Form 20-F: ING Group's 2024 Financial Performance And Outlook

Table of Contents

Key Financial Highlights from ING Group's 2024 Form 20-F

This section analyzes the core financial data reported by ING Group in its 2024 Form 20-F filing. We'll compare these figures to previous years to identify significant trends and potential contributing factors. Remember that this analysis is based on the information publicly available and may not reflect all nuances of the report.

Revenue and Net Income

ING Group's 2024 Form 20-F will reveal crucial information about its revenue and net income. Analyzing these figures in relation to previous years' performance helps understand the company's overall financial health. For example:

- Year-over-year revenue growth/decline percentage: (Insert Percentage from Form 20-F – e.g., +5%). A positive percentage indicates growth, while a negative indicates a decline.

- Net income growth/decline percentage: (Insert Percentage from Form 20-F – e.g., +3%). Similar to revenue, this shows the change in profitability.

- Analysis of key drivers of revenue and net income performance: (This requires interpretation of the Form 20-F and should include discussion of factors like market conditions, specific business segments’ performance, and any significant one-off events). For example: "Strong growth in the banking segment offset slightly weaker performance in the insurance sector."

- Comparison to analyst expectations: (Compare the reported figures to consensus analyst forecasts. Were the results better or worse than expected? Explain any discrepancies.)

Profitability and Margins

Profitability is a crucial indicator of a company's financial health. Key metrics to consider from the ING Group 2024 Form 20-F include Return on Equity (ROE) and Return on Assets (ROA).

- ROE and ROA figures: (Insert figures from Form 20-F – e.g., ROE: 12%, ROA: 1%). Higher figures generally indicate better profitability.

- Comparison to industry benchmarks: (Compare ING Group's ROE and ROA to those of its competitors. This helps assess relative performance within the industry.)

- Analysis of margin trends and factors influencing them: (Analyze net interest margins, operating margins etc. Explain changes and identify the factors driving those changes, including cost management, competition, and interest rate environments.)

Capital Adequacy and Risk Management

ING Group's Form 20-F will also provide details on its capital ratios, a key aspect of its financial stability and risk management.

- Key capital ratios and their levels: (Insert figures from Form 20-F, such as Common Equity Tier 1 (CET1) ratio and Tier 1 Capital ratio. These figures indicate the bank's ability to absorb losses.)

- Assessment of the company’s risk profile: (Based on the Form 20-F, discuss the key risks facing ING Group – e.g., credit risk, market risk, operational risk).

- Discussion of any significant changes in risk management strategies: (Note any adjustments to ING Group's risk management approach as highlighted in the 2024 Form 20-F filing.)

Analysis of ING Group's 2024 Outlook as Presented in the Form 20-F

The Form 20-F provides insight into ING Group's future plans and expectations. Analyzing this section offers a glimpse into the company’s strategic direction and potential challenges.

Growth Projections and Strategies

ING Group's Form 20-F 2024 will include its outlook and projections.

- Key growth areas identified by ING Group: (Identify the business segments or geographic regions that ING Group expects to drive future growth.)

- Planned investments and strategic initiatives: (Highlight any major investments or initiatives ING Group plans to undertake to achieve its growth objectives.)

- Expected impact of macroeconomic factors on future performance: (Discuss how factors like interest rate changes, inflation, and economic growth are expected to affect ING Group's performance.)

Potential Challenges and Risks

The Form 20-F will also address potential risks that could hinder ING Group's progress.

- Economic downturn risks: (Discuss the potential impact of a recession or economic slowdown on ING Group's financial performance.)

- Geopolitical risks: (Analyze the potential impact of global political events or instability on ING Group's operations and profitability.)

- Regulatory risks: (Discuss any regulatory changes or potential regulatory actions that could affect ING Group.)

Dividend Policy and Shareholder Returns

Shareholder returns are a key consideration for investors. The Form 20-F provides details on ING Group’s dividend policy.

- Dividend per share: (State the dividend per share announced by ING Group.)

- Dividend payout ratio: (Discuss the percentage of earnings paid out as dividends.)

- Share buyback programs: (Mention any share buyback programs announced by ING Group.)

Conclusion

The ING Group 2024 Form 20-F provides a comprehensive overview of the company's financial performance and future outlook. This analysis highlighted key financial metrics, growth strategies, and potential risks. While the year showed [mention a summary of overall performance – e.g., strong growth despite challenging market conditions], investors should carefully consider the potential challenges and risks identified in the report. For a complete understanding of ING Group's financial position, review the full Form 20-F filing. Stay informed on ING Group's performance by regularly checking for updates on their financial reporting and analyzing subsequent Form 20-F filings. Understanding the nuances of ING Group's Form 20-F is crucial for making informed investment decisions regarding this significant financial institution.

