How The Student Loan Crisis Will Impact The US Economy

Table of Contents

Reduced Consumer Spending and Economic Growth

High student loan payments significantly reduce disposable income, leading to decreased consumer spending and hindering economic growth. This decreased spending power ripples through the economy, impacting various sectors and slowing overall economic expansion.

Decreased Disposable Income

- Delayed Major Purchases: Many young adults burdened by student loan debt postpone significant purchases like homes, cars, and even starting a family. This delay in major life milestones directly affects economic activity.

- Reduced Discretionary Spending: Less disposable income means less money for entertainment, travel, dining out, and other discretionary purchases that fuel economic growth.

- Impact on Small Businesses: Reduced consumer spending disproportionately affects small businesses that rely heavily on local consumer demand.

The correlation between student loan debt and reduced consumer spending is well-documented. Studies show a direct link between high debt levels and lower spending on non-essential goods and services. Economists warn that this suppressed consumer demand could lead to slower economic growth and hinder the recovery from past economic downturns. For example, a recent study by the Federal Reserve found that individuals with high student loan debt are significantly less likely to invest in stocks or other assets, further impacting economic activity.

Impact on the Housing Market

The student loan crisis is significantly impacting the housing market, particularly for young adults. The high cost of student loan repayments makes it difficult for many to save for a down payment or qualify for a mortgage, leading to delayed homeownership.

Delayed Homeownership

- High Student Loan Payments: Monthly student loan payments often consume a substantial portion of a young adult's income, leaving little room for saving for a down payment.

- Difficulty Qualifying for Mortgages: Lenders often consider student loan debt in mortgage applications, making it harder for borrowers to qualify for loans, even with good credit scores.

- Reduced Housing Demand: The inability of many young adults to enter the housing market reduces overall demand, impacting home prices and the construction industry.

Data from the National Association of Realtors shows a decline in homeownership rates among millennials, a generation heavily burdened by student loan debt. Real estate experts point out that this reduced housing demand contributes to a slower housing market and can lead to price stagnation or even decline in certain areas. The longer this trend continues, the more it negatively affects the economy and the dreams of many to own a home.

The Burden on the Federal Budget

A significant portion of student loan debt is held by the federal government. Potential government interventions, such as loan forgiveness programs, would place an enormous strain on the national budget, creating long-term fiscal challenges.

Government Intervention and Debt Forgiveness Programs

- Loan Forgiveness Programs: While politically popular, widespread loan forgiveness programs would be incredibly expensive, potentially adding trillions of dollars to the national debt.

- Income-Driven Repayment Plans: While offering some relief, income-driven repayment plans can extend repayment periods, ultimately increasing the total amount paid over the loan's lifetime.

- Increased Federal Spending: Government interventions necessitate increased federal spending, potentially leading to cuts in other essential programs or increased taxation.

The sheer volume of student loan debt held by the federal government presents a significant fiscal challenge. Experts warn that the long-term cost of potential government interventions could be substantial, potentially impacting future government spending on crucial social programs like healthcare and infrastructure. Analyzing the long-term fiscal implications of various approaches is critical in addressing the student loan crisis responsibly.

Long-Term Implications for Future Generations

The student loan crisis is not simply a problem for current borrowers; it carries significant long-term implications for future generations, exacerbating existing wealth inequality.

Intergenerational Wealth Inequality

- Delayed Career Starts: High student loan debt can force young adults to delay career aspirations or take lower-paying jobs to manage their debt, hindering their long-term financial prospects.

- Reduced Savings: With a significant portion of income allocated to loan repayments, individuals may find it difficult to save for retirement, further exacerbating wealth inequality across generations.

- Impact on Entrepreneurship: The burden of student loan debt can discourage young people from starting their own businesses, limiting innovation and job creation.

The disproportionate impact of student loan debt on specific demographics, particularly low-income families and minority groups, deepens existing societal inequalities and limits opportunities for future economic mobility. This creates a cycle of debt that impacts not just individuals but also the overall economic health and social fabric of the nation. Sociologists and economists alike highlight the crucial need to address this issue to ensure a more equitable and prosperous future.

Conclusion

The student loan crisis is a multifaceted problem with significant and far-reaching implications for the US economy. Reduced consumer spending, a strained housing market, a burdened federal budget, and long-term consequences for future generations are all key aspects of this growing economic challenge. Understanding the complex interplay of these factors is crucial for developing effective and sustainable solutions. Staying informed about policy debates and potential solutions to mitigate the economic impact of this growing issue is vital. Learn more about the evolving student loan crisis and its effects on the U.S. economy to become a more informed and engaged citizen.

