Frankfurt Equities: DAX's Continued Ascent - Record Within Reach

Table of Contents

Strong Performance Drivers of Frankfurt Equities

Several key factors are contributing to the robust performance of Frankfurt equities and the upward trajectory of the DAX.

Robust German Economic Growth

Germany's economic engine is humming, providing a strong foundation for the DAX's growth.

- Positive GDP Growth: Recent quarters have shown healthy GDP growth, exceeding expectations in several instances. This signifies a thriving economy capable of supporting higher stock valuations.

- Low Unemployment Rates: Sustained low unemployment rates point to a strong labor market and increased consumer spending, further bolstering economic growth.

- High Consumer Confidence: Consumer confidence indicators remain positive, suggesting continued spending and economic optimism.

- Sectoral Strength: Key sectors like automotive manufacturing (despite ongoing challenges), technology, and pharmaceuticals are contributing significantly to this growth. Government initiatives promoting technological advancement and green energy are also playing a role. The resurgence of the automotive sector, boosted by the shift towards electric vehicles, is a particularly significant contributor.

Global Economic Factors Favoring the DAX

Favorable global economic trends are also contributing to the rise of Frankfurt equities.

- Easing Inflationary Pressures: While inflation remains a concern globally, signs of easing pressure in major economies are positive for investor sentiment. This reduces the pressure on central banks to aggressively raise interest rates.

- Stable Oil Prices: Relatively stable oil prices mitigate inflationary risks and support global economic activity. This stability benefits export-oriented German companies.

- International Investment: Significant international investment continues to flow into the German market, driven by confidence in the country's economic stability and growth prospects. The Euro's exchange rate, while fluctuating, hasn't presented a major impediment to this inflow.

- Uncertainties Remain: However, geopolitical instability and potential global economic slowdowns remain significant risks that could impact investor sentiment and the DAX's performance.

Positive Corporate Earnings and Investor Sentiment

Strong corporate earnings and positive investor sentiment are further fueling the rise of Frankfurt equities.

- Strong Earnings Reports: Many major DAX companies have reported robust earnings, exceeding analysts' expectations and showcasing the health of the German corporate sector.

- Positive Analyst Forecasts: Analysts are largely optimistic about the future prospects of DAX companies, issuing positive upgrades and forecasts.

- Increased Capital Inflows: Significant capital inflows from both domestic and international investors are driving up demand for Frankfurt equities.

- Mergers and Acquisitions: Several significant mergers and acquisitions have further boosted investor confidence and market activity.

