Frankfurt Stock Exchange: DAX Ends Day Below 24,000

Table of Contents

Factors Contributing to DAX's Decline

The DAX's fall below 24,000 is the result of a confluence of factors, each playing a significant role in shaping the current market landscape. Understanding these factors is crucial for navigating the complexities of the German Stock Market and making informed investment decisions.

-

Rising Inflation and its Impact on Consumer Spending: Persistent high inflation across the Eurozone is eroding consumer purchasing power. Reduced consumer spending directly impacts company revenues, particularly in consumer-facing sectors, leading to decreased profits and potentially lower stock prices. This is a significant drag on the DAX index.

-

The ECB's Monetary Policy and its Influence on Interest Rates: The European Central Bank's (ECB) efforts to combat inflation through interest rate hikes are impacting borrowing costs for businesses and consumers. Higher interest rates can stifle economic growth and reduce investment, contributing to a negative outlook for the German economy and the DAX.

-

Concerns about Slowing Economic Growth in Germany and the Eurozone: Economic forecasts for Germany and the Eurozone have been revised downwards, fueling concerns about a potential recession. This uncertainty is a major driver of the current market pessimism and impacts investor confidence in the DAX.

-

Geopolitical Uncertainties and their Market Impact: The ongoing war in Ukraine continues to create significant geopolitical uncertainty, impacting energy supplies and overall economic stability. Furthermore, tensions between the US and China add to the global economic instability and risk aversion among investors.

-

Volatility in Energy Prices and its Effect on German Businesses: The significant volatility in energy prices, largely driven by the war in Ukraine, places a considerable strain on German businesses, impacting their profitability and investment capacity. This sector-specific pressure is reflected in the broader DAX performance.

-

Disappointing Earnings Reports from Key DAX Companies: Several key companies listed on the DAX have recently reported disappointing earnings, further contributing to the negative market sentiment. These results highlight the challenges faced by businesses operating in the current economic climate.

Investor Reactions and Market Sentiment

The decline in the DAX has triggered a noticeable shift in investor sentiment, characterized by increased risk aversion and a cautious approach to investment.

-

Increased Risk Aversion Among Investors: Investors are moving towards safer assets, reducing their exposure to riskier investments, including stocks listed on the Frankfurt Stock Exchange. This flight to safety is a clear indication of the prevailing market pessimism.

-

Changes in Trading Volume Reflecting Investor Sentiment: The increased volatility has led to a higher trading volume as investors react to the changing market conditions. This heightened activity reflects the uncertainty and the need for swift adjustments to investment portfolios.

-

Impact on Individual Stock Prices within the DAX: The overall decline in the DAX is reflected in the decreased prices of individual stocks. However, the impact varies across sectors and individual companies, highlighting the diverse nature of the market's response.

-

Analysis of Potential Investment Strategies in Light of the Current Market Conditions: Given the prevailing uncertainty, investors are reassessing their investment strategies. Conservative approaches, diversification, and careful risk management are becoming increasingly important.

Analysis of Key DAX Performers

The performance of individual sectors within the DAX has varied significantly. While some sectors have been more resilient, others have experienced sharper declines.

-

Performance Analysis of Leading Sectors (e.g., automotive, technology, financials): The automotive sector, heavily reliant on energy and supply chains, has been particularly affected. Technology stocks have also experienced some downward pressure, reflecting broader global economic concerns. The financial sector faces challenges due to rising interest rates.

-

Discussion of Individual Company Stock Price Movements and Contributing Factors: Specific company news and individual performance have contributed to the overall DAX movement. Analyzing these individual factors provides a deeper understanding of the market dynamics.

-

Examination of the Impact of Specific Company News on the Overall DAX Index: News related to earnings reports, mergers, and acquisitions, or regulatory changes impacting individual DAX constituents has a direct impact on the overall index performance.

Outlook and Predictions for the Frankfurt Stock Exchange

Predicting the future performance of the Frankfurt Stock Exchange and the DAX index is challenging, given the complex interplay of economic and geopolitical factors.

-

Short-Term and Long-Term Predictions for the DAX Index: Short-term forecasts suggest continued volatility, with the potential for further fluctuations. Long-term predictions are highly dependent on the resolution of several key global and regional uncertainties.

-

Assessment of Potential Risks and Opportunities for Investors: Investors need to carefully assess the risks and opportunities in this uncertain climate. Diversification and a thorough understanding of individual company performance are crucial.

