Impact Of The GOP's Plan On Student Loan Borrowers And Pell Grants

Table of Contents

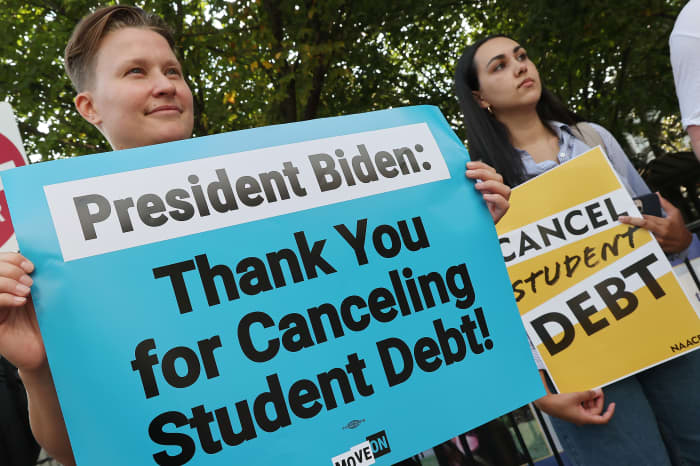

Potential Changes to Student Loan Forgiveness Programs Under the GOP Plan

The GOP's approach to student loan forgiveness remains a key area of contention. Their proposed plan could significantly alter existing programs, creating challenges for millions of borrowers.

Impact on existing forgiveness programs (Public Service Loan Forgiveness, Income-Driven Repayment)

The GOP's plan may lead to several significant changes impacting existing forgiveness programs:

- Reduced eligibility criteria: Stricter requirements for programs like Public Service Loan Forgiveness (PSLF) could exclude many borrowers who currently qualify.

- Increased repayment amounts: Changes to income-driven repayment (IDR) plans could result in higher monthly payments for borrowers, potentially delaying or preventing loan forgiveness.

- Elimination of certain forgiveness programs: Some GOP proposals suggest eliminating certain forgiveness programs altogether, leaving borrowers with substantial outstanding debt.

These changes could have devastating consequences. Borrowers relying on PSLF for public service or IDR plans for manageable payments could face increased debt burdens, delayed repayment, and significant financial hardship. Understanding the GOP's student loan policy is crucial for those relying on these programs.

The GOP's Proposed Approach to Student Loan Repayment

Beyond forgiveness, the GOP's plan could also reshape student loan repayment.

Changes to interest rates and repayment plans

The proposed changes may include:

- Higher interest rates on federal student loans: Increased interest rates would dramatically increase the total cost of borrowing, potentially making repayment even more challenging.

- Elimination of income-based repayment plans: Removing flexible repayment options would leave many borrowers with inflexible and unaffordable monthly payments.

These modifications would have substantial financial implications. Borrowers could face significantly increased monthly payments and substantially higher total interest paid over the life of their loans. The GOP's student loan reform proposals need careful consideration by those concerned about manageable repayment.

Impact of the GOP Plan on Pell Grant Funding and Accessibility

The GOP's plan also has potential implications for Pell Grants, a crucial source of financial aid for low-income students.

Potential cuts or modifications to Pell Grant funding

Proposed changes might include:

- Reduced Pell Grant funding: Decreased funding could limit the number of students who can receive Pell Grants.

- Increased eligibility requirements: More stringent eligibility criteria could exclude many low-income students currently receiving aid.

- Lower maximum Pell Grant award: A reduction in the maximum award amount would leave students with a larger gap to fill in their tuition costs.

These potential cuts would severely impact low-income students' access to higher education, potentially widening the existing inequality in educational attainment. The GOP's education policy concerning Pell Grants deserves close scrutiny.

Political and Economic Considerations of the GOP Plan

The GOP's proposed changes are rooted in specific political and economic philosophies.

Analysis of the GOP's rationale behind the proposed changes

The driving forces behind these proposals often include:

- Fiscal conservatism: The GOP aims to reduce government spending and the national debt.

- Reduced government intervention: A core tenet is to limit the government's role in higher education financing.

However, these arguments face counterarguments. Critics argue that reducing student aid could harm economic growth and exacerbate social inequality.

