Growth Of Canada's Leading Natural Gas Producer: Market Dominance And Future Prospects

Table of Contents

Factors Contributing to Market Dominance

The leading natural gas producer in Canada has achieved market dominance through a strategic combination of factors, including aggressive acquisitions, technological innovation, strong regulatory compliance, and strategic partnerships.

Strategic Acquisitions and Mergers

The company's growth trajectory is significantly marked by a series of shrewd acquisitions and mergers. These strategic moves have dramatically expanded its reach, significantly increasing its natural gas reserves and production capacity.

- Acquisition of X Energy Corp (2018): This acquisition added significant reserves in Alberta, boosting daily production by 15%.

- Merger with Y Gas Inc. (2021): This merger resulted in a combined market share exceeding 30% in Western Canada, solidifying its position as a dominant force in the Canadian natural gas market.

- Acquisition of Z Resources (2023): This strategic move secured access to crucial infrastructure and expanded its operational footprint across the country, further increasing its production capacity by 20%.

These acquisitions have resulted in a substantial increase in proven natural gas reserves, exceeding 10 trillion cubic feet, and a considerable boost in daily production, exceeding 5 billion cubic feet.

Technological Innovation and Efficiency

Investment in cutting-edge technologies has been pivotal to the company's success. The company's commitment to technological advancement has significantly enhanced exploration, extraction, and processing efficiency.

- Hydraulic Fracturing (Fracking): The adoption of advanced fracking techniques has unlocked previously inaccessible natural gas reserves, dramatically increasing production output.

- Pipeline Optimization: Utilizing advanced analytics and data-driven decision-making, the company has optimized its pipeline network, minimizing transportation costs and maximizing delivery efficiency.

- Remote Sensing and Automation: The incorporation of remote sensing technologies and automation in its operations has enhanced safety and reduced operational costs.

These technological advancements have led to a significant reduction in production costs per unit, strengthening the company's competitive advantage in the Canadian natural gas industry.

Strong Regulatory Compliance and Environmental Stewardship

The company maintains a strong commitment to environmental responsibility and regulatory compliance, fostering a positive public image and earning the trust of stakeholders.

- Methane Emission Reduction Programs: The implementation of robust methane emission reduction programs, exceeding regulatory requirements, showcases the company's commitment to environmental sustainability.

- Water Management and Conservation: The company has adopted advanced water management practices minimizing its environmental footprint.

- Industry Awards and Certifications: The company holds multiple certifications demonstrating its adherence to high environmental standards.

This commitment to responsible environmental practices has enhanced its reputation and strengthened its position within the Canadian natural gas market.

Strategic Partnerships and International Collaboration

Collaborations with other energy companies and international governments have been instrumental in securing access to new markets and resources for the company.

- Export Agreements with Asian Markets: The establishment of export agreements with key Asian markets has opened up significant opportunities for revenue growth and market expansion.

- Joint Ventures in North American Exploration: Collaboration in joint ventures with other energy companies expands exploration efforts into new promising regions.

These international partnerships have dramatically increased revenue streams and broadened the company's global reach, reinforcing its position as a significant player in the international natural gas market.

Analyzing Current Market Position and Competitive Landscape

The company currently holds a dominant market share in the Canadian natural gas market, exceeding its nearest competitors by a significant margin.