Featured Posts

-

Wardrobe Malfunction Cat Deeleys This Morning Dress Blunder

May 23, 2025

Wardrobe Malfunction Cat Deeleys This Morning Dress Blunder

May 23, 2025 -

The Who Drummers Account Of His Dismissal After Royal Albert Hall Event

May 23, 2025

The Who Drummers Account Of His Dismissal After Royal Albert Hall Event

May 23, 2025 -

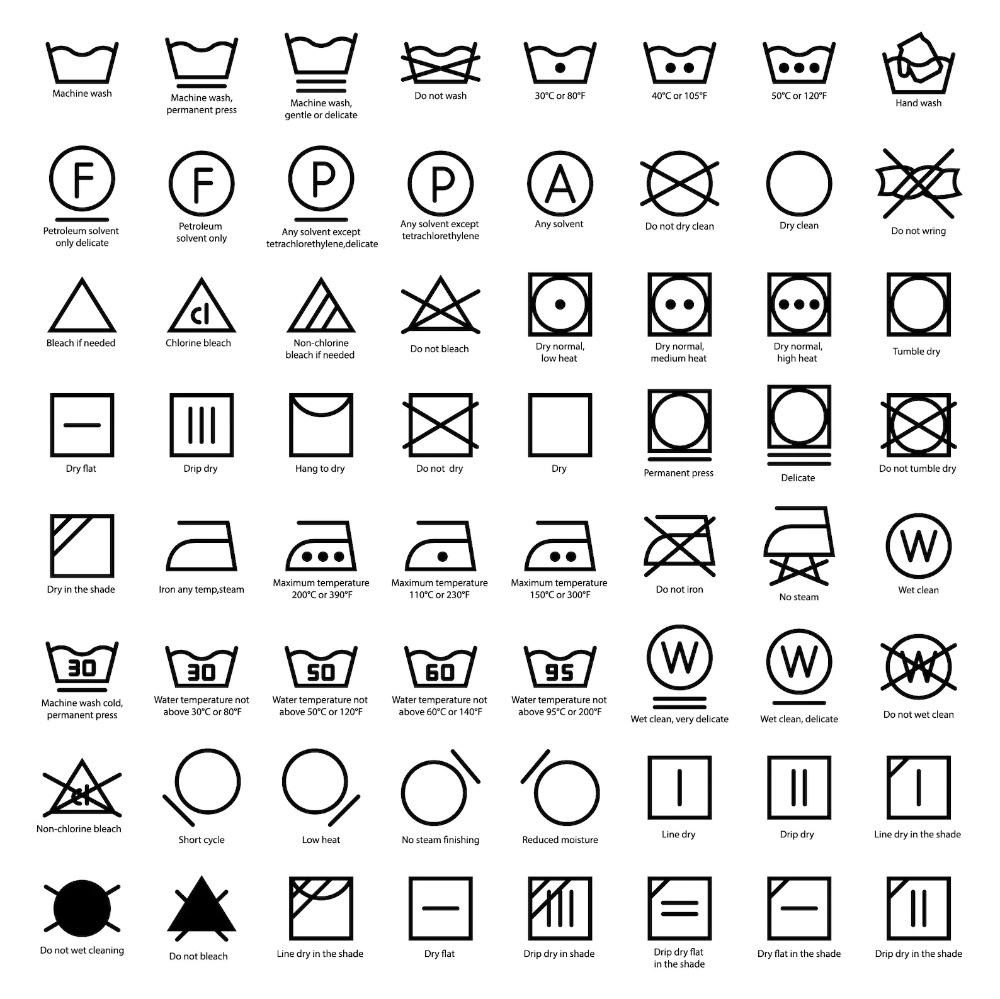

How To Care For Your Briefs Washing And Maintaining Quality

May 23, 2025

How To Care For Your Briefs Washing And Maintaining Quality

May 23, 2025 -

Coree Du Sud 8 6 Milliards De Dollars Pour Faire Face Aux Droits De Douane Et Aux Catastrophes Naturelles

May 23, 2025

Coree Du Sud 8 6 Milliards De Dollars Pour Faire Face Aux Droits De Douane Et Aux Catastrophes Naturelles