Potential long-term effects on the economy and higher education

The long-term economic consequences of the GOP's plan are complex and uncertain. Potential impacts include:

- Impact on college enrollment: Reduced financial aid could lead to lower college enrollment rates, particularly among low-income students.

- Effects on the labor market: A less-educated workforce could negatively impact economic productivity and innovation. The economic impact of these decisions needs thorough consideration.

Conclusion: Understanding the GOP's Plan and its Effects on Student Loan Borrowers and Pell Grants

This analysis has explored the potential ramifications of the GOP's plan on student loan borrowers and Pell Grants. The proposed changes could significantly impact student loan forgiveness programs, repayment options, and Pell Grant accessibility, leading to increased debt burdens, higher repayment costs, and reduced access to higher education for many. The GOP's plan on student loan borrowers and Pell Grants necessitates careful consideration of its far-reaching economic and social consequences. Understanding the GOP's plan on student loan borrowers and Pell Grants is crucial for informed participation in the ongoing debate. Stay informed about the ongoing debate surrounding the GOP's Plan on Student Loan Borrowers and Pell Grants and make your voice heard by contacting your elected officials and engaging in the national conversation.

Featured Posts

-

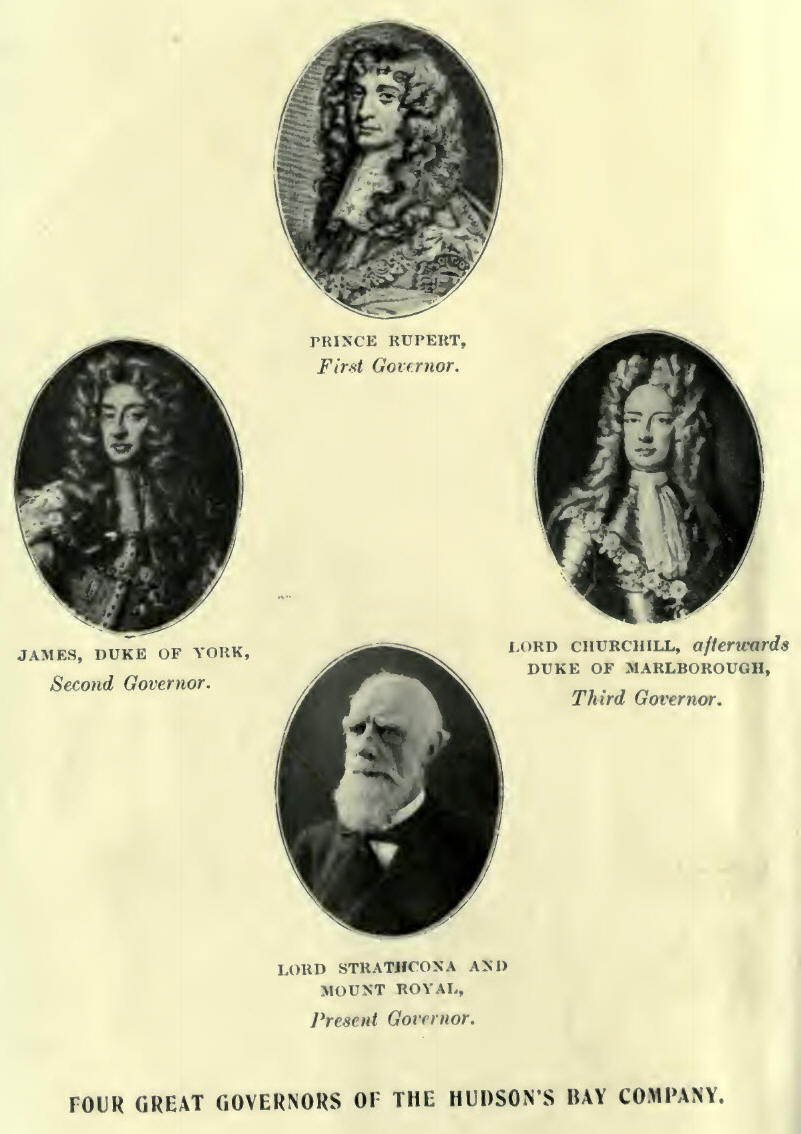