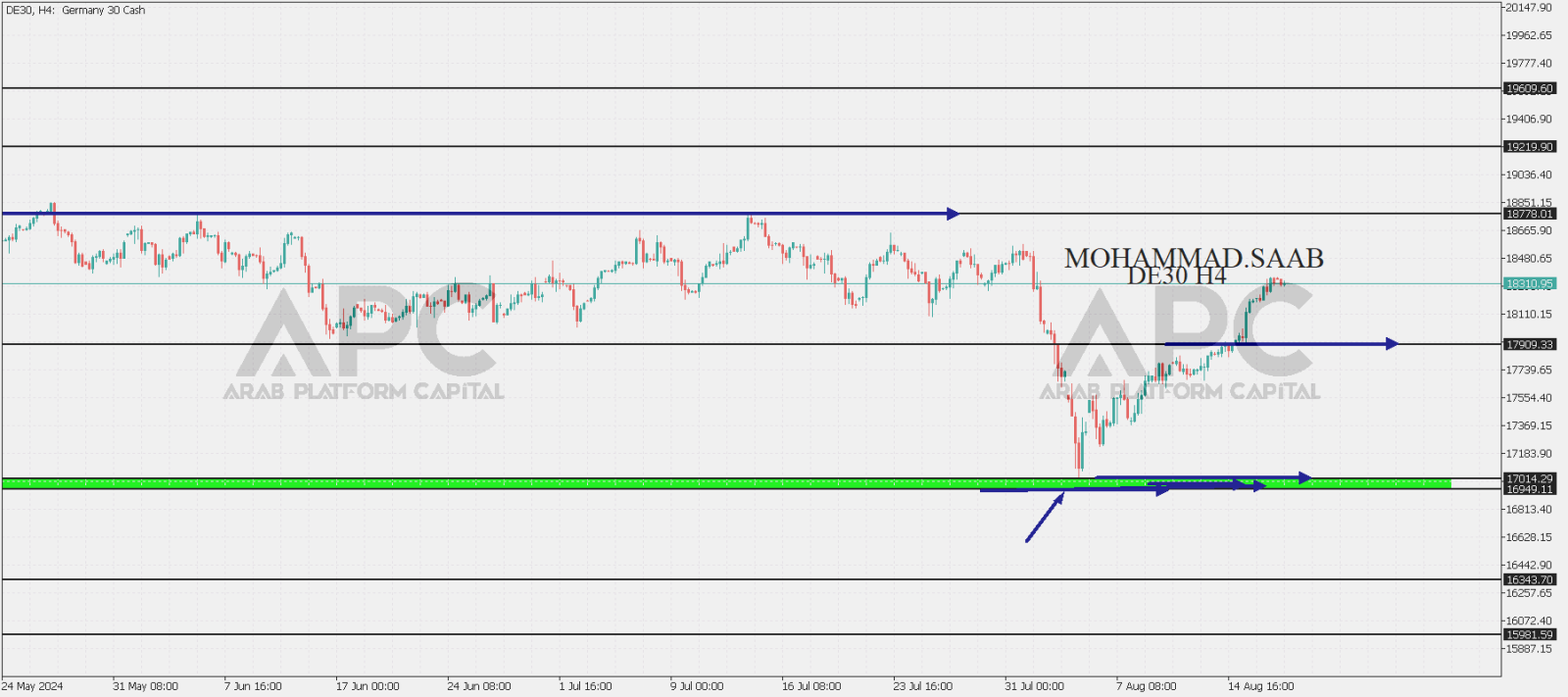

Technical Analysis and Chart Patterns Suggesting Further Upside

Technical analysis suggests that the DAX may have further upside potential.

Key Technical Indicators

Several key technical indicators point towards a bullish outlook for the DAX.

- Moving Averages: Major moving averages (e.g., 50-day, 200-day) are aligned in a bullish configuration, suggesting continued upward momentum.

- RSI (Relative Strength Index): The RSI is currently in a healthy range, indicating neither overbought nor oversold conditions.

- MACD (Moving Average Convergence Divergence): The MACD shows a bullish signal, further supporting the upward trend. (Note: Charts and graphs would be inserted here)

Chart Patterns

Certain chart patterns suggest continued upward movement.

- Bullish Flags: The presence of bullish flag patterns indicates potential breakouts and further price increases.

- Other Patterns: (Note: Specific patterns with accompanying charts and graphs would be added here.)

Support and Resistance Levels

While the DAX is showing strength, it's essential to consider potential support and resistance levels.

- Support Levels: Identifying key support levels is crucial for gauging potential downside risks. (Note: Charts illustrating support and resistance levels would be included here.)

- Resistance Levels: Breaching key resistance levels would signal a significant bullish breakout.

Potential Risks and Challenges for Frankfurt Equities

While the outlook is generally positive, several risks and challenges could impact Frankfurt equities.

Geopolitical Risks

Geopolitical instability, such as escalating global conflicts or political uncertainty in key regions, could negatively impact investor sentiment and the DAX.

Inflationary Pressures

Persistent inflationary pressures could dampen consumer spending and corporate profitability, potentially affecting the DAX's performance. The ECB's response to inflation will be crucial.

Interest Rate Hikes

Further interest rate hikes by the European Central Bank (ECB) could increase borrowing costs for businesses and dampen economic growth, impacting the German stock market.

