Fremantle Reports 5.6% Q1 Revenue Drop: Impact Of Reduced Buyer Budgets

Table of Contents

Detailed Analysis of the 5.6% Revenue Drop

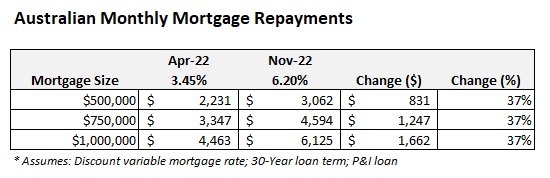

Fremantle's Q1 financial report revealed a precise 5.6% decrease in revenue compared to the same period last year. While the exact figures weren't publicly specified in the press release, the impact was clearly felt across various segments. This represents a considerable downturn compared to the steady growth experienced in previous quarters. A year-on-year comparison paints a stark picture of the challenges faced by the company.

- Specific Segment Impacts: Although precise figures for each segment (TV, film, and digital) remain undisclosed, analysts suggest the decline is most pronounced in the traditional television sector, reflecting the ongoing shift in viewing habits towards streaming platforms. The digital sector, while showing growth, failed to offset losses in other areas.

- Quarterly Earnings Comparison: The Q1 revenue drop marks a significant deviation from the positive trends observed in previous quarters. The company has not yet released full details about their profitability, but the revenue decline suggests a potential impact on overall earnings. This data underscores the urgent need to understand and address the underlying causes.

- Financial Report Implications: The overall financial report paints a concerning picture. The impact on investor confidence remains to be seen, with potential repercussions for future investment and growth strategies.

The Role of Reduced Buyer Budgets in the Revenue Drop

The primary driver behind Fremantle's Q1 revenue decline is the significant reduction in buyer budgets across the media landscape. Major TV networks and streaming platforms are tightening their purse strings due to a confluence of factors.

- Economic Downturn: The global economic climate, marked by inflation and recessionary fears, has forced many companies to curtail discretionary spending, including media acquisitions and production budgets.

- Increased Competition: The streaming wars have intensified competition, driving down the price of content and reducing the overall spending power of platforms. Several streaming giants have recently announced cost-cutting measures and subscriber slowdowns, directly impacting their content acquisition budgets.

- Changing Viewing Habits: The fragmentation of audiences and the rise of cord-cutting have altered the traditional television landscape. Networks are forced to adapt, which often involves reducing production budgets. For example, network executives have openly discussed the need for tighter control on budgets due to changes in viewership and audience engagement.

Examples of reduced spending include several major streaming services that have announced cancellations of previously commissioned projects or cuts to planned budgets for upcoming seasons. This trend is not limited to any particular genre; it affects drama, comedy, and reality television productions alike.

Fremantle's Response to Reduced Buyer Budgets

Fremantle is actively implementing strategies to navigate this challenging environment.

- Cost Reduction Measures: The company is actively exploring opportunities to streamline operations and reduce production costs without compromising creative quality. This may involve renegotiating contracts with suppliers, exploring more efficient production methods, or focusing on cost-effective genres.

- Content Diversification: To mitigate risk, Fremantle is diversifying its content portfolio to cater to a broader audience across multiple platforms. This includes exploring formats suitable for shorter-form video and podcasting, in addition to traditional long-form television.

- New Revenue Streams: Fremantle is exploring and expanding alternative revenue streams beyond traditional licensing deals. This includes investing in branded content, merchandising, and leveraging its intellectual property for new ventures. The focus is on creating a more robust and less reliant revenue model. For instance, the company has recently expanded into the gaming market, licensing its intellectual property for new video games.

Industry-Wide Impact and Future Outlook

Fremantle's experience is not isolated; reduced buyer budgets are impacting the entire entertainment industry. Many media companies are grappling with similar challenges. This suggests a broader systemic issue rather than a company-specific problem.

- Media Industry Trends: The current trend reflects a broader shift in the media landscape, with economic factors, audience fragmentation, and increased competition all playing a part.

- Future of Television: The future of television is increasingly uncertain, with the rise of streaming platforms and the ongoing challenges of attracting and retaining audiences. The industry needs to adapt to these changes to ensure long-term sustainability.

- Industry Forecast: While the short-term outlook for Fremantle and the broader media industry remains uncertain, the company’s proactive strategies suggest a potential for resilience. Their efforts to diversify revenue and adapt to market changes indicate a capacity to weather this current storm.

Conclusion: Navigating the Challenges of Reduced Buyer Budgets for Fremantle

Fremantle's 5.6% Q1 revenue drop underscores the significant impact of reduced buyer budgets on the entertainment industry. The economic climate, intensified competition, and changing viewer habits are forcing media companies to adapt. Fremantle's response, including cost reduction measures, content diversification, and the exploration of new revenue streams, demonstrates a commitment to navigating this challenging landscape. The company's ability to adapt and innovate will be crucial to its future success. To stay informed about Fremantle's financial performance and the ongoing impact of reduced buyer budgets on the media industry, follow updates on their financial reports and stay abreast of industry news concerning Fremantle financial performance, buyer budget trends, and media industry news. Keep an eye on how Fremantle manages these challenges in the future to fully understand the evolving dynamics of the entertainment market.

Featured Posts

-

Huuhkajat Avauskokoonpanoon Kolme Muutosta Kaellman Penkille

May 21, 2025

Huuhkajat Avauskokoonpanoon Kolme Muutosta Kaellman Penkille

May 21, 2025 -

Quantum Computing Stock Investment D Wave Quantum Qbts Evaluation

May 21, 2025

Quantum Computing Stock Investment D Wave Quantum Qbts Evaluation

May 21, 2025 -

High Ranking Admirals Fall From Grace Corruption Case Analysis

May 21, 2025

High Ranking Admirals Fall From Grace Corruption Case Analysis

May 21, 2025 -

Solve The Nyt Mini Crossword April 8 2025 Tuesday Answers And Hints

May 21, 2025

Solve The Nyt Mini Crossword April 8 2025 Tuesday Answers And Hints

May 21, 2025 -

La Forte Demande En Cordistes Due Au Developpement De Tours A Nantes

May 21, 2025

La Forte Demande En Cordistes Due Au Developpement De Tours A Nantes

May 21, 2025

Latest Posts

-

Promena Imena Vanje Mijatovic Detalji I Razlozi

May 22, 2025

Promena Imena Vanje Mijatovic Detalji I Razlozi

May 22, 2025 -

Ing Provides Project Finance Facility To Freepoint Eco Systems

May 22, 2025

Ing Provides Project Finance Facility To Freepoint Eco Systems

May 22, 2025 -

Freepoint Eco Systems Announces New Project Finance Facility With Ing

May 22, 2025

Freepoint Eco Systems Announces New Project Finance Facility With Ing

May 22, 2025 -

Vanja I Sime Iz Gospodina Savrsenog Neocekivana Popularnost Njihovih Fotografija

May 22, 2025

Vanja I Sime Iz Gospodina Savrsenog Neocekivana Popularnost Njihovih Fotografija

May 22, 2025 -

Alfa Romeo Junior 1 2 Turbo Speciale Performance Et Conduite Selon Le Matin Auto

May 22, 2025

Alfa Romeo Junior 1 2 Turbo Speciale Performance Et Conduite Selon Le Matin Auto

May 22, 2025