Funding Sustainability Initiatives For Small And Medium-Sized Enterprises (SMEs)

Table of Contents

Identifying Funding Opportunities for Sustainable Practices

Securing funding for your sustainability projects requires a multi-pronged approach. Several avenues exist, each with its own unique requirements and benefits. Exploring these options thoroughly is crucial for securing the necessary capital.

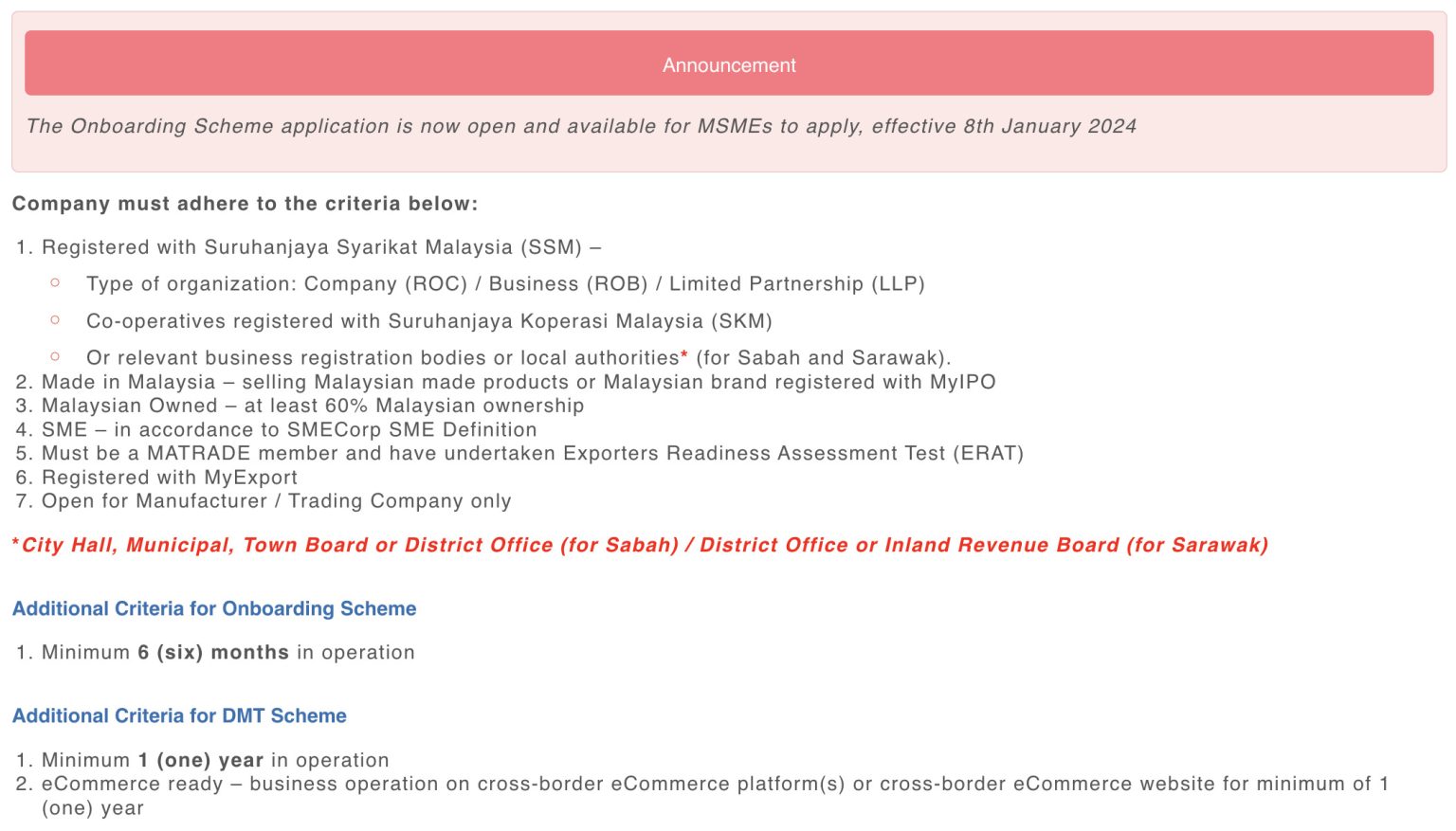

Government Grants and Subsidies

Many national and regional governments offer grants and subsidies specifically designed to support green initiatives in SMEs. These programs often focus on areas like energy efficiency, waste reduction, and renewable energy adoption. Finding and applying for these grants can significantly reduce the upfront cost of sustainability projects.

- Tax credits for green investments: Several countries offer tax credits for businesses investing in energy-efficient equipment or renewable energy technologies.

- Grants for renewable energy installations: Numerous government programs provide grants to cover a portion of the cost of installing solar panels, wind turbines, or other renewable energy systems.

- Subsidies for energy audits: Energy audits can identify areas for improvement and help you prioritize investments. Some governments subsidize the cost of these audits.

