Is News Corp's Stock Price Underestimating Its True Worth?

Table of Contents

News Corp, the global media and information services giant, has experienced significant stock price fluctuations. This raises a crucial question: Is the current market valuation accurately reflecting News Corp's intrinsic value and future potential? This article delves into a comprehensive analysis of News Corp's diverse assets, the factors influencing its stock price, and ultimately explores whether it presents a potentially undervalued investment opportunity.

News Corp's Diverse Portfolio and Revenue Streams

News Corp's strength lies in its diversified portfolio, generating revenue from various sectors, mitigating risk and offering potential for growth across multiple market segments.

Digital Real Estate Holdings

News Corp boasts substantial digital real estate holdings, a key driver of future growth. The most prominent example is realtor.com, a leading online real estate platform in the United States.

- realtor.com's Market Position: realtor.com enjoys a significant market share in the lucrative online real estate market, consistently ranking among the top platforms for property listings and buyer/seller engagement. Its strong brand recognition and extensive network contribute to its substantial revenue generation.

- Monetization Strategies: News Corp leverages various monetization strategies on realtor.com, including advertising revenue, subscription services for enhanced features, and lead generation for real estate professionals. This diversified approach helps to maximize profitability.

- Revenue Growth and Market Share: While precise figures fluctuate, realtor.com's revenue growth consistently reflects its strong position within the booming online real estate sector. Its market share data indicates its continued dominance and competitive edge. Further analysis of publicly available financial reports is crucial for precise figures.

Print and Subscription Businesses

Despite the challenges facing traditional print media, News Corp's flagship publications demonstrate surprising resilience. The Wall Street Journal and The Times maintain substantial print and digital subscriptions.

- Strength of Flagship Publications: The Wall Street Journal and The Times retain significant influence and readership, attracting a premium subscriber base willing to pay for high-quality journalism and insightful analysis. Their strong brands contribute significantly to News Corp's revenue and profitability.

- Subscription Models and Cost-Cutting Measures: News Corp has strategically adapted to the changing media landscape by implementing robust digital subscription models and implementing cost-cutting measures in print operations, optimizing profitability and efficiency.

- Circulation and Subscriber Numbers: Though print circulation may be declining, News Corp has effectively transitioned many readers to digital subscriptions, maintaining overall subscriber numbers and even increasing digital-only subscriptions. Publicly available data on circulation and subscriptions can provide further insights.

Book Publishing Division

HarperCollins, News Corp's book publishing division, continues to be a significant contributor to its overall financial performance.

- Successful Authors and Titles: HarperCollins publishes a wide range of best-selling authors and titles, consistently securing prominent positions on bestseller lists across various genres. This consistent success contributes to its market share and profitability.

- Market Trends and Profitability: While navigating market trends such as e-book sales and audio books, HarperCollins strategically adapts its publishing strategies, maintaining its profitability and market position within the competitive book publishing industry. Industry reports can provide detailed analysis on market trends and HarperCollins’s performance.

Factors Affecting News Corp's Stock Price

Several factors beyond News Corp's operational performance significantly influence its stock price.

Macroeconomic Conditions

Broader economic trends significantly impact News Corp's stock performance, like most publicly traded companies.

- Correlation Between Macroeconomic Indicators and Stock Price: Economic downturns often lead to reduced advertising spending and decreased consumer discretionary spending, impacting News Corp’s revenue streams. Conversely, economic growth can positively affect its performance. Analyzing the correlation between macroeconomic indicators (inflation, interest rates) and News Corp's stock price reveals this relationship.

- Cyclical Nature of the Media Industry: The media industry, like many others, experiences cyclical trends influenced by the overall economic climate. News Corp's stock price reflects these cycles, showing periods of growth and contraction.

Market Sentiment and Investor Perception

Investor sentiment plays a crucial role in shaping News Corp's stock price.

- News, Controversies, and Analyst Reports: Negative news coverage, controversies surrounding News Corp's operations, or negative analyst reports can significantly impact investor confidence and depress the stock price. Positive news and favorable analyst ratings, conversely, have the opposite effect.