May 23, 2025 -

Los Mejores Memes De Canada Vs Mexico Liga De Naciones Concacaf

May 23, 2025

Los Mejores Memes De Canada Vs Mexico Liga De Naciones Concacaf

May 23, 2025

Latest Posts

-

Nfls Tush Push Survives The End Of The Butt Ban

May 23, 2025

Nfls Tush Push Survives The End Of The Butt Ban

May 23, 2025 -

The Nfls War On Butts The Tush Push Lives On

May 23, 2025

The Nfls War On Butts The Tush Push Lives On

May 23, 2025 -

Israeli Embassy Staffers Killed In Washington Museum Shooting Details Emerge

May 23, 2025

Israeli Embassy Staffers Killed In Washington Museum Shooting Details Emerge

May 23, 2025 -

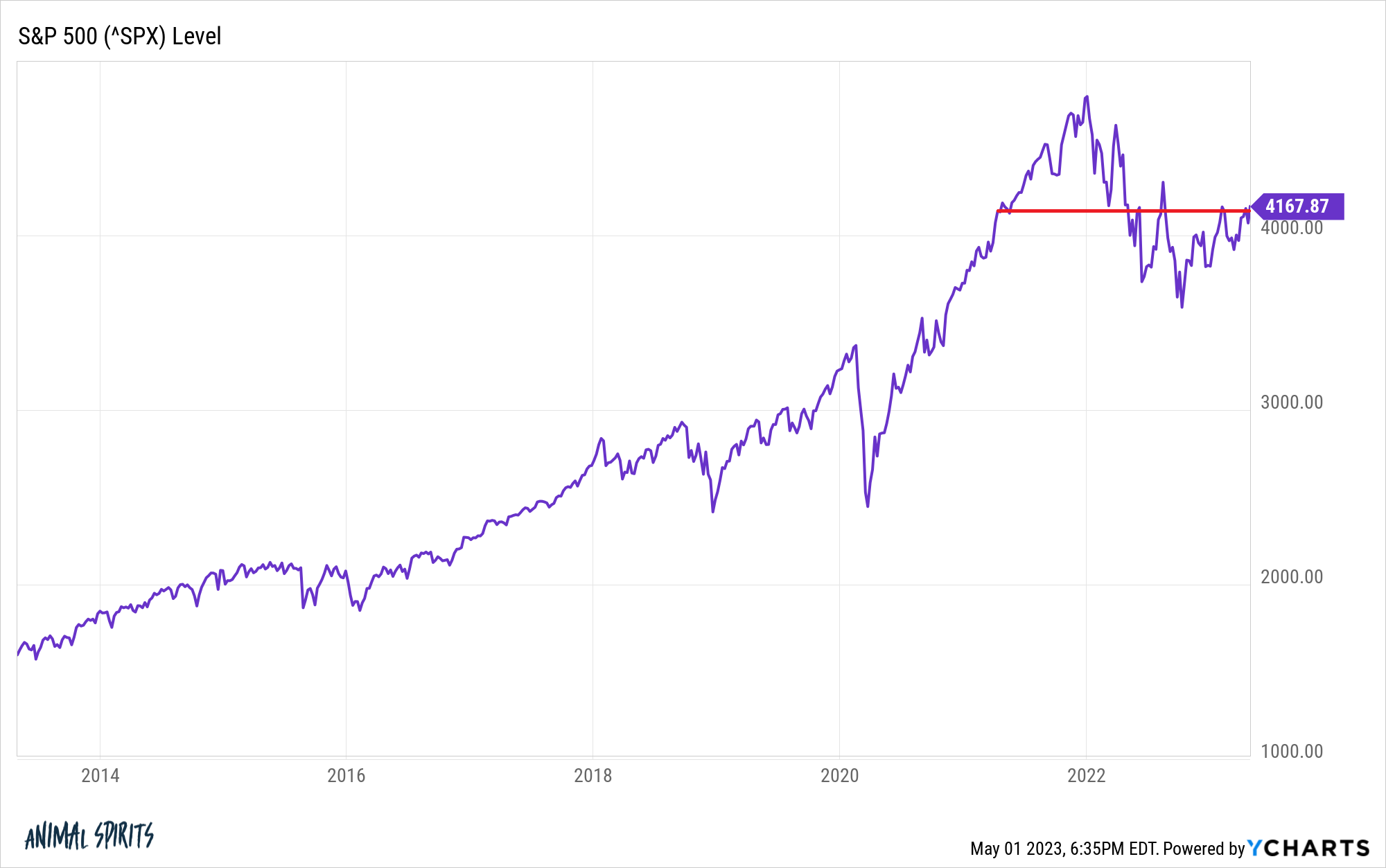

Bof As View Why Current Stock Market Valuations Are Not A Red Flag

May 23, 2025

Bof As View Why Current Stock Market Valuations Are Not A Red Flag

May 23, 2025 -

Gen Zs Marketing Maven How Alix Earle Became A Dancing With The Stars Success Story

May 23, 2025

Gen Zs Marketing Maven How Alix Earle Became A Dancing With The Stars Success Story

May 23, 2025