Gas Prices Surge: Nearly 20 Cent Per Gallon Increase

Table of Contents

Causes of the Gas Price Surge

Several interconnected factors have contributed to the recent sharp increase in gas prices. Understanding these contributing elements is crucial to navigating this challenging economic climate.

Increased Crude Oil Prices

The most significant driver of the gas price surge is the substantial increase in crude oil prices. Several geopolitical and economic factors have played a role:

- OPEC+ Production Cuts: The Organization of the Petroleum Exporting Countries (OPEC) and its allies (OPEC+) have implemented production cuts, reducing the global supply of crude oil. This deliberate reduction aims to stabilize and increase prices.

- Geopolitical Instability: Ongoing conflicts and tensions in various regions of the world, particularly those with significant oil production, create uncertainty and disrupt supply chains, driving up prices. The war in Ukraine, for instance, has significantly impacted global energy markets.

- Increased Global Demand: As the global economy recovers from the pandemic, demand for oil and gas has increased, putting further pressure on supply and causing prices to rise. This increased demand is particularly noticeable in developing economies experiencing rapid growth.

- Sanctions and Embargoes: International sanctions and embargoes on certain oil-producing nations have further constrained the global supply of crude oil, exacerbating the price increase.

Refinery Capacity Constraints

Reduced refinery capacity has further amplified the impact of higher crude oil prices. Several factors have contributed to this issue:

- Planned and Unplanned Maintenance: Refineries regularly undergo scheduled maintenance, which can temporarily reduce their output. However, unexpected shutdowns due to unforeseen technical issues or accidents can further exacerbate supply shortages.

- Aging Infrastructure: Many refineries are aging and require significant investment to maintain optimal operational capacity. This lack of investment can lead to reduced efficiency and output.

- Conversion to Biofuels: Some refineries are converting their operations to produce biofuels, temporarily impacting the production of traditional gasoline.

Seasonal Demand

The summer months typically see an increase in gasoline demand due to increased travel and tourism. This seasonal surge in demand further exacerbates the impact of tighter supply, leading to higher prices at the pump.

- Vacation Travel: Increased road trips and vacations during summer months directly translate to higher gasoline consumption.

- Tourism and Recreation: Outdoor recreational activities, often involving driving long distances, contribute to the seasonal increase in gas demand.

Speculation and Market Volatility

Market speculation and volatility also play a significant role in influencing gas prices. Futures contracts and trading activities can amplify price fluctuations, particularly in periods of uncertainty. Sudden shifts in investor sentiment or unexpected geopolitical events can lead to rapid price changes.

Impact of the Gas Price Surge

The nearly 20-cent-per-gallon increase in gas prices has far-reaching consequences across various sectors of the economy.

Consumers

For consumers, the increased gas prices directly translate to higher transportation costs, reducing disposable income and impacting household budgets.

- Reduced Spending Power: Higher gas prices leave less money for other essential expenses, potentially affecting consumer spending on goods and services.

- Increased Commute Costs: Individuals who commute to work by car experience a direct increase in their daily or weekly expenses.

- Shifting Consumption Habits: Consumers may adjust their spending habits, potentially reducing non-essential purchases or opting for less expensive alternatives.

Businesses

Businesses, especially those in the transportation and logistics sectors, are significantly affected by the rising gas prices. Increased fuel costs lead to higher operating expenses and potentially reduced profitability.

- Increased Transportation Costs: Businesses that rely on trucking or other forms of transportation face substantial increases in their operational costs.

- Higher Prices for Goods and Services: Increased transportation costs are often passed on to consumers in the form of higher prices for goods and services.

- Potential for Job Losses: Some businesses, particularly small businesses, may be forced to reduce staff or even close due to the increased operating costs.

Inflation

The surge in gas prices contributes to overall inflation, impacting the broader economy. Rising energy prices tend to push up the cost of other goods and services, leading to a broader increase in the price level. This can also lead to increased interest rates and tighter monetary policy from central banks.

Predictions and Mitigation Strategies

Predicting future gas price trends is inherently challenging due to the complex interplay of geopolitical, economic, and environmental factors.

Future Gas Price Outlook

Experts generally expect gas prices to remain volatile in the short term, influenced by continued geopolitical uncertainty, OPEC+ policies, and global demand. However, long-term predictions vary considerably, depending on the speed of the global energy transition and technological advancements.

Strategies to Reduce the Impact

While we cannot control global gas prices directly, there are several strategies consumers and businesses can implement to reduce their vulnerability to gas price surges:

- Fuel-Efficient Driving: Adopting fuel-efficient driving habits, such as maintaining proper tire pressure and avoiding aggressive acceleration and braking, can improve fuel economy.

