Grayscale's XRP ETF Filing: Why XRP Is Outperforming Bitcoin

Table of Contents

The Grayscale Effect: Why an XRP ETF Matters

Grayscale Investments, a prominent digital currency asset manager, filing for an XRP ETF is a monumental event. This move signifies a significant step towards increased legitimacy and potential institutional investment in XRP. The implications are far-reaching:

-

Increased regulatory clarity and institutional adoption: An approved XRP ETF would bring much-needed regulatory clarity to the XRP market, potentially encouraging more institutional investors to allocate funds to this cryptocurrency. This contrasts with the current environment where many institutional investors are hesitant due to regulatory uncertainty.

-

Potential for massive capital inflow into the XRP market: The sheer size and reach of Grayscale could bring a massive influx of capital into the XRP market. This increased liquidity would likely drive up the price and increase overall market capitalization.

-

Enhanced liquidity and trading volume: An ETF would significantly improve XRP's liquidity, making it easier for investors to buy and sell the digital asset. Higher trading volume would further increase its market efficiency and appeal to institutional traders.

-

Comparison to Grayscale's Bitcoin Trust (GBTC): The success of Grayscale's Bitcoin Trust (GBTC) serves as a precedent. If the XRP ETF gains similar traction, it could dramatically alter the XRP market dynamics, mirroring the impact GBTC had on the Bitcoin market.

The SEC's approval (or disapproval) of Grayscale's XRP ETF application will be a defining moment for XRP's price. A positive decision could catapult XRP into a new phase of growth and adoption.

XRP's Underlying Technology and Utility

XRP's value proposition extends far beyond simple speculation. Unlike Bitcoin, which primarily serves as a store of value, XRP boasts significant utility, particularly in the realm of cross-border payments.

-

RippleNet and its global partnerships: RippleNet, Ripple's payment network leveraging XRP, has established numerous partnerships with banks and financial institutions worldwide, facilitating faster and cheaper international transactions.

-

Faster transaction speeds and lower fees than Bitcoin: XRP transactions are significantly faster and cheaper than Bitcoin's, making it a more attractive option for everyday use cases, especially for high-volume transactions.

-

Potential for wider adoption in the financial industry: XRP's efficiency and integration with existing financial infrastructure position it for widespread adoption within the traditional banking sector, potentially disrupting current cross-border payment systems.

-

XRP Ledger and its scalability: The XRP Ledger, the technology underpinning XRP, is known for its scalability and efficiency, handling thousands of transactions per second, unlike Bitcoin's limitations.

This inherent utility differentiates XRP from Bitcoin, giving it a competitive edge and contributing to its growing appeal among investors and financial institutions.

Market Sentiment and Investor Confidence

The market sentiment towards XRP has undergone a significant shift. The successful navigation of the legal battles with the SEC has boosted investor confidence considerably.

-

Impact of the Ripple vs. SEC lawsuit outcome: A partial victory for Ripple in the SEC lawsuit removed much of the regulatory uncertainty surrounding XRP, creating a more favorable investment climate.

-

Growing institutional interest and positive analyst predictions: The positive legal outcome, combined with XRP's technological advantages, has attracted increased institutional interest and positive analyst forecasts, suggesting a bullish outlook.

-

Increased media coverage and public awareness: Greater media attention and public awareness are contributing to heightened investor interest and a more positive perception of XRP.

-

Comparison of public sentiment towards XRP versus Bitcoin: While Bitcoin enjoys widespread recognition, the positive narrative surrounding XRP's utility and legal clarity is increasingly shifting investor sentiment in its favor.

This positive news cycle and growing speculation are crucial factors driving XRP's price upwards.

Bitcoin's Current Market Challenges

While this article focuses on XRP's potential, it's important to acknowledge some of the challenges Bitcoin currently faces. These factors are not directly compared to XRP's strengths, but provide context for understanding market dynamics.

-

Bitcoin's energy consumption and environmental concerns: Bitcoin's high energy consumption remains a persistent concern for some investors and regulators.

-

Regulatory scrutiny and potential future restrictions: Bitcoin, like other cryptocurrencies, remains under regulatory scrutiny, with potential for future restrictions impacting its price.

-

Competition from other cryptocurrencies and blockchain technologies: Bitcoin faces competition from other cryptocurrencies and blockchain technologies that offer innovative solutions and improved functionalities.

Conclusion

Grayscale's XRP ETF filing, coupled with XRP's inherent utility, growing institutional interest, and a more positive regulatory landscape, presents a compelling case for XRP's potential to outperform Bitcoin in the coming years. The increased regulatory clarity, enhanced liquidity, and the potential for massive capital inflow all contribute to a bullish outlook for XRP. Is it time to consider adding XRP to your cryptocurrency portfolio?

