Gold Market Update: Two Straight Weeks Of Losses In 2025

Table of Contents

Rising Interest Rates and Their Impact on Gold Prices

Gold, unlike interest-bearing assets, doesn't offer returns in the form of dividends or interest. This means its attractiveness is inversely related to interest rates. When interest rates rise, as they have recently, bonds and other fixed-income securities become more appealing to investors. This is because they offer a guaranteed return, making them a more attractive alternative to gold, which only offers potential price appreciation.

The recent increase in interest rates, for example, a hypothetical 0.5% increase by the Federal Reserve, has directly impacted investor sentiment. This shift in monetary policy makes holding non-yielding assets like gold less desirable. We can see a clear correlation; as interest rates climbed, gold prices experienced a corresponding drop.

- Higher interest rates increase the opportunity cost of holding non-yielding assets like gold. The potential return from alternative investments outweighs the potential for gold price increases.

- Investors may shift to higher-yielding investments like bonds and treasury bills. These offer a safer, more predictable return in the current economic climate.

- Central bank actions significantly influence interest rate movements and gold prices. The decisions made by central banks worldwide directly impact gold market dynamics.

The Strengthening US Dollar and its Influence on Gold

Gold is priced in US dollars, creating an inverse relationship between the dollar's value and the price of gold. When the US dollar strengthens, as it has recently, it makes gold more expensive for investors holding other currencies. This reduced affordability leads to decreased international demand and puts downward pressure on the price of gold.

The US Dollar Index (DXY) provides a clear indication of this relationship. Recent rises in the DXY have coincided with drops in gold prices, clearly illustrating the impact of a strong dollar on gold's appeal to global investors. For instance, a hypothetical 5% increase in the DXY can often translate to a noticeable decrease in gold prices, even with other market factors remaining unchanged.

- A strong dollar generally puts downward pressure on gold prices. This makes gold less accessible and less attractive to international buyers.

- International investors may find it less attractive to buy gold when the dollar is appreciating. The transaction costs and the relative cost increase make it less profitable.

- Track the US Dollar Index (DXY) to understand its impact on the gold market. Monitoring the DXY is a crucial tool for gold price prediction and analysis.

Geopolitical Factors Affecting the Gold Market

Geopolitical instability often drives investors toward safe-haven assets like gold. However, in recent weeks, geopolitical events have had a less pronounced impact on gold prices than interest rates and the dollar’s strength. While certain regions might experience ongoing conflicts or political uncertainty, their overall effect on the global gold market has been muted compared to the economic factors mentioned above. This suggests that currently, economic concerns overshadow geopolitical anxieties in shaping gold prices.

- Geopolitical uncertainty can drive safe-haven demand for gold. However, this effect is currently being overshadowed by other market forces.

- Unexpected events can cause market volatility impacting gold prices significantly. However, the current downturn seems less driven by surprise events and more by consistent economic trends.

- Analyze the impact of specific geopolitical events on gold price fluctuations. While significant geopolitical events can influence the gold market, currently their impact is secondary to economic factors.

Technical Analysis of the Gold Price Drop

A look at recent gold price charts reveals a clear downtrend, with key support levels being tested. Technical indicators, such as moving averages, show a bearish momentum. The Relative Strength Index (RSI) suggests the market might be oversold, hinting at a potential price reversal, but it remains in bearish territory. The absence of clear bullish reversal patterns in the short term is a cause for concern for investors hoping for an immediate price upswing.

- Discuss specific chart patterns (e.g., head and shoulders, double top). While some bearish patterns might be visible, confirming patterns are absent to date.

- Analyze moving averages to gauge momentum. Moving averages are currently pointing downwards, confirming a bearish trend.

- Interpret the Relative Strength Index (RSI) to identify overbought or oversold conditions. While the RSI suggests oversold conditions, it doesn’t necessarily signal an imminent price reversal.

Conclusion: Navigating the Current Gold Market Landscape

The recent two-week decline in gold prices is largely attributable to rising interest rates, a strengthening US dollar, and the current muted impact of geopolitical factors, all confirmed by technical analysis. While geopolitical risks always exist, the economic factors are currently outweighing them in their influence on gold pricing. It’s crucial to stay informed about market trends and developments, continuously monitoring interest rate movements, the US Dollar Index, and global economic news.

