Grants And Loans For Sustainable SMEs

Table of Contents

Understanding Funding Options for Sustainable Businesses

Before diving into specific programs, let's clarify the key differences between grants and loans. Grants are essentially free money awarded based on merit and alignment with the funder's objectives. They typically don't require repayment. Loans, on the other hand, are borrowed funds that must be repaid with interest over a defined period. Both are crucial tools for sustainable business financing.

Government Grants for Sustainable SMEs

Governments at local, national, and international levels recognize the importance of fostering sustainable business practices. Numerous government grants for sustainable businesses are available, offering financial incentives to adopt eco-friendly technologies and operations. These programs often prioritize specific areas like renewable energy, waste reduction, and sustainable agriculture.

-

Examples of grant programs: (Note: Specific programs and their availability change. Always check with the relevant government agencies for the most up-to-date information. Links to government websites providing grant information would be included here in a published version.) Examples could include grants from the European Union's Horizon Europe program, or regional/national initiatives focusing on green technology adoption.

-

Key Criteria and Application: Eligibility criteria vary widely and often include factors like business size, location, type of sustainable project, and demonstrated environmental or social impact. Application processes typically involve submitting a detailed proposal outlining the project, budget, and expected outcomes. Grant amounts range significantly, from a few thousand to hundreds of thousands of dollars or euros, depending on the program and the scale of the project.

Private Sector Loans for Sustainable Initiatives

Several banks and financial institutions now offer green loans for small businesses specifically designed for sustainable projects. These loans often come with competitive interest rates and favorable repayment terms, recognizing the long-term economic and environmental benefits of sustainable investments.

-

Benefits and Drawbacks: The benefits include access to capital for sustainable improvements and the potential for lower interest rates compared to traditional loans. However, securing a loan may require collateral, and interest rates still need to be carefully considered as part of your financial planning.

-

Sustainable Loan Products: Examples of green loan products include financing for energy-efficient equipment, renewable energy installations, sustainable supply chain improvements, and waste reduction technologies. Loan approval depends on factors like creditworthiness, business plan strength, and the project's environmental impact.

Impact Investing and Venture Capital for Sustainable SMEs

Impact investing and venture capital firms are increasingly focusing on sustainable businesses. These investors seek both financial returns and positive social and environmental impact. They often provide larger investment amounts than grants or smaller loans, but typically require a significant equity stake in the business.

-

Investment Process: The investment process involves a rigorous due diligence process, assessing the business's sustainability strategy, financial projections, and potential for growth. Investment amounts can range from tens of thousands to millions of dollars or euros, depending on the company’s stage and potential.

-

Examples of Investors: Many venture capital firms and impact investment funds now explicitly focus on environmentally and socially responsible businesses. (Note: specific examples of firms would be included here in a published version).

Finding and Applying for Grants and Loans

Securing funding requires diligent research and a well-structured approach. Begin by identifying potential funding opportunities relevant to your business and its sustainability goals.

-

Step-by-Step Guide:

- Research: Utilize online databases, government websites, and industry associations to find relevant grants and loans.

- Eligibility: Carefully review the eligibility criteria of each program before applying.

- Application: Prepare a comprehensive and compelling application, including a strong business plan, financial projections, and a detailed description of your sustainable project.

- Follow-up: Follow up with the funding organizations to ensure your application is received and to address any queries they may have.

-

Resources: Numerous online resources and networking events can connect sustainable SMEs with potential funding sources.

-

Business Plan and Sustainability Report: A well-written business plan is essential, highlighting your business model, market analysis, financial projections, and, critically, your commitment to sustainability. A comprehensive sustainability report demonstrates your environmental and social impact, further strengthening your application. This should detail your sustainable business plan and how you intend to measure and report on your progress.

Maximizing Your Chances of Securing Funding

A strong application significantly increases your chances of success. Focus on demonstrating a clear understanding of your target market, a well-defined sustainability strategy, and realistic financial projections.

-

Sustainability Metrics: Quantify your environmental and social impact using clear metrics, such as reduced carbon emissions, waste diverted from landfills, or community engagement initiatives.

-

Financial Projections: Accurate and realistic financial projections build investor confidence. Show a clear path to profitability and demonstrate how the requested funding will contribute to your growth.

-

Tips for a Compelling Proposal: Clearly articulate the problem your business solves, the value proposition for your customers, your sustainability strategy, and the specific use of the requested funds. Use strong visuals and data to support your claims.

Unlocking Growth for Your Sustainable SME Through Funding

Securing funding, whether through grants, loans, or impact investments, is crucial for the growth and success of sustainable SMEs. By carefully researching funding opportunities, developing a compelling application, and demonstrating a clear commitment to sustainability, you can unlock the resources needed to expand your business and make a significant positive impact. Start your search for grants and loans for sustainable SMEs today and unlock your business's full potential! (Links to relevant resources would be included here in a published version).

