Re-evaluating News Corp: Is It Undervalued By The Market?

Table of Contents

News Corp's recent market performance has left many investors questioning whether the current stock price accurately reflects the company's true worth. Is News Corp undervalued? This article delves into a comprehensive analysis to determine if the market is overlooking the significant intrinsic value within this media conglomerate. We will examine News Corp's diversified revenue streams, the prevailing market sentiment, and its future growth potential to assess whether the "News Corp Undervalued" narrative holds water.

2. Main Points:

H2: News Corp's Diversified Revenue Streams: A Key to Undervaluation?

News Corp's diverse portfolio of assets could be a significant factor contributing to its undervaluation. The company isn't reliant on a single revenue stream, offering resilience against economic fluctuations and industry disruption.

H3: Analyzing the Strength of News Corp's Divisions:

News Corp operates across several key divisions, each contributing to its overall financial health. Let's look at the performance and potential of each:

- News & Information Services: This division, a major contributor to News Corp revenue, includes prominent newspapers and digital platforms. Strong digital subscription growth and a loyal readership base suggest ongoing profitability.

- Dow Jones: The Dow Jones division, home to the Wall Street Journal, boasts a prestigious brand and a substantial subscriber base. Its robust financial reporting and data analytics services contribute significantly to Dow Jones valuation and overall News Corp revenue.

- Book Publishing: News Corp's book publishing arm maintains a strong presence in the market, consistently publishing bestselling titles and leveraging strong author relationships. Analyzing the book publishing market reveals a resilient sector, despite the rise of ebooks.

- Other Divisions: News Corp also has other divisions that contribute to its diversification and overall stability.

The resilience of these divisions during economic downturns and industry disruption suggests a stronger underlying value than the current market price reflects. For instance, during the recent pandemic, News Corp's digital platforms experienced significant growth, demonstrating adaptability and strength.

H3: Synergies and Cross-Promotion Opportunities:

A critical element often overlooked is the potential for synergies and cross-promotion within News Corp's diverse portfolio. News Corp synergy is achievable through leveraging the brand recognition of Dow Jones to boost subscriptions to other News Corp publications. A successful cross-promotion strategy could significantly enhance overall value. For example, promoting book releases within the Wall Street Journal could drive sales and increase revenue streams. The potential for News Corp synergy is vast and largely untapped.

H2: Market Sentiment and the Impact on News Corp's Valuation:

Negative market sentiment can significantly impact a company's valuation, and News Corp is not immune.

H3: Negative Market Perception and Mispricing:

Concerns regarding the future of print media and increasing regulatory scrutiny have contributed to negative News Corp market sentiment. However, the strength of its digital assets and diversified revenue streams may mitigate these concerns. The current News Corp stock price might reflect an overblown negative perception, resulting in mispricing. Analyzing News Corp market sentiment reveals a disconnect between the perceived risks and the company's actual performance.