Grayscale's XRP ETF filing signals a potential turning point for XRP. Is it time to consider adding XRP to your cryptocurrency portfolio? Research thoroughly and make informed investment decisions based on your risk tolerance. Learn more about XRP and its potential by [link to relevant resource/further reading]. Don't miss out on the potential of XRP – start exploring today!

Featured Posts

-

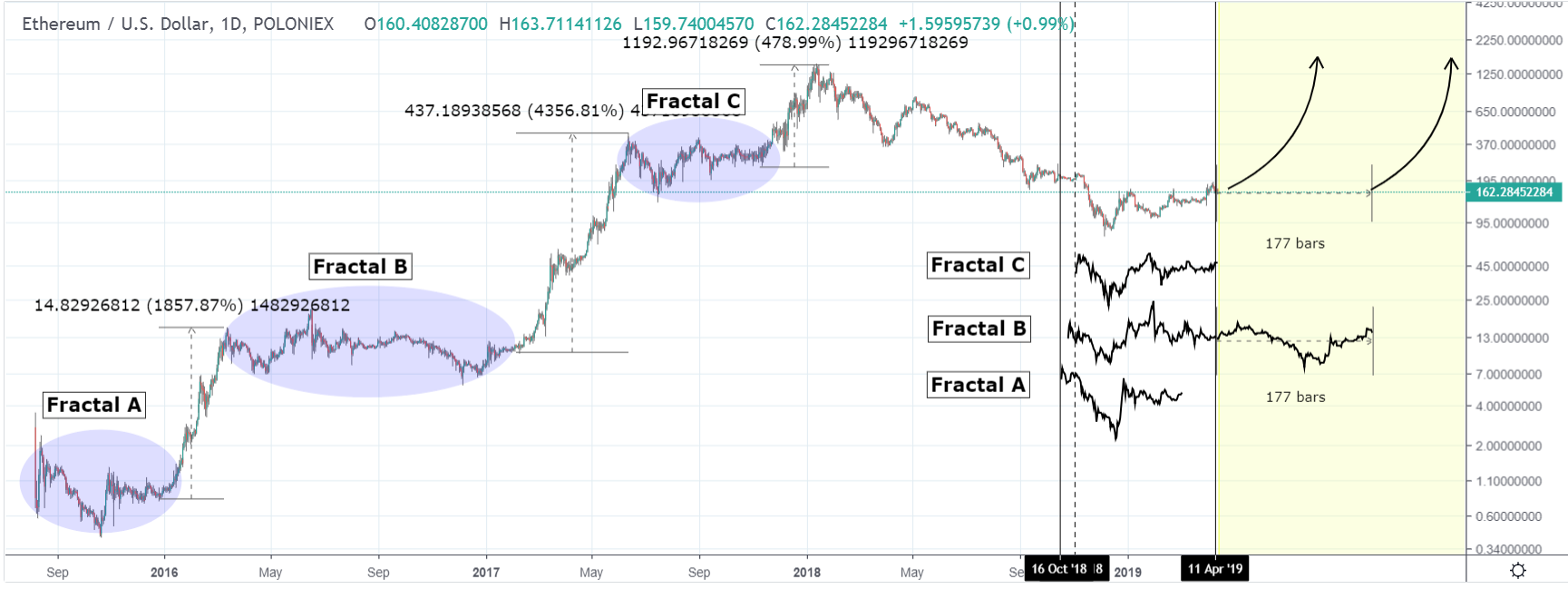

Is An Ethereum Price Breakout On The Horizon

May 08, 2025

Is An Ethereum Price Breakout On The Horizon

May 08, 2025 -

Are You A True Nba Fan Test Your Triple Doubles Knowledge Playoffs Edition

May 08, 2025

Are You A True Nba Fan Test Your Triple Doubles Knowledge Playoffs Edition

May 08, 2025 -

New Uber Shuttle Option Offers Fans Cheap Rides From United Center

May 08, 2025

New Uber Shuttle Option Offers Fans Cheap Rides From United Center

May 08, 2025 -

United Center Fans Get 5 Rides With New Uber Shuttle Service

May 08, 2025

United Center Fans Get 5 Rides With New Uber Shuttle Service

May 08, 2025 -

Hong Kong Dollar Interest Rate Fall Significant Implications For Hkd Usd Exchange Rate

May 08, 2025

Hong Kong Dollar Interest Rate Fall Significant Implications For Hkd Usd Exchange Rate

May 08, 2025