- Stock Market Analysis: Thorough analysis of news articles, analyst reports, and investor discussions provides a comprehensive understanding of the market sentiment surrounding News Corp and its impact on its stock price.

Competitive Landscape

News Corp operates in a highly competitive media landscape, impacting its valuation.

- Key Competitors and Market Strategies: News Corp faces stiff competition from other major media companies, both traditional and digital. Understanding their strategies and market share is crucial in assessing News Corp's competitive advantage.

- Impact on Market Share and Profitability: Competitive pressures can affect News Corp's market share and profitability, directly impacting its stock price. Analysis of market share data provides insights into the competitive dynamics.

Valuation Analysis and Potential Upside

Determining whether News Corp is undervalued requires a thorough valuation analysis.

Discounted Cash Flow (DCF) Analysis

While a detailed DCF model is beyond the scope of this article, a simplified approach suggests News Corp's intrinsic value may exceed its current market price. This simplified analysis considers future projected cash flows and discounts them back to their present value. The key assumptions (discount rate, growth rate) significantly affect the results, warranting a detailed professional analysis.

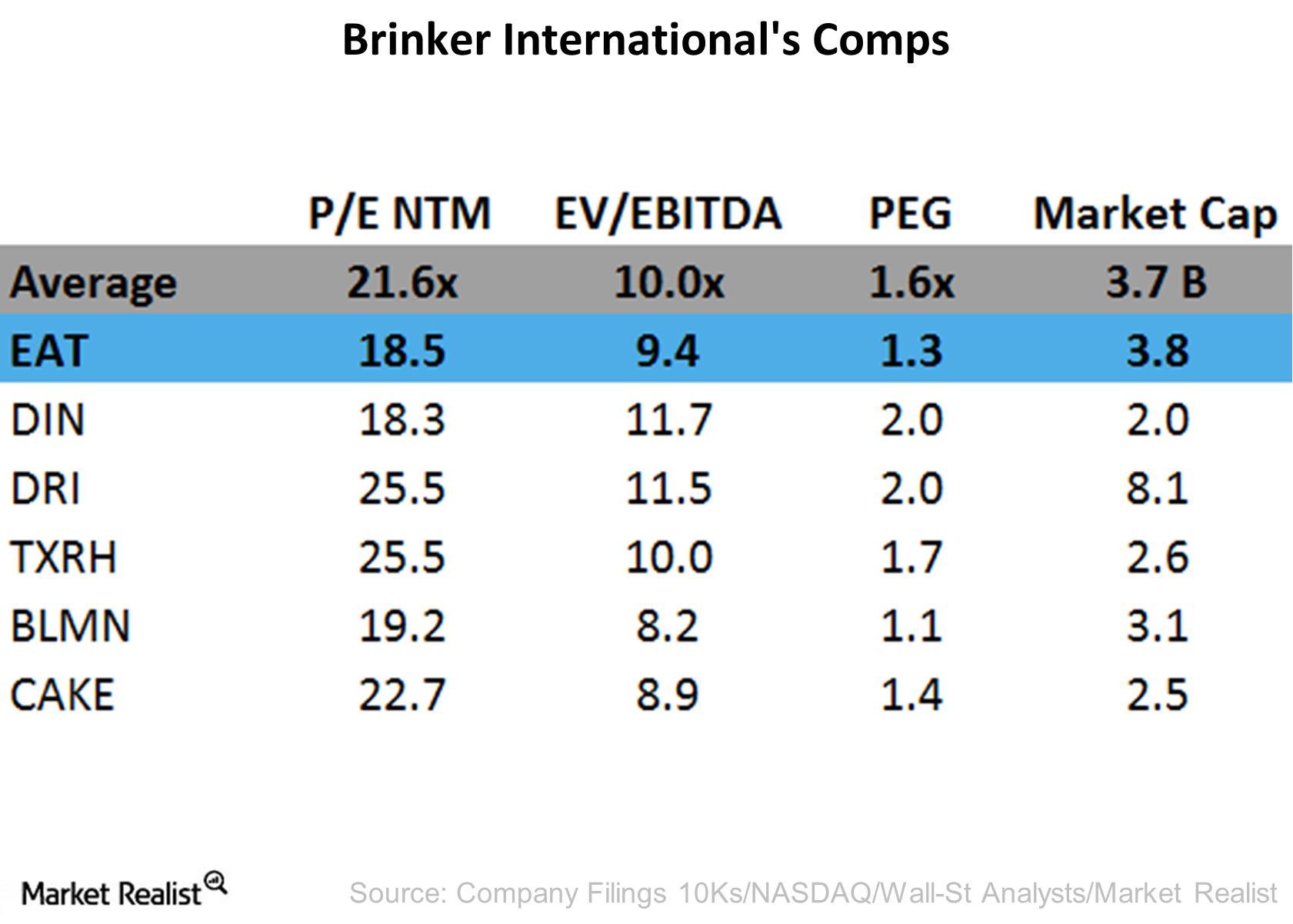

Comparison to Peers

Comparing News Corp's valuation multiples (P/E ratio, etc.) to those of its competitors reveals potential undervaluation. If News Corp's multiples are significantly lower than its peers, despite comparable performance, it could indicate that the market is underestimating its true worth. Analyzing financial data for peer companies allows for direct comparison and strengthens the argument for potential undervaluation.

Conclusion

News Corp's diverse portfolio, spanning digital real estate, print media, and book publishing, offers a compelling foundation for future growth. While macroeconomic conditions and market sentiment impact its stock price, a thorough valuation analysis suggests potential undervaluation compared to its peers. This analysis, coupled with its resilient core businesses and the potential for further growth in digital assets, makes News Corp stock a potential