- Public Transportation: Utilizing public transportation whenever feasible can significantly reduce reliance on personal vehicles and lower fuel consumption.

- Carpooling: Sharing rides with colleagues or friends can reduce individual fuel consumption and costs.

- Government Initiatives: Governments can implement policies such as fuel tax rebates or subsidies to alleviate the burden on consumers. Investing in renewable energy sources and improving public transportation infrastructure also play crucial roles.

Conclusion

The nearly 20-cent-per-gallon increase in gas prices is a significant event with wide-ranging consequences across the economy. Understanding the causes – from increased crude oil prices and refinery constraints to seasonal demand and market speculation – is vital. The impact on consumers, businesses, and overall inflation is undeniable. To prepare for future gas price increases, it's crucial to monitor gas price surges, understand gas price fluctuations, and adopt fuel-efficient practices. By remaining informed and implementing appropriate strategies, individuals and businesses can better manage their expenses and navigate this challenging economic landscape.

Featured Posts

-

How To Watch Peppa Pig Online Free Streaming Guide For The Animated Tv Show

May 22, 2025

How To Watch Peppa Pig Online Free Streaming Guide For The Animated Tv Show

May 22, 2025 -

Sses Revised Spending Plan 3 Billion Cut Reflects Economic Uncertainty

May 22, 2025

Sses Revised Spending Plan 3 Billion Cut Reflects Economic Uncertainty

