The Latest April Outlook Update: A Comprehensive Overview

Table of Contents

Economic Forecasts for April and Beyond

Understanding the economic landscape is crucial for navigating the April outlook. This section will delve into key economic indicators and their projected impact.

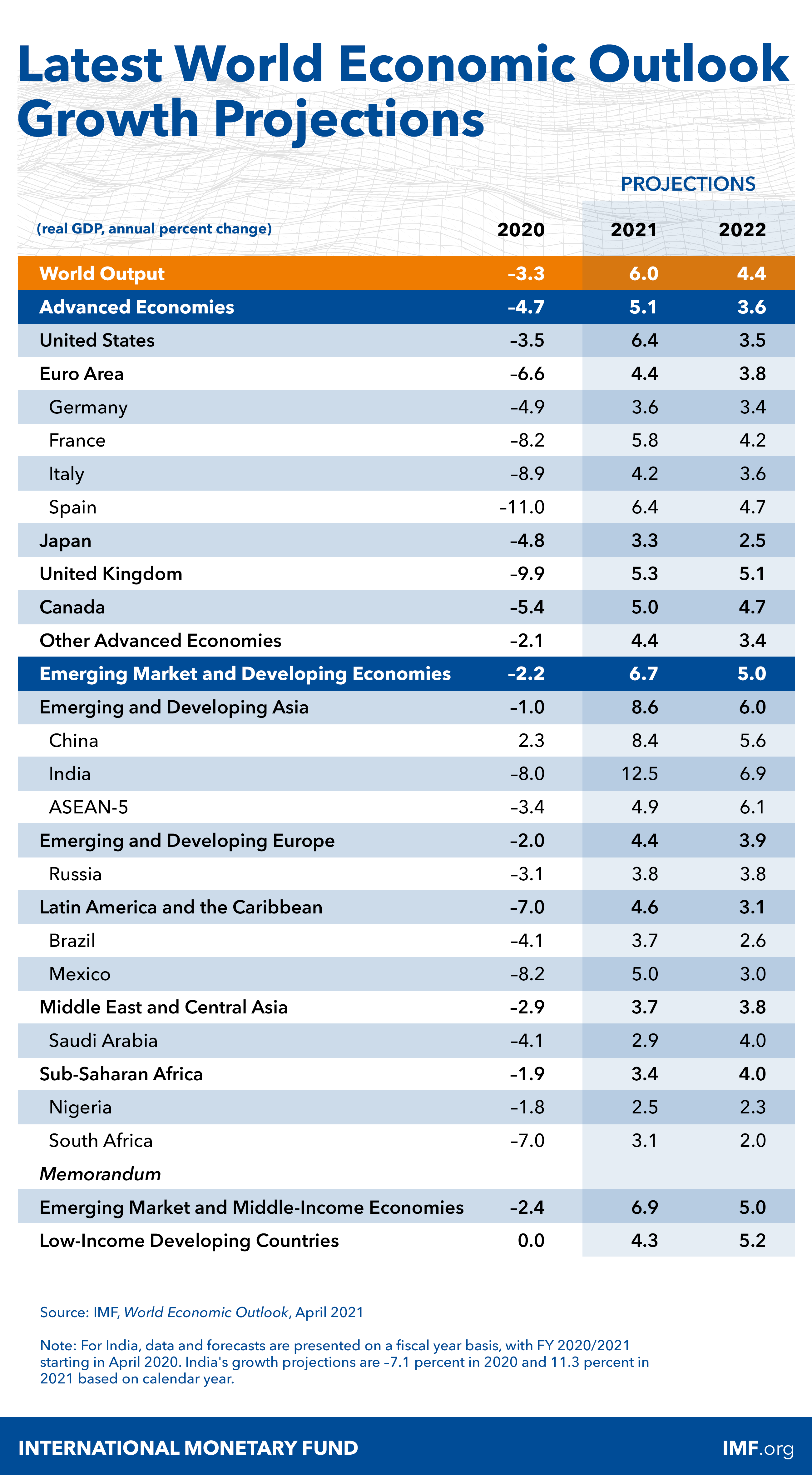

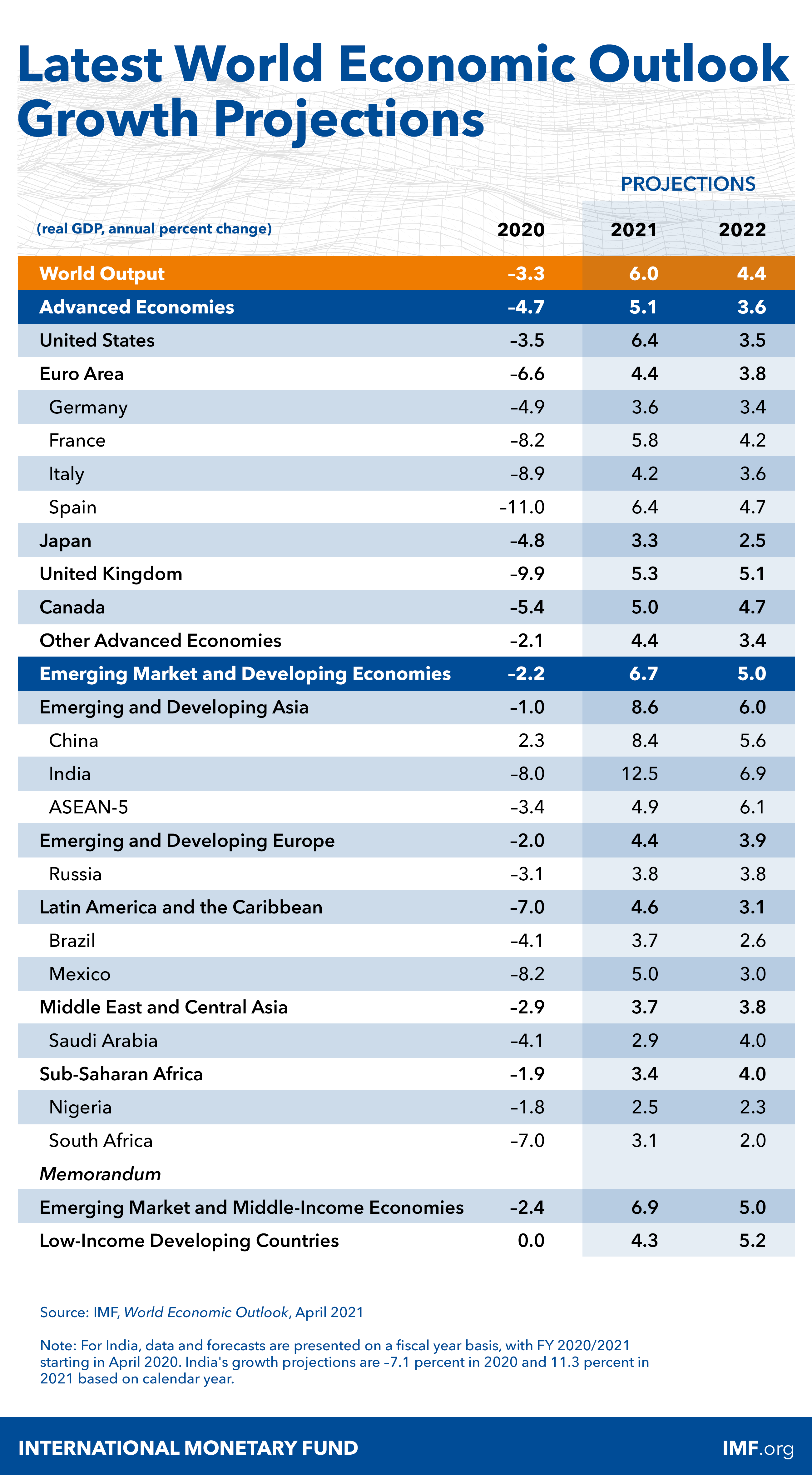

GDP Growth Projections

Predicting GDP growth is a cornerstone of any economic forecast. Current projections suggest a [Insert Projected GDP Growth Rate]% growth for April, although this is subject to considerable uncertainty. Several factors could influence this projection:

- Geopolitical instability: Ongoing conflicts and international tensions can significantly impact global trade and investment.

- Inflationary pressures: High inflation continues to erode consumer spending power and impact business investment.

- Supply chain disruptions: Lingering supply chain issues could continue to constrain economic activity.

Sources like the [Insert Source, e.g., IMF, World Bank] provide detailed analysis and data on GDP growth, offering further insight into the economic indicators influencing this projection. Keywords: GDP growth, economic indicators, recession risk, inflation rate.

Inflation Trends and Predictions

Inflation remains a key concern. The projected inflation rate for April is [Insert Projected Inflation Rate]%, potentially impacting monetary policy decisions.

- Consumer Price Index (CPI): A close watch on the CPI will be crucial in understanding the impact of inflation on consumer spending and overall economic activity.

- Monetary Policy Response: Central banks are likely to continue monitoring inflation closely and may adjust interest rates accordingly to manage inflationary pressures. This could impact borrowing costs and investment decisions.

- Impact on Consumer Spending: High inflation erodes purchasing power, potentially leading to decreased consumer spending.

Keywords: inflation, consumer price index (CPI), monetary policy, interest rates.

Unemployment Rate Outlook

The unemployment rate is another vital economic indicator. The April outlook suggests a [Insert Projected Unemployment Rate]% unemployment rate.

- Job Market Dynamics: The strength of the job market will significantly influence consumer confidence and spending. Sectors like [mention specific sectors] are anticipated to see [growth/decline].

- Labor Market Trends: Analyzing labor market participation rates and wage growth will provide a clearer picture of the overall health of the economy.

Keywords: unemployment rate, job market, labor market trends.

