How Federal Budget Deficits Influence Mortgage Interest Rates

Table of Contents

The Government's Role in the Bond Market

The federal government, when facing a budget deficit (spending exceeding revenue), needs to borrow money to cover the shortfall. It does this primarily by issuing Treasury bonds. These bonds are essentially IOUs, promising investors a return on their investment over a specified period. The government's increased borrowing to finance the deficit increases the overall demand for loanable funds in the market. This increased demand impacts the bond market significantly.

- Increased demand pushes bond prices down. More buyers competing for a limited supply of bonds drives up prices.

- Inverse relationship between bond prices and yields. Bond yields (the return an investor receives) and bond prices move in opposite directions. As prices rise, yields fall, and vice versa.

- Higher yields represent higher borrowing costs for the government. When the government has to offer higher yields to attract investors, it faces increased borrowing costs. This increased cost of borrowing is a direct consequence of the budget deficit.

The Impact of Bond Yields on Mortgage Rates

Treasury bonds serve as a benchmark for other debt instruments, including mortgage-backed securities (MBS). MBS are bundles of mortgages sold to investors. The yields on Treasury bonds directly influence the pricing of MBS. When Treasury bond yields rise (due to increased government borrowing), mortgage lenders face higher borrowing costs.

- Mortgage lenders adjust rates based on the cost of funds. Lenders need to make a profit, and rising costs for their funding (borrowing money to lend) mean they must adjust mortgage rates upward.

- Higher bond yields translate to higher mortgage rates. This is a direct consequence of the increased cost of capital for lenders. The higher the yield on government bonds, the higher the cost of funds for mortgage lenders, resulting in higher mortgage interest rates for consumers.

- Increased borrowing costs for lenders impact consumer mortgage rates. Ultimately, the increased cost of borrowing for lenders is passed on to consumers in the form of higher mortgage rates.

Inflationary Pressures and Mortgage Rates

Large and persistent budget deficits can contribute to inflationary pressures. When the government borrows heavily, it increases the money supply, potentially leading to an increase in the overall price level. To combat inflation, the Federal Reserve (the central bank of the US) often raises interest rates.

- Increased money supply can fuel inflation. More money chasing the same amount of goods and services increases demand and subsequently prices.

- The Fed raises interest rates to curb inflation. Higher interest rates make borrowing more expensive, reducing demand and slowing economic growth, thus curbing inflation.

- Higher interest rates increase mortgage rates. The Fed's actions to control inflation directly impact mortgage rates, as lenders adjust their rates to reflect the overall rise in interest rates.

Investor Sentiment and Market Volatility

Concerns about a growing national debt and the government's ability to manage its finances can negatively impact investor sentiment. This uncertainty can lead to increased risk premiums in the mortgage market.

- Uncertainty surrounding government finances impacts market stability. Investors become hesitant to invest in riskier assets, like MBS, in times of economic uncertainty.

- Investors demand higher returns to compensate for increased risk. To offset the perceived risk, investors demand higher yields on mortgage-backed securities.

- Higher risk premiums directly impact mortgage rates. These higher yields are passed on to borrowers in the form of higher mortgage interest rates.

Conclusion: Navigating the Impact of Federal Budget Deficits on Your Mortgage

Federal budget deficits exert a multifaceted influence on mortgage interest rates. The interplay between government borrowing, bond yields, inflation, and investor sentiment creates a complex environment. Understanding how federal budget deficits influence mortgage interest rates is vital for homeowners and prospective homebuyers. Stay informed about economic trends, including government fiscal policy and Federal Reserve actions, to make the best choices for your homeownership journey. By monitoring these factors, you can better navigate the complexities of fluctuating interest rates and secure the most favorable mortgage terms possible.

