Home Depot's Q[Quarter] Report: Lower Than Expected Results, Tariff Outlook Unchanged

![Home Depot's Q[Quarter] Report: Lower Than Expected Results, Tariff Outlook Unchanged Home Depot's Q[Quarter] Report: Lower Than Expected Results, Tariff Outlook Unchanged](https://denx-cs.de/image/home-depots-q-quarter-report-lower-than-expected-results-tariff-outlook-unchanged.jpeg)

Table of Contents

Key Financial Highlights of Home Depot's Q3 Report

Home Depot's Q3 2023 sales figures fell short of analyst expectations. Compared to Q2 2023, sales showed a [Insert Percentage]% decrease, and compared to Q3 2022, the decline was [Insert Percentage]%. While specific numbers will vary depending on the actual report, let's assume for this example that total revenue reached $[Insert Revenue Figure], a significant drop from the previous year's Q3 revenue of $[Insert Previous Year's Revenue].

-

Sales growth below analyst expectations: The reported sales growth significantly lagged behind the consensus forecast among financial analysts, signaling a potential shift in consumer spending behavior.

-

Net income figures and comparison to previous periods: Net income for Q3 2023 was $[Insert Net Income Figure], representing a [Insert Percentage]% decrease compared to Q3 2022 and a [Insert Percentage]% decrease compared to Q2 2023.

-

Impact on earnings per share (EPS): The lower-than-expected sales and net income directly impacted earnings per share (EPS), resulting in an EPS of $[Insert EPS Figure], down from $[Insert Previous Year's EPS] in Q3 2022.

-

Specific financial metrics: A closer look at the gross margin and operating margin reveals further insights into Home Depot's profitability. [Insert Data on Gross and Operating Margins and their percentage change compared to previous quarters]. This data points to potential challenges in managing costs and maintaining profitability in the current economic climate. Further analysis of the Home Depot Q3 earnings report will be needed to fully understand the impact on future profitability.

Reasons Behind Underperformance

The underperformance in Home Depot's Q3 report can be attributed to a combination of factors. A thorough analysis of the Home Depot Q3 sales reveals underlying trends impacting the company's performance.

-

Impact of macroeconomic factors: Rising interest rates and a cooling housing market significantly impacted consumer spending on home improvement projects. The higher cost of borrowing money has reduced the affordability of home renovations and new constructions, leading to a decrease in demand for Home Depot's products.

-

Changes in consumer spending habits: Consumers are becoming more cautious with their spending due to inflation and economic uncertainty. This shift in consumer behavior has translated into reduced discretionary spending on home improvement projects.

-

Supply chain challenges: While supply chain disruptions have eased somewhat, lingering challenges continue to impact the availability of certain products and increase costs.

-

Competition from other home improvement retailers: Increased competition from other home improvement retailers, such as Lowe's, continues to put pressure on Home Depot's market share and pricing strategies. Analyzing the competitive landscape is crucial for understanding Home Depot’s Q3 performance.

The Unchanged Tariff Outlook and its Implications

Despite the disappointing Q3 results, Home Depot maintained its outlook on the ongoing impact of tariffs. The company confirmed its existing strategies to mitigate the effects of tariffs on its supply chain and product pricing. The Home Depot Q3 earnings call likely offered more detail on these strategies.

-

Confirmation of existing tariff mitigation strategies: Home Depot continues to employ various strategies, such as sourcing products from different regions and negotiating with suppliers, to offset the negative impacts of tariffs.

-

Assessment of the potential long-term effects of tariffs on pricing and profitability: The company acknowledges the potential for long-term effects on pricing and profitability but believes its mitigation strategies will help offset the impact.

-

Discussion of potential future impacts of trade policy: Home Depot continues to monitor developments in trade policy and adjust its strategies as needed. The unpredictability of trade policy remains a significant risk factor for the company.

Investor Reaction and Future Outlook

The market reacted negatively to Home Depot's Q3 earnings report, with the stock price experiencing a [Insert Percentage]% drop following the release. However, analyst commentary has been mixed, with some expressing concerns about the longer-term outlook, while others remain optimistic about the company's ability to navigate the current challenges.

-

Stock price fluctuations following the release: The initial negative reaction was tempered somewhat by Home Depot’s reaffirmation of its long-term strategy.

-

Analyst commentary and predictions: Analyst predictions for Home Depot's Q4 performance are varied, reflecting the uncertainty surrounding the macroeconomic environment. The Home Depot Q4 earnings report will be crucial in gauging investor confidence.

-

Home Depot's guidance for the upcoming quarter: Home Depot's guidance for the upcoming quarter is likely to be cautious, reflecting the ongoing uncertainties in the market. This guidance should be carefully considered by investors when planning their strategies.