Global Economic Slowdown

A global economic slowdown could significantly impact export-oriented German companies and reduce demand for Frankfurt equities.

Conclusion: Frankfurt Equities and the DAX – Investing in the Future

The strong performance of Frankfurt equities and the DAX is driven by a confluence of factors, including robust German economic growth, positive global economic trends, and strong corporate earnings. Technical analysis further suggests the potential for continued upward momentum. While geopolitical risks, inflationary pressures, interest rate hikes, and a potential global economic slowdown present challenges, the overall outlook remains positive. The DAX's potential to reach new record highs is significant. Learn more about investing in Frankfurt Equities and capitalize on the DAX's potential for growth. Explore investment opportunities today!

Featured Posts

-

France Considers Tougher Sentences For Young Offenders

May 25, 2025

France Considers Tougher Sentences For Young Offenders

May 25, 2025 -

Manny Garcias Lego Masterclass At Veterans Memorial Elementary School A Photo Recap

May 25, 2025

Manny Garcias Lego Masterclass At Veterans Memorial Elementary School A Photo Recap

May 25, 2025 -

Astonishing 90mph Refueling Police Helicopter Chase Ends In Dramatic Moment

May 25, 2025

Astonishing 90mph Refueling Police Helicopter Chase Ends In Dramatic Moment

May 25, 2025 -

Mwshr Daks Alalmany Ytjawz Aela Mstwa Lh Fy Mars

May 25, 2025

Mwshr Daks Alalmany Ytjawz Aela Mstwa Lh Fy Mars

May 25, 2025 -

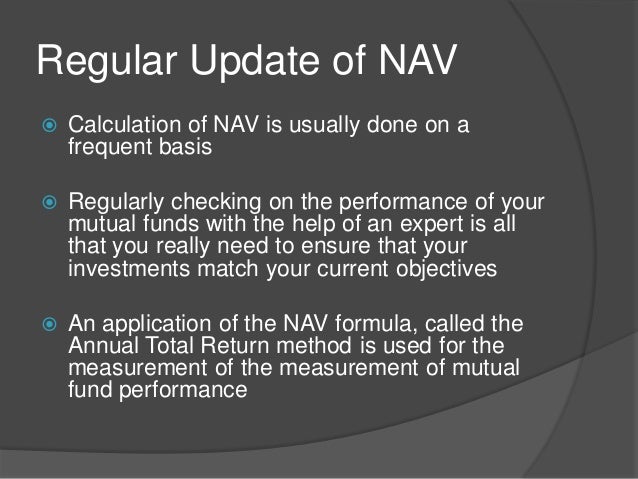

What Is Net Asset Value Nav A Focus On The Amundi Dow Jones Industrial Average Ucits Etf

May 25, 2025

What Is Net Asset Value Nav A Focus On The Amundi Dow Jones Industrial Average Ucits Etf