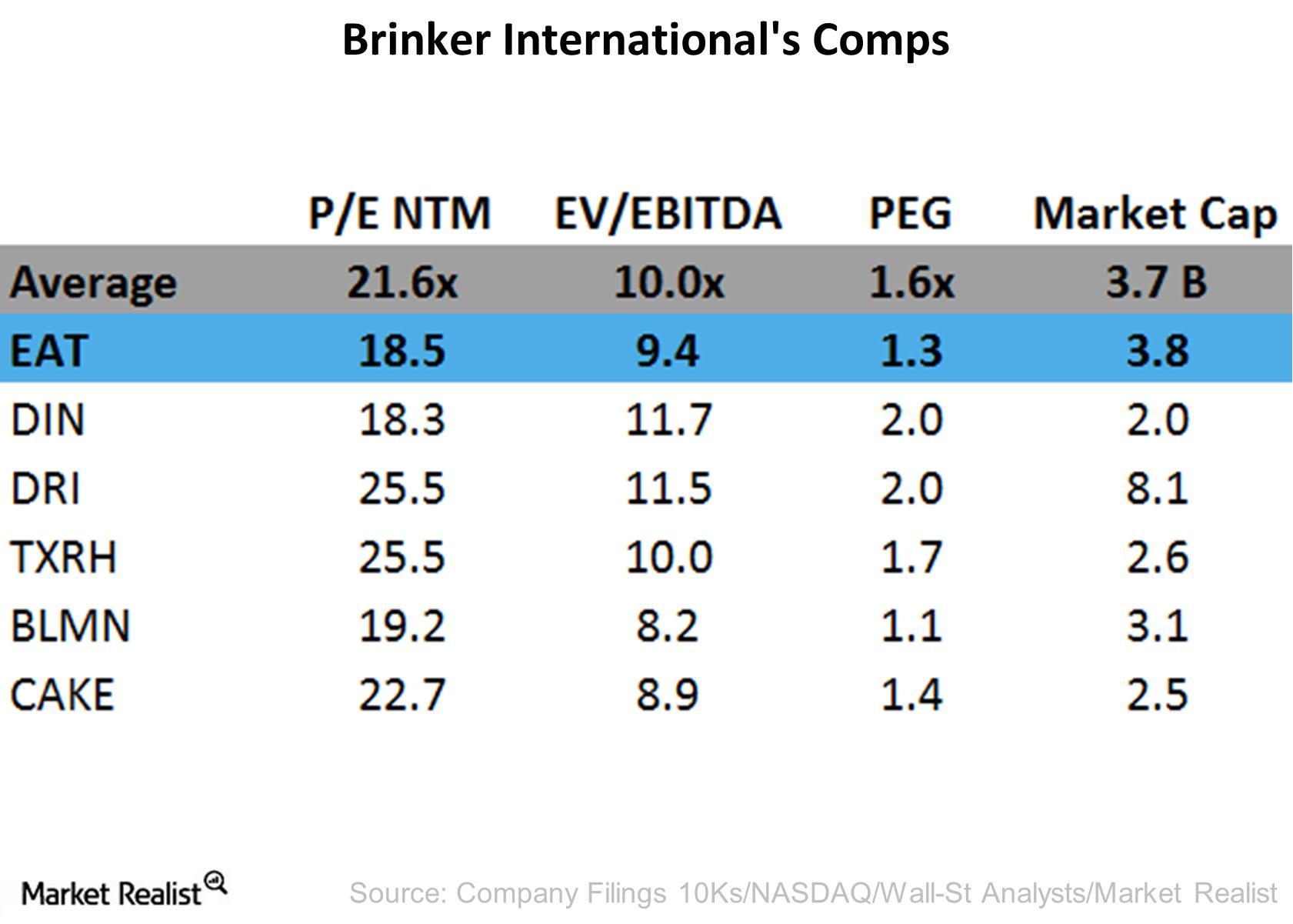

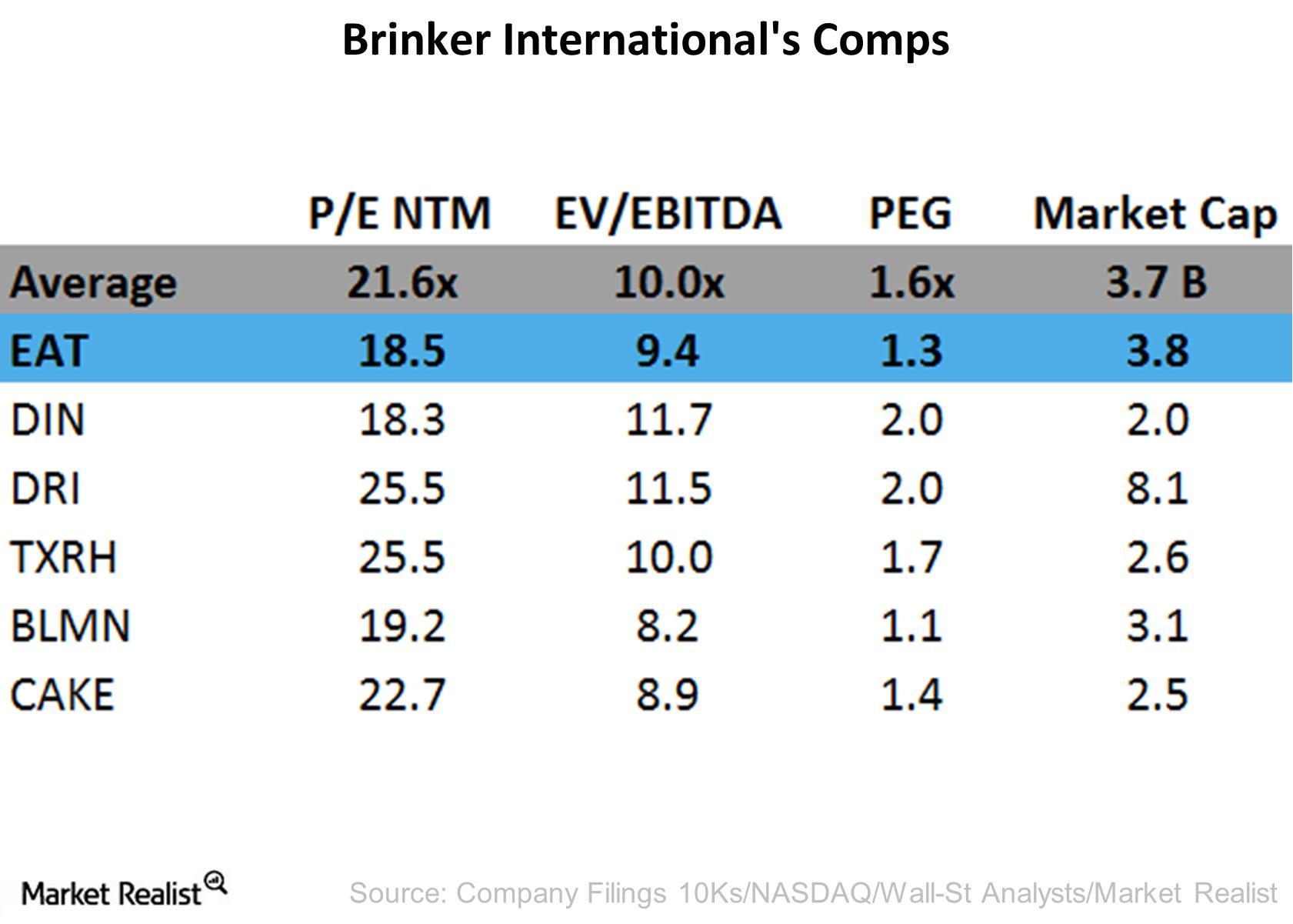

H3: Comparing News Corp's Valuation to Peers:

Comparing News Corp's valuation multiples, such as the News Corp PE ratio, to its peers in the media industry reveals potential undervaluation. While peer comparison analysis has its limitations, a significantly lower PE ratio compared to competitors with similar growth prospects suggests a potential opportunity.

H2: Future Growth Potential and Undervalued Assets:

News Corp possesses considerable future growth potential and potentially undervalued assets.

H3: Identifying Potential Growth Drivers:

News Corp's digital strategy is focused on expanding digital subscriptions across its various platforms. This growth, combined with expansion into new markets, presents significant opportunities. The company’s investments in digital content and technology represent potential catalysts for future growth, shaping a positive News Corp future outlook.

H3: Hidden or Undervalued Assets:

News Corp might hold undervalued assets beyond its core business. Real estate holdings and a substantial intellectual property portfolio could contribute significant value, currently untapped by the market. The potential for unlocking this value could substantially impact the company's overall valuation. A thorough analysis of News Corp assets is crucial in determining the extent of this undervaluation.

3. Conclusion: Reassessing the Investment Case for News Corp

Our analysis suggests that the market may be undervaluing News Corp. The company's diversified revenue streams, strong digital growth potential, and potentially undervalued assets paint a picture of significant intrinsic value. While conducting thorough due diligence is crucial before any investment decision, the evidence points toward a compelling investment case for News Corp. The "News Corp Undervalued" thesis, supported by a deeper dive into its financials and strategic position, suggests a potential for significant returns on investment in this often-overlooked media giant. Don't overlook the potential of a possibly undervalued News Corp.

