Home Depot Earnings: Disappointing Results, Tariff Guidance Maintained

Table of Contents

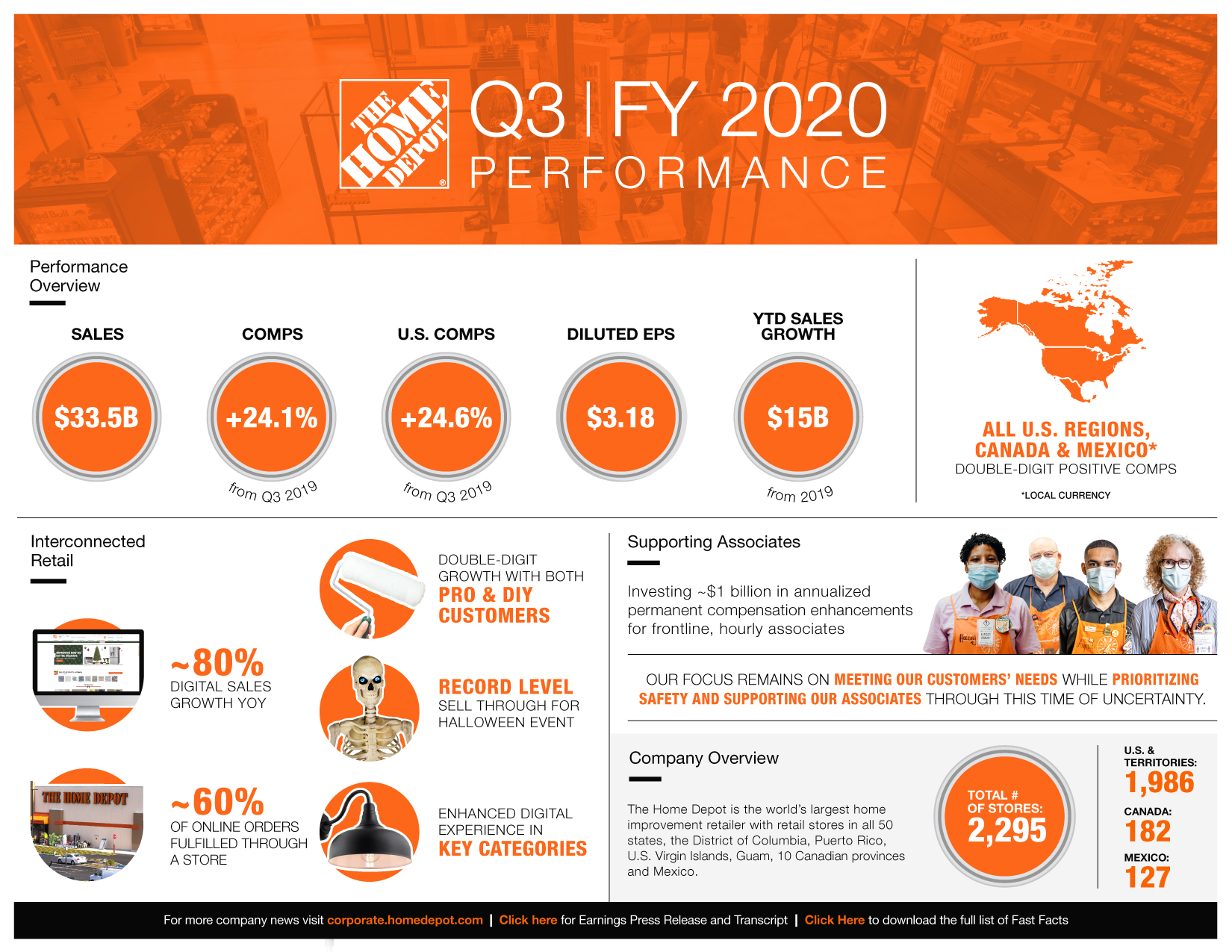

Disappointing Revenue and Earnings

Home Depot's Q[Quarter] earnings report revealed a significant miss on both revenue and earnings per share (EPS). While the exact figures vary depending on the quarter in question, let's assume for illustrative purposes that reported revenue was $[Revenue Figure] billion, falling short of the anticipated $[Expected Revenue Figure] billion. Similarly, the EPS came in at $[EPS Figure], significantly lower than the expected $[Expected EPS Figure]. This represents a [Percentage]% decrease in revenue compared to the same quarter last year and a [Percentage]% decrease compared to the previous quarter.