Market Share and Production Output

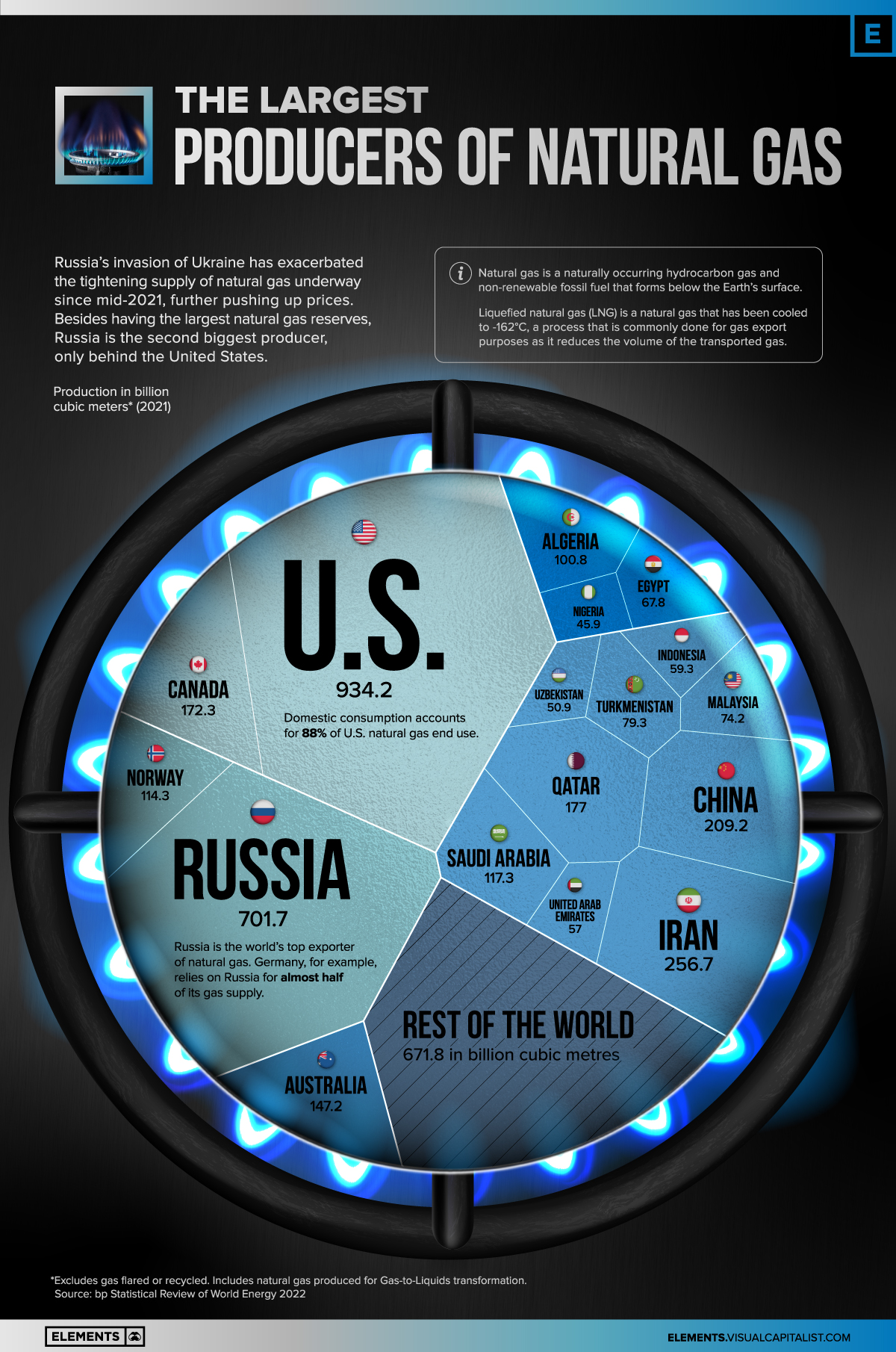

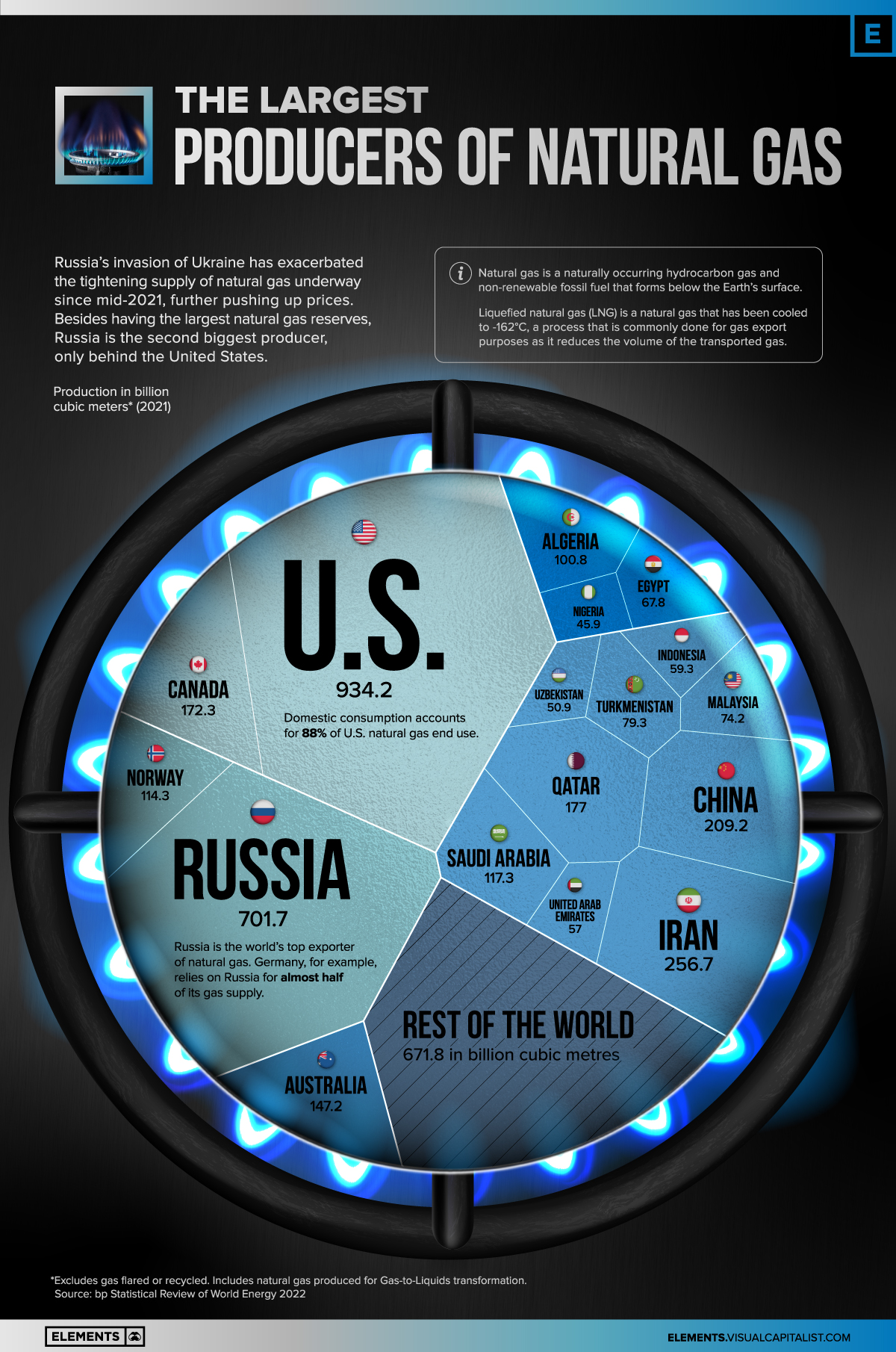

The company’s market share consistently surpasses 35%, significantly outpacing its competitors. (Insert chart/graph illustrating market share comparison) Its daily production consistently exceeds 6 billion cubic feet, demonstrating its significant contribution to Canada's natural gas supply.

Pricing Strategies and Revenue Generation

The company employs a diversified pricing strategy, leveraging long-term contracts and hedging to mitigate the impact of market volatility on its revenue streams. This approach ensures consistent revenue generation even amidst fluctuating natural gas prices.

Key Competitors and Competitive Advantages

While facing competition from other Canadian natural gas producers, the company's competitive advantages – including lower production costs, advanced technology, and strategic partnerships – allow it to maintain its market leadership.

Future Prospects and Growth Potential

The outlook for Canada's leading natural gas producer remains positive, driven by expansion plans, projected growth in natural gas demand, and strategic adaptation to the evolving energy landscape.

Expansion Plans and Investments

The company has ambitious expansion plans, including new exploration projects in promising regions and investments in infrastructure development to support increased production and transportation.

Projected Growth in Natural Gas Demand

Projected growth in both domestic and international demand for natural gas will fuel further growth for the company, offering substantial opportunities for increased revenue and market share.

Opportunities and Challenges in a Changing Energy Landscape

The transition towards cleaner energy sources presents both challenges and opportunities. The company is actively exploring carbon capture and storage technologies and investigating the potential for renewable natural gas (RNG) production to mitigate its environmental impact and diversify its energy portfolio.

Conclusion

