FTC's Appeal Against Court Approval Of Microsoft-Activision Merger

Table of Contents

The FTC's Concerns Regarding Anticompetitive Practices

The FTC’s primary concern revolves around the potential for anticompetitive practices stemming from Microsoft’s acquisition of Activision Blizzard, a powerhouse in the gaming industry, boasting iconic franchises such as Call of Duty, World of Warcraft, and Candy Crush.

Stifling Competition in the Gaming Console Market

The FTC argues that the merger would grant Microsoft an unfair advantage in the console market, particularly against its main rival, Sony PlayStation. Their argument rests on several key points:

- Call of Duty's Dominance: Call of Duty is a global phenomenon, a consistently top-selling title with millions of players. The FTC fears Microsoft could leverage its ownership to make Call of Duty exclusive to Xbox, significantly harming PlayStation's market share and competitiveness.

- Market Share Consolidation: The merger would dramatically increase Microsoft's market share in the gaming industry, consolidating power and potentially leading to less innovation and higher prices. The FTC likely cites market share data and analysis to support this claim.

- Reduced Consumer Choice: The potential exclusivity of key titles like Call of Duty would limit consumer choice, forcing players to switch consoles or gaming platforms to access popular games.

Impact on Cloud Gaming Services

Beyond consoles, the FTC is deeply concerned about the impact on the burgeoning cloud gaming market. Microsoft's Xbox Cloud Gaming is a significant player, and the addition of Activision Blizzard’s titles could strengthen its dominance:

- Control over Key Titles: The merger would give Microsoft control over many popular games, allowing them to favor their own cloud gaming platform and potentially exclude rivals.

- Stifling Innovation: Reduced competition in cloud gaming could stifle innovation and limit the development of new services and features.

- Impact on Smaller Competitors: Smaller cloud gaming providers could be squeezed out of the market, leading to less consumer choice and potentially higher prices.

Concerns about Game Prices and Subscriptions

The FTC also raises concerns about the potential for increased prices and reduced consumer choice across various gaming platforms:

- Higher Game Prices: The reduced competition resulting from the merger could lead to higher prices for games and in-game purchases.

- Subscription Service Costs: The merged entity might increase the prices of subscription services like Xbox Game Pass, potentially making gaming less accessible to consumers.

- Limited Bundles and Offers: The lack of competition could lead to fewer attractive bundles and discounts for consumers.

Microsoft's Defense and Arguments Against the FTC's Claims

Microsoft has vigorously defended the merger, countering the FTC's claims with several arguments:

Promises to Maintain Competition

Microsoft has made several public commitments to mitigate the FTC's concerns:

- Call of Duty on PlayStation: Microsoft has repeatedly pledged to keep Call of Duty available on PlayStation, signing long-term agreements to ensure continued access for PlayStation users.

- Commitment to Cloud Gaming Interoperability: Microsoft has also promised to maintain interoperability with other cloud gaming platforms.

Benefits of the Merger

Microsoft argues that the merger will ultimately benefit consumers and the gaming industry:

- Increased Innovation: The combined resources and expertise of Microsoft and Activision Blizzard could lead to increased innovation in game development and new gaming experiences.

- Benefits for Game Developers: The merger could create new opportunities for game developers, particularly smaller independent studios.

- Enhanced Game Development: Access to more resources and technology will speed up game development and potentially lead to better games.

Legal Strategy and Precedent

Microsoft’s legal strategy centers around demonstrating that the merger aligns with past precedents and doesn't represent an undue concentration of market power. They will likely highlight similar mergers in other industries that have been approved without similar antitrust concerns.

The Judge's Ruling and the Basis for the FTC's Appeal

A judge initially ruled in favor of the merger, dismissing the FTC's lawsuit. The judge likely found that Microsoft’s commitments to maintain Call of Duty availability on other platforms were sufficient to address the FTC’s concerns. The FTC's appeal contests this ruling, arguing that the judge incorrectly assessed the potential for anticompetitive practices and underestimated the long-term impact of the merger on competition and consumer welfare. The FTC's appeal rests on demonstrating that the judge misapplied antitrust law or failed to adequately weigh the potential for harm.

Potential Outcomes and Implications of the Appeal

The FTC's appeal could lead to several outcomes:

- Affirmation of the Lower Court Ruling: The appeals court could uphold the lower court's decision, effectively allowing the merger to proceed.

- Reversal of the Lower Court Ruling: The appeals court could overturn the lower court's decision, blocking the merger.

- Remand for Further Proceedings: The appeals court could send the case back to the lower court for further review and consideration of additional evidence.

Each outcome carries significant implications for the gaming industry: A blocked merger could set a precedent for future mergers and acquisitions in the tech sector, impacting industry consolidation and regulatory oversight. Conversely, an affirmed ruling could signal a more lenient approach to mergers in the rapidly evolving gaming landscape.

Conclusion

The FTC's appeal against the Microsoft-Activision merger represents a crucial moment for antitrust enforcement in the gaming industry. The arguments presented by both sides highlight the complex issues surrounding market dominance, competition, and the potential impact on consumers. The outcome of this appeal will significantly shape the future of the gaming industry and set a precedent for future mergers and acquisitions in the tech sector. Staying informed about the ongoing legal battle is vital for anyone interested in the future of gaming. Further research into previous antitrust cases and analyses of the gaming market will provide a more comprehensive understanding of this landmark legal battle. Understanding the implications of the FTC's appeal against the Microsoft-Activision merger is critical to understanding the evolving landscape of the gaming industry.