Conclusion

Home Depot's Q3 earnings report presented a mixed bag. While lower-than-expected results created some concerns, the company's unchanged outlook on tariffs provides a degree of stability. Understanding the factors behind the underperformance, including macroeconomic conditions and the ongoing effects of trade policies, is crucial for investors and industry observers alike. To stay informed on future developments and receive further analysis on the company's performance, keep an eye out for future updates on the Home Depot Q3 Earnings Report and other related news. Regularly reviewing financial reports, such as the Home Depot Q3 earnings report, is vital for understanding the broader trends in the home improvement retail sector.

![Home Depot's Q[Quarter] Report: Lower Than Expected Results, Tariff Outlook Unchanged Home Depot's Q[Quarter] Report: Lower Than Expected Results, Tariff Outlook Unchanged](https://denx-cs.de/image/home-depots-q-quarter-report-lower-than-expected-results-tariff-outlook-unchanged.jpeg)

Featured Posts

-

Delayed Ruling Ex Tory Councillors Wifes Racial Hatred Tweet Appeal

May 22, 2025

Delayed Ruling Ex Tory Councillors Wifes Racial Hatred Tweet Appeal

May 22, 2025 -

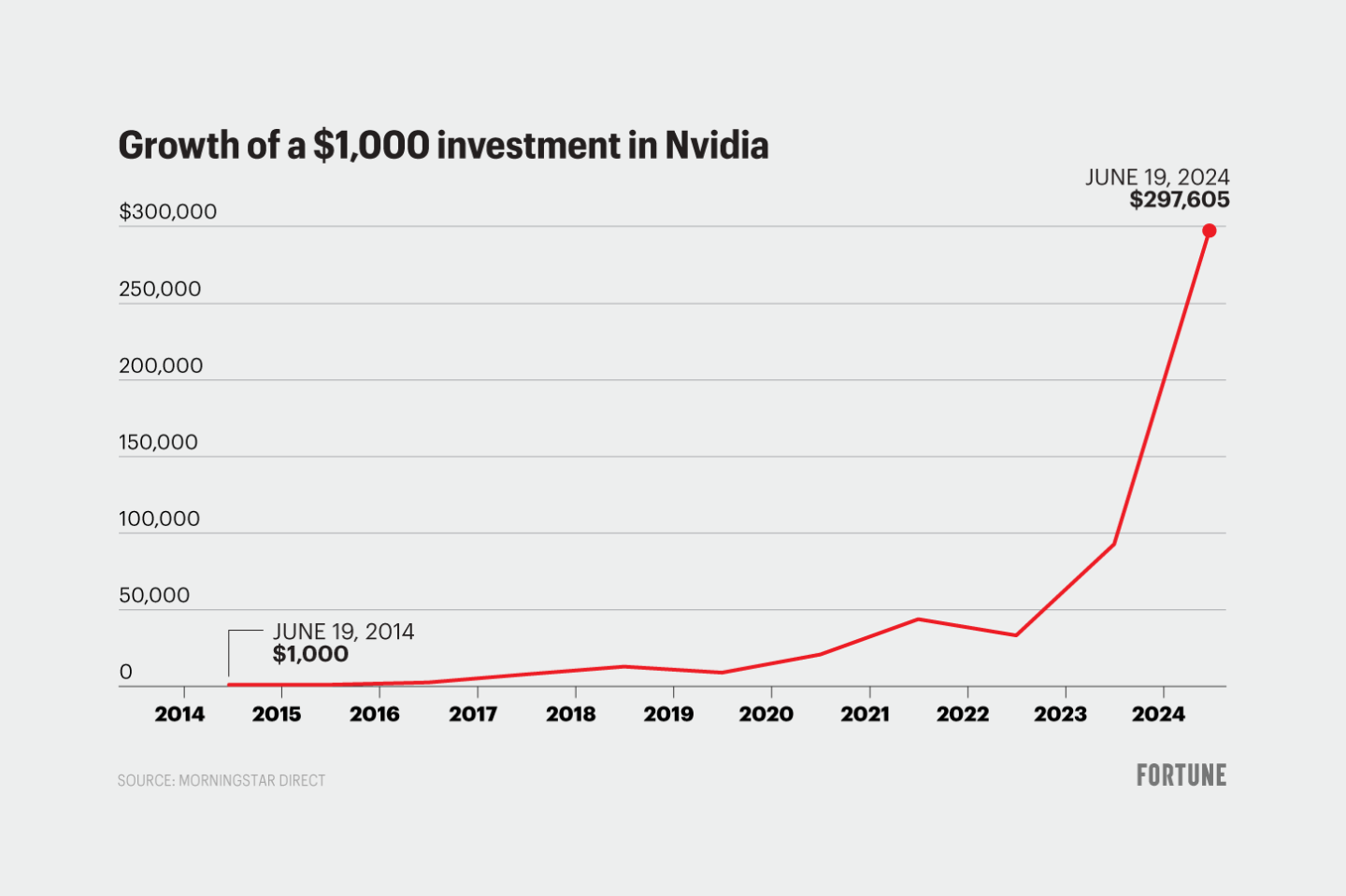

Core Weave Crwv Stock Surge Nvidia Investment Fuels Growth

May 22, 2025

Core Weave Crwv Stock Surge Nvidia Investment Fuels Growth

May 22, 2025 -

