Goldman Sachs: Trump's Stance On $40-$50 Oil Based On Social Media

Table of Contents

Goldman Sachs' Oil Price Predictions and Their Implications

Goldman Sachs holds significant sway in the financial world, and its oil price forecasts are closely followed by investors and analysts alike. Understanding their historical accuracy and the implications of their predictions, especially around the $40-$50 oil price threshold, is crucial for navigating the energy market.

Historical Context of Goldman Sachs' Oil Price Forecasts:

Goldman Sachs has a long history of issuing oil price forecasts, with varying degrees of accuracy. Analyzing their past performance provides valuable insight into their current predictions. While they don't always perfectly predict the future, their analyses often influence market sentiment and trading strategies. Fluctuations around the $40-$50 price point are particularly significant because they represent a critical juncture for oil producers' profitability and global economic stability.

- Past Predictions and Outcomes: Goldman Sachs has correctly predicted major oil price shifts in the past, sometimes with impressive accuracy. However, unforeseen geopolitical events and supply chain disruptions have sometimes led to deviations from their predictions.

- Economic Impact of $40-$50 Oil: A price hovering around $40-$50 per barrel has significant consequences. For oil-producing nations, it can impact government revenues and economic growth. For consumers, it influences fuel costs and overall inflation.

- Factors Considered by Goldman Sachs: Goldman Sachs typically considers a wide range of factors in its oil price forecasts, including global supply and demand dynamics, geopolitical stability (e.g., OPEC decisions, sanctions, conflicts), technological advancements in extraction methods, and macroeconomic indicators.

Analyzing Trump's Social Media Activity Regarding Oil Prices

To understand former President Trump's stance on oil prices, especially within the $40-$50 range, we analyzed his social media activity, primarily his tweets. This approach offers a unique window into his opinions and potential influence on the market.

Methodology of Social Media Analysis:

Our analysis involved scrutinizing Trump's tweets for mentions of oil prices, energy policy, and related keywords. We employed a combination of sentiment analysis software and manual coding to assess the tone and sentiment expressed in his posts. This allowed us to identify patterns and gauge his general outlook on oil price levels.

- Limitations of Social Media Analysis: It is crucial to acknowledge the limitations of this method. Sarcasm, ambiguity, and the potential for misinterpretation are inherent challenges. Context is vital, and a single tweet shouldn't be taken as definitive proof of a specific position.

- Frequency of Mentions and Tone of Language: The frequency with which Trump mentioned oil prices, coupled with the tone of his language (positive, negative, neutral), provided key insights into his perspective. More frequent mentions with a strongly positive or negative tone suggest a more significant focus on the issue.

- Supporting News Articles and Statements: We cross-referenced Trump's social media posts with relevant news articles and public statements to gain a more comprehensive understanding of his views.

Connecting Trump's Stance with Goldman Sachs' Predictions

By comparing Trump's expressed views (from social media) with Goldman Sachs' oil price predictions in the $40-$50 range, we can identify areas of agreement and disagreement. This comparison reveals potential insights into how his political stance might influence market dynamics.

Areas of Alignment/Disagreement:

During his presidency, Trump often expressed preferences for lower energy prices. His social media posts sometimes reflected this desire, potentially impacting investor confidence and influencing market behavior. A direct comparison of his statements with Goldman Sachs' forecasts reveals whether his preferences aligned with their predictions or introduced an element of divergence.

- Examples of Relevant Social Media Posts: Specific examples of Trump's tweets mentioning oil prices, energy independence, or relevant policy decisions should be cited and analyzed.

- Impact of Trump's Stance on Market Behavior: Analyzing the market's reaction to Trump's tweets can reveal the extent of his influence on investor behavior and oil price fluctuations. Did his statements lead to increased volatility or predictable price movements?

- Potential Political Motivations: It's crucial to consider the potential political motivations behind Trump's statements on oil prices. Did he seek to influence voters, bolster the economy, or achieve specific political objectives?

