How U.S. Companies Are Responding To Tariff Uncertainty: A Focus On Cost Reduction

Table of Contents

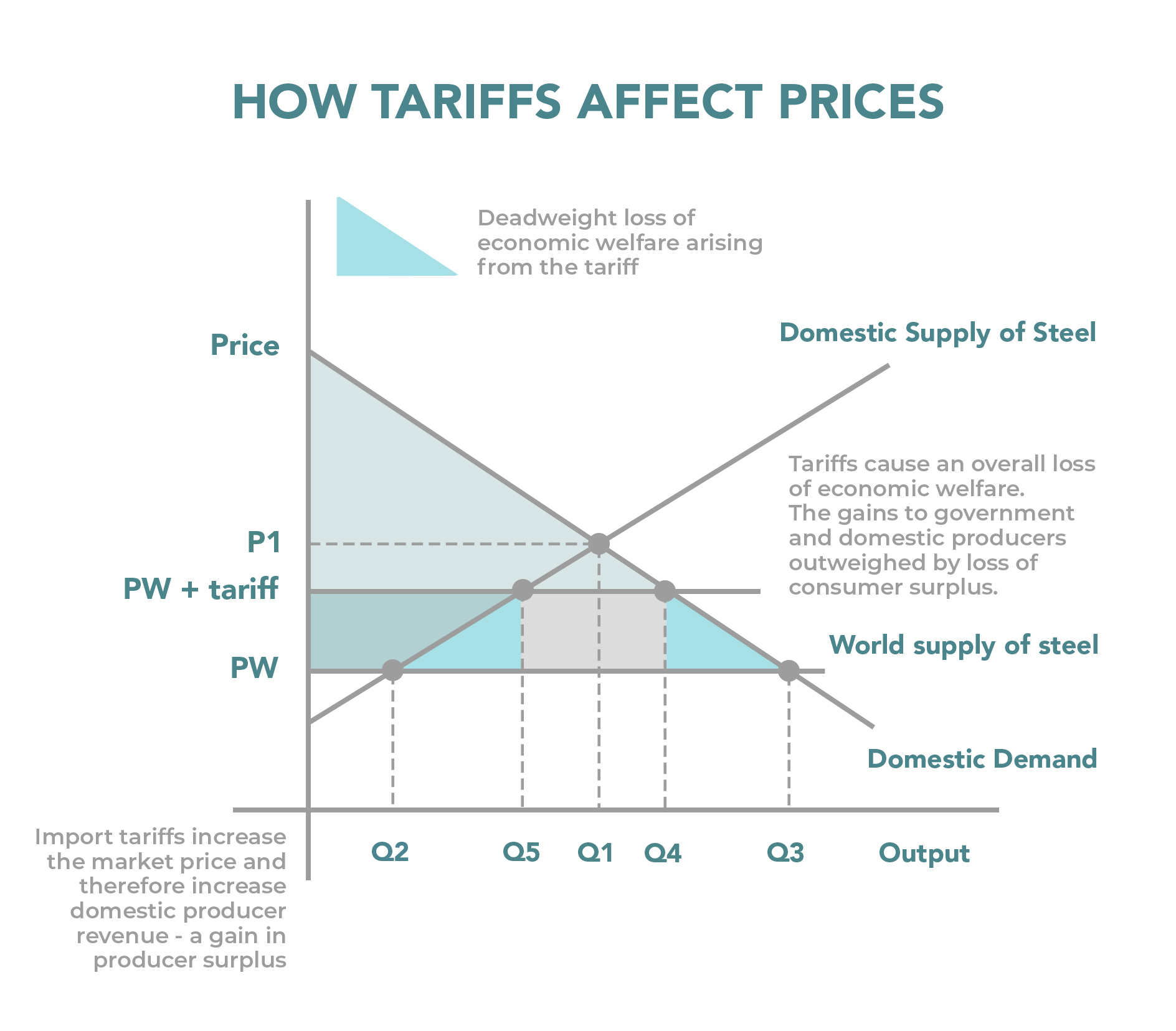

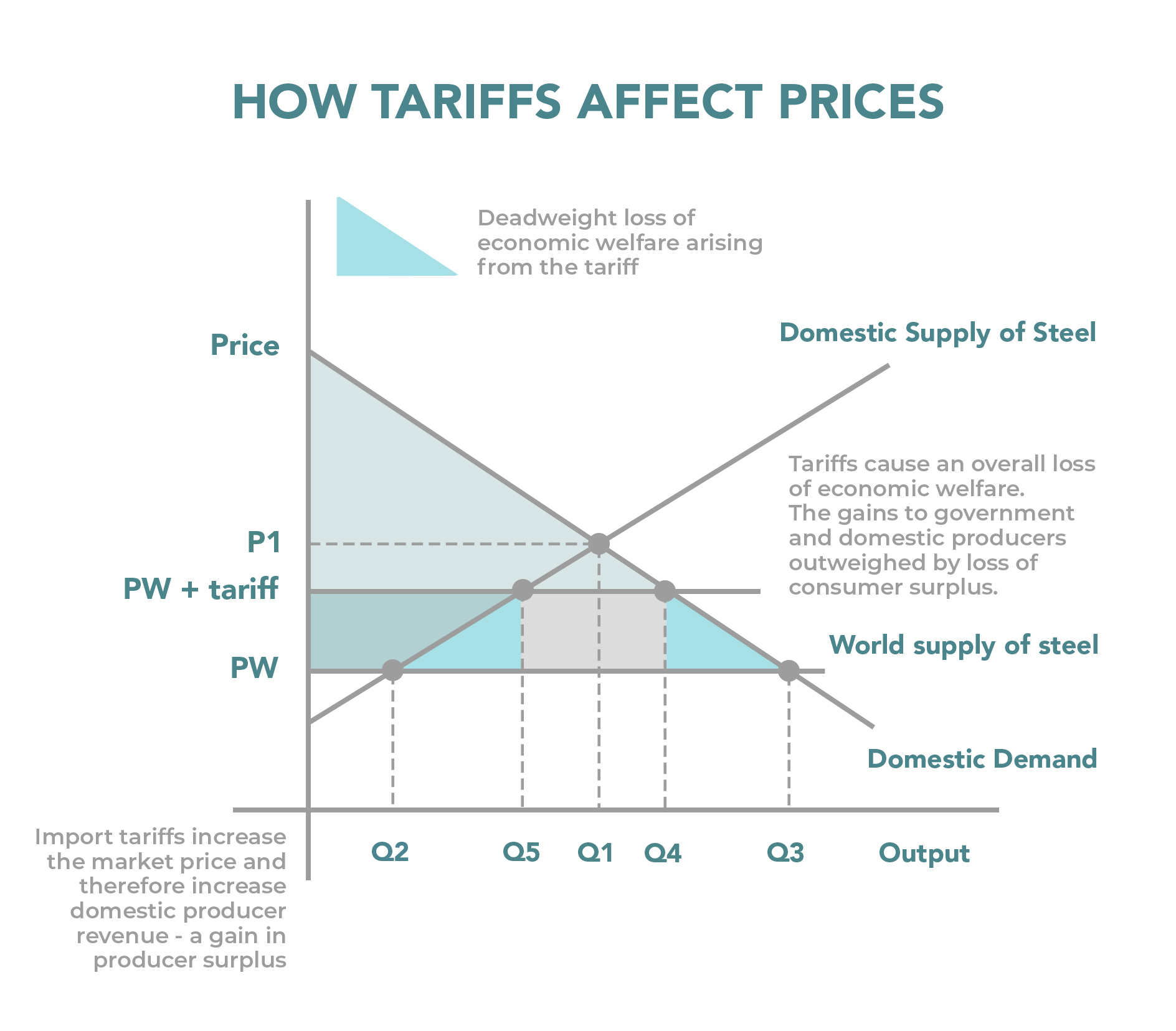

The fluctuating landscape of global trade has left many U.S. companies grappling with the significant challenges of tariff uncertainty. A recent study showed that tariffs imposed in 2018 led to a 1.4% decrease in U.S. manufacturing output. This anecdote highlights the urgent need for proactive strategies to mitigate the impact of unpredictable tariff policies. This article focuses on how U.S. companies are actively addressing tariff uncertainty by implementing various cost reduction measures. We will explore effective strategies that enable businesses to navigate this complex environment and maintain profitability.