The short-term outlook for gold remains somewhat cautious. While a price reversal is possible, particularly given the potential oversold conditions indicated by some technical indicators, the underlying economic factors suggest that further downward pressure might persist. Continue monitoring this Gold Market Update regularly for further analysis and insights into future price movements. Consider exploring additional resources on gold investment strategies and precious metal diversification to refine your investment approach in this dynamic market.

Featured Posts

-

Arnold Schwarzeneggers Son Patrick A Nude Scene And Fathers Reaction

May 06, 2025

Arnold Schwarzeneggers Son Patrick A Nude Scene And Fathers Reaction

May 06, 2025 -

Trotyl Z Polski Dla Amerykanskiej Armii Szczegoly Kontraktu

May 06, 2025

Trotyl Z Polski Dla Amerykanskiej Armii Szczegoly Kontraktu

May 06, 2025 -

Polski Nitro Chem Najwiekszy Europejski Producent Trotylu

May 06, 2025

Polski Nitro Chem Najwiekszy Europejski Producent Trotylu

May 06, 2025 -

Why Jeff Goldblum Should Have Won An Oscar For The Fly

May 06, 2025

Why Jeff Goldblum Should Have Won An Oscar For The Fly

May 06, 2025 -

Falling Profits At Westpac Wbc The Impact Of Margin Pressure

May 06, 2025

Falling Profits At Westpac Wbc The Impact Of Margin Pressure

May 06, 2025

Latest Posts

-

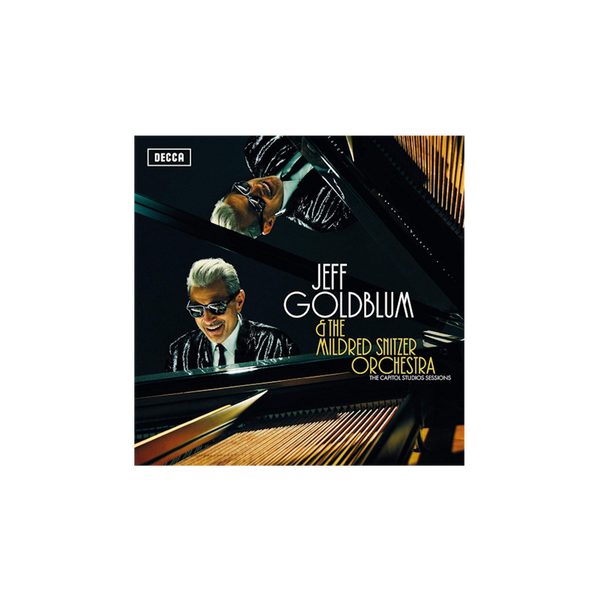

I Dont Know Why I Just Do Jeff Goldblum Ariana Grande And The Mildred Snitzer Orchestras Unexpected Hit

May 06, 2025

I Dont Know Why I Just Do Jeff Goldblum Ariana Grande And The Mildred Snitzer Orchestras Unexpected Hit

May 06, 2025 -

Sabrina Carpenters Fun Size Reunion On Snl A Surprise Performance

May 06, 2025

Sabrina Carpenters Fun Size Reunion On Snl A Surprise Performance

May 06, 2025 -

Jeff Goldblum And The Mildred Snitzer Orchestras I Dont Know Why I Just Do Featuring Ariana Grande A Musical Collaboration

May 06, 2025

Jeff Goldblum And The Mildred Snitzer Orchestras I Dont Know Why I Just Do Featuring Ariana Grande A Musical Collaboration

May 06, 2025 -

Unexpected Snl Appearance Sabrina Carpenter And A Fun Size Friend

May 06, 2025

Unexpected Snl Appearance Sabrina Carpenter And A Fun Size Friend

May 06, 2025 -

Sabrina Carpenters Unexpected Snl Collaboration A Fun Size Flashback

May 06, 2025

Sabrina Carpenters Unexpected Snl Collaboration A Fun Size Flashback

May 06, 2025