Greg Abel: The Man Set To Lead Berkshire Hathaway After Buffett

Table of Contents

Greg Abel's Background and Rise Within Berkshire Hathaway

Early Career and Key Roles

Greg Abel's journey within Berkshire Hathaway is a testament to his dedication and capabilities. His Berkshire Hathaway career showcases a steady climb through various roles of increasing responsibility, providing him with invaluable experience across diverse sectors.

- Early Roles: Abel initially held positions demonstrating his operational and financial expertise within the company's diverse portfolio of businesses.

- Energy and Utilities: He gained significant experience leading Berkshire Hathaway Energy, overseeing its growth and strategic acquisitions. This provided him with deep insights into managing large-scale operations and navigating complex regulatory environments. His achievements in this sector cemented his reputation as a highly effective executive.

- Key Leadership Positions: His ascension to Vice Chairman, alongside Ajit Jain, further solidified his standing within the organization, positioning him as a key figure in the company's strategic decision-making processes. This managerial experience prepared him for the immense responsibility of leading Berkshire Hathaway.

Demonstrated Leadership and Management Skills

Abel's success is not solely based on his technical expertise but also on his proven leadership and management skills. His executive leadership style is characterized by:

- Strategic Vision: He consistently demonstrates a clear understanding of the market and the ability to formulate and execute long-term strategies that drive growth and profitability.

- Operational Excellence: Abel has a knack for improving operational efficiency and streamlining processes, maximizing the performance of Berkshire Hathaway's diverse subsidiaries.

- Team Building: He fosters a collaborative work environment, motivating and empowering his teams to achieve ambitious goals. This has been crucial in integrating acquired companies and fostering a unified corporate culture.

- Financial Acumen: His profound understanding of finance and investment principles is evident in his success in leading Berkshire Hathaway Energy, a testament to his ability to manage significant financial resources effectively.

Abel's Management Style and Vision for Berkshire Hathaway

Comparison with Warren Buffett's Approach

While it's impossible to perfectly replicate Warren Buffett's unique investment philosophy, Abel's leadership style incorporates elements of continuity while also hinting at potential future changes.

- Shared Values: Both share a focus on long-term value creation, responsible investing, and a commitment to the company's long-term success.

- Different Approaches: Buffett's approach is more hands-on, while Abel might adopt a more delegated approach, leveraging the expertise of Berkshire Hathaway's diverse leadership team. This could result in a more decentralized structure while maintaining the core values of the company.

- Buffett's Legacy: Abel recognizes and respects Buffett's legacy, emphasizing continuity in the core principles that have driven Berkshire Hathaway's success. He is likely to build upon that foundation rather than drastically altering the company’s direction.

Potential Future Strategies and Initiatives under Abel's Leadership

Abel's leadership could usher in a new era for Berkshire Hathaway, characterized by:

- Future Investment Strategies: While maintaining a focus on value investing, Abel might explore new investment opportunities in emerging sectors such as renewable energy and technology, building upon the existing strengths of the company.

- Business Diversification: While Berkshire Hathaway already boasts a diverse portfolio, Abel may seek opportunities for strategic diversification, expanding into new and potentially high-growth markets.

- Growth Opportunities: He's likely to focus on identifying and capitalizing on growth opportunities within existing businesses, enhancing operational efficiency and expanding market share.

- Sustainable Business Practices: Increasingly, investors are prioritizing ESG (Environmental, Social, and Governance) factors. Abel’s leadership may see a more pronounced emphasis on integrating sustainable business practices across Berkshire Hathaway's operations.

The Significance of a Smooth Transition and the Challenges Ahead

Maintaining Investor Confidence and Market Stability

The transition from Warren Buffett to Greg Abel is critical for maintaining investor confidence and market stability.

- Investor Relations: Clear and consistent communication with investors is paramount during this transition phase to address any concerns and maintain market confidence.

- Market Volatility: Market reactions are to be expected, and strategies for mitigating potential volatility must be proactively implemented.

