HMRC Website Crash: Hundreds Unable To Access Accounts Across UK

Table of Contents

Extent of the HMRC Website Outage

The HMRC website crash affected a significant portion of the UK population, impacting both individual taxpayers and businesses.

Geographic Reach

While reports indicated a nationwide impact, certain regions experienced a more pronounced disruption. Anecdotal evidence suggests higher levels of reported issues in areas like London HMRC, followed by Scotland HMRC and other major cities. The geographically widespread nature of the problem underscores the scale of the technological failure.

User Impact

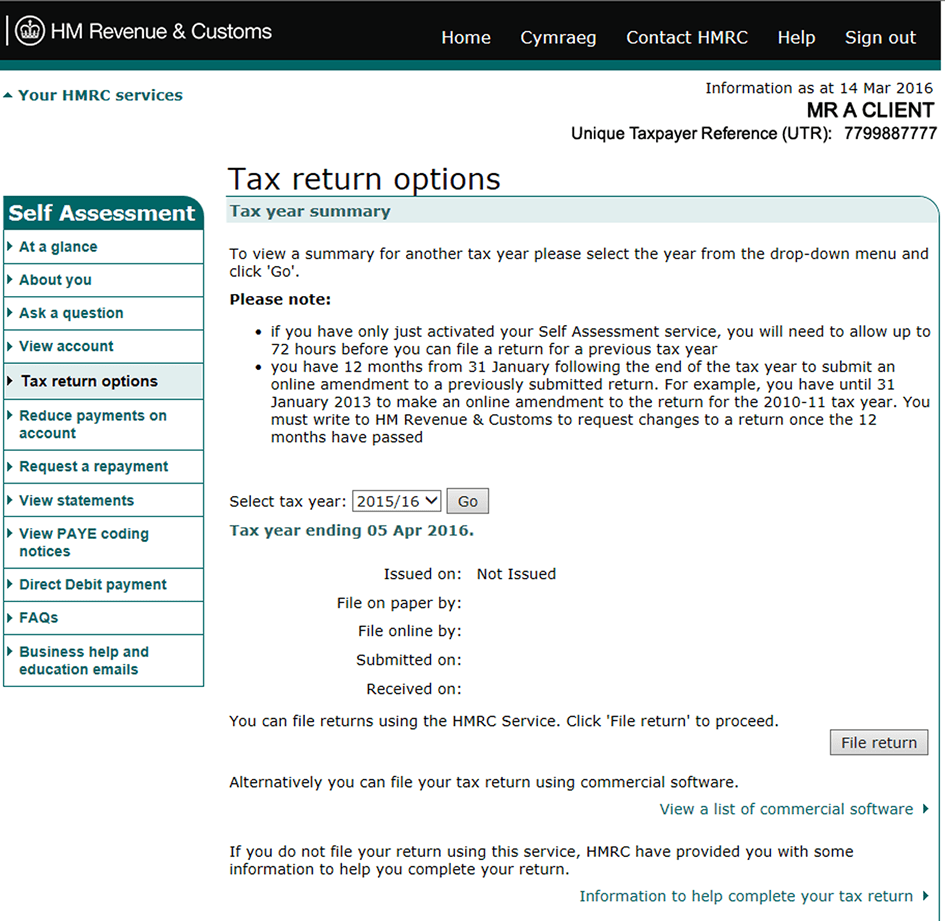

The outage affected a broad range of users relying on HMRC online services. This included:

- Individuals filing their self-assessment tax returns.

- Businesses submitting their VAT returns.

- Employees accessing their PAYE information.

- Taxpayers attempting to make online tax payments.

- Individuals seeking to access previous tax statements.

Many users reported being unable to access any online HMRC services, creating considerable anxiety and uncertainty, especially for those with impending deadlines. One user commented, "[Insert Quote from affected user if available]." HMRC released an initial statement acknowledging the issues and promising to provide further updates, though the timing of these updates was a point of contention for many affected individuals.

Potential Causes of the HMRC Website Crash

Several factors could have contributed to the HMRC website crash.

Technical Issues

The most likely explanation lies within HMRC's technical infrastructure. Potential causes include:

- Server Overload: An unexpected surge in website traffic, perhaps due to a tax deadline or a widely circulated news story, might have overwhelmed HMRC's servers, leading to a complete shutdown.

- Software Glitch: A critical software bug or a failed software update could have rendered large portions of the HMRC website inaccessible.

- DDoS Attack: While unconfirmed, the possibility of a Distributed Denial of Service (DDoS) attack, which floods a website with traffic to render it unusable, cannot be entirely ruled out.

External Factors

External factors might have also played a role, potentially exacerbating existing technical vulnerabilities:

- Third-Party Service Failure: A failure in a third-party service relied upon by HMRC's website could have triggered the outage.

HMRC's Response to the Website Crash

HMRC's response to the website crash was a key factor in determining the overall impact.

Official Statements

HMRC released several official statements throughout the outage. The initial statement acknowledged the problem, while subsequent updates provided (or failed to provide) details on the cause, the extent of the disruption, and the estimated time for restoration. The frequency and clarity of these updates were crucial factors in managing public perception and anxiety.

Communication with Affected Users

Communication with affected users was a point of significant concern. While HMRC did utilize social media, the lack of a centralized information hub and proactive communication left many taxpayers feeling frustrated and uninformed.

Tips for Avoiding Future Disruptions

To mitigate the impact of future HMRC website crashes, consider these strategies:

Planning Ahead

- File your tax returns and VAT returns well in advance of deadlines. Don't wait until the last minute.

- Set reminders for important tax dates, preventing last-minute rushes.

Utilizing Alternative Methods

- Utilize HMRC's phone lines, although expect longer wait times during peak periods.

- Consider using the postal service for submitting paperwork, though this method is slower.

Remember to monitor the HMRC website for updates and alerts regarding service disruptions.

Conclusion: Staying Informed During Future HMRC Website Issues

The HMRC website crash highlighted the significant reliance on online services for managing tax obligations and the serious consequences of widespread system failures. Potential causes ranged from server overload to unforeseen software glitches, impacting taxpayers and businesses nationwide. HMRC's response, while acknowledging the problem, could have been more proactive and transparent in communicating with affected users.

To avoid future disruption from an "HMRC website crash," plan ahead, explore alternative methods for interacting with HMRC, and actively monitor the HMRC website and their social media channels for updates. Staying informed is critical to managing your tax obligations effectively.

Featured Posts

-

Trumps Tariffs And Gretzkys Allegiance Fueling The Canada Us Statehood Discussion

May 20, 2025

Trumps Tariffs And Gretzkys Allegiance Fueling The Canada Us Statehood Discussion

May 20, 2025 -

Premijera Jutarnji List Donosi Popis Slavnih Gostiju

May 20, 2025

Premijera Jutarnji List Donosi Popis Slavnih Gostiju

May 20, 2025 -

Champions League I Kroyz Azoyl Toy Giakoymaki Diekdikei Tin Prokrisi Ston Teliko

May 20, 2025

Champions League I Kroyz Azoyl Toy Giakoymaki Diekdikei Tin Prokrisi Ston Teliko

May 20, 2025 -

Hmrc Nudge Letters E Bay Vinted And Depop Sellers Beware

May 20, 2025

Hmrc Nudge Letters E Bay Vinted And Depop Sellers Beware

May 20, 2025 -

Wwe Raw Sami Zayn Caught In The Crossfire Of Rollins And Breakker

May 20, 2025

Wwe Raw Sami Zayn Caught In The Crossfire Of Rollins And Breakker

May 20, 2025