Grayscale XRP ETF Filing: Why XRP Is Outperforming Bitcoin And Other Cryptos

Table of Contents

The Grayscale Effect: Increased Institutional Interest in XRP

The Grayscale announcement regarding an XRP ETF filing has been a major catalyst for the recent price surge. Understanding this effect requires looking at Grayscale's history and the specifics of the filing.

What is the Grayscale XRP ETF Filing?

Grayscale Investments is a prominent digital currency asset manager known for its Grayscale Bitcoin Trust (GBTC). Their influence on the crypto market is substantial, as their investments often signal market trends and attract institutional capital. The Grayscale XRP ETF filing represents their intention to offer an exchange-traded fund specifically focused on XRP, making it significantly easier for institutional investors to gain exposure to this cryptocurrency. This filing, however, faces regulatory hurdles and the ultimate approval is not guaranteed. The SEC's decision will greatly impact the trajectory of XRP's price.

Institutional Investor Appetite for XRP:

The ETF filing is attracting significant institutional interest. Previously, many large investors hesitated to invest directly in XRP due to concerns about regulatory uncertainty and the complexities of managing crypto assets. An ETF offers a familiar and regulated vehicle for investment, alleviating these concerns. Institutional investors benefit from the increased ease of trading, regulatory compliance, and the reduced risk associated with a structured investment product. The success of other ETFs, such as those tracking gold or various indices, demonstrates the positive impact such products can have on asset prices and liquidity.

- Increased liquidity due to ETF trading: An ETF increases the volume of XRP traded, leading to improved price discovery and reduced volatility.

- Reduced risk perception for institutional investors: The regulatory framework surrounding an ETF reduces the perceived risk for institutional investors, encouraging larger investments.

- Potential for larger trading volumes: The increased accessibility afforded by an ETF is expected to significantly increase XRP trading volume.

XRP's Technological Advantages and Use Cases

Beyond the Grayscale effect, XRP's inherent strengths contribute to its outperformance. Its technological advantages and real-world applications make it a compelling investment for both institutional and retail investors.

Faster and Cheaper Transactions:

XRP boasts significantly faster and cheaper transaction speeds compared to Bitcoin and many other cryptocurrencies. Its scalability allows for a high volume of transactions per second, making it well-suited for large-scale payments. These advantages are crucial in a world increasingly reliant on quick and cost-effective cross-border payments.

Real-World Applications and Partnerships:

Ripple, the company behind XRP, has fostered numerous partnerships and integrations focusing on cross-border payments. This real-world utility sets XRP apart from many altcoins that lack widespread adoption. The use of XRP in remittance services and microtransactions showcases its practical application beyond pure speculation.

- Focus on XRP's role in the global financial system: XRP's potential to streamline international finance is a major driver of its value.

- Showcase ongoing projects and collaborations utilizing XRP: Highlighting real-world deployments builds investor confidence and demonstrates XRP's utility.

- Emphasize the utility of XRP beyond speculation: Focusing on the practical applications of XRP differentiates it from many other cryptocurrencies.

Bitcoin and Altcoin Market Weakness – Comparative Analysis

XRP's recent success is also partly due to the relative weakness in the Bitcoin and broader altcoin markets.

Bitcoin's Price Volatility:

Bitcoin, while remaining the dominant cryptocurrency, has experienced significant price volatility recently. Negative market sentiment and regulatory uncertainty have contributed to this volatility, making XRP, with its relatively strong performance, a more attractive alternative for some investors.

Altcoin Market Stagnation:

Many altcoins are struggling with adoption and lack clear utility, leading to market stagnation. This lackluster performance across the altcoin space highlights XRP's relative strength, driven by its technological advantages and real-world applications.

- Compare XRP's market capitalization against Bitcoin and other major cryptocurrencies: Show XRP's position within the crypto market relative to its competitors.

- Chart the price performance of XRP against Bitcoin and other altcoins: Visual data clearly illustrates XRP's outperformance.

- Analyze factors contributing to the relative strength of XRP: Summarize the key reasons why XRP has outperformed other cryptocurrencies.

Conclusion

The Grayscale XRP ETF filing has significantly boosted XRP's price, outperforming Bitcoin and other cryptocurrencies. This surge is driven by increased institutional interest, fueled by the potential for an ETF, XRP's technological advantages, and the relative weakness in other sectors of the crypto market. The potential approval of the XRP ETF could further propel XRP's growth, making it a compelling asset for investors seeking exposure to the cryptocurrency market.