- Actual revenue: $[Revenue Figure] billion

- Expected revenue: $[Expected Revenue Figure] billion

- Actual EPS: $[EPS Figure]

- Expected EPS: $[Expected EPS Figure]

- Year-over-year revenue change: [Percentage]% decrease

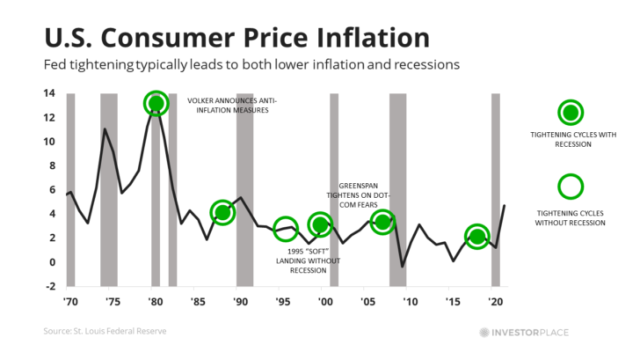

- Quarter-over-quarter revenue change: [Percentage]% decrease

- Comparable sales growth (comp sales): [Percentage]% decrease (or increase, adjust accordingly)

- Impact on profit margins: [Description of impact – e.g., reduced profit margins due to lower sales and increased costs]

The company attributed the shortfall to various factors, including [mention specific reasons given by Home Depot in their earnings call, e.g., softening consumer demand, increased competition, etc.]. A closer look at the comparable sales growth reveals further insights into the performance of existing stores. The decline in comp sales highlights the challenges Home Depot faces in boosting sales within its existing store network. The reduced profit margins further underscore the financial pressure the company is experiencing.