To find relevant programs, explore your national and regional government websites. For example, in the [insert country/region] you can find programs listed on [insert relevant government website link]. Eligibility criteria vary, so carefully review the requirements before applying.

Private Sector Investment

Beyond government funding, the private sector offers significant opportunities for SMEs seeking capital for sustainability initiatives. Impact investing and venture capital are increasingly targeting businesses with strong environmental and social performance.

- Angel investors interested in ESG (Environmental, Social, and Governance) factors: Many angel investors are actively seeking opportunities to invest in companies with strong ESG profiles.

- Venture capital firms focused on green technology: Dedicated venture capital firms are emerging, specializing in funding innovative green technologies and sustainable business models.

- Crowdfunding platforms for sustainable projects: Platforms like Kickstarter and Indiegogo offer avenues to raise capital from a broad base of individuals interested in supporting sustainable initiatives.

Creating a compelling business plan that emphasizes both environmental and financial returns is crucial for attracting private sector investment. Clearly demonstrating a strong ROI (Return on Investment) is key to securing funding.

Green Loans and Financing

Traditional financial institutions are also increasingly offering green loans and financing options specifically designed to support environmental projects. These often come with lower interest rates than conventional loans.

- Green loans from banks and credit unions: Many banks and credit unions now offer dedicated green loan products with attractive terms.

- Government-backed green loans: Government agencies may guarantee or subsidize green loans, reducing the risk for lenders and making them more accessible.

- Sustainable bonds: Larger SMEs may consider issuing green bonds to raise capital from investors specifically interested in sustainable projects.

These financing options can help bridge the gap between the upfront costs of sustainability improvements and the long-term benefits. Be prepared to demonstrate the environmental and financial viability of your project to qualify for these programs.

Developing a Compelling Sustainability Business Plan

A well-structured sustainability business plan is essential for securing funding, regardless of the source. This plan needs to demonstrate both the environmental benefits and the financial viability of your initiatives.

Defining Your Sustainability Goals

Setting clear and measurable sustainability goals is critical. Use the SMART framework (Specific, Measurable, Achievable, Relevant, and Time-bound) to define your targets.

- Specific targets for energy consumption reduction: Define specific percentage reductions in energy consumption over a defined timeframe.

- Measurable waste reduction strategies: Quantify your waste reduction targets, specifying the types of waste and the reduction percentages.

- Timeline for implementing sustainability initiatives: Create a realistic timeline for implementing your sustainability projects, outlining key milestones and deadlines.

Aligning your sustainability goals with your overall business objectives strengthens your funding proposal, demonstrating a cohesive and strategically driven approach.

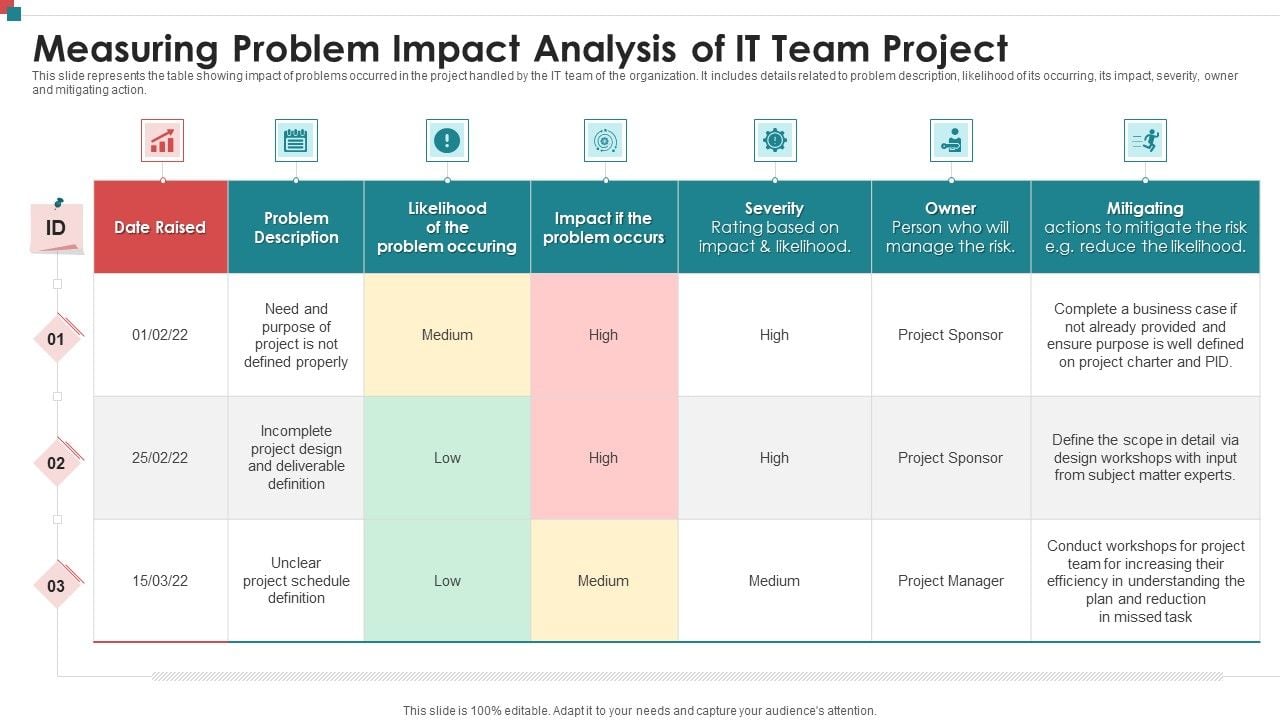

Demonstrating Financial Viability

Financial viability is a cornerstone of any successful funding application. Clearly show how your sustainability initiatives will generate financial returns.

