How To Interpret The Net Asset Value (NAV) Of The Amundi Dow Jones Industrial Average UCITS ETF

Table of Contents

Understanding the Components of the Amundi Dow Jones Industrial Average UCITS ETF NAV

The NAV of the Amundi Dow Jones Industrial Average UCITS ETF represents the total value of its underlying assets, less any liabilities. Understanding its components is key to interpreting its fluctuations.

Asset Holdings and their Contribution to NAV

The ETF's NAV is directly tied to the performance of its underlying assets: the 30 stocks that make up the Dow Jones Industrial Average. Each stock contributes to the overall NAV based on its weighting within the ETF, which aims to mirror the composition of the Dow Jones Industrial Average index. Keywords: Asset allocation, portfolio holdings, Dow Jones Industrial Average, weighting, underlying assets.

- Price Changes: Increases or decreases in the market price of these individual stocks directly impact the ETF's NAV. If a significant component like Apple experiences a large price jump, the NAV will generally reflect that increase.

- Dividend Impact: Dividends paid by the underlying companies are reinvested or distributed to ETF shareholders, affecting the NAV. Reinvestment increases the NAV, while distributions slightly decrease it.

- Other Income: While less common in this type of ETF, any other income-generating assets held by the fund (e.g., interest from cash holdings) would also influence the NAV.

Expenses and their Impact on NAV

Several expenses impact the NAV, primarily management fees and operating expenses. These are deducted from the value of the assets, reducing the net value available to investors. Keywords: Management fees, expense ratio, operating expenses, total expense ratio (TER).

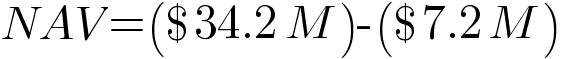

- Gross vs. Net NAV: The gross NAV represents the total value of the assets before expenses. The net NAV, which is what investors see, reflects the deduction of these expenses.

- Expense Calculation (Simplified): Imagine a $100 million portfolio with a 0.5% expense ratio. The annual expense would be $500,000, directly reducing the NAV.

- Expense Comparison: Always compare the total expense ratio (TER) of different ETFs before investing to ensure you are making the most cost-effective choice.

Currency Fluctuations and NAV

For investors holding the Amundi Dow Jones Industrial Average UCITS ETF in a currency different from the base currency (likely USD), exchange rate fluctuations can impact the NAV. Keywords: Currency risk, exchange rate, foreign currency, hedging.

- NAV Increase/Decrease: If the USD strengthens against the investor's currency, the NAV (when converted) will appear higher. Conversely, a weakening USD would decrease the converted NAV.

- Hedging Strategies: The fund might employ currency hedging strategies to mitigate this risk, but this can also impact the NAV. Hedging generally aims to reduce currency volatility but might also limit potential gains.

Using NAV to Make Informed Investment Decisions

Understanding the NAV is crucial for both monitoring performance and evaluating potential investment opportunities.

NAV and ETF Pricing

The NAV is closely related to but not always identical to the market price of the ETF. A small deviation is normal due to supply and demand dynamics. Keywords: Market price, premium, discount, arbitrage.

- Market Price Deviation: The market price can trade at a slight premium or discount to the NAV due to factors like trading volume and arbitrage opportunities.

- Premiums and Discounts: A premium indicates the market price exceeds the NAV; a discount means the opposite. Significant and sustained deviations can signal market inefficiencies or investor sentiment.

Tracking Performance Using NAV

By tracking the NAV over time, you can monitor the ETF's performance and calculate returns. Keywords: Performance tracking, returns, historical data, growth.

- Benchmark Comparison: Compare the NAV data to the Dow Jones Industrial Average index to see how closely the ETF tracks its benchmark.

- Time Horizon: Remember that performance analysis should always consider the time horizon. Short-term fluctuations are less significant than long-term trends.

Conclusion: Mastering Amundi Dow Jones Industrial Average UCITS ETF NAV Interpretation

Understanding the NAV of the Amundi Dow Jones Industrial Average UCITS ETF is essential for effective investment management. By considering its components—asset holdings, expenses, and currency fluctuations—and comparing it to the market price, you can make more informed decisions. Regularly monitoring the NAV and its relation to the market price and benchmark performance allows for a more comprehensive view of your investment's growth. Keywords: Amundi Dow Jones Industrial Average UCITS ETF, NAV, Net Asset Value, ETF investment, informed decisions.

To further enhance your understanding of ETF investing and the Amundi Dow Jones Industrial Average UCITS ETF NAV, explore additional resources available online or consult with a financial advisor. Mastering the interpretation of NAV is key to successful ETF investing.

Featured Posts

-

Amsterdam Exchange Plunges 11 Since Wednesday

May 24, 2025

Amsterdam Exchange Plunges 11 Since Wednesday

May 24, 2025 -

Sharp Decline In Amsterdam Stock Exchange Aex Index Down Over 4

May 24, 2025

Sharp Decline In Amsterdam Stock Exchange Aex Index Down Over 4

May 24, 2025 -

Bbc Radio 1 Big Weekend 2025 Sefton Park Ticket Information And Application

May 24, 2025

Bbc Radio 1 Big Weekend 2025 Sefton Park Ticket Information And Application

May 24, 2025 -

Avoid Crowds Smart Travel Tips For Memorial Day Weekend 2025 Flights

May 24, 2025

Avoid Crowds Smart Travel Tips For Memorial Day Weekend 2025 Flights

May 24, 2025 -

Nyt Mini Crossword Clues And Answers March 24 2025

May 24, 2025

Nyt Mini Crossword Clues And Answers March 24 2025

May 24, 2025

Latest Posts

-

Buffetts Apple Investment Navigating The Impact Of Trump Era Tariffs

May 24, 2025

Buffetts Apple Investment Navigating The Impact Of Trump Era Tariffs

May 24, 2025 -

Apple Vs Trump Tariffs Will Buffetts Top Tech Stock Crack

May 24, 2025

Apple Vs Trump Tariffs Will Buffetts Top Tech Stock Crack

May 24, 2025 -

Apple Stock Price Drops On 900 Million Tariff Announcement

May 24, 2025

Apple Stock Price Drops On 900 Million Tariff Announcement

May 24, 2025 -

Apple Stock Suffers Setback Amidst 900 Million Tariff Projection

May 24, 2025

Apple Stock Suffers Setback Amidst 900 Million Tariff Projection

May 24, 2025 -

Apple Stock Slumps 900 Million Tariff Impact

May 24, 2025

Apple Stock Slumps 900 Million Tariff Impact

May 24, 2025