May 25, 2025

Latest Posts

-

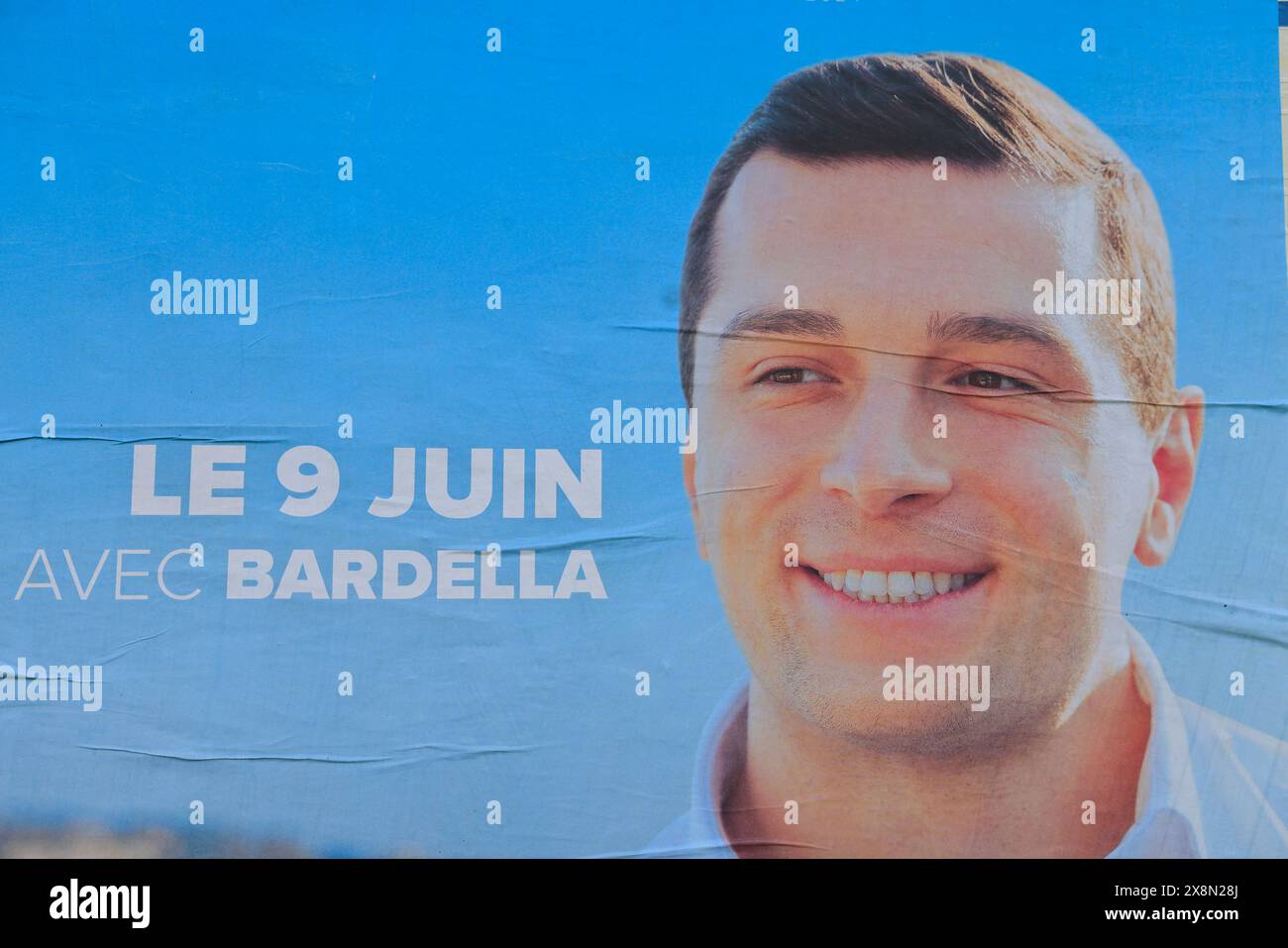

Bardellas Candidacy A Contender Or Long Shot In The French Presidential Race

May 25, 2025

Bardellas Candidacy A Contender Or Long Shot In The French Presidential Race

May 25, 2025 -

News Corp Hidden Value And Undervalued Potential In Its Portfolio

May 25, 2025

News Corp Hidden Value And Undervalued Potential In Its Portfolio

May 25, 2025 -

Jordan Bardella Leading The French Election Opposition

May 25, 2025

Jordan Bardella Leading The French Election Opposition

May 25, 2025 -

Unlocking The Potential Why News Corp Might Be Undervalued

May 25, 2025

Unlocking The Potential Why News Corp Might Be Undervalued

May 25, 2025 -

Is News Corps Stock Price Underestimating Its True Worth

May 25, 2025

Is News Corps Stock Price Underestimating Its True Worth

May 25, 2025