Frankfurt Stock Exchange: DAX Remains Unchanged Post-Record

Table of Contents

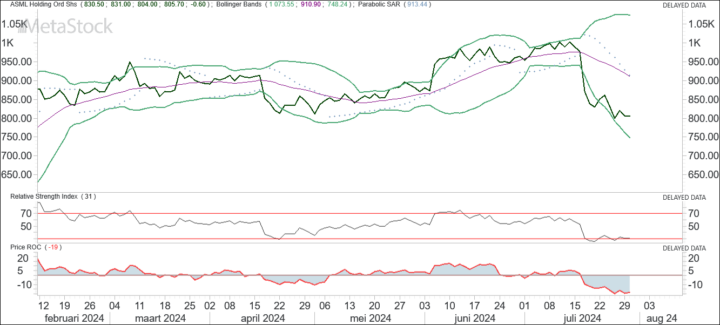

Factors Contributing to DAX Stagnation Post-Record

The DAX's recent lack of significant movement, despite its previous record-breaking performance, is a result of several intertwined factors:

Global Economic Uncertainty

- Rising inflation globally: Persistent inflation across major economies continues to exert pressure on businesses and consumers, dampening investment appetite.

- Geopolitical tensions (e.g., Ukraine conflict): The ongoing war in Ukraine and other geopolitical uncertainties create volatility and risk aversion in the financial markets, impacting investor confidence in the DAX.

- Potential recessionary fears in major economies: Concerns about a potential global recession are prompting investors to adopt a more cautious approach, leading to reduced investment activity and market stagnation.

- Impact of interest rate hikes by central banks: Aggressive interest rate hikes by central banks worldwide to combat inflation are increasing borrowing costs for businesses, potentially slowing economic growth and impacting stock market performance.

These global factors contribute to a climate of uncertainty, causing investors to adopt a "wait-and-see" attitude, resulting in the DAX's current consolidation phase. The lack of decisive movement reflects a cautious investor sentiment navigating a complex global economic landscape.

Strong Corporate Earnings vs. Economic Headwinds

While some DAX companies have reported strong corporate earnings, this positive news is somewhat offset by the prevailing economic headwinds.

- Analysis of recent earnings reports from major DAX companies: A mixed bag of earnings reports highlights the sector-specific nature of the current economic climate. While some sectors thrive, others face challenges.

- Comparison of projected growth vs. actual performance: In several instances, actual growth has fallen short of initial projections, reflecting the overall economic uncertainty.

- Discussion of sectors showing strength and weakness: The automotive and energy sectors, for example, demonstrate divergent trends; while energy companies benefit from high prices, the automotive sector faces challenges related to supply chains and slowing demand.

The contrasting picture of strong corporate performance alongside broader economic concerns creates a stalemate, preventing a significant upward or downward trend in the DAX. It's a balancing act between positive individual company results and the overarching global economic anxieties.

Investor Sentiment and Market Volatility

Investor sentiment and market volatility play crucial roles in shaping the DAX's trajectory.

- Discuss the VIX index (volatility index) and its current state: A relatively low VIX index might indicate reduced market volatility and thus contribute to the DAX's stability.

- Mention investor confidence surveys: Recent surveys reflecting investor sentiment can provide valuable insights into market expectations and potential future trends.

- Analyze trading volumes to gauge investor activity: Low trading volumes might suggest a lack of decisive action from investors, contributing to the DAX's unchanged status.

Understanding investor behavior and its relationship with the VIX and trading volume provides valuable context to the DAX’s current stagnation. The relative calmness may be temporary, however, and a sudden shift in sentiment could rapidly change the situation.

Potential Future Trends for the DAX

Predicting the future of the DAX requires careful consideration of several key factors:

Impact of Upcoming Economic Data Releases

Upcoming economic data releases will significantly influence investor sentiment and, consequently, the DAX.

- List key economic indicators (e.g., inflation data, unemployment figures, consumer confidence): These indicators provide crucial insights into the health of the German and global economies.

- Analyze how upcoming data releases might shift investor sentiment and consequently impact the DAX: Positive data could boost investor confidence, while negative data could trigger a market downturn. For example, unexpectedly high inflation could lead to a drop in the DAX.

