Frankfurt Equities Opening: DAX Continues Record-Breaking Rise

Table of Contents

Strong Corporate Earnings Drive DAX Growth

Strong corporate earnings are a primary engine driving the DAX's upward trajectory. Numerous major German companies have reported exceptionally strong financial results, exceeding analyst expectations and boosting investor confidence. This robust company performance is directly translating into increased DAX values.

- Top Performers: Volkswagen, fueled by strong sales of its electric vehicles, and Siemens, benefiting from robust demand in its industrial automation sector, are prime examples of companies contributing significantly to the DAX's rise. BASF, a leading chemical company, also reported impressive profits, reflecting global industrial growth.

- Positive Analyst Outlook: Many analysts are maintaining positive outlooks for these and other DAX constituents, citing sustained growth potential and strong order books as key factors. This positive sentiment further reinforces the upward trend. Keywords like "profit growth," "strong financial results," and "company performance" accurately reflect this situation.

Global Economic Optimism Fuels Investor Confidence

Positive global economic indicators are significantly fueling investor confidence in the German market. Easing supply chain issues, a gradual decline in inflation rates in many key markets, and relatively strong consumer spending are all contributing to a more optimistic global economic outlook. This positive sentiment spills over into the German market, leading to increased investment in DAX equities.

- Key Global Indicators: Lower inflation rates in several major economies, including the US and Eurozone, are reducing concerns about future interest rate hikes, thereby boosting investor sentiment. Simultaneously, improved supply chain dynamics are reducing production bottlenecks and contributing to higher corporate profits.

- International Forecasts: Many international financial institutions have upgraded their global growth forecasts, highlighting a more positive outlook that benefits investor confidence and fuels investment in the DAX. This optimism is a critical factor driving the market upward.

Low Interest Rates and Monetary Policy Influence

The European Central Bank's (ECB) monetary policy, characterized by relatively low interest rates, plays a significant role in supporting the DAX's growth. Low borrowing costs encourage corporate investment and expansion, further boosting economic activity and positively impacting stock prices.

- ECB's Monetary Stance: The ECB's current monetary policy, while shifting towards a less accommodative stance, still maintains relatively low interest rates compared to historical levels. This continues to support market liquidity and encourages borrowing for investment.

- Impact on Market Liquidity: Low interest rates contribute to increased market liquidity, making it easier for companies to raise capital and for investors to participate in the market. This increased liquidity fuels the demand for DAX equities.

Sector-Specific Performance Within the DAX

While the entire DAX is experiencing growth, certain sectors are outperforming others. The automotive sector, driven by the ongoing shift towards electric vehicles and increased global demand, is a significant contributor to the DAX's rise. The technology sector is also performing strongly, benefiting from continued digital transformation and technological advancements.

- Top-Performing Sectors: The automotive, technology, and chemicals sectors are amongst the best-performing sectors within the DAX, collectively driving a substantial portion of the index's growth.

- Underperforming Sectors: While most sectors are contributing positively, some sectors may show less significant gains or even minor declines. This is often due to sector-specific challenges or global economic headwinds. Analyzing these sector-specific trends provides a more nuanced understanding of the market's dynamics.

Conclusion: DAX's Record-Breaking Rise and Future Outlook

The DAX's record-breaking rise is a result of a confluence of positive factors, including robust corporate earnings, strong global economic optimism, supportive monetary policy, and excellent sector-specific performance. However, it’s crucial to maintain a cautious outlook. Potential risks and uncertainties, such as geopolitical instability and potential future interest rate hikes, could impact the market's future trajectory.

While the current outlook is positive, investors should adopt a diversified investment strategy and remain informed about the latest economic and market developments. Stay updated on the latest developments in the Frankfurt equities market and continue to monitor the DAX’s performance for further insights. Understanding the nuances of the Frankfurt equities market and the DAX is crucial for informed investment decisions.

Featured Posts

-

Auto Tariff Relief Speculation Drives European Stock Market Gains Lvmh Shares Fall

May 25, 2025

Auto Tariff Relief Speculation Drives European Stock Market Gains Lvmh Shares Fall

May 25, 2025 -

Michael Caines Revealing Story A Sex Scene With Mia Farrow And An Uninvited Guest

May 25, 2025

Michael Caines Revealing Story A Sex Scene With Mia Farrow And An Uninvited Guest

