High Stock Market Valuations: A BofA Analysis And Investor Guidance

Table of Contents

BofA's Assessment of Current High Stock Market Valuations

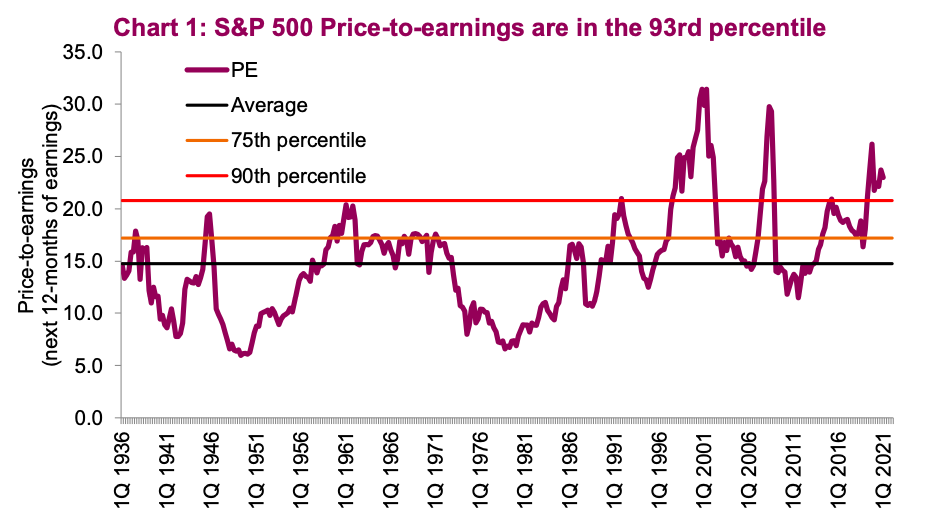

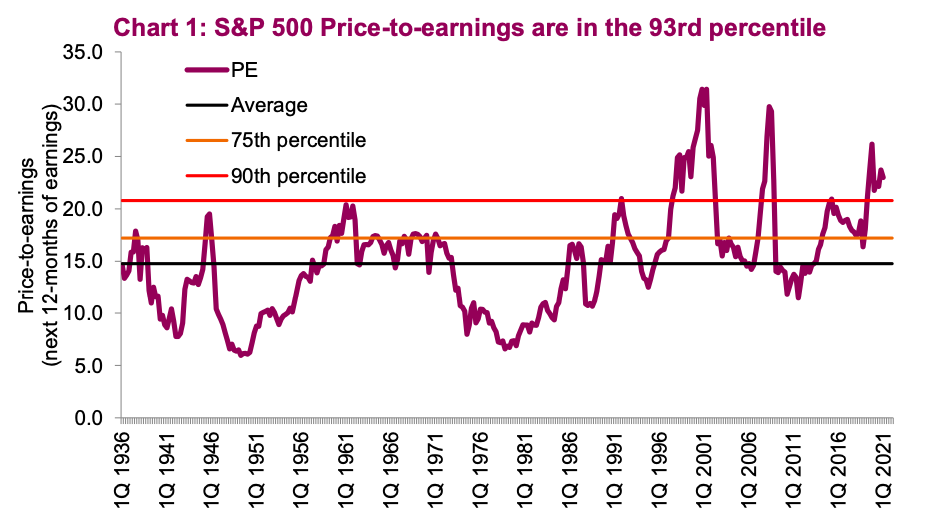

Bank of America's research consistently highlights elevated market valuations. Their analysis employs various valuation metrics, including the widely used Price-to-Earnings ratio (P/E), the cyclically adjusted price-to-earnings ratio (CAPE, also known as the Shiller P/E), and other forward-looking indicators. These metrics compare current market prices to historical earnings and projected future earnings, offering a comprehensive view of market valuation.

- Summary of BofA's valuation models and their conclusions: BofA's models frequently indicate that current market valuations are above historical averages, suggesting a potentially elevated risk. Their conclusions often emphasize the need for caution and a well-diversified investment strategy.

- Key indicators used in BofA's analysis (e.g., forward P/E ratios, dividend yields): BofA utilizes a range of indicators, including forward P/E ratios (which look at projected future earnings) and dividend yields (which assess the return on investment from dividends). These provide a more nuanced understanding of valuation than relying on a single metric.

- Comparison to historical valuations and market cycles: BofA's reports typically compare current valuations to those observed during previous market cycles, highlighting periods of high valuations followed by corrections or bear markets. This historical context is crucial for gauging the potential risks.