Careful monitoring of these economic indicators is vital for forecasting the DAX's future direction.

Sector-Specific Performance and Predictions

Different sectors within the DAX are expected to perform differently in the coming months.

- Highlight specific sectors (e.g., automotive, technology, energy) within the DAX and their predicted performance based on current trends: Some sectors are more resilient to economic downturns than others.

- Offer informed projections for different sectors and their possible effect on the overall DAX performance: The strength or weakness of individual sectors will influence the overall performance of the DAX index.

Analyzing sector-specific performance allows for a more nuanced understanding of potential DAX movements.

Geopolitical Events and Their Influence

Geopolitical events continue to exert a significant influence on the DAX.

- Discuss ongoing geopolitical events (e.g., the war in Ukraine, US-China relations) and their potential impact on the German economy and the DAX: These external factors can cause sudden shifts in investor sentiment.

- Analyze how external events can cause volatility and impact investment decisions affecting the DAX: Unexpected geopolitical developments can introduce significant uncertainty and trigger market volatility.

Staying informed about geopolitical developments is crucial for successfully navigating the complexities of the DAX.

Conclusion

The Frankfurt Stock Exchange's DAX index currently reflects a period of consolidation, influenced by a complex interplay of global economic uncertainty, mixed corporate earnings, and cautious investor sentiment. While strong corporate performance in some sectors exists, it is counterbalanced by concerns over inflation, recession, and geopolitical risks. Future trends will largely depend on upcoming economic data releases, sector-specific performance, and the evolving geopolitical landscape.

Call to Action: Stay informed about the Frankfurt Stock Exchange and the DAX index by regularly checking back for updates on market analysis and investment strategies. Understanding these factors is crucial for navigating the complexities of the German stock market and making informed decisions about your DAX investments. Learn more about the DAX and its future trajectory by [link to relevant resource].

Featured Posts

-

Frances 2027 Election Can Bardellas Rn Challenge Macron

May 25, 2025

Frances 2027 Election Can Bardellas Rn Challenge Macron

May 25, 2025 -

Planning Your Country Escape Considerations For A Relaxing Getaway

May 25, 2025

Planning Your Country Escape Considerations For A Relaxing Getaway

May 25, 2025 -

Bbc Radio 1 Big Weekend Confirmed Artists Include Jorja Smith Biffy Clyro And Blossoms

May 25, 2025

Bbc Radio 1 Big Weekend Confirmed Artists Include Jorja Smith Biffy Clyro And Blossoms

May 25, 2025 -

Amundi Msci World Ii Ucits Etf Usd Hedged Dist A Guide To Net Asset Value Nav

May 25, 2025

Amundi Msci World Ii Ucits Etf Usd Hedged Dist A Guide To Net Asset Value Nav

May 25, 2025 -

Poor Glastonbury 2025 Headliners Leave Fans Disappointed

May 25, 2025

Poor Glastonbury 2025 Headliners Leave Fans Disappointed

May 25, 2025

Latest Posts

-

Kapitaalmarkt Rentestijging En De Euro Dollar Wisselkoers

May 25, 2025

Kapitaalmarkt Rentestijging En De Euro Dollar Wisselkoers

May 25, 2025 -

Relx Trotseert Economische Zwakte Met Ai Voorspellingen Voor Sterke Groei Tot 2025

May 25, 2025

Relx Trotseert Economische Zwakte Met Ai Voorspellingen Voor Sterke Groei Tot 2025

May 25, 2025 -

Stocks Trading 8 Higher On Euronext Amsterdam Analysis Of Trumps Tariff Impact

May 25, 2025

Stocks Trading 8 Higher On Euronext Amsterdam Analysis Of Trumps Tariff Impact

May 25, 2025 -

Verdere Stijging Kapitaalmarktrentes Euro Dollar Koersanalyse

May 25, 2025

Verdere Stijging Kapitaalmarktrentes Euro Dollar Koersanalyse

May 25, 2025 -

Datavorser Relx Sterke Groei Ondanks Economische Tegenwind Dankzij Ai

May 25, 2025

Datavorser Relx Sterke Groei Ondanks Economische Tegenwind Dankzij Ai

May 25, 2025