From $3K Babysitter To $3.6K Daycare: A Cautionary Tale Of Childcare Expenses

Table of Contents

The Steep Rise in Childcare Costs: A Case Study

Consider the Johnson family. Initially, they relied on a babysitter for their infant, paying $3,000 per month. This seemed manageable, but it came with limitations. The babysitter wasn't available full-time, making scheduling difficult, and sick days created constant childcare juggling. As their child grew, the need for full-time care became apparent, pushing them to seek daycare options. This transition, however, led to a significant jump in their childcare expenses. Their current daycare center costs a staggering $3,600 per month – a $600 increase! This case study highlights the common experience of many families.

- Initial babysitter costs and limitations: The Johnsons' initial $3,000 monthly expense didn't cover full-time care, weekends, or sick days. The babysitter's limited availability caused consistent stress.

- The search for daycare options and associated costs: Finding a suitable daycare proved challenging, with long waitlists and varying costs. The available options often exceeded their initial budget.

- Breakdown of daycare fees: The $3,600 monthly fee included tuition, registration fees, and various other charges. These add-on costs often caught parents off-guard.

- Unexpected costs: Beyond tuition, the Johnsons discovered additional expenses like supplies, special activity fees, and occasional late pickup charges. These unexpected costs added considerably to their monthly burden.

Factors Influencing Childcare Costs

Several factors contribute to the high cost of childcare, making it a significant budgetary concern for many families. Understanding these influences can help in planning and budgeting for childcare expenses.

- Location: Childcare costs in urban areas are typically much higher than in suburban or rural communities due to higher rent and operational costs.

- Type of childcare: Center-based care generally costs more than in-home care due to increased overhead, staffing requirements, and regulatory compliance. Nanny share arrangements can be a more affordable alternative.

- Quality of care: Higher quality childcare, indicated by factors like lower staff-to-child ratios, accredited programs, and specialized educational offerings, often comes with a higher price tag. However, investing in quality care can benefit a child's development.

- Additional services: Daycares offering additional services such as meals, transportation, and extended hours naturally charge more. Carefully evaluate which services are essential to your family's needs.

- Demand and supply: High demand and limited availability of quality childcare in certain areas can drive up prices. Early planning and registration are crucial.

Strategies for Managing High Childcare Expenses

Navigating the high costs of childcare requires proactive planning and resourcefulness. Here are some actionable strategies to alleviate the financial strain.

- Exploring alternative childcare options: Consider family assistance, childcare cooperatives, or nanny shares as potentially more affordable alternatives to traditional daycares.

- Negotiating fees with providers: Don't hesitate to negotiate fees with daycare centers, especially if you're committing to a long-term contract or enrolling multiple children.

- Seeking financial assistance programs: Explore government subsidies, employer-sponsored childcare benefits, or scholarships offered by community organizations. These programs can significantly reduce the financial burden.

- Budgeting and prioritizing childcare costs: Integrate childcare expenses into your monthly budget, prioritizing them as a necessary expenditure. Consider making adjustments elsewhere to accommodate the cost.

- Tax deductions and credits related to childcare: Familiarize yourself with available tax deductions and credits related to childcare expenses, which can provide valuable tax relief.

Long-Term Financial Planning for Childcare

Factoring childcare costs into long-term financial planning is crucial for responsible financial management.

- Saving for childcare costs before having children: Start saving early to build a financial cushion for childcare expenses.

- Adjusting financial goals based on childcare expenses: Adjust your saving and spending goals to accommodate the substantial costs of childcare, potentially delaying other financial goals.

- Seeking financial advice on managing childcare costs within a larger financial plan: Consider consulting a financial advisor to develop a comprehensive financial plan that integrates childcare costs and other major life expenses.

Conclusion

The significant increase in childcare expenses, as illustrated by the Johnson family's experience transitioning from a $3,000 monthly babysitter to a $3,600 monthly daycare, highlights a widespread financial challenge for parents. Numerous factors influence these costs, but with careful planning, research, and resourcefulness, it is possible to manage this substantial expense. Don't let unexpected childcare expenses derail your financial plans. Start planning and researching affordable childcare options today. Are you facing similar challenges with rising childcare expenses? Don't let unexpected costs derail your financial plans. Start planning and researching affordable childcare options today to ensure a secure financial future for your family. Start your research on managing childcare expenses now!

