High Stock Market Valuations: Why BofA Thinks Investors Shouldn't Worry

Table of Contents

BofA's Rationale: Why High Valuations Aren't Necessarily a Bear Market Signal

BofA's analysts argue that current high stock market valuations, while undeniably high, don't automatically signal an impending bear market. Their assessment hinges on several key factors contributing to a more optimistic outlook.

-

Low Interest Rates: Persistently low interest rates globally provide a supportive environment for equity investments. These low rates make borrowing cheaper for companies, fueling investment and growth, and increase the relative attractiveness of stocks compared to bonds. BofA's analysis suggests that this supportive interest rate environment is likely to persist for some time.

-

Strong Corporate Earnings: Many companies are reporting robust earnings, exceeding expectations and demonstrating resilience even amidst economic uncertainty. BofA's research highlights specific sectors exhibiting exceptional strength, contributing to the overall market valuations.

-

Robust Economic Growth (in certain sectors): Although global economic growth is uneven, specific sectors show surprising strength, justifying, according to BofA, the higher valuations in those areas. This positive economic momentum, they argue, supports continued growth in corporate profits.

-

Specific BofA Reports: Specific reports from BofA Global Research, citing detailed analysis of earnings and economic forecasts, underpin their assessment. These reports emphasize the long-term growth potential of the market despite the high valuations.

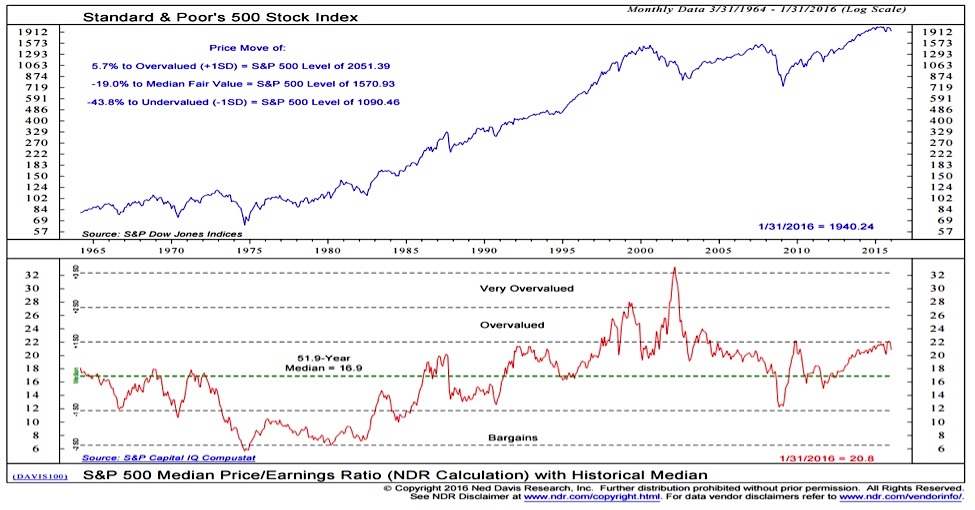

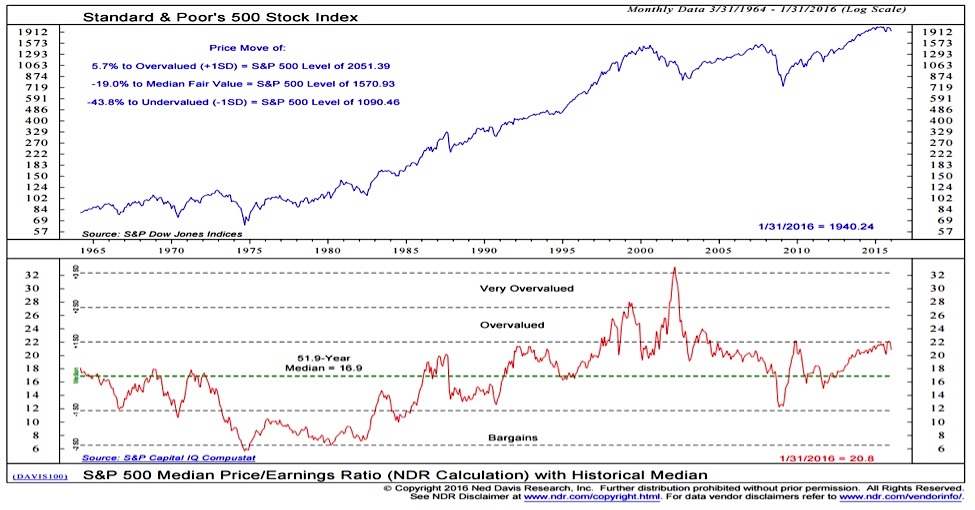

BofA's argument centers on the idea that strong fundamentals, while supporting higher valuations, aren't necessarily unsustainable. The long-term growth prospects of many companies, they argue, justify these valuations. Focusing solely on the price-to-earnings ratio without considering these underlying factors would, according to their analysis, present an incomplete picture.

Understanding the Current Economic Landscape and Its Impact on Valuations

The current macroeconomic environment is complex and plays a significant role in shaping stock market valuations. Several key indicators deserve close attention:

-

Inflation: While inflation is a concern, BofA's analysis suggests that current inflation rates aren't necessarily unsustainable and are being managed by central banks. This assessment helps to contextualize the potential impact on corporate earnings and market growth.

