats can lead to increased investor confidence in global markets.

- Improved diplomatic relations: Signs of improved relations with key global players can lessen geopolitical uncertainty.

Related keywords: trade war, tariffs, international relations, political risk.

Investor Sentiment and Market Reactions

The change in Trump's tone has influenced investor sentiment, shifting their risk appetite. Investors who previously favored safe-haven assets due to concerns about political instability may now be more willing to invest in riskier assets.

- Shift from safe-haven assets: Reduced geopolitical risk can lead investors to move away from gold and towards higher-yielding assets.

- Increased investor confidence: A more stable political climate can boost overall market confidence.

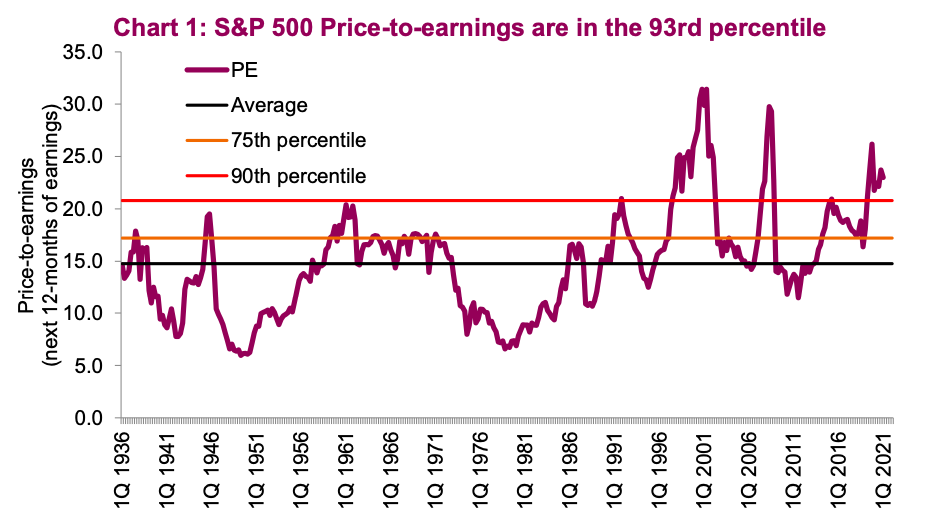

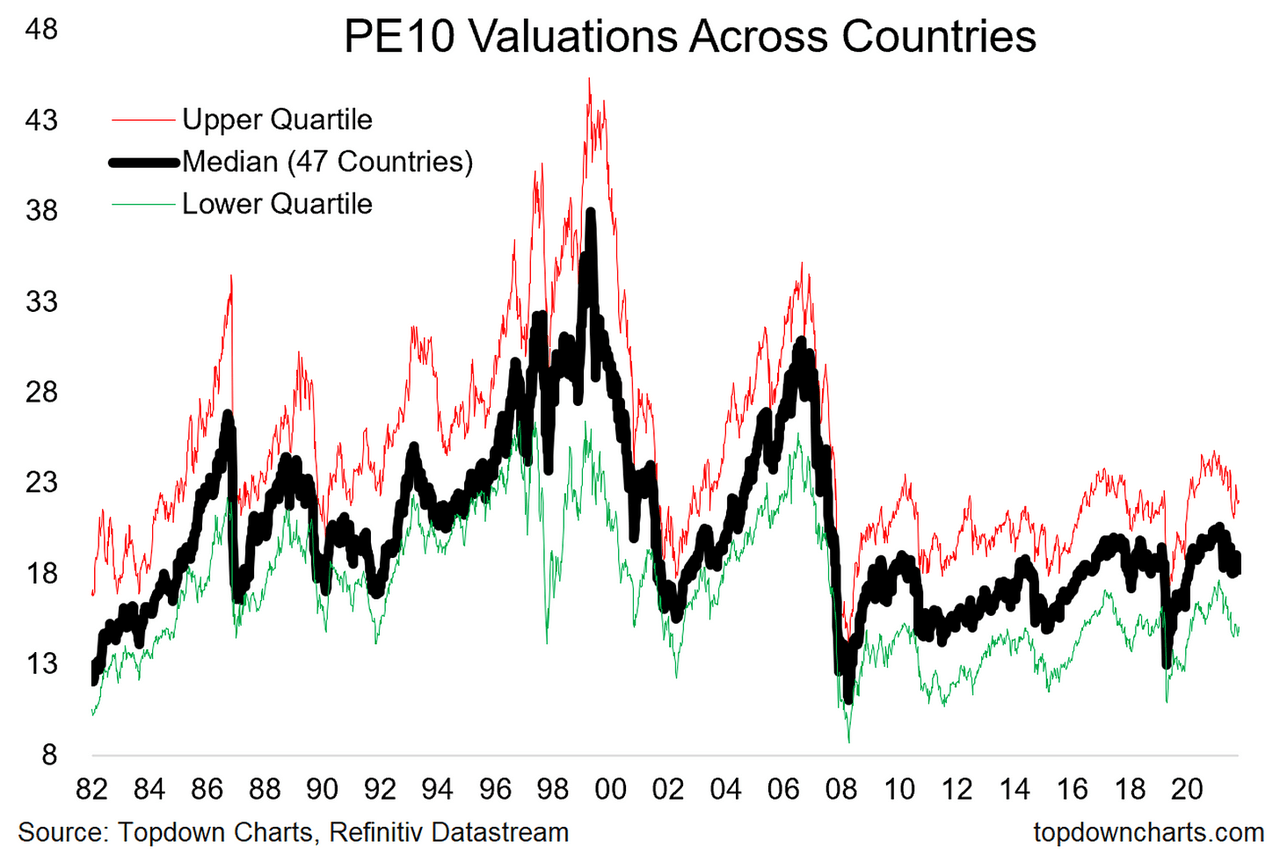

[Insert data showing correlation between changes in indices like the S&P 500 and gold price movements]

Alternative Explanations for the Gold Rally

While Trump's altered approach is a significant factor, other potential influences on the gold price rally should be considered:

- Interest rate changes: Lower interest rates can make gold more attractive to investors.

- Currency fluctuations: Changes in the value of major currencies relative to the US dollar can impact gold prices.

Analyzing the Future of Gold Prices

Predicting future gold prices is inherently challenging. However, we can analyze potential scenarios based on ongoing developments.

Predicting Future Market Trends

- Scenario 1: Continued de-escalation of tensions could lead to a decline in gold prices as investors shift towards riskier assets.

- Scenario 2: A resurgence of geopolitical uncertainty could drive gold prices higher again.

- Scenario 3: Economic factors, such as inflation or currency devaluation, could independently influence gold prices, regardless of political developments.

Investment Strategies

Investors interested in gold should research various investment options, including gold ETFs, physical gold, and gold futures. It is crucial to remember that investing in gold, like any other investment, carries risk. Consult a financial advisor before making any investment decisions.

Related keywords: gold investment, gold ETFs, gold futures.

Conclusion: Navigating the Gold Market Rally

