How Tariffs Threaten China's Export-Led Growth Model

Table of Contents

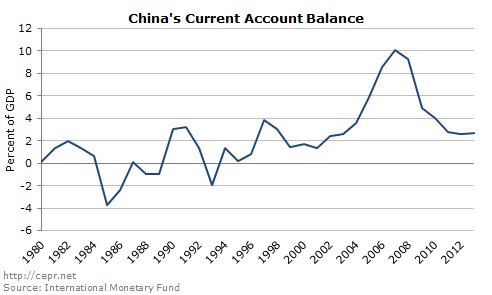

China's remarkable economic ascent over the past few decades has been largely attributed to its export-led growth model. This strategy, focused on manufacturing goods for global markets, propelled China to become the world's second-largest economy. However, the escalating wave of global tariffs, particularly the trade tensions with the US, poses a significant threat to this model, potentially triggering a substantial economic slowdown and reshaping the global economic landscape. This article delves into the multifaceted ways in which tariffs are undermining China's export-driven strategy and the broader implications for the global economy.

Reduced Global Demand for Chinese Exports

The imposition of tariffs, especially the US-China trade war, has directly impacted global demand for Chinese exports. This reduction in demand reverberates throughout the Chinese economy and beyond.

Impact of Tariffs on US-China Trade

The US tariffs on Chinese goods, implemented in stages since 2018, have significantly reduced US imports of numerous Chinese products. This directly affects key sectors of the Chinese economy.

- Decreased US imports of Chinese electronics, textiles, and machinery: These sectors have experienced substantial job losses and reduced production capacity.

- Increased prices for US consumers: Tariffs have led to higher prices for consumers in the US, impacting purchasing power and further reducing demand for Chinese goods.

- Retaliatory tariffs from China further impacting trade flows: China's retaliatory tariffs on US goods have created a cycle of reduced trade between the two economic giants, harming both economies.

- Loss of market share to competitors: Other countries, such as Vietnam and Mexico, have capitalized on the trade tensions, attracting foreign investment and gaining market share previously held by China.

Ripple Effects on Other Export Markets

The US-China trade war hasn't been isolated. The uncertainty created by these tariffs has spread across global markets, influencing purchasing decisions and supply chain strategies worldwide.

- Reduced investment in Chinese manufacturing: Businesses are hesitant to invest heavily in Chinese manufacturing due to the unpredictable trade environment.

- Shifting of production to other countries like Vietnam and Mexico: Manufacturers are actively diversifying their supply chains, moving production away from China to reduce their exposure to tariffs and geopolitical risks.

- Increased costs for businesses reliant on Chinese imports: Even if tariffs are avoided, the cost of sourcing from China has increased due to supply chain disruptions and transportation challenges.

- Slowdown in global trade growth: The overall impact of these tariffs has been a significant slowdown in global trade growth, impacting economies worldwide.

Increased Production Costs and Reduced Competitiveness

Tariffs don't just reduce demand; they also directly increase production costs and reduce the competitiveness of Chinese goods in the global marketplace.

Rising Raw Material Prices

Many raw materials used in Chinese manufacturing are imported. Tariffs on these inputs directly translate to higher production costs for Chinese manufacturers.

- Higher prices for components and inputs: This makes Chinese goods more expensive compared to products from countries with lower input costs.

- Reduced profit margins for Chinese manufacturers: The increased costs squeeze profit margins, forcing manufacturers to cut costs elsewhere, potentially impacting quality or leading to factory closures.

- Difficulty competing with manufacturers in countries with lower input costs: China is facing increasing competition from countries with lower labor costs and potentially lower input costs due to favorable trade agreements.

Supply Chain Disruptions

The trade war has had a significant impact on global supply chains, leading to increased uncertainty and costs for businesses.

- Increased lead times for sourcing materials: Disruptions to global trade flows have caused significant delays in sourcing raw materials and components.

- Higher transportation costs due to trade diversion: Businesses are forced to find alternative routes and suppliers, leading to higher transportation costs.

- Loss of efficiency and increased operational complexity: Managing these disruptions requires significant effort, reducing efficiency and increasing operational costs.

- Damage to long-term business relationships: The uncertainty caused by trade wars can damage long-term business relationships between buyers and suppliers.

Impact on Employment and Domestic Consumption

The reduced competitiveness and decreased demand for Chinese exports have had a significant impact on employment and domestic consumption.