Canadian Tire Acquires Hudsons Bay Assets For 30 Million

May 17, 2025

Canadian Tire Acquires Hudsons Bay Assets For 30 Million

May 17, 2025 -

Inexpensive Items That Actually Work

May 17, 2025

Inexpensive Items That Actually Work

May 17, 2025 -

14 0 Shutout Mariners First Inning Dominance Against Miami Marlins

May 17, 2025

14 0 Shutout Mariners First Inning Dominance Against Miami Marlins

May 17, 2025 -

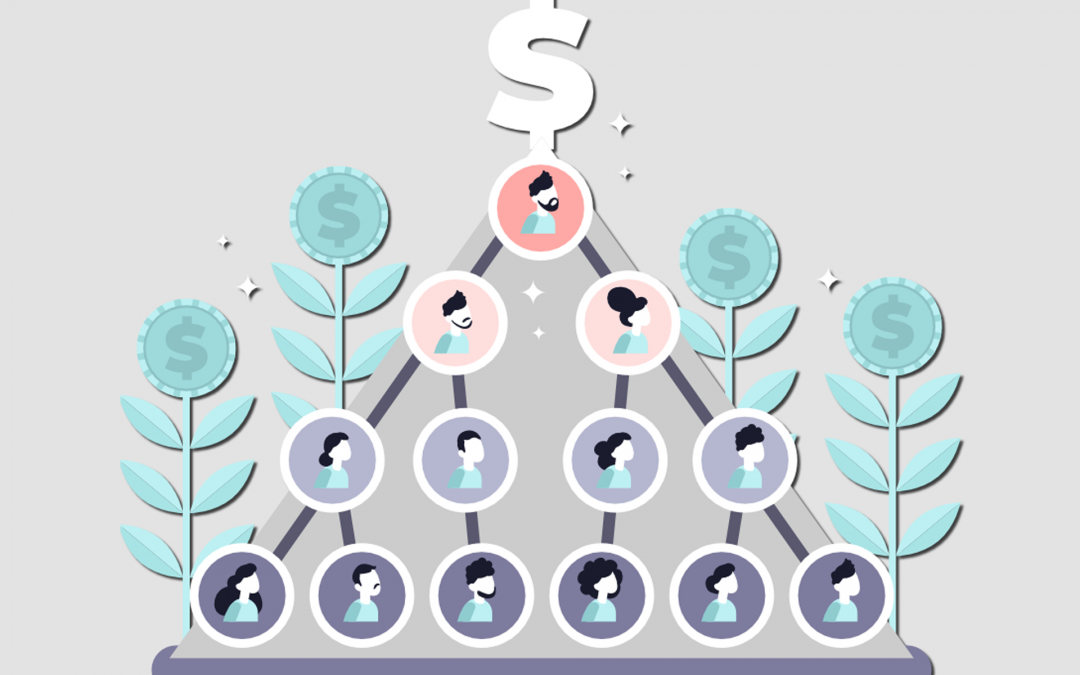

Entendiendo El Fraude De Koriun Inversiones Analisis Del Esquema Ponzi

May 17, 2025

Entendiendo El Fraude De Koriun Inversiones Analisis Del Esquema Ponzi

May 17, 2025 -

Knicks Roster Crunch The Landry Shamet Factor

May 17, 2025

Knicks Roster Crunch The Landry Shamet Factor

May 17, 2025

Latest Posts

-

Betting On Ubers Driverless Future Etfs That Could Pay Off

May 17, 2025

Betting On Ubers Driverless Future Etfs That Could Pay Off

May 17, 2025 -

Best Online Casinos In New Zealand 7 Bit Casino Review And Top Picks

May 17, 2025

Best Online Casinos In New Zealand 7 Bit Casino Review And Top Picks

May 17, 2025 -

Comparing Waymo And Ubers Autonomous Ride Services In Austin

May 17, 2025

Comparing Waymo And Ubers Autonomous Ride Services In Austin

May 17, 2025 -

Taking Your Pet On Uber In Mumbai Steps And Requirements

May 17, 2025

Taking Your Pet On Uber In Mumbai Steps And Requirements

May 17, 2025 -

Autonomous Vehicles Waymo And Ubers Austin Expansion

May 17, 2025

Autonomous Vehicles Waymo And Ubers Austin Expansion

May 17, 2025