The recent gold market rally is significantly linked to a perceived softening in President Trump's rhetoric and subsequent shifts in policy, reducing perceived political risk. Understanding the interplay of geopolitical factors and economic conditions is essential for navigating the gold market. Gold remains a vital safe-haven asset, offering investors a potential hedge against uncertainty. To effectively navigate this gold market rally and future fluctuations, stay informed about political and economic developments and consider diversifying your investment portfolio accordingly. Remember to always seek professional financial advice before making investment decisions.

Featured Posts

-

Basel Approves Eurovision Village 2025 Funding

Apr 25, 2025

Basel Approves Eurovision Village 2025 Funding

Apr 25, 2025 -

Maquiagem Em Aquarela Como Criar Um Visual Delicado E Moderno

Apr 25, 2025

Maquiagem Em Aquarela Como Criar Um Visual Delicado E Moderno

Apr 25, 2025 -

Memorial Event For Wwii Anniversary Russian Ambassadors Attendance

Apr 25, 2025

Memorial Event For Wwii Anniversary Russian Ambassadors Attendance

Apr 25, 2025 -

Against All Odds Bochums Incredible Comeback Against Bayern Munich

Apr 25, 2025

Against All Odds Bochums Incredible Comeback Against Bayern Munich

Apr 25, 2025 -

Grammys 2025 Olivia Rodrigos Fashion Formula Success

Apr 25, 2025

Grammys 2025 Olivia Rodrigos Fashion Formula Success

Apr 25, 2025

Latest Posts

-

Addressing Investor Concerns Bof As View On High Stock Market Valuations

Apr 26, 2025

Addressing Investor Concerns Bof As View On High Stock Market Valuations

Apr 26, 2025 -

Bof A On Stock Market Valuations A Rationale For Investor Confidence

Apr 26, 2025

Bof A On Stock Market Valuations A Rationale For Investor Confidence

Apr 26, 2025 -

Why Current Stock Market Valuations Are Not A Reason To Panic According To Bof A

Apr 26, 2025

Why Current Stock Market Valuations Are Not A Reason To Panic According To Bof A

Apr 26, 2025 -

Understanding Stock Market Valuations Bof As Argument For Calm

Apr 26, 2025

Understanding Stock Market Valuations Bof As Argument For Calm

Apr 26, 2025 -

Bof A Reassures Investors Why High Stock Market Valuations Are Not A Threat

Apr 26, 2025

Bof A Reassures Investors Why High Stock Market Valuations Are Not A Threat

Apr 26, 2025