-

Consideration of Factors That Could Influence Future Market Performance: Key factors to watch include inflation rates, ECB monetary policy decisions, geopolitical developments, and the performance of key DAX constituents.

Conclusion

The DAX closing below 24,000 reflects the current complexities of the global and European economic landscape. Rising inflation, ECB monetary policy, geopolitical risks, and disappointing company earnings have all played a significant role in shaping the current negative market sentiment. Investors are exercising increased risk aversion, leading to a reassessment of investment strategies. While the short-term outlook remains uncertain, a careful understanding of the factors influencing the Frankfurt Stock Exchange and the DAX index is crucial for informed decision-making. Stay updated on the latest developments at the Frankfurt Stock Exchange and monitor the DAX index closely for informed investment strategies. Keep an eye on the DAX to make optimal investment decisions in this dynamic market.

Featured Posts

-

Czy Porsche Cayenne Gts Coupe To Suv Marzen Moja Opinia Po Tescie

May 24, 2025

Czy Porsche Cayenne Gts Coupe To Suv Marzen Moja Opinia Po Tescie

May 24, 2025 -

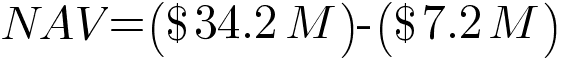

Net Asset Value Nav Of The Amundi Dow Jones Industrial Average Ucits Etf

May 24, 2025

Net Asset Value Nav Of The Amundi Dow Jones Industrial Average Ucits Etf

May 24, 2025 -

How To Interpret The Net Asset Value Nav Of The Amundi Dow Jones Industrial Average Ucits Etf

May 24, 2025

How To Interpret The Net Asset Value Nav Of The Amundi Dow Jones Industrial Average Ucits Etf