Key Market Trends Shaping the April Outlook

Understanding market trends is essential for informed investment decisions. The following sections analyze key market segments.

Stock Market Analysis

The stock market's performance in April will likely depend on various factors:

- Geopolitical Events: Global events can significantly influence market sentiment and volatility.

- Company Earnings: Strong corporate earnings reports tend to boost market confidence, while disappointing results can lead to declines.

- Interest Rate Hikes: Changes in interest rates directly influence stock valuations.

Major stock indices like the S&P 500 and Dow Jones Industrial Average are expected to [show projected performance, e.g., experience moderate growth/show increased volatility]. Keywords: stock market, stock market forecast, stock indices, market volatility.

Bond Market Outlook

The bond market offers a different perspective on the economic outlook.

- Bond Yields: Bond yields are expected to [rise/fall] in April, reflecting [mention reasons, e.g., inflation expectations, interest rate changes].

- Interest Rate Risk: Changes in interest rates directly impact bond prices. Rising interest rates generally lead to falling bond prices.

Keywords: bond market, bond yields, interest rate risk, fixed income.

Commodity Market Trends

Commodity prices play a vital role in various sectors.

- Oil Prices: Oil prices are projected to [rise/fall] due to [mention reasons, e.g., geopolitical tensions, OPEC decisions]. This directly impacts energy costs and inflation.

- Gold Prices: Gold is often seen as a safe haven asset. Its price will likely be influenced by [mention factors, e.g., inflation concerns, economic uncertainty].

Keywords: commodity prices, oil prices, gold prices, commodity market analysis.

Industry-Specific April Outlook Updates

Let's look at specific industry sectors and their April outlook.

Technology Sector

The technology sector is expected to [show projected performance]. Key trends include [mention specific trends, e.g., increased investment in AI, growth in cloud computing]. Keywords: technology sector, tech stocks, software, hardware.

Real Estate Market Trends

The real estate market is anticipated to [show projected performance]. Factors like mortgage rates and housing supply will significantly influence home prices and sales volume. Keywords: real estate market, housing market, home prices, mortgage rates.

Other Relevant Sectors

Other sectors, including energy, healthcare, and consumer goods, will also experience fluctuations based on specific factors. Analyzing these sectors requires a more detailed look at individual market reports.

Conclusion: Actionable Insights from the April Outlook Update

The April outlook update paints a picture of a dynamic economic and market environment. Understanding the projected GDP growth, inflation trends, market movements, and industry-specific predictions allows for more informed financial planning and investment strategies. Remember that these are predictions, and actual outcomes may vary. Stay ahead of the curve by regularly reviewing the latest April outlook updates and incorporating these insights into your financial and business strategies. For personalized guidance, contact us today! Use variations of the main keyword phrase: April outlook updates, economic forecasts, market trend analysis.

Featured Posts

-

Trumps Plan To Divert Harvard Funds To Trade Schools Explained

May 28, 2025

Trumps Plan To Divert Harvard Funds To Trade Schools Explained

May 28, 2025 -

Historical Find 13th Century Construction At Binnenhof

May 28, 2025

Historical Find 13th Century Construction At Binnenhof

May 28, 2025 -

Reunion Depp Productor Confirma El Regreso De Jack Sparrow A Piratas Del Caribe

May 28, 2025

Reunion Depp Productor Confirma El Regreso De Jack Sparrow A Piratas Del Caribe

May 28, 2025 -

Rent Regulation Changes Are Tenants The Victims Interest Group Sounds Alarm

May 28, 2025

Rent Regulation Changes Are Tenants The Victims Interest Group Sounds Alarm

May 28, 2025 -

Cassidy Hutchinson January 6th Testimony And Upcoming Memoir

May 28, 2025

Cassidy Hutchinson January 6th Testimony And Upcoming Memoir

May 28, 2025

Latest Posts

-

Live Music Stock Market Update Pre Market Gains After Recent Volatility

May 30, 2025

Live Music Stock Market Update Pre Market Gains After Recent Volatility

May 30, 2025 -

Fernando Cabral De Mello Nomeado Ceo Da Sony Music Entertainment Brasil

May 30, 2025

Fernando Cabral De Mello Nomeado Ceo Da Sony Music Entertainment Brasil

May 30, 2025 -

Sony Music Entertainment Brasil Apresenta Seu Novo Ceo Fernando Cabral De Mello

May 30, 2025

Sony Music Entertainment Brasil Apresenta Seu Novo Ceo Fernando Cabral De Mello

May 30, 2025 -

Sony Music Brasil Fernando Cabral De Mello E O Novo Ceo

May 30, 2025

Sony Music Brasil Fernando Cabral De Mello E O Novo Ceo

May 30, 2025 -

Get Ready Dublin Metallicas Two Night Show At Aviva Stadium

May 30, 2025

Get Ready Dublin Metallicas Two Night Show At Aviva Stadium

May 30, 2025