Featured Posts

-

Trumps Tariff Relief Signals Boost European Stock Markets Lvmh Decline

May 25, 2025

Trumps Tariff Relief Signals Boost European Stock Markets Lvmh Decline

May 25, 2025 -

M56 Road Closure Live Updates On Traffic Disruptions

May 25, 2025

M56 Road Closure Live Updates On Traffic Disruptions

May 25, 2025 -

Large Scale Gun Trafficking Ring Dismantled In Massachusetts 18 Arrests 100 Firearms Seized

May 25, 2025

Large Scale Gun Trafficking Ring Dismantled In Massachusetts 18 Arrests 100 Firearms Seized

May 25, 2025 -

Demnas Appointment At Gucci Expectations And Analysis

May 25, 2025

Demnas Appointment At Gucci Expectations And Analysis

May 25, 2025 -

Bolee 600 Svadeb Na Kharkovschine Za Mesyats Prichiny Populyarnosti Brakosochetaniy

May 25, 2025

Bolee 600 Svadeb Na Kharkovschine Za Mesyats Prichiny Populyarnosti Brakosochetaniy

May 25, 2025

Latest Posts

-

Analysis Of Sean Penns Stance On Dylan Farrows Accusations Against Woody Allen

May 25, 2025

Analysis Of Sean Penns Stance On Dylan Farrows Accusations Against Woody Allen

May 25, 2025 -

The Sean Penn Woody Allen Dylan Farrow Controversy A Deeper Look

May 25, 2025

The Sean Penn Woody Allen Dylan Farrow Controversy A Deeper Look

May 25, 2025 -

Woody Allen Sexual Assault Allegations Sean Penns Doubts

May 25, 2025

Woody Allen Sexual Assault Allegations Sean Penns Doubts

May 25, 2025 -

Understanding Frank Sinatras Four Marriages Wives Love And Legacy

May 25, 2025

Understanding Frank Sinatras Four Marriages Wives Love And Legacy

May 25, 2025 -

Sean Penns Response To Dylan Farrows Sexual Assault Claims Against Woody Allen

May 25, 2025

Sean Penns Response To Dylan Farrows Sexual Assault Claims Against Woody Allen

May 25, 2025