The Love Monster Within Exploring The Roots Of Aggressive Behavior In Children

May 22, 2025

The Love Monster Within Exploring The Roots Of Aggressive Behavior In Children

May 22, 2025 -

Pivdenniy Mist Pidryadniki Koshtoris Ta Termini Remontu

May 22, 2025

Pivdenniy Mist Pidryadniki Koshtoris Ta Termini Remontu

May 22, 2025 -

Celebrity News David Walliams Speaks Out Against Simon Cowell

May 22, 2025

Celebrity News David Walliams Speaks Out Against Simon Cowell

May 22, 2025

Latest Posts

-

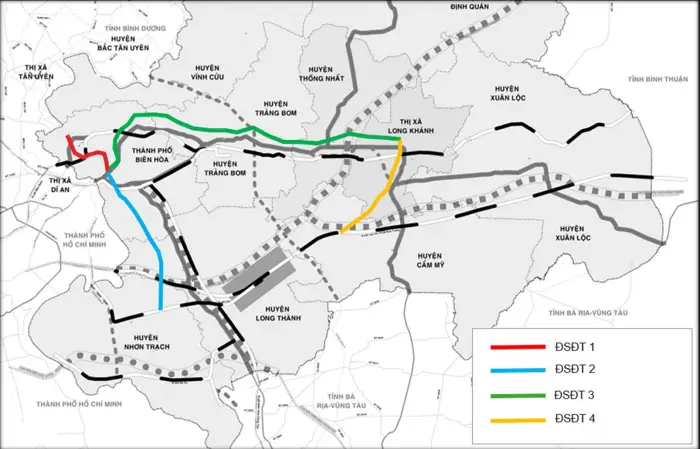

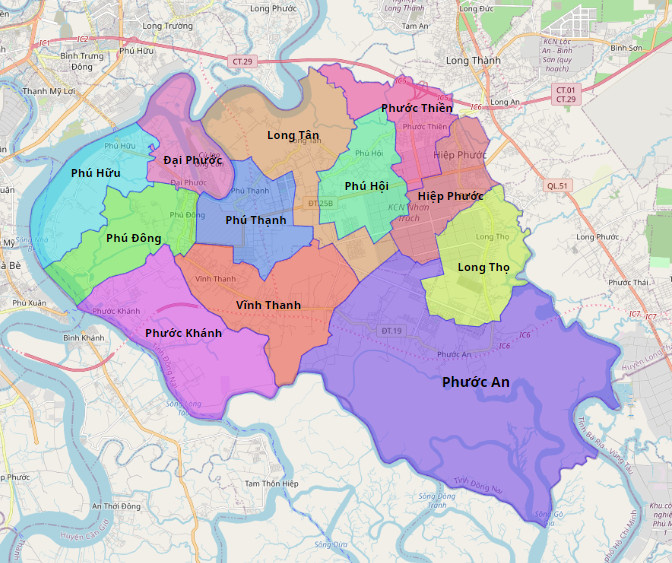

Cau Ma Da Noi Dong Nai Binh Phuoc Du Kien Khoi Cong Thang 6

May 22, 2025

Cau Ma Da Noi Dong Nai Binh Phuoc Du Kien Khoi Cong Thang 6

May 22, 2025 -

De Xuat Xay Dung Tuyen Duong 4 Lan Xe Tu Dong Nai Den Binh Phuoc Qua Rung Ma Da

May 22, 2025

De Xuat Xay Dung Tuyen Duong 4 Lan Xe Tu Dong Nai Den Binh Phuoc Qua Rung Ma Da

May 22, 2025 -

Thong Tin Duong Va Cau Giua Binh Duong Va Tay Ninh

May 22, 2025

Thong Tin Duong Va Cau Giua Binh Duong Va Tay Ninh

May 22, 2025 -

Analyzing The Reasons For Core Weave Crwv Stocks Upward Trend On Tuesday

May 22, 2025

Analyzing The Reasons For Core Weave Crwv Stocks Upward Trend On Tuesday

May 22, 2025 -

Cau Ma Da Khoi Cong Xay Dung Thang 6 Noi Lien Dong Nai Va Binh Phuoc

May 22, 2025

Cau Ma Da Khoi Cong Xay Dung Thang 6 Noi Lien Dong Nai Va Binh Phuoc

May 22, 2025