May 24, 2025 -

Picture This Soundtrack Your Complete Guide To The Music

May 24, 2025

Picture This Soundtrack Your Complete Guide To The Music

May 24, 2025 -

Frankfurt Stock Market Opening Dax Holds Steady After Record High

May 24, 2025

Frankfurt Stock Market Opening Dax Holds Steady After Record High

May 24, 2025

Latest Posts

-

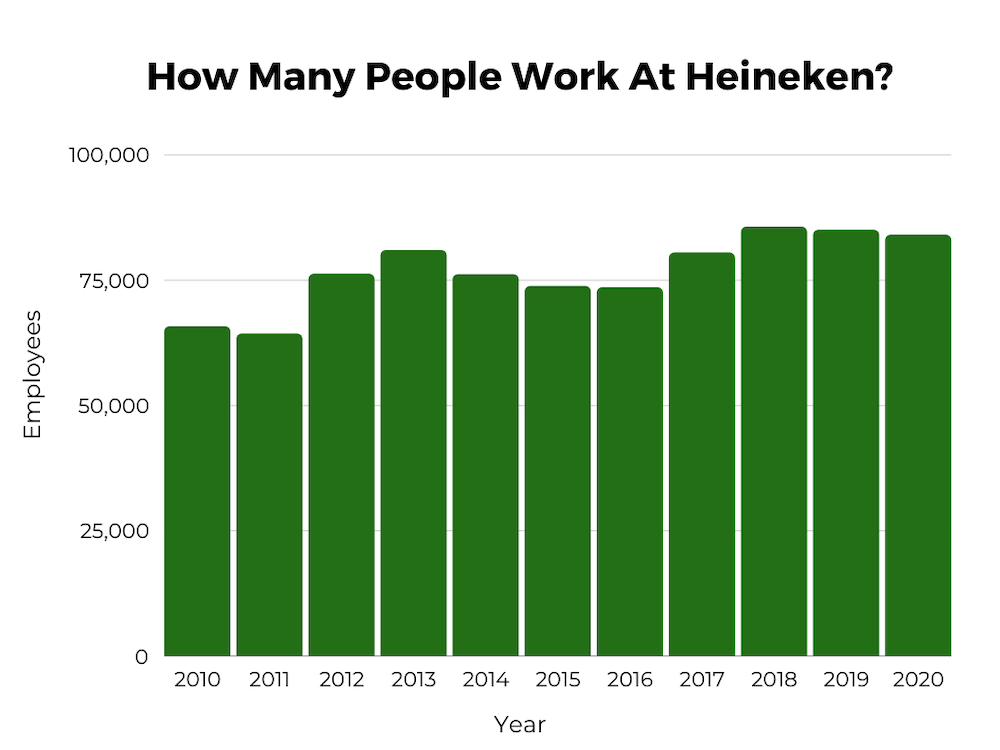

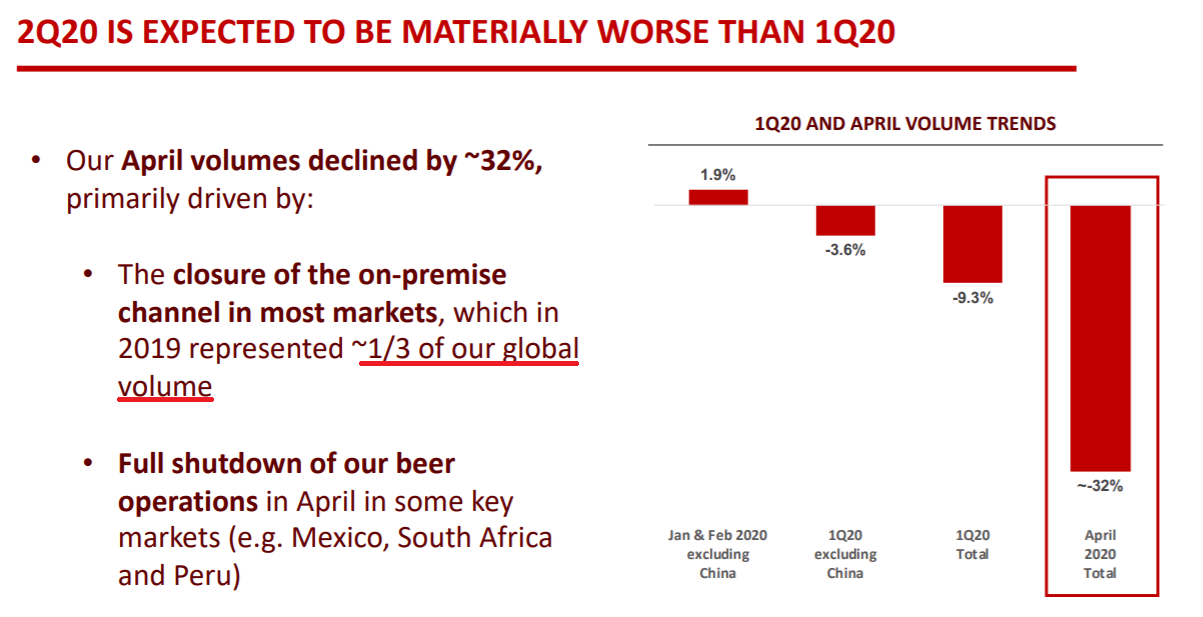

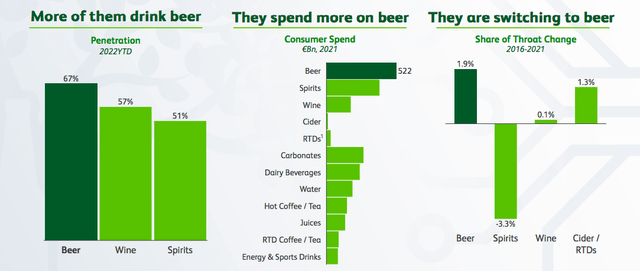

Heineken Revenue Beats Estimates Company Confirms Future Outlook

May 24, 2025

Heineken Revenue Beats Estimates Company Confirms Future Outlook

May 24, 2025 -

Mercati Azionari Europei Aspettative Fed Analisi Banche E Italgas

May 24, 2025

Mercati Azionari Europei Aspettative Fed Analisi Banche E Italgas

May 24, 2025 -

Heinekens Revenue Surpasses Projections Outlook Remains Strong Despite Trade Tensions

May 24, 2025

Heinekens Revenue Surpasses Projections Outlook Remains Strong Despite Trade Tensions

May 24, 2025 -

Borsa Italiana La Fed Detta L Agenda Performance Banche E Italgas

May 24, 2025

Borsa Italiana La Fed Detta L Agenda Performance Banche E Italgas

May 24, 2025 -

Heineken Exceeds Revenue Forecasts Maintains Positive Outlook Amidst Tariffs

May 24, 2025

Heineken Exceeds Revenue Forecasts Maintains Positive Outlook Amidst Tariffs

May 24, 2025