Hong Kong Intervenes In FX Market To Defend US Dollar Peg

Table of Contents

Understanding Hong Kong's Currency Peg Mechanism

Hong Kong operates under a linked exchange rate system, where the Hong Kong dollar (HKD) is pegged to the US dollar (USD) within a narrow band of 7.75 to 7.85 HKD per USD. This mechanism, managed by the Hong Kong Monetary Authority (HKMA), is crucial for maintaining price stability and facilitating trade. The peg has been in place since 1983, providing a stable and predictable currency environment that has been vital to Hong Kong's economic success.

-

Mechanism Details: The HKMA uses its considerable foreign currency reserves to buy or sell USD to maintain the HKD within the designated band. When the HKD weakens towards the upper limit of the band, the HKMA buys USD, increasing demand for USD and strengthening the HKD. Conversely, if the HKD strengthens towards the lower limit, the HKMA sells USD, increasing the supply and weakening the HKD.

-

Benefits of the Peg: The benefits of this USD peg are substantial, including: low and stable inflation, enhanced investor confidence, and ease of international trade and investment. The predictable exchange rate minimizes currency risk for businesses and consumers.

-

Potential Risks: However, the peg also exposes Hong Kong to external shocks impacting the USD. A sharp devaluation of the USD, for example, could create pressure on the HKD, requiring significant intervention by the HKMA. Furthermore, maintaining the peg requires substantial foreign exchange reserves.

Reasons Behind Recent FX Market Intervention

The recent intervention by the HKMA stemmed from a confluence of factors, both internal and external. Global economic uncertainty, fueled by rising US interest rates and geopolitical tensions, created significant pressure on emerging markets and, consequently, on the HKD. Speculative attacks, driven by concerns about the potential for a weakening USD and a widening interest rate differential between the US and Hong Kong, also played a role.

-

Specific Economic Indicators: A weakening HKD, approaching the upper limit of the band, coupled with a decline in Hong Kong's trade surplus, signaled the need for intervention.

-

Impact of Global Events: The strengthening US dollar, driven by aggressive interest rate hikes by the Federal Reserve, put upward pressure on the HKD/USD exchange rate, necessitating HKMA action to prevent a breach of the currency band.

-

Analysis of Potential Speculative Pressure: The HKMA likely detected unusual trading activities suggesting speculative attacks aimed at profiting from a potential weakening of the HKD.

The HKMA's Response and Market Impact

In response to these pressures, the HKMA intervened decisively, utilizing its extensive foreign exchange reserves to buy US dollars, thus supporting the HKD and maintaining the peg within the designated band. The scale of intervention varied depending on the intensity of the market pressure.

-

Specific Actions Taken: The HKMA's actions included direct buying of USD in the foreign exchange market, potentially through its agents, to counter downward pressure on the HKD.

-

Impact on HKD/USD Exchange Rate: The intervention successfully stabilized the HKD/USD exchange rate within the predefined band, preventing a significant depreciation of the HKD.

-

Market Reaction and Investor Confidence: The decisive action by the HKMA reassured investors, helping to restore confidence in the stability of the HKD and bolstering market sentiment. The intervention served as a clear signal of the HKMA's commitment to the peg.

-

Short-term and Long-term Implications: While the short-term impact was a stabilization of the exchange rate, the long-term implications will depend on global economic developments and future pressure on the USD and HKD.

Implications and Future Outlook

Hong Kong's intervention in the FX market has significant implications for its economy, its financial markets, and its relationship with the US. Maintaining the peg requires a considerable commitment of resources and ongoing vigilance.

-

Potential Risks and Benefits of Maintaining the Peg: The benefits of the peg remain significant, however, the potential risks associated with external shocks and maintaining substantial foreign exchange reserves need to be continuously managed.

-

Alternative Currency Regime Options: While abandoning the peg is unlikely, exploring alternative mechanisms to manage exchange rate fluctuations could be considered in the long term.

-

Forecast for the HKD/USD Exchange Rate: The forecast for the HKD/USD exchange rate will largely depend on the trajectory of the US dollar and global economic conditions.

-

Suggestions for Future Policy Adjustments: The HKMA might consider refinements to its intervention strategy, potentially incorporating more sophisticated tools to manage exchange rate volatility and mitigate risks associated with the peg.