- Seamless Transition: A well-planned and meticulously executed transition minimizes disruption, safeguarding Berkshire Hathaway's long-term stability.

Addressing Future Challenges Facing Berkshire Hathaway

Berkshire Hathaway faces numerous challenges in the years ahead:

- Economic Uncertainty: Navigating economic downturns and global uncertainties requires strategic foresight and adaptability, characteristics Abel has already demonstrated.

- Competitive Landscape: Intense competition in various sectors necessitates a proactive approach to innovation, diversification, and strategic partnerships.

- Regulatory Compliance: Adherence to evolving regulatory frameworks across different sectors is crucial to maintain compliance and avoid legal issues.

- Future Challenges: Unforeseen challenges are inevitable, and effective risk management is crucial to navigating these obstacles successfully. Abel's experience in crisis management will be instrumental in these moments.

Conclusion: Greg Abel and the Future of Berkshire Hathaway

Greg Abel's deep experience within Berkshire Hathaway, his proven leadership abilities, and his commitment to the company's core values position him ideally to lead the organization into the future. The success of the succession planning hinges on a smooth transition, maintaining investor confidence, and navigating the considerable challenges that lie ahead. Understanding Greg Abel's role in shaping the future of this iconic company is crucial for investors and business leaders alike. To learn more about Greg Abel and Berkshire Hathaway's future, explore resources such as Berkshire Hathaway's investor relations website and reputable financial news sources. Understanding the Berkshire Hathaway succession plan and the role of Greg Abel is key to grasping the future of this investment giant.

Featured Posts

-

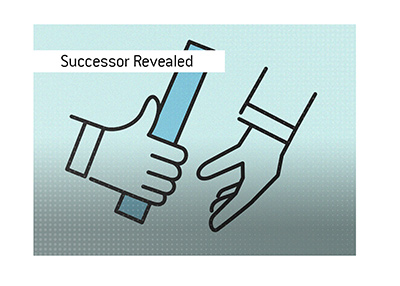

Broadcoms V Mware Acquisition At And T Highlights Extreme Price Increase

May 06, 2025

Broadcoms V Mware Acquisition At And T Highlights Extreme Price Increase

May 06, 2025 -

1050 V Mware Price Hike At And T Sounds Alarm On Broadcoms Acquisition

May 06, 2025

1050 V Mware Price Hike At And T Sounds Alarm On Broadcoms Acquisition

May 06, 2025 -

Fortnite Season 8 Music Festival Features Sabrina Carpenter

May 06, 2025

Fortnite Season 8 Music Festival Features Sabrina Carpenter

May 06, 2025 -

Halle Bailey And Ddg Feud Intensifies New Diss Track Surfaces

May 06, 2025

Halle Bailey And Ddg Feud Intensifies New Diss Track Surfaces

May 06, 2025 -

Constitutional Adherence Trump States I Dont Know

May 06, 2025

Constitutional Adherence Trump States I Dont Know

May 06, 2025

Latest Posts

-

Virtual Concert Sabrina Carpenter Headlines Fortnite Festival

May 06, 2025

Virtual Concert Sabrina Carpenter Headlines Fortnite Festival

May 06, 2025 -

Sabrina Carpenters Fortnite Performance Details And Fan Reactions

May 06, 2025

Sabrina Carpenters Fortnite Performance Details And Fan Reactions

May 06, 2025 -

Fortnite Season 8 Music Festival Features Sabrina Carpenter

May 06, 2025

Fortnite Season 8 Music Festival Features Sabrina Carpenter

May 06, 2025 -

Fortnites Next Big Event Sabrina Carpenters Virtual Concert

May 06, 2025

Fortnites Next Big Event Sabrina Carpenters Virtual Concert

May 06, 2025 -

Fortnite Season 8 Sabrina Carpenter Confirmed As Headliner

May 06, 2025

Fortnite Season 8 Sabrina Carpenter Confirmed As Headliner

May 06, 2025