Job Losses in Export-Oriented Industries

Reduced exports and factory closures, particularly in export-oriented industries, have resulted in significant job losses.

- Increased unemployment in export-dependent regions: Coastal regions, traditionally reliant on export manufacturing, have experienced the most severe job losses.

- Social and economic unrest in affected communities: High unemployment rates can lead to social unrest and economic hardship in these communities.

- Strain on social safety nets: Governments face increased pressure on social safety nets to support those who have lost their jobs.

Weakened Domestic Demand

Reduced employment and wage stagnation significantly weaken domestic consumption, creating a vicious cycle of economic slowdown.

- Less disposable income for consumers: Job losses and wage stagnation mean that consumers have less disposable income, impacting their spending power.

- Decreased spending on goods and services: This reduced spending further hampers economic growth and creates a downward spiral.

- Impact on growth of the domestic market: A weak domestic market further reduces the ability of the Chinese economy to absorb the shock of reduced export demand.

Conclusion

The escalating global tariffs pose a serious threat to China's export-led growth model, with far-reaching implications for the Chinese economy and the global economic order. Reduced global demand, increased production costs, and supply chain disruptions have already led to economic slowdowns and job losses. Addressing these challenges requires a multifaceted approach, including diversification of export markets, investment in domestic consumption, and a commitment to resolving global trade disputes through dialogue and cooperation. The future of China's economic growth hinges on its ability to successfully adapt and navigate this complex and ever-changing landscape. Understanding how tariffs threaten China's export-led growth model is crucial for policymakers, businesses, and anyone interested in the future of the global economy. Ignoring the challenges presented by this trade-related disruption would be a significant oversight. Developing strategies to mitigate the risks associated with tariffs and their impact on China's export-led growth model is vital for both short-term stability and long-term economic prosperity.

Featured Posts

-

Land Your Dream Private Credit Job 5 Essential Dos And Don Ts

Apr 22, 2025

Land Your Dream Private Credit Job 5 Essential Dos And Don Ts

Apr 22, 2025 -

Chronology Of The Karen Read Murder Trials And Legal Battles

Apr 22, 2025

Chronology Of The Karen Read Murder Trials And Legal Battles

Apr 22, 2025 -

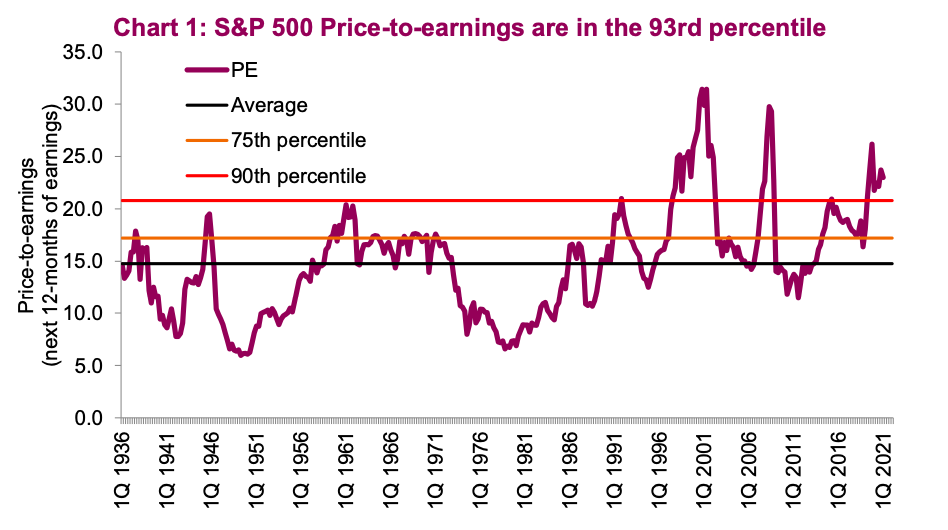

Understanding High Stock Market Valuations Insights From Bof A

Apr 22, 2025

Understanding High Stock Market Valuations Insights From Bof A

Apr 22, 2025 -

Investing In Middle Management A Strategy For Enhanced Company Performance

Apr 22, 2025

Investing In Middle Management A Strategy For Enhanced Company Performance

Apr 22, 2025 -

Leaked Signal Messages Reveal Hegseths Military Strategies

Apr 22, 2025

Leaked Signal Messages Reveal Hegseths Military Strategies

Apr 22, 2025