Conclusion: Sustaining Hong Kong's Commitment to the US Dollar Peg

Hong Kong's recent intervention in the FX market underscores the ongoing importance of its US dollar peg. The HKMA's decisive action successfully stabilized the HKD and reassured investors. However, maintaining this crucial link requires ongoing vigilance and potentially, adjustments to its strategy in response to future global economic uncertainties. Stay updated on Hong Kong's interventions in the FX market, monitor the stability of the US dollar peg in Hong Kong, and understand the complexities of Hong Kong's currency mechanism to fully grasp the implications of this vital economic policy. Further research into the HKMA's policy statements and economic reports will provide a deeper understanding of this complex issue.

Featured Posts

-

The China Factor Challenges And Opportunities For Luxury Car Brands Like Bmw And Porsche

May 05, 2025

The China Factor Challenges And Opportunities For Luxury Car Brands Like Bmw And Porsche

May 05, 2025 -

Cassidy Hutchinsons Memoir A Jan 6 Witness Speaks Out This Fall

May 05, 2025

Cassidy Hutchinsons Memoir A Jan 6 Witness Speaks Out This Fall

May 05, 2025 -

The Evolution Of Marvel How The Mcu Can Adapt And Improve

May 05, 2025

The Evolution Of Marvel How The Mcu Can Adapt And Improve

May 05, 2025 -

Lizzos Health Transformation A Look At Her Fitness And Wellness Routine

May 05, 2025

Lizzos Health Transformation A Look At Her Fitness And Wellness Routine

May 05, 2025 -

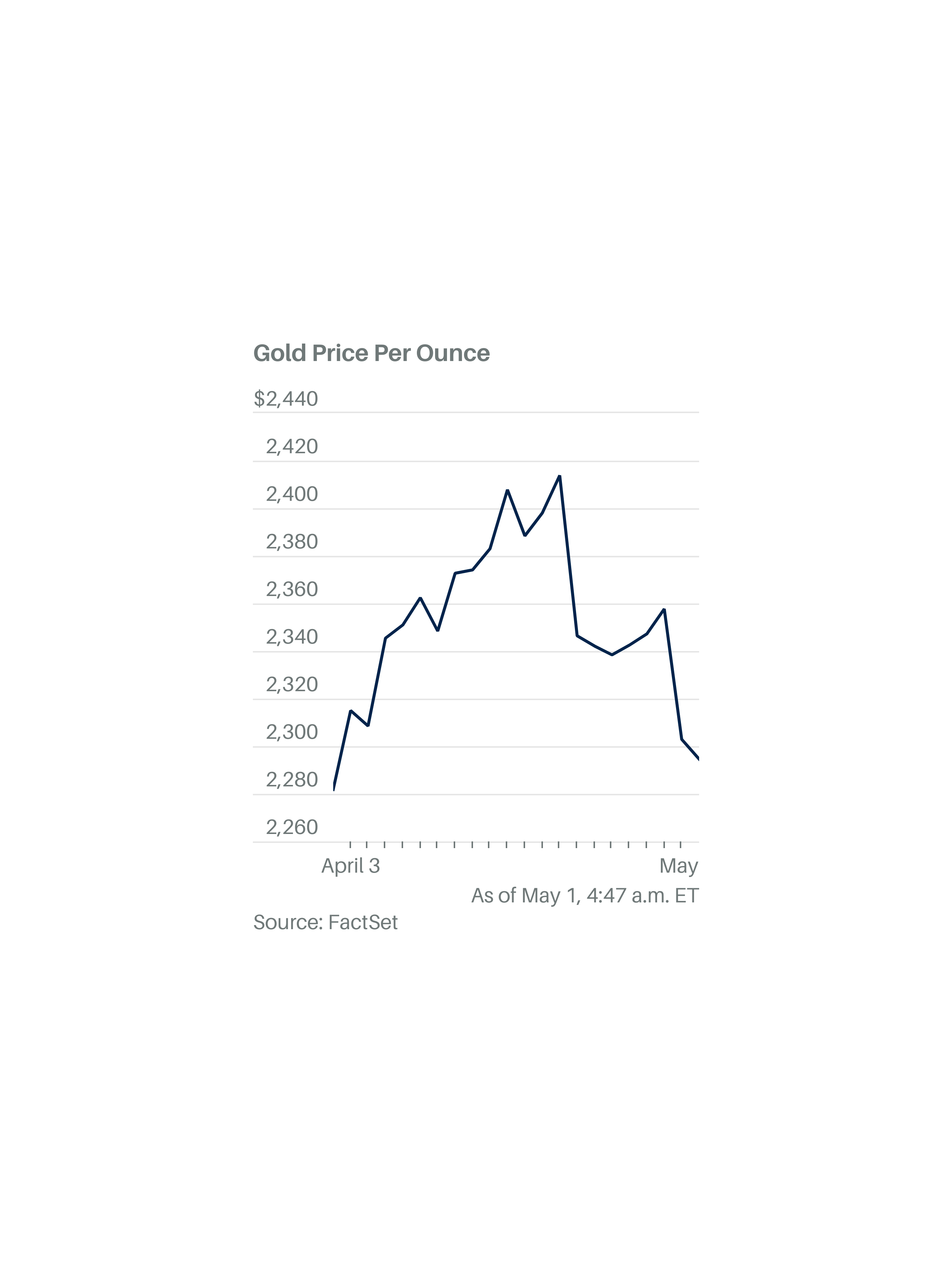

Gold Price Slumps Consecutive Weekly Losses In 2025

May 05, 2025

Gold Price Slumps Consecutive Weekly Losses In 2025

May 05, 2025

Latest Posts

-

Fans Obsessed Anna Kendricks Perfect Blake Lively Reply

May 05, 2025

Fans Obsessed Anna Kendricks Perfect Blake Lively Reply

May 05, 2025 -

Rising Temperatures In South Bengal Holi Brings Near 38 C Heat

May 05, 2025

Rising Temperatures In South Bengal Holi Brings Near 38 C Heat

May 05, 2025 -

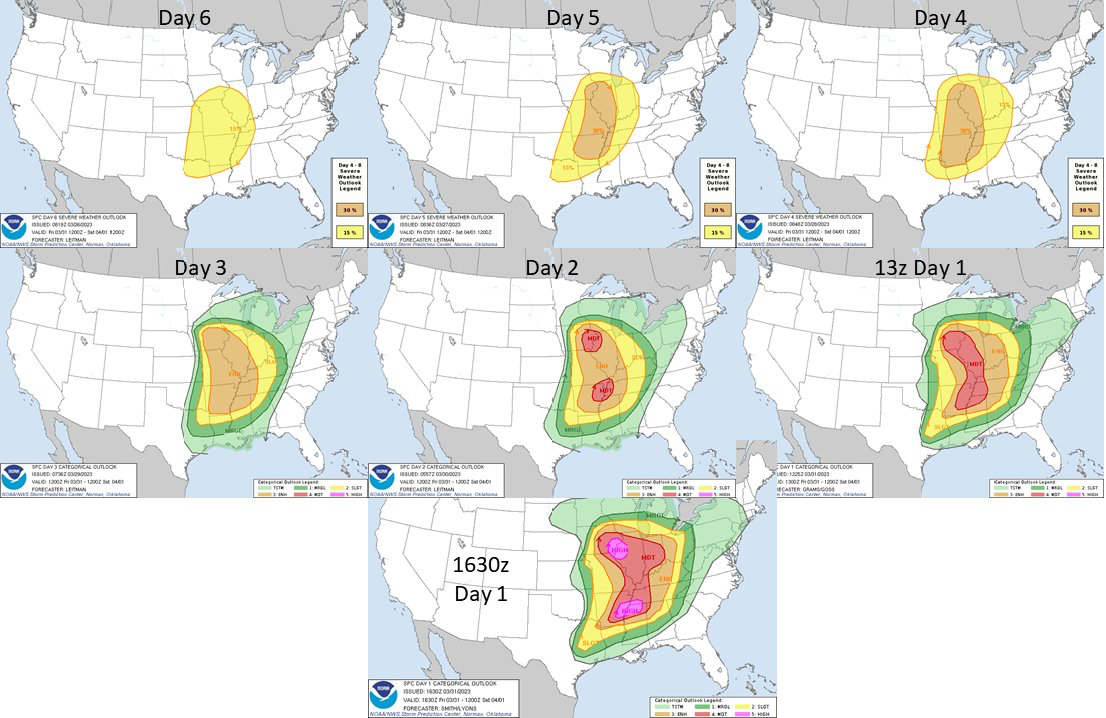

Severe Weather Threat In Nyc Monday Timing Impacts And Preparations

May 05, 2025

Severe Weather Threat In Nyc Monday Timing Impacts And Preparations

May 05, 2025 -

Anna Kendrick And Blake Livelys Public Interaction At Another Simple Favor Screening

May 05, 2025

Anna Kendrick And Blake Livelys Public Interaction At Another Simple Favor Screening

May 05, 2025 -

Anna Kendricks Three Word Blake Lively Comment Goes Viral

May 05, 2025

Anna Kendricks Three Word Blake Lively Comment Goes Viral

May 05, 2025