Florida Condo Market Crash: Why Owners Are Selling Now

Table of Contents

Rising Interest Rates and Mortgage Costs

Higher interest rates are significantly impacting the affordability of Florida condos. The increased cost of borrowing money makes it harder for potential buyers to secure mortgages, leading to a slowdown in sales and putting downward pressure on prices.

-

Increased mortgage payments deterring potential buyers: Higher interest rates translate directly into higher monthly mortgage payments. This makes condo ownership less attractive to many, especially first-time homebuyers and those on a budget. The impact is especially felt in a state like Florida where condo prices, even before this downturn, were not inexpensive.

-

Reduced buyer purchasing power leading to slower sales: With higher interest rates, buyers can afford less house for the same monthly payment. This reduced purchasing power shrinks the pool of potential buyers, slowing down the sales velocity in the Florida condo market. Search terms like "mortgage rates Florida" are seeing increased traffic as buyers grapple with these changes.

-

Impact of rising rates on existing condo owners facing refinancing challenges: Condo owners who might have been considering refinancing to lower their monthly payments are now facing significantly higher interest rates, making refinancing less appealing or even impossible. This can lead some owners to sell to avoid further financial strain. The keywords "condo affordability Florida" and "interest rate impact Florida real estate" reflect the widespread concern.

Increased Insurance Costs and Property Assessments

The Florida condo market is facing a double whammy from escalating insurance premiums and rising property taxes. These increased costs significantly impact the overall expense of condo ownership, prompting many owners to sell.

-

Rising insurance premiums making condo ownership unaffordable: Insurance costs in Florida, especially for condos, have skyrocketed in recent years. Hurricane risk and increased litigation are major contributors. These high premiums can make condo ownership financially unsustainable for many. The keyword phrase "Florida condo insurance" reflects the anxiety many owners are facing.

-

Increased property assessments leading to higher property taxes: Property assessments are rising across Florida, leading to substantially higher property taxes for condo owners. This adds another layer of financial burden, further pushing some owners toward selling their units. "Property taxes Florida" and "condo assessment Florida" are frequently searched terms showcasing this concern.

-

Difficulty in securing insurance for older buildings or those in high-risk areas: Older condo buildings or those located in high-risk areas face particularly challenging insurance situations. Securing adequate insurance can be difficult and expensive, making these properties less desirable for buyers and prompting owners to sell.

Oversupply of Condos and Reduced Demand

The combination of reduced demand and an oversupply of condos on the market is exacerbating the downturn. Market saturation is creating increased competition among sellers, leading to price reductions.

-

High number of condos currently on the market: Many new condo developments were completed just as the market began to soften, leading to a surplus of available units. This increased supply puts downward pressure on prices.

-

Increased competition among sellers leading to price reductions: With more condos available than buyers, sellers are forced to reduce their asking prices to attract potential purchasers. This creates a downward spiral, impacting market values.

-

Slower sales velocity impacting market values: The combination of reduced demand and increased supply has resulted in a significant slowdown in sales velocity. This slow turnover further impacts property values and creates a sense of urgency for many owners to sell. The terms "Florida condo inventory" and "condo market saturation Florida" are becoming increasingly relevant in online searches.

Impact of Hurricane Damage and Repairs

Hurricane damage and the subsequent costs of repairs are significantly impacting condo values and contributing to the desire to sell.

-

Damage claims and repair costs impacting condo owners' financial situations: The costs associated with hurricane damage, insurance claims, and repairs can be substantial, placing a significant financial strain on condo owners. This financial burden can compel owners to sell to recoup some of their losses.

-

Concerns about future hurricane damage and insurance availability: The increasing frequency and severity of hurricanes in Florida are creating concerns about future damage and the availability and affordability of insurance. This uncertainty makes condo ownership less appealing to many.

-

Increased scrutiny of building safety and maintenance impacting property values: In the wake of hurricane damage, there is increased scrutiny of building safety and maintenance standards. Condos needing significant repairs or lacking proper safety measures may see a further decline in value, prompting owners to sell. Searching for "hurricane damage Florida condos," "condo repairs Florida," and "Florida condo insurance claims" has increased recently.

Changes in Lifestyle and Relocation

Changes in lifestyle and relocation are also contributing factors in the decision of many Florida condo owners to sell.

-

Downsizing or upsizing needs leading to condo sales: As people's life circumstances change – retirement, family growth, or simply a desire for a different living arrangement – many find their current condo no longer suits their needs, leading to a sale.