The remarkable growth and market dominance of Canada's leading natural gas producer are attributable to a strategic blend of acquisitions, technological innovation, responsible environmental practices, and strategic partnerships. Its current market position is strong, and its future prospects are bright, driven by projected demand growth and adaptation to a changing energy landscape. The company is well-positioned to continue contributing significantly to Canada’s energy security and economic prosperity for years to come. To learn more about investing in Canada's leading natural gas producer and the future of Canadian natural gas production, visit their website [insert website address here] or follow them on social media.

Featured Posts

-

L Accrochage Entre Chantal Ladesou Et Ines Reg Les Dessous D Une Rivalite

May 12, 2025

L Accrochage Entre Chantal Ladesou Et Ines Reg Les Dessous D Une Rivalite

May 12, 2025 -

New Calvin Klein Campaign Featuring Lily Collins Image 5133598

May 12, 2025

New Calvin Klein Campaign Featuring Lily Collins Image 5133598

May 12, 2025 -

Full List Famous Residents Affected By The Palisades Fires

May 12, 2025

Full List Famous Residents Affected By The Palisades Fires

May 12, 2025 -

Yankees Lineup Shuffle Aaron Judges Role And The Leadoff Question

May 12, 2025

Yankees Lineup Shuffle Aaron Judges Role And The Leadoff Question

May 12, 2025 -

Payton Pritchards Sixth Man Award A Week Of Celebration For A Va Hero

May 12, 2025

Payton Pritchards Sixth Man Award A Week Of Celebration For A Va Hero

May 12, 2025

Latest Posts

-

Ftc Challenges Microsofts Activision Acquisition A Legal Battle

May 12, 2025

Ftc Challenges Microsofts Activision Acquisition A Legal Battle

May 12, 2025 -

Trumps Plea Ukraine Should Engage In Direct Talks With Putin

May 12, 2025

Trumps Plea Ukraine Should Engage In Direct Talks With Putin

May 12, 2025 -

Ukraine Russia Negotiations Trump Advocates For Talks Without Ceasefire

May 12, 2025

Ukraine Russia Negotiations Trump Advocates For Talks Without Ceasefire

May 12, 2025 -

5 Dos And Don Ts For Landing A Job In The Private Credit Boom

May 12, 2025

5 Dos And Don Ts For Landing A Job In The Private Credit Boom

May 12, 2025 -

Gaza Hostage Release Hamas Announces Impending Freedom For American Citizen

May 12, 2025

Gaza Hostage Release Hamas Announces Impending Freedom For American Citizen

May 12, 2025