- BofA's outlook on future market performance based on valuation analysis: While BofA does not offer definitive predictions, their valuation analysis frequently suggests that the potential for future returns may be lower than in periods of lower valuations, implying a higher risk-adjusted return is needed for investors.

Factors Contributing to High Stock Market Valuations

Several macroeconomic factors contribute to the current environment of high stock market valuations.

- Impact of low interest rates on discounted cash flow models and investor appetite for risk: Low interest rates reduce the discount rate used in discounted cash flow models, leading to higher valuations for stocks. Simultaneously, low interest rates incentivize investors to seek higher returns in the stock market, increasing demand and pushing prices upwards. This is a significant driver of inflated stock prices.

- Role of quantitative easing and monetary policy on asset prices: Central banks' quantitative easing (QE) programs, involving large-scale asset purchases, have injected liquidity into the market, supporting asset prices, including stocks. This monetary policy has indirectly fueled high stock market valuations.

- Influence of strong corporate earnings growth (where applicable) on valuations: While some sectors have experienced strong earnings growth, this is not uniform across all industries. Strong earnings in specific sectors can contribute to higher valuations within those sectors but doesn't necessarily justify high valuations across the entire market. It's crucial to analyze earnings on a sector-by-sector basis.

- Analysis of investor behavior and market psychology: Investor sentiment, exuberance, and the "fear of missing out" (FOMO) can significantly drive market prices beyond fundamental valuations, leading to bubbles and unsustainable growth. This psychological aspect plays a major role in periods of high stock market valuations.

Risks Associated with High Stock Market Valuations

Investing in a market with high stock market valuations presents considerable risks.

- Risk of a market correction or crash: High valuations often precede market corrections or crashes, where prices experience a sharp decline. This risk is heightened when valuations are significantly above historical averages.

- Potential for increased market volatility: Markets with high valuations tend to be more volatile, experiencing larger price swings in both directions. This increased volatility creates uncertainty and potential losses for investors.

- Lower expected returns compared to historically lower valuations: When valuations are high, the potential for future returns is typically lower than when valuations are low. Investors may need to accept higher risk for similar returns.

- Sector-specific risks and vulnerabilities: High valuations don't apply uniformly across all sectors. Some sectors may be overvalued relative to others, creating sector-specific risks.

Strategies for Navigating High Stock Market Valuations

Investors can adopt several strategies to manage their portfolios in a market characterized by high stock market valuations.

- Importance of portfolio diversification across asset classes: Diversification is paramount. Spreading investments across different asset classes (stocks, bonds, real estate, etc.) can reduce overall portfolio risk.

- Strategies for identifying undervalued stocks (value investing): Value investing focuses on identifying companies trading below their intrinsic value. This approach can help mitigate some of the risks associated with high market valuations.

- Benefits of investing in dividend-paying stocks for income generation: Dividend-paying stocks offer a steady income stream, which can be valuable in a volatile market.

- Exploring alternative investments to reduce overall market exposure (e.g., bonds, real estate): Allocating a portion of the portfolio to less correlated asset classes can reduce overall market risk.

- Importance of a long-term investment strategy: A long-term perspective is crucial. Short-term market fluctuations should not dictate long-term investment decisions.

Conclusion

BofA's analysis, along with other indicators, consistently suggests elevated high stock market valuations. While these valuations present challenges, understanding the factors driving them and adopting a prudent investment strategy is crucial. Diversification, value investing, and incorporating alternative investments are key strategies to navigate this environment. Remember that high stock market valuations don't necessarily signal an immediate crash but highlight a heightened risk environment. Continue to monitor market trends and seek professional financial advice to manage your portfolio effectively. Don't hesitate to research further into high stock market valuations and their implications for your personal investment plan.

Featured Posts

-

La Fires Price Gouging Allegations Surface Amidst Housing Crisis

May 10, 2025

La Fires Price Gouging Allegations Surface Amidst Housing Crisis

May 10, 2025 -

25 Million Shortfall Analysing West Hams Financial Situation

May 10, 2025

25 Million Shortfall Analysing West Hams Financial Situation

May 10, 2025 -

Harry Styles Reacts To A Critically Bad Snl Impression

May 10, 2025

Harry Styles Reacts To A Critically Bad Snl Impression

May 10, 2025 -

Understanding Trumps Nomination Of Casey Means As Surgeon General

May 10, 2025

Understanding Trumps Nomination Of Casey Means As Surgeon General

May 10, 2025 -

Indian Stock Market Update Sensex And Nifty Performance For Today

May 10, 2025

Indian Stock Market Update Sensex And Nifty Performance For Today

May 10, 2025