-

Retirement plans impacting housing choices: Retirement plans often involve relocating to a different location or downsizing to a smaller, more manageable home. This frequently leads to the sale of Florida condos.

-

Desire for different lifestyles or locations: A change in lifestyle preferences – perhaps a desire for more outdoor space, a different climate, or a change in community – can also prompt condo owners to sell and relocate. Keywords such as "Florida condo relocation," "downsizing Florida," and "lifestyle changes Florida" reflect these shifts.

Conclusion

The "Florida Condo Market Crash" is a complex issue driven by a confluence of factors. Rising interest rates, increased insurance and property taxes, market oversupply, the lingering impact of hurricane damage, and changing lifestyles are all contributing to the increased number of condo owners choosing to sell. Understanding these factors is crucial for anyone navigating this challenging market. To further explore the nuances of this downturn and to make informed decisions regarding your own Florida condo, we encourage you to conduct thorough research and consult with a qualified real estate professional. Understanding the Florida condo market, and navigating the Florida condo downturn, requires a comprehensive approach.

Featured Posts

-

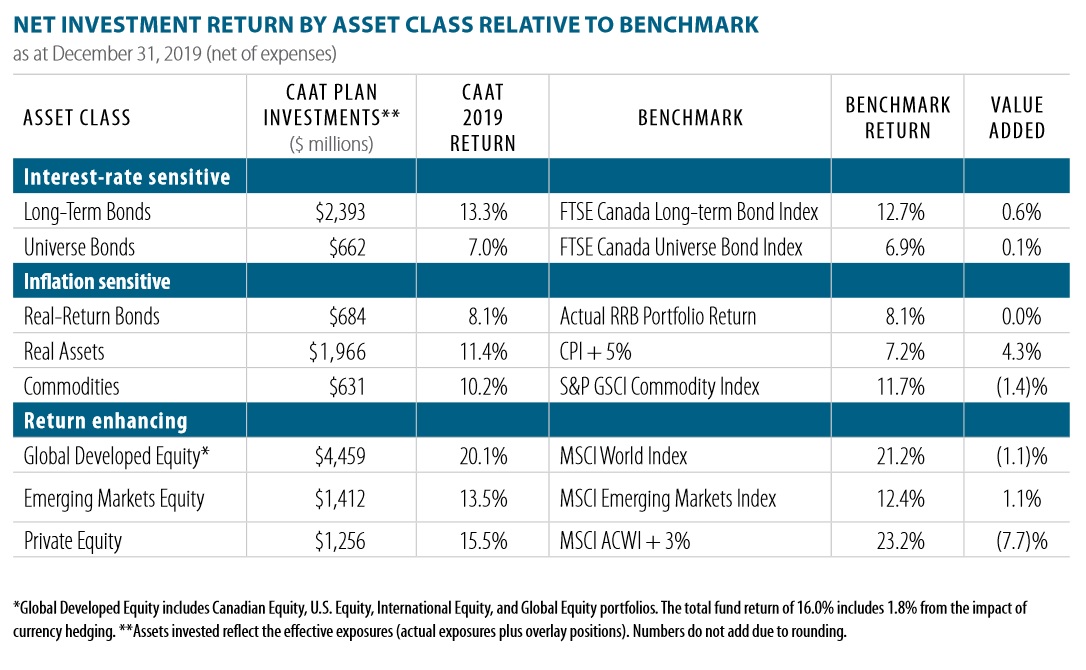

Canadian Private Investment A Key Focus For Caat Pension Plan

Apr 23, 2025

Canadian Private Investment A Key Focus For Caat Pension Plan

Apr 23, 2025 -

Updated Sanctions Switzerland Targets Russian Media In Line With Eu Measures

Apr 23, 2025

Updated Sanctions Switzerland Targets Russian Media In Line With Eu Measures

Apr 23, 2025 -

77 Inch Lg C3 Oled Is It Worth The Hype

Apr 23, 2025

77 Inch Lg C3 Oled Is It Worth The Hype

Apr 23, 2025 -

The Impact Of Artificial Intelligence On Wildlife Conservation Efforts

Apr 23, 2025

The Impact Of Artificial Intelligence On Wildlife Conservation Efforts

Apr 23, 2025 -

Guilty Plea Lab Owner Admits To Fraudulent Covid 19 Testing

Apr 23, 2025

Guilty Plea Lab Owner Admits To Fraudulent Covid 19 Testing

Apr 23, 2025