May 22, 2025 -

Trinidad And Tobago Newsday Kartels Safety Restrictions Explained

May 22, 2025

Trinidad And Tobago Newsday Kartels Safety Restrictions Explained

May 22, 2025 -

Gas Prices Surge Nearly 20 Cent Increase Per Gallon

May 22, 2025

Gas Prices Surge Nearly 20 Cent Increase Per Gallon

May 22, 2025 -

1 050 V Mware Price Hike At And T Highlights Broadcoms Extreme Cost Increase

May 22, 2025

1 050 V Mware Price Hike At And T Highlights Broadcoms Extreme Cost Increase

May 22, 2025

Latest Posts

-

European Midday Briefing Stock Market Dip On Pmi Data

May 23, 2025

European Midday Briefing Stock Market Dip On Pmi Data

May 23, 2025 -

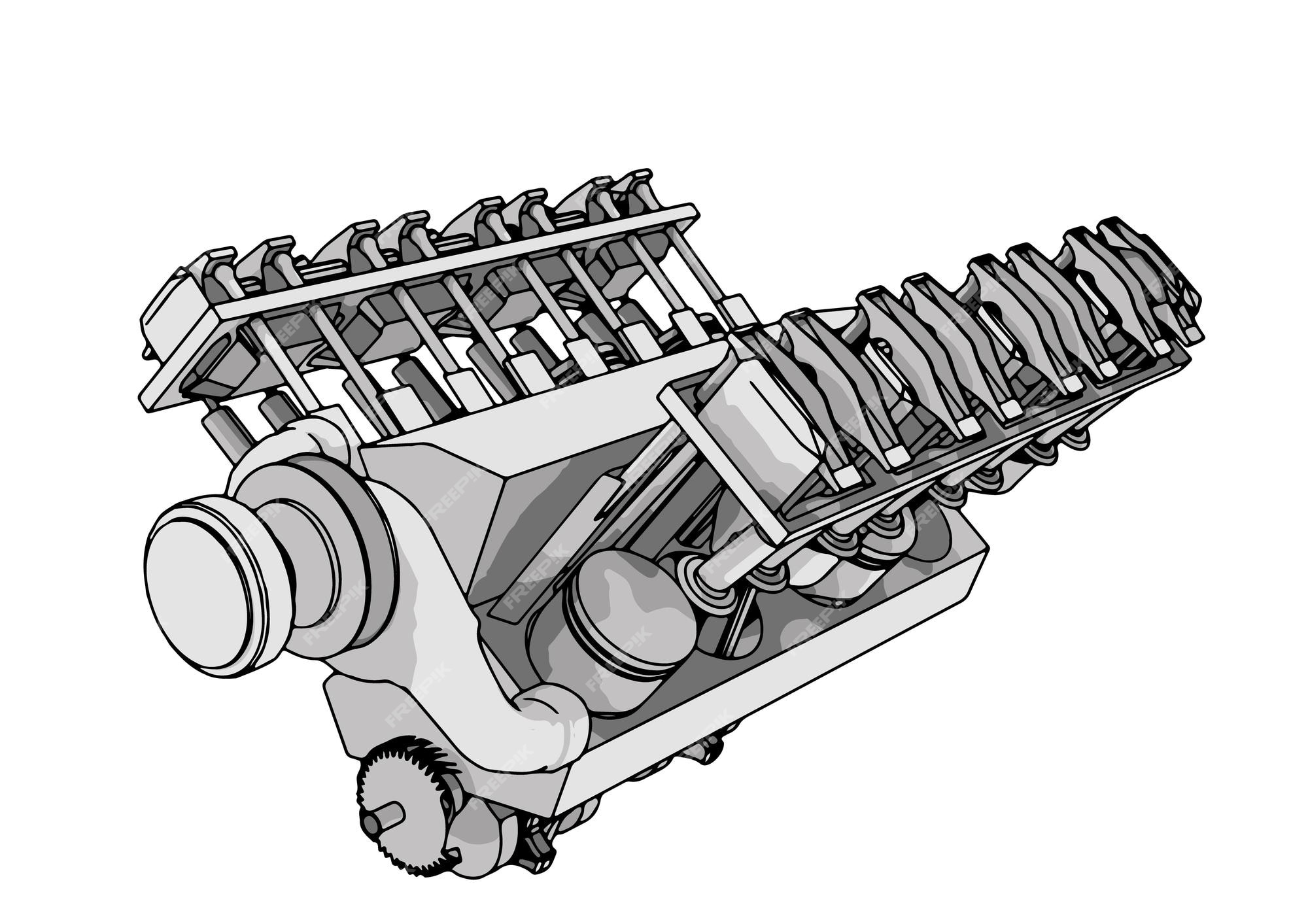

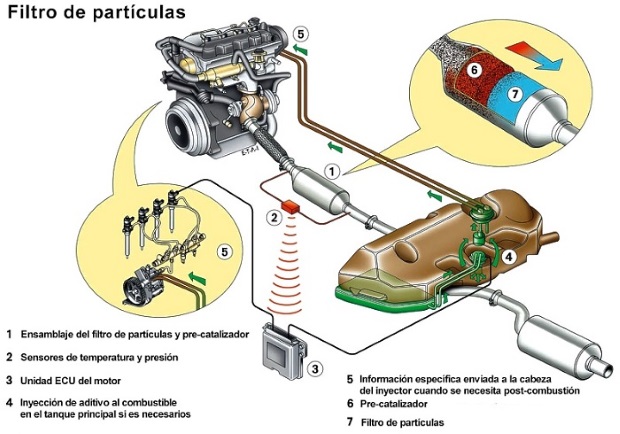

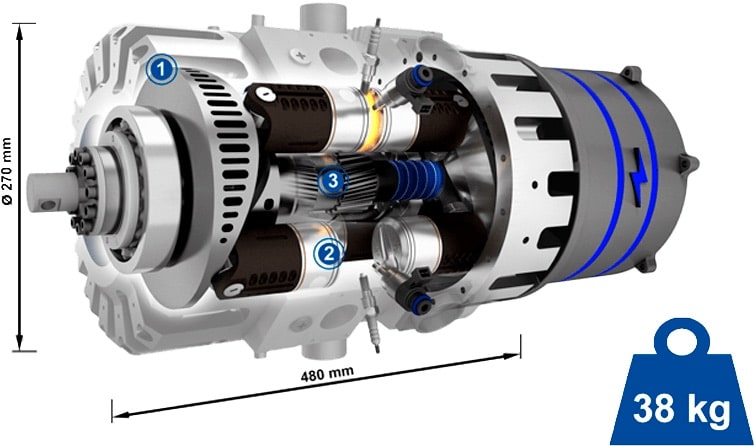

Motor De Particulas De Agua Innovacion Britanica En La Combustion

May 23, 2025

Motor De Particulas De Agua Innovacion Britanica En La Combustion

May 23, 2025 -

El Reino Unido Crea Un Motor De Combustion Con Tecnologia De Particulas De Agua Un Avance Cientifico

May 23, 2025

El Reino Unido Crea Un Motor De Combustion Con Tecnologia De Particulas De Agua Un Avance Cientifico

May 23, 2025 -

Ciencia Y Tecnologia Motor Britanico Funciona Con Particulas De Agua

May 23, 2025

Ciencia Y Tecnologia Motor Britanico Funciona Con Particulas De Agua

May 23, 2025 -

Motor De Combustion Revolucionario El Reino Unido Quema Particulas De Agua

May 23, 2025

Motor De Combustion Revolucionario El Reino Unido Quema Particulas De Agua

May 23, 2025