Featured Posts

-

Austrias Eurovision 2025 Triumph A Story Of Resilience And Protest

May 19, 2025

Austrias Eurovision 2025 Triumph A Story Of Resilience And Protest

May 19, 2025 -

Parg Represents Armenia At Eurovision In Concert 2025

May 19, 2025

Parg Represents Armenia At Eurovision In Concert 2025

May 19, 2025 -

Direkt Ucuslar Ve Kibris Tatar In Aciklamalarinin Analizi

May 19, 2025

Direkt Ucuslar Ve Kibris Tatar In Aciklamalarinin Analizi

May 19, 2025 -

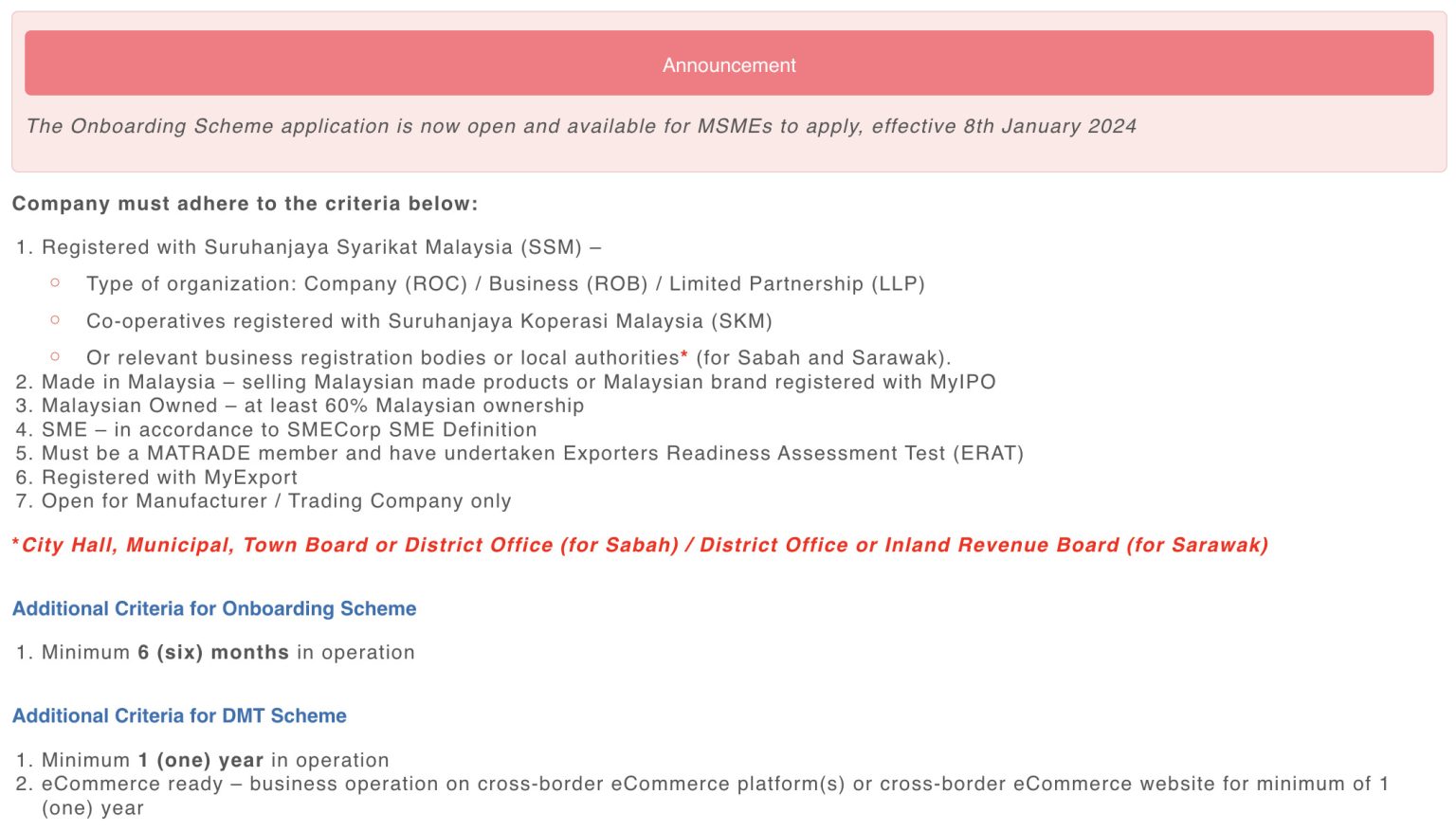

Nyt Mini Crossword Clues And Answers For March 13 2025

May 19, 2025

Nyt Mini Crossword Clues And Answers For March 13 2025

May 19, 2025 -

Zheneva Stanet Ploschadkoy Dlya Peregovorov Po Kipru Pod Rukovodstvom Genseka Oon

May 19, 2025

Zheneva Stanet Ploschadkoy Dlya Peregovorov Po Kipru Pod Rukovodstvom Genseka Oon

May 19, 2025

Latest Posts

-

The Private Credit Job Hunt 5 Dos And Don Ts To Remember

May 19, 2025

The Private Credit Job Hunt 5 Dos And Don Ts To Remember

May 19, 2025 -

Fatal Mosque Attacks In Iran Death Sentences Imposed

May 19, 2025

Fatal Mosque Attacks In Iran Death Sentences Imposed

May 19, 2025 -

5 Must Know Tips For A Private Credit Job Application

May 19, 2025

5 Must Know Tips For A Private Credit Job Application

May 19, 2025 -

Three Receive Death Penalty For Fatal Iranian Mosque Attacks

May 19, 2025

Three Receive Death Penalty For Fatal Iranian Mosque Attacks

May 19, 2025 -

Navigating The China Market Challenges For Bmw Porsche And Other Auto Brands

May 19, 2025

Navigating The China Market Challenges For Bmw Porsche And Other Auto Brands

May 19, 2025