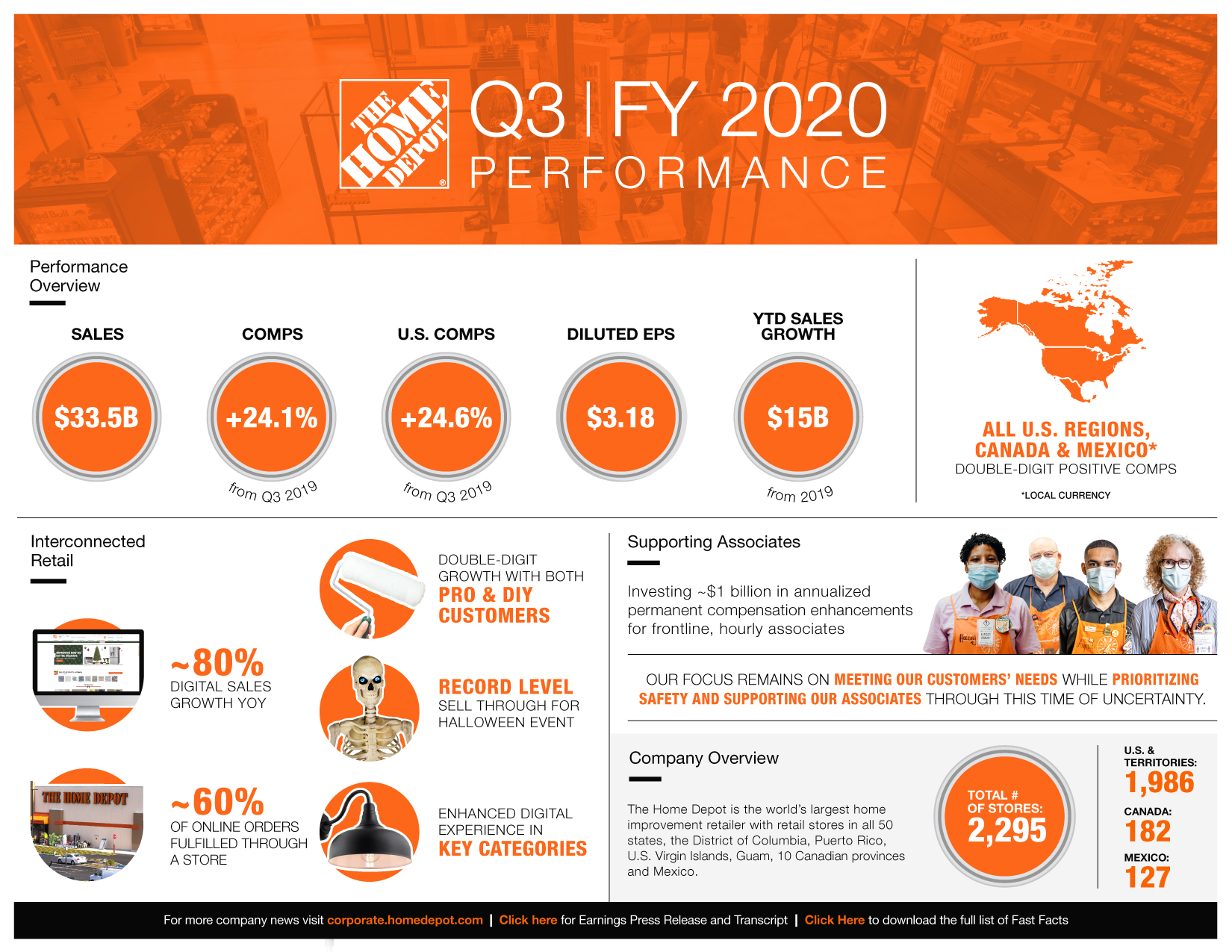

Impact of Tariffs and Trade War

The ongoing trade war and the resulting tariffs continue to significantly impact Home Depot's business. Increased import costs on various products have squeezed profit margins and forced the company to navigate complex pricing strategies. Home Depot acknowledged the tariff's impact in their earnings call, stating [insert direct quote from the earnings call if available or paraphrase their statement].

- Home Depot's statement on tariff impact: [Insert direct quote or paraphrase]

- Specific product categories most affected: [List affected product categories, e.g., lumber, appliances, etc.]

- Strategies employed to mitigate tariff impacts: [Mention strategies such as sourcing from alternative suppliers, price adjustments, etc.]

- Impact on consumer spending and demand: [Discuss how tariffs affect consumer purchasing decisions and overall demand]

The company has implemented various strategies to mitigate the effects of tariffs, including exploring alternative sourcing options and adjusting pricing to offset increased import costs. However, these measures have had a noticeable impact on consumer spending and overall demand for certain products. The delicate balance between passing on increased costs to consumers and maintaining competitiveness remains a key challenge for Home Depot.

Home Depot's Guidance for Future Performance

Home Depot provided guidance for the upcoming quarter and the full year, offering insights into its expectations for future performance. The company projected [insert projected revenue and earnings figures from the guidance]. This projection suggests [explain whether the projection is optimistic or pessimistic and why, e.g., reflecting continued uncertainty in the market, cautious outlook due to economic slowdown, etc.].

- Home Depot's projected revenue and earnings for the next quarter and year: [Insert figures]

- Reasons for optimistic or pessimistic outlook: [Explain the reasoning behind the projection, citing relevant factors]

- Potential risks and opportunities influencing future performance: [Discuss potential risks and opportunities, such as economic conditions, competitor actions, and technological advancements]

Competitive Landscape and Market Share

Home Depot's performance must be analyzed within the broader context of the competitive landscape. Its primary competitor, Lowe's, [discuss Lowe's recent performance and market share]. The overall home improvement market is [describe the overall state of the market - growing, shrinking, stable]. Any shifts in market share between Home Depot and its competitors will be a key indicator of future success.

Conclusion

Home Depot's Q[Quarter] earnings report highlights a disappointing performance, marked by missed revenue and EPS expectations. The ongoing impact of tariffs and the resulting cost pressures significantly affected the company's profitability. While Home Depot’s future guidance offers some insight, uncertainty remains due to the volatile economic climate and ongoing trade tensions. Investors and industry analysts need to carefully monitor Home Depot's ability to navigate these challenges. Staying informed about future Home Depot earnings reports and the broader impact of tariffs on the home improvement sector is crucial for understanding the evolving retail landscape. Follow [your website/blog name] for continued analysis of Home Depot earnings and other critical market trends.