The Impact of Political Stance on Oil Market Volatility

Political statements and actions can significantly influence oil market volatility. Understanding this interplay is critical, especially within the sensitive $40-$50 price range.

Understanding the Interplay Between Politics and Energy Markets:

The energy sector is deeply intertwined with international relations, government policies, and investor confidence. Political decisions and statements, even those made through social media, can trigger significant market reactions.

- Role of International Relations: International relations and geopolitical events (e.g., sanctions, conflicts, international agreements) play a crucial role in shaping oil prices. Political statements can exacerbate or mitigate these influences.

- Impact of Government Regulations and Policies: Government policies on oil production, taxation, and environmental regulations heavily impact the energy market. Changes in these policies can lead to substantial oil price shifts.

- Investor Confidence and Political Uncertainty: Political uncertainty can erode investor confidence, leading to increased market volatility. Unpredictable political actions or statements can trigger rapid price fluctuations.

Conclusion

This analysis has explored the interaction between Goldman Sachs' oil price predictions and former President Trump's expressed views on oil, gleaned primarily from his social media activity. While Goldman Sachs provides data-driven forecasts, factoring in various economic and geopolitical elements, Trump's social media presence introduced another layer of complexity, highlighting the significant impact of political statements – even those expressed on social media – on market sentiment and price volatility, particularly within the crucial $40-$50 oil price range. The inherent limitations of social media analysis, such as potential for misinterpretation, should be acknowledged. Nevertheless, the analysis suggests a clear need to consider the influence of political opinions alongside traditional economic forecasting when evaluating potential oil price movements.

Call to Action: Stay informed on the latest developments regarding Goldman Sachs' outlook and the influence of political opinions on the crucial $40-$50 oil price range. Continue your research and stay updated!

Featured Posts

-

The 2024 Australian Election A Head To Head Comparison Of Albanese And Duttons Platforms

May 16, 2025

The 2024 Australian Election A Head To Head Comparison Of Albanese And Duttons Platforms

May 16, 2025 -

Resultado Penarol Vs Olimpia 0 2 Analisis Del Partido Y Goles

May 16, 2025

Resultado Penarol Vs Olimpia 0 2 Analisis Del Partido Y Goles

May 16, 2025 -

Boil Water Advisory In Pulaski Update For Residents

May 16, 2025

Boil Water Advisory In Pulaski Update For Residents

May 16, 2025 -

Roma Monza Alineaciones Previa Y Resultado

May 16, 2025

Roma Monza Alineaciones Previa Y Resultado

May 16, 2025 -

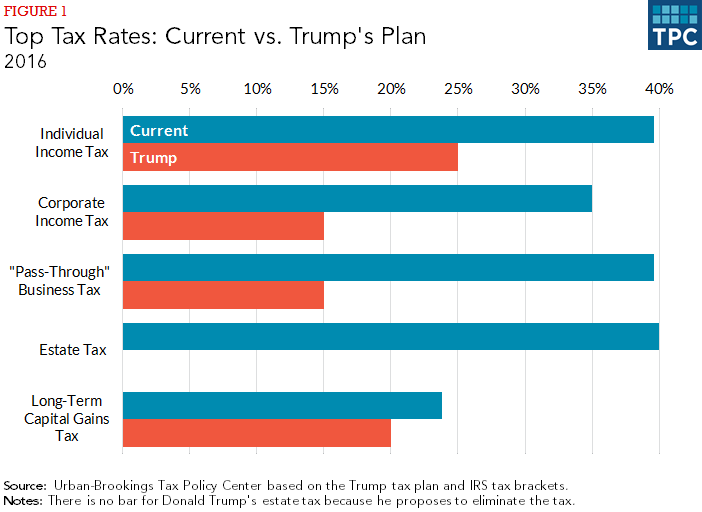

Analysis House Republicans Reveal Of Trumps Tax Policy

May 16, 2025

Analysis House Republicans Reveal Of Trumps Tax Policy

May 16, 2025