HMRC Letters To UK Households Earning Over £23,000: What You Need To Know

Table of Contents

Common Reasons for HMRC Letters to Higher Earners

HMRC contacts individuals earning over £23,000 for various reasons, many relating to self-assessment and tax compliance. Understanding why you've received a letter is the first step to a successful resolution. Here are some common causes:

-

Tax Return Discrepancies (Self-Assessment Inaccuracies): Errors in your self-assessment tax return are a frequent reason for HMRC contact. This could involve incorrect income declarations, expenses claimed, or capital gains reporting. Addressing these discrepancies promptly is crucial.

-

Missing Tax Returns or Late Filing Penalties: Failing to submit your self-assessment tax return by the deadline results in automatic penalties. HMRC letters often highlight these outstanding returns and associated penalties. Understanding the self-assessment tax return deadlines is vital.

-

Changes to Tax Codes or Allowances: Changes in your employment, personal circumstances, or tax legislation can lead to adjustments in your tax code. HMRC might inform you of these changes and their implications for your tax liability.

-

National Insurance Contributions Inquiries: HMRC might contact you regarding potential discrepancies in your National Insurance contributions, particularly if you're self-employed or have multiple sources of income.

-

Investigation into Potential Tax Avoidance: In more serious cases, HMRC might investigate potential tax avoidance schemes or deliberate non-compliance. This usually involves a more thorough investigation and requires professional tax advice. Keywords: HMRC enquiry, tax investigation.

Deciphering the Language of HMRC Letters

HMRC letters can seem daunting, filled with complex terminology and official language. Understanding the structure and common phrases is essential for a timely and appropriate response.

-

Typical Structure: HMRC letters generally start with a reference number, your details, and the reason for contact. They clearly outline the issue and what action is required.

-

Key Phrases and Abbreviations: Look out for phrases like "underpayment," "outstanding tax," "penalty," "tax code," and "self-assessment." Familiarizing yourself with HMRC terminology, including abbreviations like PAYE (Pay As You Earn) and NIC (National Insurance Contributions), is crucial.

-

Simple Explanations of Complex Tax Terms: If you encounter unfamiliar terms, use HMRC's online resources or seek help from a tax professional to understand the implications.

How to Respond to an HMRC Letter

Responding promptly and appropriately to an HMRC letter is critical. Ignoring it will only worsen the situation.

-

Timely Responses: Always adhere to the response deadlines specified in the letter. Late responses can lead to further penalties.

-

Response Methods: You can usually respond through the HMRC online portal, by post, or, in some cases, by telephone. The preferred method will be specified in the letter.

-

Seeking Professional Help: If the letter is complex or you're unsure how to proceed, don't hesitate to seek help from a qualified accountant or tax advisor. They can guide you through the process and represent you with HMRC. Keywords: HMRC response deadlines, tax advisor, accountant, HMRC online services.

Avoiding Future HMRC Correspondence

Proactive tax planning and accurate record-keeping are essential to minimise the risk of future HMRC letters.

-

Accurate Record-Keeping: Maintain detailed records of all income, expenses, and tax-relevant transactions. This will simplify the self-assessment process and reduce the chance of errors.

-

Filing Tax Returns on Time: Always submit your self-assessment tax return by the deadline. Plan ahead and allow sufficient time for preparation.

-

Understanding Tax Obligations: Stay informed about your tax obligations and any changes to tax laws. Utilize HMRC's online resources and seek professional advice if needed.

-

Seeking Professional Tax Advice Regularly: Regular consultations with a tax advisor can help you understand your tax liabilities, plan effectively, and avoid potential issues. Keywords: preventing HMRC letters, avoiding tax problems, accurate tax records, tax planning.

Conclusion: Taking Control of Your Tax Affairs

Receiving an HMRC letter can be stressful, but understanding the reasons behind it and responding promptly can alleviate the pressure. This article has highlighted common reasons for HMRC letters to UK households earning over £23,000, how to understand the correspondence, and the importance of timely responses. Remember, accurate record-keeping, timely tax returns, and seeking professional help when needed are key to avoiding future correspondence. Don't ignore those HMRC letters! Understand your tax obligations and take control of your finances. Learn more about managing your tax affairs and avoiding future HMRC letters to UK households earning over £23,000.

Featured Posts

-

How Climate Change Could Impact Your Mortgage Application And Credit Score

May 20, 2025

How Climate Change Could Impact Your Mortgage Application And Credit Score

May 20, 2025 -

D Wave Quantum Qbts Stock Price Increase Monday News And Market Analysis

May 20, 2025

D Wave Quantum Qbts Stock Price Increase Monday News And Market Analysis

May 20, 2025 -

Unraveling The Mysteries A Look At Agatha Christies Poirot Stories

May 20, 2025

Unraveling The Mysteries A Look At Agatha Christies Poirot Stories

May 20, 2025 -

Hmrc System Failure Thousands Affected By Website Crash In Uk

May 20, 2025

Hmrc System Failure Thousands Affected By Website Crash In Uk

May 20, 2025 -

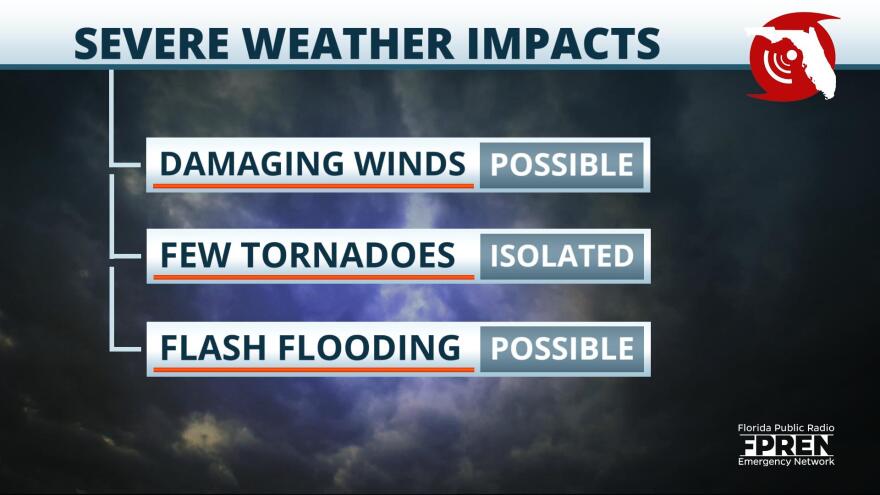

Fast Moving Storms Assessing The Risk Of Damaging Winds

May 20, 2025

Fast Moving Storms Assessing The Risk Of Damaging Winds

May 20, 2025