Featured Posts

-

Higher Education Faces Cuts Universities File Lawsuit Against Senate

May 19, 2025

Higher Education Faces Cuts Universities File Lawsuit Against Senate

May 19, 2025 -

Junior Eurovision 2025 Australias Absence Confirmed

May 19, 2025

Junior Eurovision 2025 Australias Absence Confirmed

May 19, 2025 -

Death Sentences Handed Down In Iran Following Mosque Attacks

May 19, 2025

Death Sentences Handed Down In Iran Following Mosque Attacks

May 19, 2025 -

I Eiriniki Epilysi Toy Kypriakoy Mia Analysi Tis Protasis Toy L Tzoymi

May 19, 2025

I Eiriniki Epilysi Toy Kypriakoy Mia Analysi Tis Protasis Toy L Tzoymi

May 19, 2025 -

Abusa And The Future Of Ditch America Trade Relations

May 19, 2025

Abusa And The Future Of Ditch America Trade Relations

May 19, 2025

Latest Posts

-

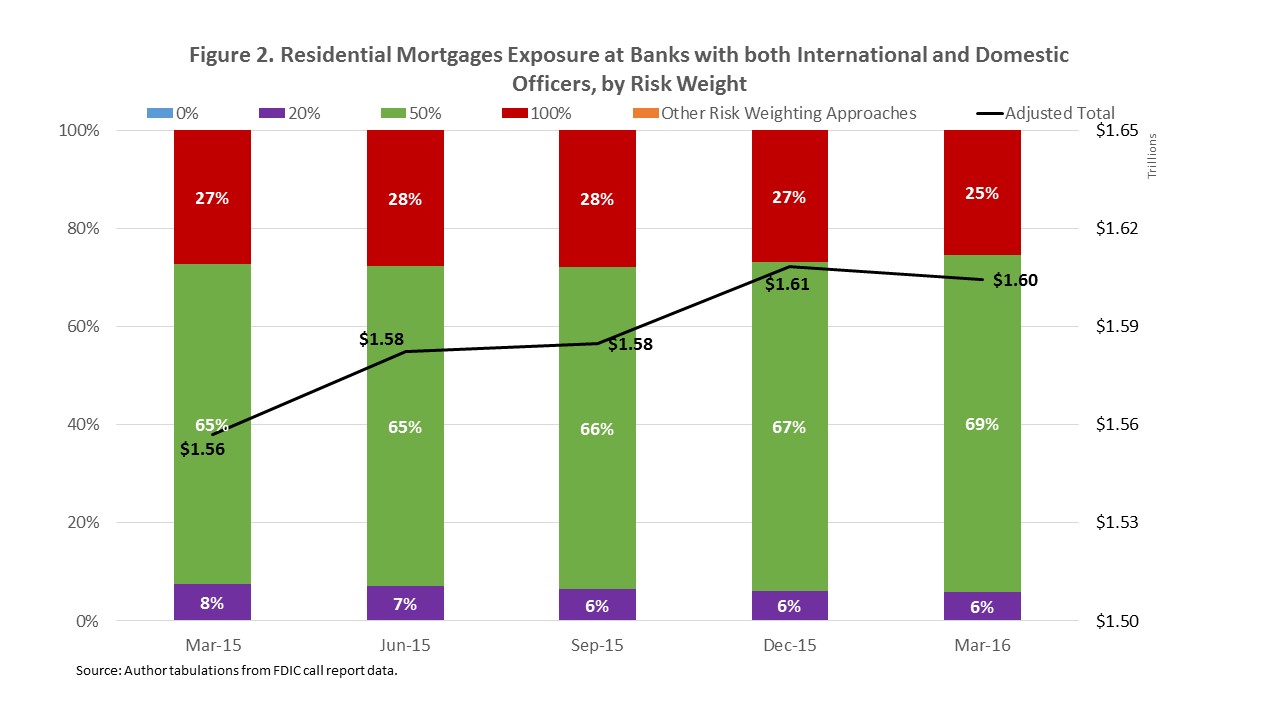

The Connection Between Federal Debt And Mortgage Rates

May 19, 2025

The Connection Between Federal Debt And Mortgage Rates

May 19, 2025 -

April 11th Nyt Connections Puzzle 670 Hints And Solutions

May 19, 2025

April 11th Nyt Connections Puzzle 670 Hints And Solutions

May 19, 2025 -

Unlocking Nyt Connections Hints And Solutions For Puzzle 674 April 15th

May 19, 2025

Unlocking Nyt Connections Hints And Solutions For Puzzle 674 April 15th

May 19, 2025 -

Rising Federal Debt How It Impacts Mortgage Borrowers

May 19, 2025

Rising Federal Debt How It Impacts Mortgage Borrowers

May 19, 2025 -

Nyt Connections Answers For April 11 2024 Puzzle 670

May 19, 2025

Nyt Connections Answers For April 11 2024 Puzzle 670

May 19, 2025