H2: Reshoring and Nearshoring as Cost-Reduction Strategies

The unpredictability inherent in tariff uncertainty has prompted many U.S. companies to reconsider their global supply chains. Reshoring (returning manufacturing to the U.S.) and nearshoring (relocating production to nearby countries) are emerging as key cost-reduction strategies.

H3: Reduced Transportation Costs: Bringing manufacturing closer to home significantly reduces shipping expenses and lead times. The elimination or reduction of lengthy ocean freight journeys translates directly to substantial cost savings.

- Example: A clothing manufacturer that reshored its production from China to Mexico saw a 40% reduction in transportation costs.

- Data: A study by the Boston Consulting Group found that reshoring can reduce transportation costs by an average of 25-30%.

- Case Study: Company X, a furniture manufacturer, relocated its production from Vietnam to Mexico, resulting in a 35% decrease in shipping costs and a 15% reduction in lead times.

H3: Improved Supply Chain Agility: Reshoring and nearshoring enhance supply chain agility, enabling faster responses to market changes and minimizing disruptions caused by tariff fluctuations.

- Improved Inventory Management: Closer proximity to production facilities allows for more efficient inventory management, reducing warehousing costs and minimizing the risk of stockouts.

- Faster Response to Changing Demand: Companies can adapt more quickly to fluctuations in demand, avoiding costly overstocking or stockouts.

- Reduced Reliance on Volatile Global Supply Chains: Reshoring and nearshoring lessen dependency on global supply chains vulnerable to geopolitical instability and tariff unpredictability.

H3: Potential Challenges of Reshoring/Nearshoring: While reshoring and nearshoring offer significant advantages, challenges exist. Higher labor costs in the U.S. compared to some overseas locations are a key consideration.

- Factors to Consider: Labor costs, infrastructure availability, regulatory environment, proximity to markets.

- Cost-Benefit Analysis: A thorough cost-benefit analysis is crucial to determine the feasibility of reshoring or nearshoring.

- Government Incentives: Companies should explore government incentives and programs designed to support reshoring and nearshoring initiatives. Tax breaks, grants, and other subsidies can significantly offset the initial investment costs.

H2: Optimizing Existing Supply Chains for Tariff Mitigation

For companies unable to immediately reshore or nearshore, optimizing existing supply chains is crucial for mitigating tariff uncertainty's impact.

H3: Diversification of Suppliers: Relying on a single supplier in a tariff-affected region exposes companies to significant risk. Diversifying supplier bases across multiple countries reduces this vulnerability.

- Risk Mitigation Strategies: Spread risk by sourcing from multiple countries and regions, minimizing reliance on any single source.

- Improved Negotiation Power: Diversification provides greater leverage in negotiations with suppliers, potentially leading to better pricing and terms.

- Examples: A technology company sources components from multiple countries in Asia and Europe, ensuring continued supply regardless of tariffs on specific regions.

H3: Negotiating Better Terms with Suppliers: Proactive engagement with suppliers is crucial. Companies can leverage their purchasing power to negotiate more favorable terms to offset tariff increases.

- Strategies for Effective Supplier Negotiations: Leveraging volume discounts, extended payment terms, and exploring alternative pricing models.

- Long-Term Contract Advantages: Negotiating long-term contracts with favorable pricing can provide stability and predictability during times of tariff uncertainty.

- Building Strong Supplier Relationships: Strong, collaborative relationships with suppliers are essential for effective negotiation and mutual benefit.

H3: Inventory Management Techniques: Efficient inventory management plays a crucial role in mitigating losses from tariff-related price increases.

- Just-in-Time Inventory: Minimizes storage costs and reduces the risk of obsolescence by ordering materials only when needed.

- Forecasting Techniques: Accurate demand forecasting helps companies optimize inventory levels and avoid overstocking.

- Risk Assessment for Inventory Management: Regular risk assessment helps identify potential disruptions and allows companies to develop contingency plans.