Featured Posts

-

Stolen Dreams Holding Perpetrators Accountable In The Restaurant Industry

May 19, 2025

Stolen Dreams Holding Perpetrators Accountable In The Restaurant Industry

May 19, 2025 -

Children Rescued In Dalfsen Amber Alert Parents Apprehended

May 19, 2025

Children Rescued In Dalfsen Amber Alert Parents Apprehended

May 19, 2025 -

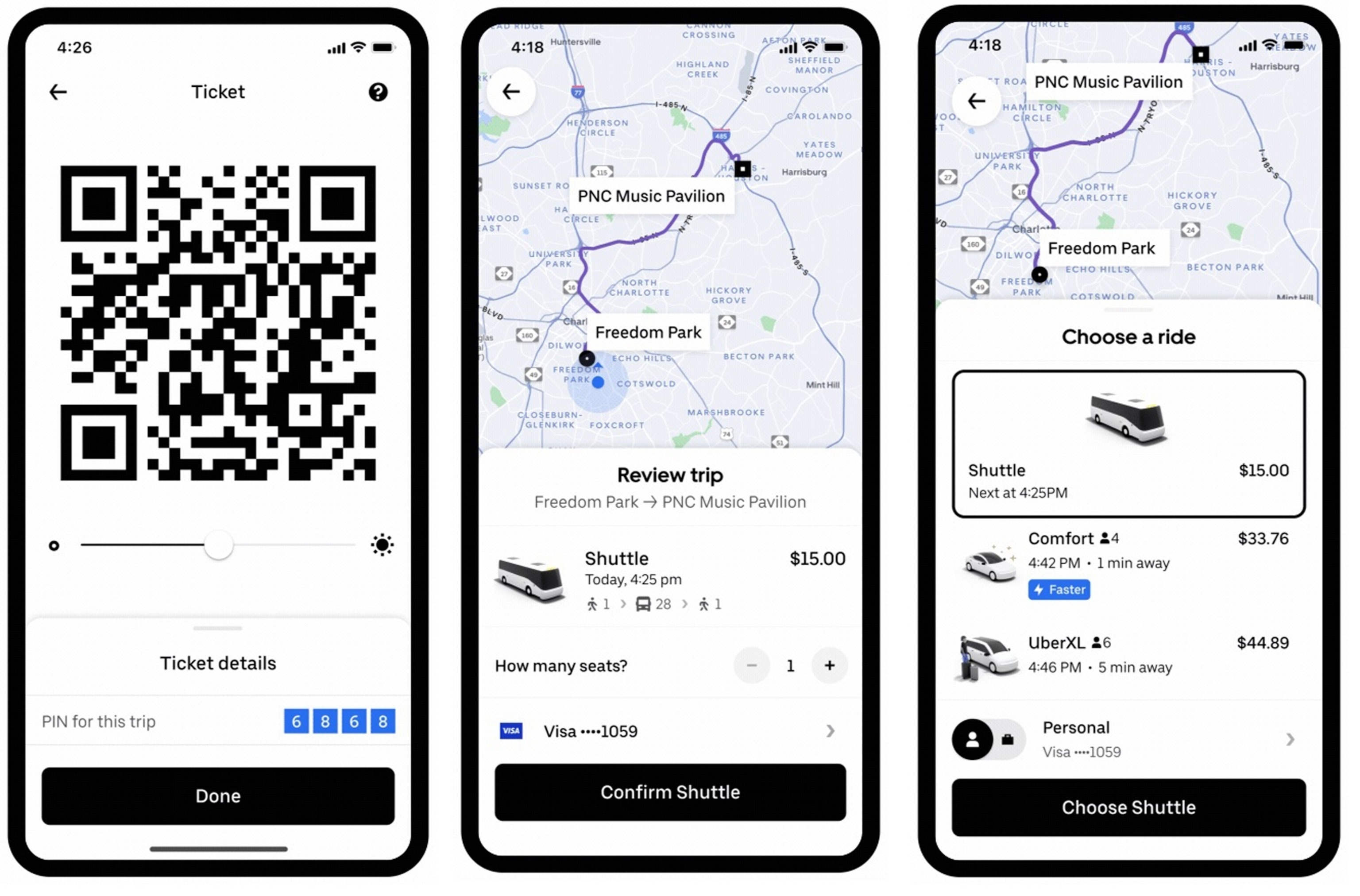

Convenient And Affordable 5 Uber Shuttle Service From United Center

May 19, 2025

Convenient And Affordable 5 Uber Shuttle Service From United Center

May 19, 2025 -

Financial Support For Sustainable Practices In Smes

May 19, 2025

Financial Support For Sustainable Practices In Smes

May 19, 2025 -

Fighting Woke France A Tech Billionaires Strategic Use Of Data

May 19, 2025

Fighting Woke France A Tech Billionaires Strategic Use Of Data

May 19, 2025

Latest Posts

-

Royal Mail Price Hike Exact Stamp Costs Rising April 7th Full List

May 19, 2025

Royal Mail Price Hike Exact Stamp Costs Rising April 7th Full List

May 19, 2025 -

Last Chance To See Johnny Mathis Live Final Tour Dates Announced

May 19, 2025

Last Chance To See Johnny Mathis Live Final Tour Dates Announced

May 19, 2025 -

Legendary Singers Farewell Performance A Final Bow Due To Memory Loss

May 19, 2025

Legendary Singers Farewell Performance A Final Bow Due To Memory Loss

May 19, 2025 -

Johnny Mathis Farewell Tour Dates And Ticket Information

May 19, 2025

Johnny Mathis Farewell Tour Dates And Ticket Information

May 19, 2025 -

Johnny Mathis Announces Retirement Final Tour Dates Revealed

May 19, 2025

Johnny Mathis Announces Retirement Final Tour Dates Revealed

May 19, 2025