Featured Posts

-

Wes Andersons Latest Film A Critique Of Its Emptiness

May 28, 2025

Wes Andersons Latest Film A Critique Of Its Emptiness

May 28, 2025 -

Angels Vs Pirates Mike Trout Kenley Jansen And Getaway Game Start Time

May 28, 2025

Angels Vs Pirates Mike Trout Kenley Jansen And Getaway Game Start Time

May 28, 2025 -

Alcarazs Soaring Confidence Vs Swiateks Challenges French Open 2024

May 28, 2025

Alcarazs Soaring Confidence Vs Swiateks Challenges French Open 2024

May 28, 2025 -

Samsung Galaxy S25 256 Go Offre Exceptionnelle A 699 90 E

May 28, 2025

Samsung Galaxy S25 256 Go Offre Exceptionnelle A 699 90 E

May 28, 2025 -

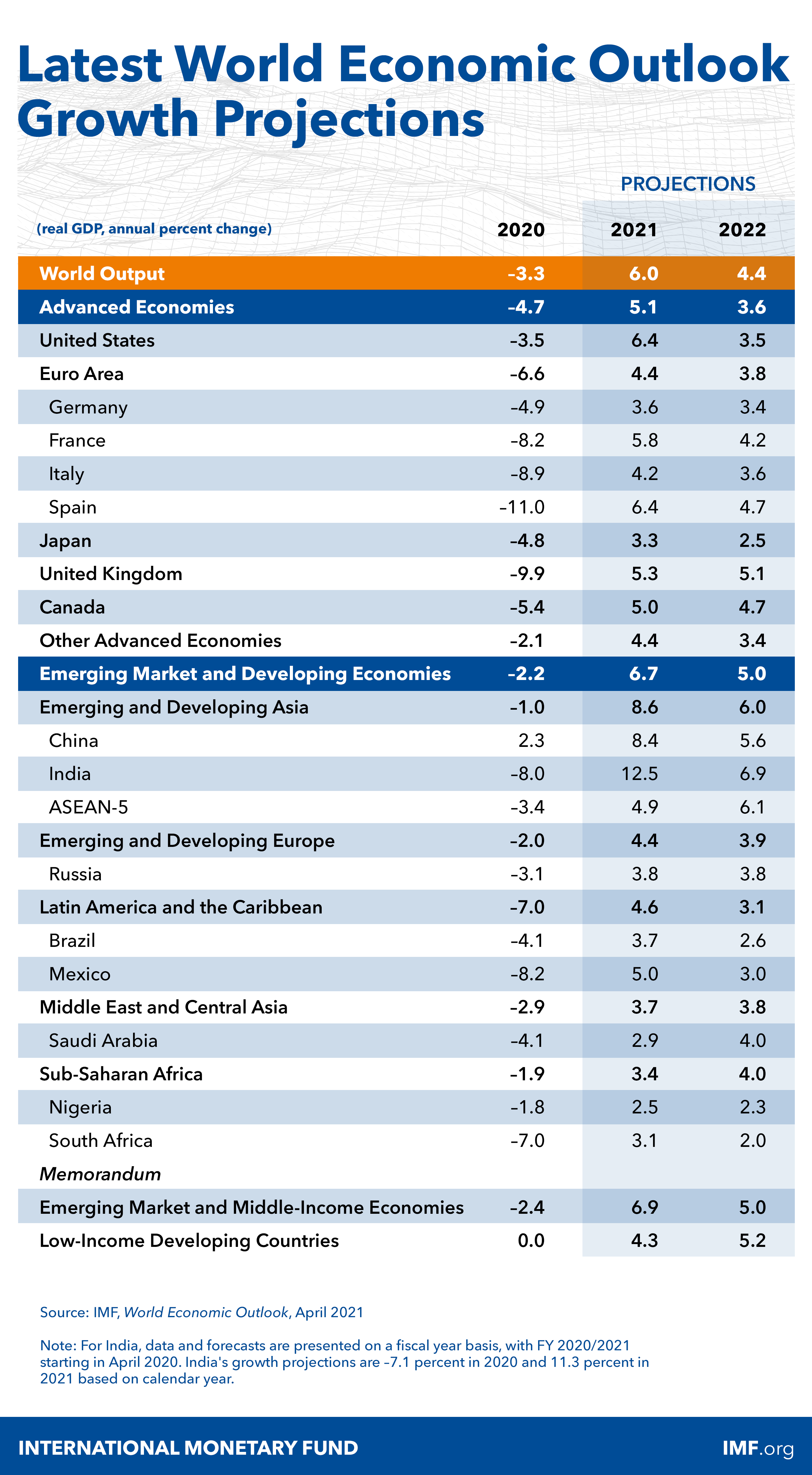

The Latest April Outlook Update A Comprehensive Overview

May 28, 2025

The Latest April Outlook Update A Comprehensive Overview

May 28, 2025

Latest Posts

-

Diese Gemeinde In Deutschland Bietet Kostenlose Unterkuenfte An

May 31, 2025

Diese Gemeinde In Deutschland Bietet Kostenlose Unterkuenfte An

May 31, 2025 -

Gratis Wohnen Diese Deutsche Stadt Sucht Neue Bewohner

May 31, 2025

Gratis Wohnen Diese Deutsche Stadt Sucht Neue Bewohner

May 31, 2025 -

Rudy Giulianis Tribute To Bernie Kerik Remembering A Friend And Public Servant

May 31, 2025

Rudy Giulianis Tribute To Bernie Kerik Remembering A Friend And Public Servant

May 31, 2025 -

Umzug In Diese Deutsche Stadt Kostenlose Unterkunft Wartet

May 31, 2025

Umzug In Diese Deutsche Stadt Kostenlose Unterkunft Wartet

May 31, 2025 -

Hospitalization Of Former Nypd Commissioner Bernard Kerik Full Recovery Anticipated

May 31, 2025

Hospitalization Of Former Nypd Commissioner Bernard Kerik Full Recovery Anticipated

May 31, 2025