H2: Investing in Automation and Technology for Cost Efficiency

Embracing automation and technology is a long-term strategy for cost reduction in the face of tariff uncertainty.

H3: Automation to Reduce Labor Costs: Automation can replace manual labor, reducing production costs and improving efficiency, thus mitigating the impact of fluctuating labor costs.

- Specific Examples of Automation Technologies: Robotics, AI-powered systems, automated guided vehicles (AGVs).

- ROI Calculations: A thorough ROI analysis should be undertaken to assess the financial viability of automation investments.

- Case Studies Illustrating Cost Savings: Numerous companies have documented substantial cost savings through automation initiatives.

H3: Improved Efficiency Through Technology: Software and data analytics can streamline operations and reduce waste, contributing to significant cost savings.

- Supply Chain Management Software: Provides real-time visibility into supply chain operations, enabling proactive decision-making.

- Data-Driven Decision Making: Using data analytics to optimize processes, reduce waste, and improve efficiency.

- Process Optimization Tools: Software solutions for streamlining workflows and eliminating bottlenecks.

H3: Long-Term Investment in Innovation: Continuous investment in R&D and new technologies provides a sustainable approach to cost reduction and a competitive advantage in the long run.

- Investing in R&D: Developing new products and processes that are less susceptible to tariff increases.

- Attracting Skilled Workforce: Investing in attracting and retaining skilled employees is crucial for the adoption and effective utilization of new technologies.

- Future-Proofing Operations: Adopting agile and flexible manufacturing processes enables companies to adapt to future changes and remain competitive.

Conclusion:

In conclusion, mitigating the impact of tariff uncertainty requires a proactive and multi-faceted approach. The strategies discussed – reshoring/nearshoring, supply chain optimization, and technological investment – offer effective means of cost reduction. These measures not only reduce immediate costs but also build resilience and enhance long-term profitability. The key takeaway is that proactive planning and adaptation are essential for navigating the challenges of tariff uncertainty. Don't let tariff uncertainty cripple your business. Explore these cost reduction strategies today to build a more resilient and profitable future! Implementing these strategies will enable your company to manage tariff uncertainty and achieve sustainable cost reduction.

Featured Posts

-

Vehicle Subsystem Problem Grounds Blue Origin Rocket

Apr 29, 2025

Vehicle Subsystem Problem Grounds Blue Origin Rocket

Apr 29, 2025 -

Cassidy Hutchinsons Memoir Key Jan 6 Witness Details Upcoming Book

Apr 29, 2025

Cassidy Hutchinsons Memoir Key Jan 6 Witness Details Upcoming Book

Apr 29, 2025 -

Trumps Trade War With China Examining The Consequences Of Tariffs On The Us Economy

Apr 29, 2025

Trumps Trade War With China Examining The Consequences Of Tariffs On The Us Economy

Apr 29, 2025 -

Understanding The Value Of Middle Managers In Todays Workplace

Apr 29, 2025

Understanding The Value Of Middle Managers In Todays Workplace

Apr 29, 2025 -

Adidas Anthony Edwards 2 A First Look At The New Signature Shoe

Apr 29, 2025

Adidas Anthony Edwards 2 A First Look At The New Signature Shoe

Apr 29, 2025

Latest Posts

-

From Street Sweeper To National Icon The Story Of Macario Martinez

Apr 29, 2025

From Street Sweeper To National Icon The Story Of Macario Martinez

Apr 29, 2025 -

The Unexpected Rise Of Macario Martinez From Street Sweeper To National Fame

Apr 29, 2025

The Unexpected Rise Of Macario Martinez From Street Sweeper To National Fame

Apr 29, 2025 -

Macario Martinez From Street Sweeper To National Celebrity

Apr 29, 2025

Macario Martinez From Street Sweeper To National Celebrity

Apr 29, 2025 -

Stock Market Valuation Concerns Bof A Offers A Counterargument

Apr 29, 2025

Stock Market Valuation Concerns Bof A Offers A Counterargument

Apr 29, 2025 -

Dismissing Valuation Concerns Bof As Argument For A Bullish Stock Market

Apr 29, 2025

Dismissing Valuation Concerns Bof As Argument For A Bullish Stock Market

Apr 29, 2025