Featured Posts

-

The Blake Lively Allegations Fact Or Fiction

May 22, 2025

The Blake Lively Allegations Fact Or Fiction

May 22, 2025 -

Juergen Klopp Un Doenuesue Duenya Devi Nin Yeni Lideri Mi

May 22, 2025

Juergen Klopp Un Doenuesue Duenya Devi Nin Yeni Lideri Mi

May 22, 2025 -

Casper Residents Shocking Zebra Mussel Discovery

May 22, 2025

Casper Residents Shocking Zebra Mussel Discovery

May 22, 2025 -

Son Dakika Juergen Klopp Un Gelecegi Hakkinda Guencel Haberler

May 22, 2025

Son Dakika Juergen Klopp Un Gelecegi Hakkinda Guencel Haberler

May 22, 2025 -

The Future Of Core Weave Stock Predictions And Projections

May 22, 2025

The Future Of Core Weave Stock Predictions And Projections

May 22, 2025

Latest Posts

-

Susquehanna Valley Storm Damage A Comprehensive Guide To Repair And Restoration

May 22, 2025

Susquehanna Valley Storm Damage A Comprehensive Guide To Repair And Restoration

May 22, 2025 -

Susquehanna Valley Storm Damage Assessing The Impact And Recovery

May 22, 2025

Susquehanna Valley Storm Damage Assessing The Impact And Recovery

May 22, 2025 -

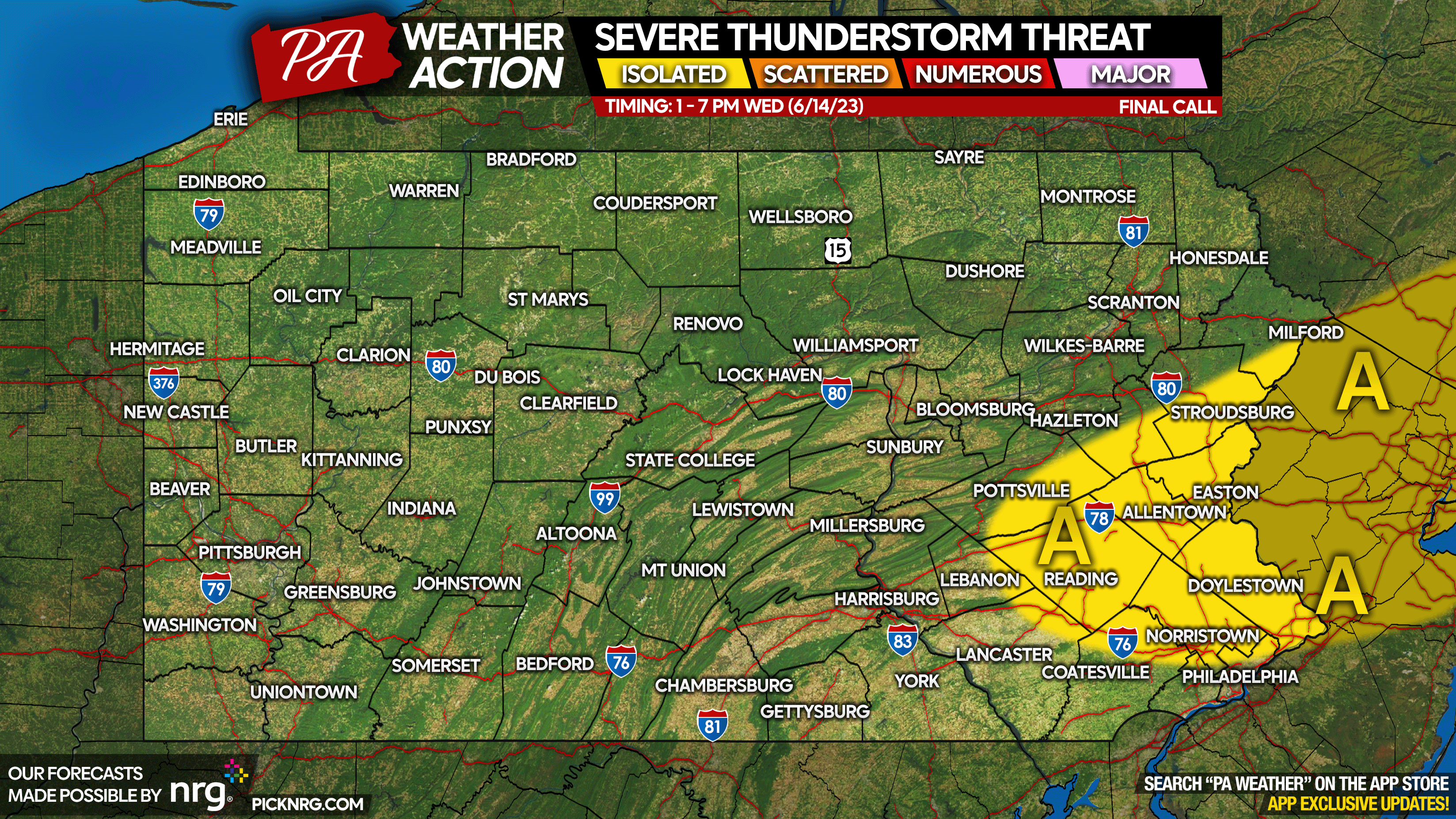

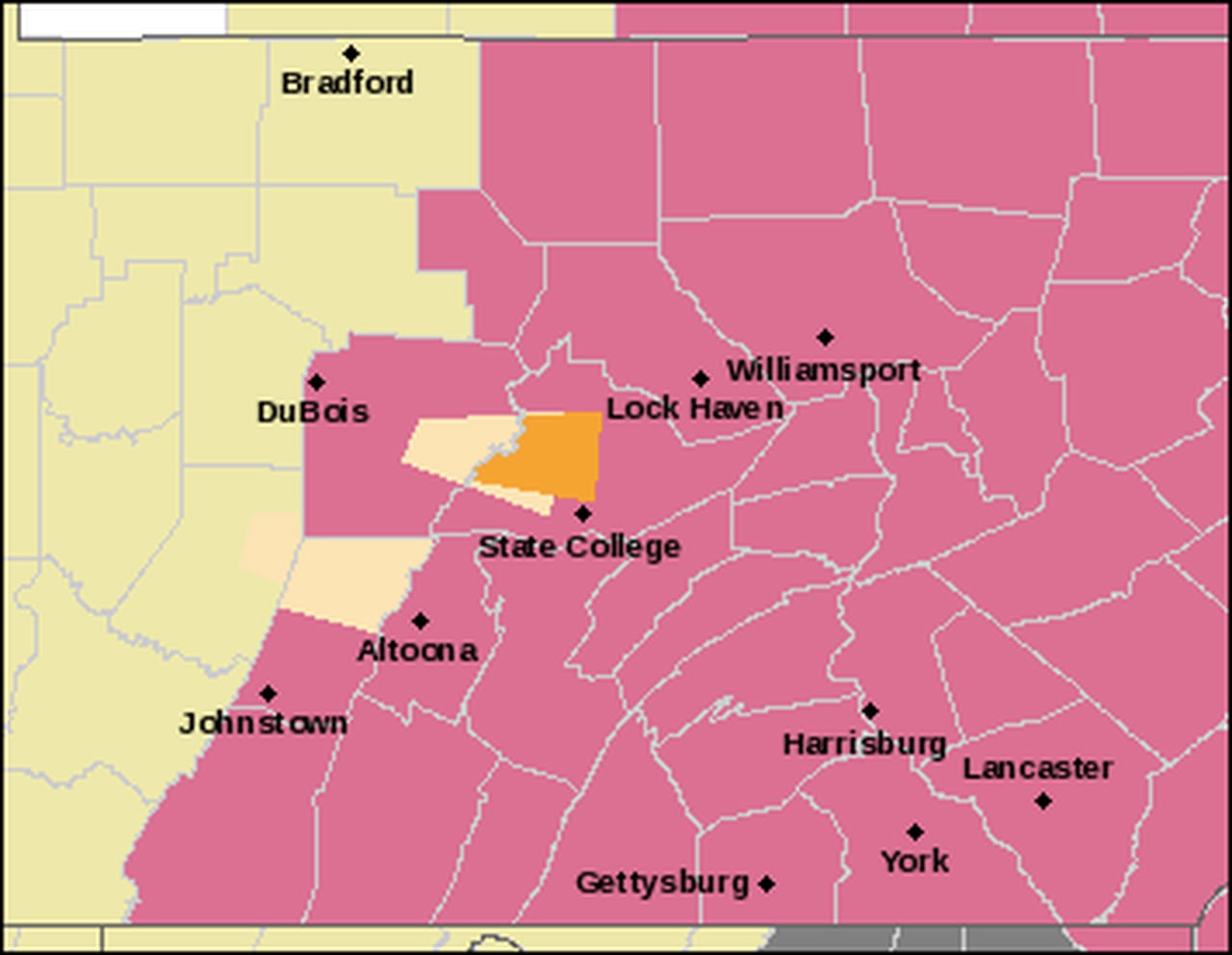

Pennsylvania Thunderstorm Warning Urgent Action Needed In South Central Region

May 22, 2025

Pennsylvania Thunderstorm Warning Urgent Action Needed In South Central Region

May 22, 2025 -

Major Fire Damages Dauphin County Apartment Complex Overnight

May 22, 2025

Major Fire Damages Dauphin County Apartment Complex Overnight

May 22, 2025 -

South Central Pennsylvania Under Severe Thunderstorm Watch

May 22, 2025

South Central Pennsylvania Under Severe Thunderstorm Watch

May 22, 2025