May 25, 2025 -

A Fathers 2 2 Million Row Funding His Sons Life Saving Treatment

May 25, 2025

A Fathers 2 2 Million Row Funding His Sons Life Saving Treatment

May 25, 2025 -

Flash Flood Emergency Preparedness Protecting Yourself And Your Family

May 25, 2025

Flash Flood Emergency Preparedness Protecting Yourself And Your Family

May 25, 2025 -

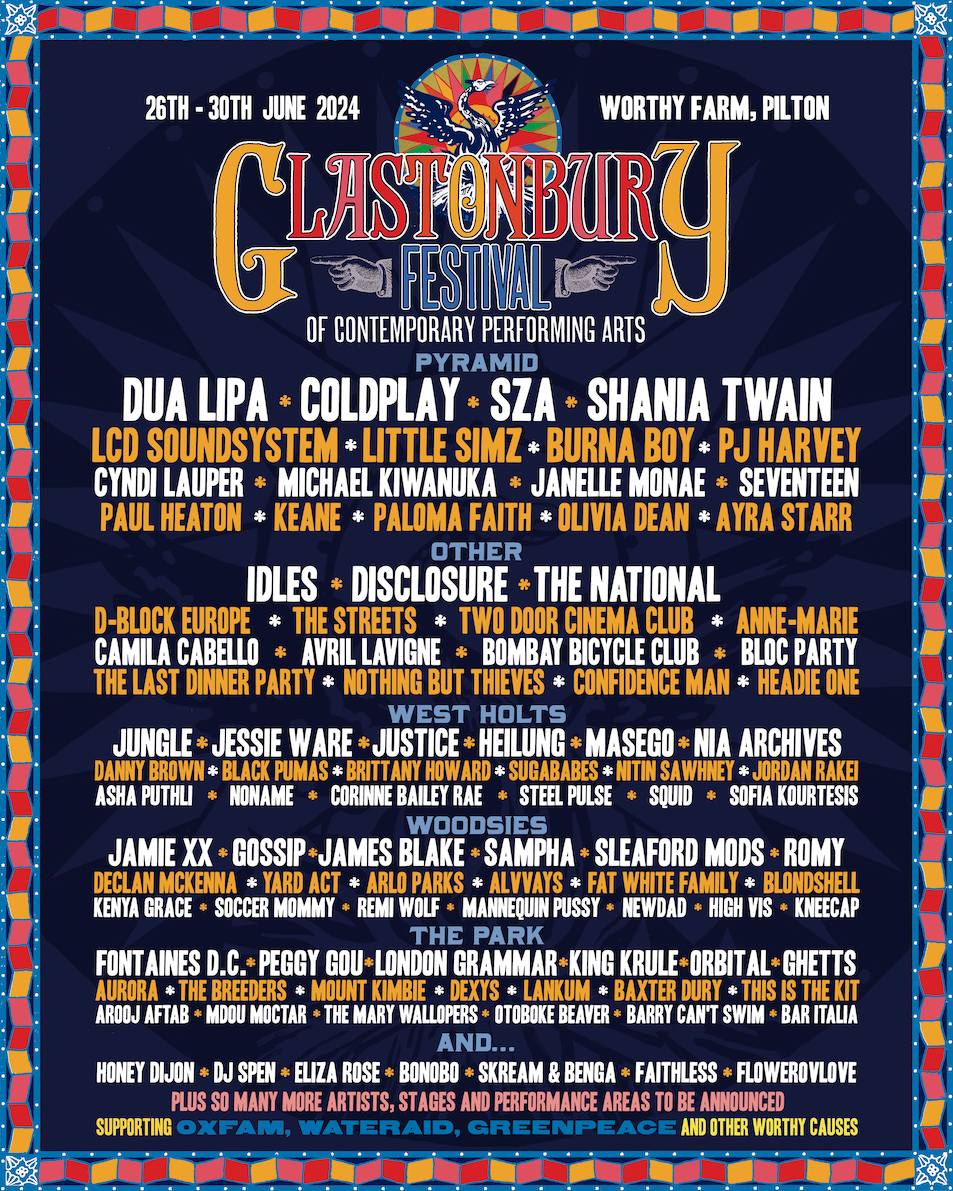

Glastonbury 2025 Full Lineup Revealed Following Leak Get Your Tickets Now

May 25, 2025

Glastonbury 2025 Full Lineup Revealed Following Leak Get Your Tickets Now

May 25, 2025

Latest Posts

-

Queen Wens Parisian Court An Update On Her Activities

May 25, 2025

Queen Wens Parisian Court An Update On Her Activities

May 25, 2025 -

Arda Gueler E Uefa Sorusturmasi Real Madrid Yildizlari Tehlikede Mi

May 25, 2025

Arda Gueler E Uefa Sorusturmasi Real Madrid Yildizlari Tehlikede Mi

May 25, 2025 -

Paris Welcomes Queen Wen A Royal Visit

May 25, 2025

Paris Welcomes Queen Wen A Royal Visit

May 25, 2025 -

Bueyuek Kuluep Krizi Doert Oyuncuya Sorusturma Acildi

May 25, 2025

Bueyuek Kuluep Krizi Doert Oyuncuya Sorusturma Acildi

May 25, 2025 -

Zheng Qinwens Path To Victory From Sabalenka To Gauff In Rome

May 25, 2025

Zheng Qinwens Path To Victory From Sabalenka To Gauff In Rome

May 25, 2025