Call to Action: Stay informed about the latest developments surrounding the Grayscale XRP ETF and its potential impact on the cryptocurrency market. Research XRP and its potential before making any investment decisions. Learn more about the Grayscale XRP ETF and how it could change your investment strategy. Consider diversifying your portfolio with promising assets like XRP.

Featured Posts

-

Xrp On The Brink Of A Record High Grayscales Sec Filing Impact

May 08, 2025

Xrp On The Brink Of A Record High Grayscales Sec Filing Impact

May 08, 2025 -

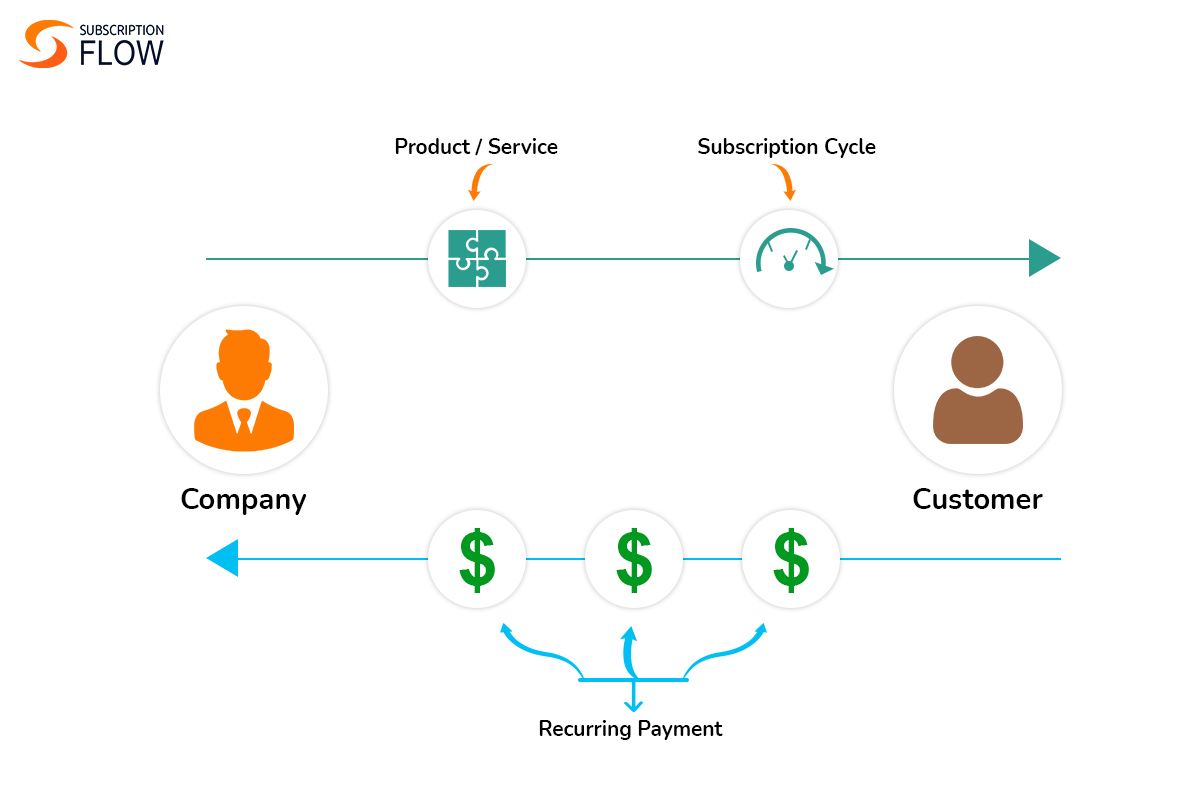

Ubers Subscription Model Lower Commissions For Drivers

May 08, 2025

Ubers Subscription Model Lower Commissions For Drivers

May 08, 2025 -

Ethereum Price Resilience Upside Break Imminent

May 08, 2025

Ethereum Price Resilience Upside Break Imminent

May 08, 2025 -

Made In Gujranwala Exhibition A Success Celebrated By Sufian And The Gcci

May 08, 2025

Made In Gujranwala Exhibition A Success Celebrated By Sufian And The Gcci

May 08, 2025 -

Pavle Grbovic I Prelazna Vlada Prihvatljivi Predlozi

May 08, 2025

Pavle Grbovic I Prelazna Vlada Prihvatljivi Predlozi

May 08, 2025