-

Unemployment: Low unemployment figures generally indicate a strong economy, supporting consumer spending and driving corporate profits, factors which can help sustain higher stock market valuations. BofA's research integrates these employment figures into their overall valuation assessment.

-

GDP Growth: GDP growth figures, while fluctuating, show some regions exhibiting significant strength, providing further support for BofA's optimism.

-

Comparison to Past Cycles: Comparing the current economic indicators and market valuations to past economic cycles provides valuable context. BofA analysts utilize this historical perspective to temper concerns about the current high valuations.

The correlation between robust economic fundamentals and higher stock market valuations is a key element of BofA's argument. Strong economic indicators, particularly when coupled with healthy corporate earnings, can reasonably justify higher valuations from a long-term perspective.

Alternative Investment Strategies for Navigating High Valuations

Even with BofA's optimistic outlook, investors should employ prudent strategies to manage risk in a market with high valuations:

-

Diversification: Diversifying across asset classes – including bonds, real estate, and alternative investments – is crucial. This reduces reliance on any single asset class and helps mitigate potential losses.

-

Value Investing: Focusing on value investing, identifying undervalued companies with strong fundamentals, can offer opportunities to capitalize on market inefficiencies. Value investing principles are especially relevant in markets characterized by high valuations.

-

Growth Stocks with Strong Fundamentals: While valuations are high across the board, selectively investing in growth stocks with demonstrably strong fundamentals can mitigate some of the associated risk.

-

Risk Management: Implementing risk management strategies like stop-loss orders (to limit potential losses) and dollar-cost averaging (to reduce the impact of market volatility) remains essential, even in a bullish environment.

These strategies allow investors to balance risk and reward, ensuring that they are positioned to benefit from potential market growth while mitigating the risks inherent in high valuation markets.

Addressing Common Investor Concerns Regarding High Stock Market Valuations

Many investors harbor concerns about high stock market valuations, fearing a market bubble or sharp correction. BofA directly addresses these anxieties:

-

Market Bubble Fears: BofA counters the "market bubble" narrative by highlighting the robust fundamentals supporting many companies. Their analysis suggests that current valuations, while elevated, aren't solely driven by speculative fervor.

-

Potential for a Sharp Correction: While acknowledging the possibility of a correction, BofA's research points to the mitigating factors – low interest rates, strong corporate earnings, and, in certain sectors, robust economic growth – which should lessen the severity of any potential downturn.

-

Balanced Perspective: BofA presents a balanced perspective, acknowledging the risks while focusing on the potential for continued growth. This approach helps investors understand the complexities of the situation.

BofA's counterarguments are supported by rigorous data analysis and extensive research, offering investors a more nuanced and informed perspective on the market situation.

Conclusion: High Stock Market Valuations – A Cautious Optimism

BofA's analysis suggests that while high stock market valuations are a reality, they don't automatically signal impending doom. Factors like low interest rates, strong corporate earnings, and, in specific areas, robust economic growth contribute to a cautiously optimistic outlook. The bank encourages investors to consider these factors in their investment decisions. While acknowledging inherent risks, BofA's research provides a valuable framework for understanding the current market landscape. Don't let concerns about high stock market valuations paralyze you. Carefully assess your investment strategy and explore the insights provided by BofA's research to make informed decisions.

Featured Posts

-

Polski Nitro Chem Najwiekszy Europejski Producent Trotylu

May 06, 2025

Polski Nitro Chem Najwiekszy Europejski Producent Trotylu

May 06, 2025 -

Warren Buffetts Greatest Investing Wins And Losses Key Lessons Learned

May 06, 2025

Warren Buffetts Greatest Investing Wins And Losses Key Lessons Learned

May 06, 2025 -

Sheins Ipo Plans In London Face Setback Due To Us Tariffs

May 06, 2025

Sheins Ipo Plans In London Face Setback Due To Us Tariffs

May 06, 2025 -

Fortnites Next Big Event Sabrina Carpenters Virtual Concert

May 06, 2025

Fortnites Next Big Event Sabrina Carpenters Virtual Concert

May 06, 2025 -

Blue Origins Rocket Launch Abruptly Halted By Subsystem Failure

May 06, 2025

Blue Origins Rocket Launch Abruptly Halted By Subsystem Failure

May 06, 2025

Latest Posts

-

Sabrina Carpenters Fun Size Friend Joins Her For Snl Performance

May 06, 2025

Sabrina Carpenters Fun Size Friend Joins Her For Snl Performance

May 06, 2025 -

Snl Sabrina Carpenter Teams Up With Fun Size Castmate

May 06, 2025

Snl Sabrina Carpenter Teams Up With Fun Size Castmate

May 06, 2025 -

Sabrina Carpenter Headline Gig A 6 99 Festival Ticket Breakdown

May 06, 2025

Sabrina Carpenter Headline Gig A 6 99 Festival Ticket Breakdown

May 06, 2025 -

6 99 Festival Featuring Sabrina Carpenter What You Need To Know

May 06, 2025

6 99 Festival Featuring Sabrina Carpenter What You Need To Know

May 06, 2025 -

Sabrina Carpenter And Fun Size Co Star Surprise Snl Audience

May 06, 2025

Sabrina Carpenter And Fun Size Co Star Surprise Snl Audience

May 06, 2025