- Cost-benefit analysis of proposed projects: Conduct a thorough cost-benefit analysis, showcasing the cost savings and potential revenue increases from your sustainability investments.

- Projected ROI on sustainable investments: Present a clear and realistic projection of the return on investment for your sustainability projects.

- Market analysis demonstrating demand for sustainable products/services: Demonstrate market demand for your sustainable products or services, highlighting the potential for increased market share and revenue.

Showcasing the potential for cost savings, increased revenue, improved brand reputation, and enhanced customer loyalty is crucial for securing funding.

Navigating the Application Process for Funding

The application process for securing funding can be complex. A well-prepared funding proposal and strong relationships with potential funders are essential.

Preparing a Strong Funding Proposal

Your funding proposal must effectively communicate your vision and the financial viability of your sustainability initiatives.

- Clear and concise executive summary: Grab the reader's attention with a compelling executive summary that highlights the key aspects of your proposal.

- Detailed project description: Provide a detailed description of your sustainability projects, outlining the specific activities, timelines, and expected outcomes.

- Comprehensive financial projections: Include detailed financial projections, including cost estimates, revenue projections, and ROI calculations.

- Impact assessment and evaluation plan: Outline a plan for measuring and evaluating the impact of your sustainability initiatives.

Use visuals and compelling storytelling to enhance your proposal's impact and make it more engaging for potential funders.

Building Relationships with Potential Funders

Networking and relationship building are crucial for securing funding.

- Attend industry events and conferences: Attend relevant industry events and conferences to network with potential funders and learn about funding opportunities.

- Network with investors and government officials: Actively build relationships with investors and government officials involved in green financing initiatives.

- Build strong relationships with financial institutions: Develop relationships with banks and other financial institutions that offer green loans and financing options.

Demonstrate transparency and accountability throughout the funding process to build trust and confidence with potential funders.

Conclusion

Securing funding for sustainability initiatives can be challenging, but it’s crucial for the long-term success and environmental responsibility of SMEs. By understanding the diverse funding opportunities available, developing a strong business plan, and navigating the application process effectively, SMEs can unlock the resources needed to implement impactful sustainability projects. Don't delay your journey towards a more sustainable future. Start exploring funding options for your sustainability initiatives today and discover how green financing can propel your SME to new heights. Take the first step towards securing funding sustainability initiatives for SMEs and build a greener, more profitable future.

Featured Posts

-

Blue Origin Rocket Launch Cancelled A Subsystem Malfunction Investigation

May 19, 2025

Blue Origin Rocket Launch Cancelled A Subsystem Malfunction Investigation

May 19, 2025 -

Kuran Ezberi Gazzeli Cocuklarin Cadirda Oegrenme Serueveni

May 19, 2025

Kuran Ezberi Gazzeli Cocuklarin Cadirda Oegrenme Serueveni

May 19, 2025 -

Grants And Loans For Sustainable Smes

May 19, 2025

Grants And Loans For Sustainable Smes

May 19, 2025 -

United Kingdoms Eurovision 2025 Result 19th Place

May 19, 2025

United Kingdoms Eurovision 2025 Result 19th Place

May 19, 2025 -

Breeze Airways Announces Two New Routes

May 19, 2025

Breeze Airways Announces Two New Routes

May 19, 2025

Latest Posts

-

Is It Time For Logitechs Forever Mouse A Realistic Look At Durability

May 19, 2025

Is It Time For Logitechs Forever Mouse A Realistic Look At Durability

May 19, 2025 -

Public Transports Bare Beating Problem Impact And Solutions

May 19, 2025

Public Transports Bare Beating Problem Impact And Solutions

May 19, 2025 -

Fortnites Return To Us App Store Hinges On Judges Ruling In Epic Games Case

May 19, 2025

Fortnites Return To Us App Store Hinges On Judges Ruling In Epic Games Case

May 19, 2025 -

Millions Listen Unpacking Dr John Delonys Unique Style Of Addressing Difficult Topics

May 19, 2025

Millions Listen Unpacking Dr John Delonys Unique Style Of Addressing Difficult Topics

May 19, 2025 -

The Rise Of Bare Beating A Growing Problem On Public Transportation

May 19, 2025

The Rise Of Bare Beating A Growing Problem On Public Transportation

May 19, 2025