investment opportunity. However, it's crucial to conduct thorough independent research and analysis before making any investment decisions. Consider News Corp stock as part of a well-diversified investment portfolio, understanding that investing in the stock market always involves risk. Further analysis of News Corp’s financial statements and industry reports is recommended before making any investment decisions. Consider seeking advice from a qualified financial advisor before investing in News Corp stock or any other security.

Featured Posts

-

Re Evaluating News Corp Is It Undervalued By The Market

May 25, 2025

Re Evaluating News Corp Is It Undervalued By The Market

May 25, 2025 -

How To Interpret The Net Asset Value Nav Of Amundi Msci World Ii Ucits Etf Usd Hedged Dist

May 25, 2025

How To Interpret The Net Asset Value Nav Of Amundi Msci World Ii Ucits Etf Usd Hedged Dist

May 25, 2025 -

Repression Chinoise En France Des Dissidents Reduits Au Silence

May 25, 2025

Repression Chinoise En France Des Dissidents Reduits Au Silence

May 25, 2025 -

L Impatto Dei Dazi Di Trump Sul Settore Moda Europeo Analisi Di Mercato

May 25, 2025

L Impatto Dei Dazi Di Trump Sul Settore Moda Europeo Analisi Di Mercato

May 25, 2025 -

Global Healthcare Transformation Insights From The Philips Future Health Index 2025 On Ai

May 25, 2025

Global Healthcare Transformation Insights From The Philips Future Health Index 2025 On Ai

May 25, 2025

Latest Posts

-

Analysis Of Sean Penns Stance On Dylan Farrows Accusations Against Woody Allen

May 25, 2025

Analysis Of Sean Penns Stance On Dylan Farrows Accusations Against Woody Allen

May 25, 2025 -

The Sean Penn Woody Allen Dylan Farrow Controversy A Deeper Look

May 25, 2025

The Sean Penn Woody Allen Dylan Farrow Controversy A Deeper Look

May 25, 2025 -

Woody Allen Sexual Assault Allegations Sean Penns Doubts

May 25, 2025

Woody Allen Sexual Assault Allegations Sean Penns Doubts

May 25, 2025 -

Understanding Frank Sinatras Four Marriages Wives Love And Legacy

May 25, 2025

Understanding Frank Sinatras Four Marriages Wives Love And Legacy

May 25, 2025 -

Sean Penns Response To Dylan Farrows Sexual Assault Claims Against Woody Allen

May 25, 2025

Sean Penns Response To Dylan Farrows Sexual Assault Claims Against Woody Allen

May 25, 2025