Featured Posts

-

Dijon Bilel Latreche Boxeur Convoque Pour Violences Conjugales

May 09, 2025

Dijon Bilel Latreche Boxeur Convoque Pour Violences Conjugales

May 09, 2025 -

The High Potential Season 1 Finale A Risky Bet That Paid Off

May 09, 2025

The High Potential Season 1 Finale A Risky Bet That Paid Off

May 09, 2025 -

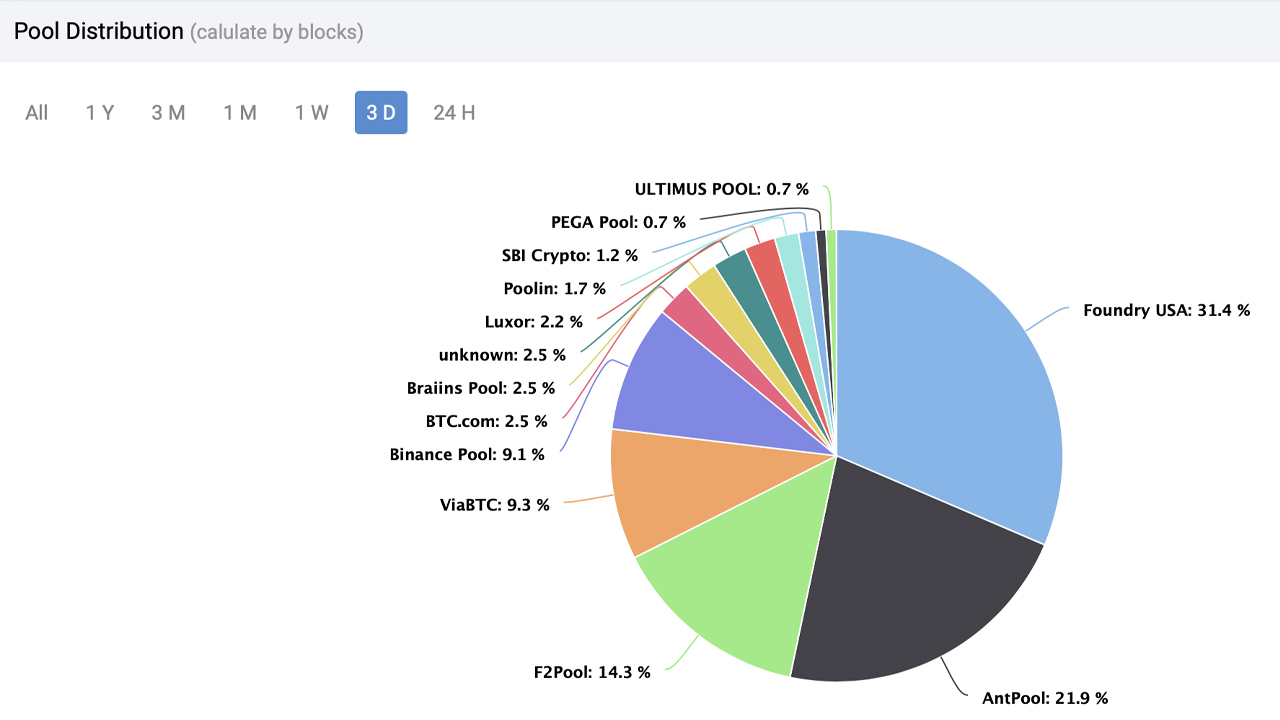

Bitcoin Mining Hashrate Explaining The Recent Increase

May 09, 2025

Bitcoin Mining Hashrate Explaining The Recent Increase

May 09, 2025 -

194 Billion Lost The Impact Of The Trump Inauguration On Tech Billionaires

May 09, 2025

194 Billion Lost The Impact Of The Trump Inauguration On Tech Billionaires

May 09, 2025 -

Stock Market Live Updates Sensex And Nifty Rally Sector Wise Gains

May 09, 2025

Stock Market Live Updates Sensex And Nifty Rally Sector Wise Gains

May 09, 2025